Greenhaven Road Partners Fund commentary for the first quarter ended March 31, 2018.

Q1 hedge fund letters, conference, scoops etc, Also read Lear Capital: Financial Products You Should Avoid?

Dear Limited Partners,

The Partners Fund returned approximately 0.47% in the quarter, which compared favorably to the overall markets during the same period. I am happy to say that, as of April 1st, 49 limited partners of our main fund1 decided to invest a portion of their savings in the Partners Fund, and we have raised approximately $22M with substantial additional commitments that can be drawn down as needed to fund additional managers. We have even begun attracting investors who are completely new to Greenhaven Road (not invested in our main fund). I think we are off to a great start.

When I set up Greenhaven Road Capital Fund 1, there were dozens of “Buffett style” partnerships, and thus there was a well-worn path for us to follow. For the Partners Fund, I believe we are breaking new ground. I am not aware of another fund of funds (FOF) that is focused on emerging managers and indifferent to AUM. The typical FOF traffics in well-established underlying funds while touting low volatility and Sharpe ratios, and needs to be very large as its own fees are very small, so their operators are primarily asset gatherers. That is not our goal.

From the beginning, I knew that the Partners Fund would look and smell different than other funds of funds. As previously discussed, my primary motivation is to take advantage of the fact that there are very talented investors out there managing very meager AUM. I have been doing this long enough to realize that the relationship between talent and AUM is tenuous at best, size is often the enemy of returns, and talented managers are most likely to generate their best returns early on when they are not burdened by AUM. These dynamics create a catch-22 of sorts because the funds’ modest assets make them untouchable for many investors who seek precisely the returns these managers can generate. Fortunately, I believe that I am well-suited to finding managers that the world has not fully embraced. By nature, some will zig when others zag, but if successful, the Partners Fund can generate attractive returns over time.

In the last letter, I outlined several attributes that I would look for in our managers. These included:

- One-Person Investment Committee

- Concentrated holdings

- Reasonable amounts of capital (AUM)

- Significant personal investments (“skin in the game”)

- Original thinking

- Mindset: Getting Rich is Not the Point

Focusing on the characteristics above narrows the universe dramatically and provides clarity on the types of managers that we will invest with. However, this focus does not provide information on how we will operate or what the portfolio will look like. In brief, I believe that the core principles that are embodied in the main fund can be applied to the Partners Fund as well. Specifically, patience to let compounding work, and enough concentration to have it matter.

Patience to Let Compounding Work:

When I first introduced the Partners Fund to the limited partners of Greenhaven Road Capital Fund 1, I used the metaphor of bringing a new baby into the world. Now I want to take a moment to daydream about what our future could look like with some good fortune.

Compounding capital at high rates is very hard. There is effectively zero chance that all of our managers and special purpose vehicles (SPVs) eventually meet our definition of successful. However, I believe that given the talent we have assembled and the conditions they operate under (reasonable AUM, concentrated, original thinking, skin in the game, etc.), there is at least a chance that one, two, or a handful compound at high rates. So with all the caveats that returns tend to decline over time with asset growth, what happens if one manager is actually able to compound at high rates for an extended period of time?

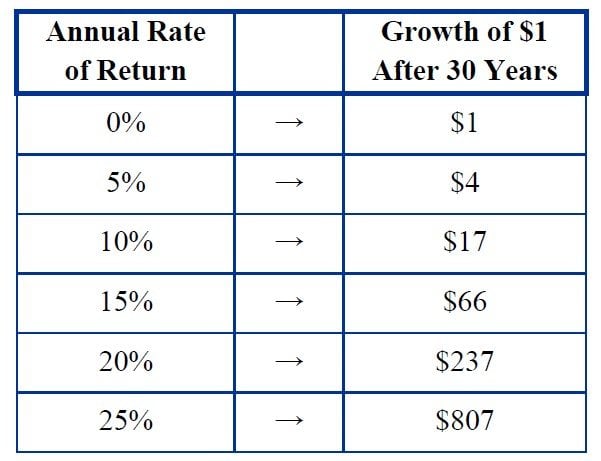

The following chart should look familiar, as it is from the Partners Fund deck.

The impacts of one manager compounding at high rates are profound. For example, if a manager who is initially given a 10% allocation compounds at 20% per annum for the next 30 years and we never reduce our exposure to this manager, we would achieve over a 23X return for the fund overall, even if every other manager returned zero. Assuming market average returns for the other funds, or even higher returns for our standout manager(s), leads to significantly greater returns. To be clear, we will have some disappointments as well. The point is that, if we are relatively concentrated, one exceptional manager and a long timeline can achieve exceptional returns.

Concentrated Enough to Let Compounding Matter

Identifying a single manager that compounds at high rates for decades will not be enough. For the magic of compounding to work, we also have to hold on. Doing nothing, sounds simple, but the two temptations to avoid are excessive dilution from new capital and trimming of appreciated investments. In Jack MacDonald’s investing class at Stanford, co-teacher Jack Kirby implored us not to cut the flowers to water the weeds. In other words, don’t sell the winners (flowers) to invest more in the losers (weeds). This is easier said than done, but it is consistent with how I have managed Greenhaven Road’s main fund, so I am not overly concerned about excessive “trimming”. For me, the harder pitfall to avoid is dilution.

When new capital comes into the partnership and is not invested in an existing holding, that holding is “diluted” and becomes a smaller percentage of the overall fund. Due to “anchoring bias”, it can be difficult to commit new capital to a large holding that has already appreciated substantially. Though we are pleased with the performance of Greenhaven’s main fund, this dilution from new capital dynamic has still come into play, muting the impact of some of our largest winners. Fortunately, the Partners Fund has a structural element that should limit the likelihood of dilution from new capital over time: we are limited to 99 investors under current regulations. If/when the partnership reaches 99 investors, additional capital will only come from existing investors, which will mute the risks of dilution.

Returning to the metaphor of the grown up baby, if the Partners Fund works as anticipated, one or two managers will eventually comprise a significant portion of AUM, primarily through capital appreciation. At present we are nowhere near this situation as we are still in our infancy, making allocations to managers. However, if we are successful, what started out as a 5% or 10% allocation at cost can grow over two or three decades to become a preponderance of assets. This would be a wonderful “problem” right up there with having children that are too kind.

PORTFOLIO CONSTRUCTION

Ultimately, the tenets that guide the construction and operation of Greenhaven’s main fund will be evident in the Partners Fund. We will strike a similar balance of having enough positions to have diversification, but few enough that if we are “right” it will make a meaningful difference. There are three primary categories of investments for the Partners Fund: Separately Managed Accounts (SMAs), Special Purpose Vehicles (SPVs), and traditional hedge funds. Let’s look at these individually.

Separately Managed Accounts: In these accounts, typically housed at Interactive Brokers, we have full transparency into the investment activities without most of the risks that very small funds can pose. We can pull our money with no notice, we have to approve any transfer of funds, and we have cost efficiency as the SMAs themselves do not require a third-party administrator or annual fund-specific audit.

There is a universe of managers who are very early in their evolution and do not yet have an LP structure set up. SMAs can be very beneficial in those situations since it is difficult to graduate from managing just the friends and family circle to adding outside capital. As we begin building relationships with some of these managers, we are happy to help them cross this bridge in a structure allows us flexibility and transparency. The Partners Fund ended the quarter with two SMAs, and I expect we will eventually build a basket. SMAs in aggregate will be less than 10% of the Partners Fund at cost, but will provide a lot of optionality, and we can increase our investments over time. I will take hungry over “fat and happy” any day.

Special Purpose Vehicles: Every fund manager hopes to come up with an idea that is so attractive that they want to put every penny they can find into it. Typically, sanity prevails and the manager recognizes that putting 100% of their fund into a single security is not prudent (and perhaps impermissible under their risk parameters), but this leaves the manager in a position where he/she wants to invest more into a company than their fund can support. Enter the Special Purpose Vehicle (SPV), which can be created to invest in a single company. Given my experience selecting single securities for Greenhaven’s main fund, I feel particularly well-suited to investing in SPVs since the primary evaluation is at the company level. SPVs are harder to find and will typically have shorter holding periods than traditional funds or SMAs. Despite the challenges of finding these opportunities, I expect we will get our share of looks over time. However, to get the looks, I have to be prepared to not invest in the underlying security through our main fund. There are over 20,000 publicly listed securities and we are only looking to invest in 4-6 per year in the main fund, so I am willing to potentially forgo investing myself if it means the Partners Fund gets an SPV that we would not have seen otherwise.

At any given moment, I would expect to have 0-4 SPVs comprising up to 20% of the portfolio. This past quarter, we invested in an SPV formed by a manager I have collaborated with for several years. The underlying name is domiciled in a geography we are not otherwise exposed to, the SPV has a more than fair fee structure, and most importantly, the opportunity has an asymmetric risk profile that surpasses any fund that I am aware of: limited downside with 5X+ upside.

Traditional Funds: The majority of our assets will be invested in conventionally-structured hedge funds with the previously discussed attributes (original thinking, etc.). Similar to Greenhaven Road, a typical “starter” position will be 5% at cost and a higher conviction investment may be north of 10%. I would expect the Partners Fund to be invested in 12-15 “traditional funds” at any given time.

Typical Holding Periods:

Our holding periods to vary based on the type of investment. I expect to have an average holding year of 2-4 years for the SPVs. The SMAs will likely have similar 2-4 year holding periods as some funds may not be successful and others will “graduate” to become traditional funds. As I simply do not believe that quarterly or annual returns are meaningful, I would be disappointed if the Partners Fund’s average holding period for traditional funds were not 10 years or more. We will want to hold our “winners” significantly longer and our disappointments will not be evident for several years.

DETAILS ON NEW MANAGERS

We launched the Partners Fund in December with 4 underlying managers and added another 5 managers this past quarter. All but one of the managers meet our criteria of a one-person investment committee, concentrated holdings, reasonable amounts of capital, skin in the game, original thinking, and a mindset of getting rich is not the point. I did make an exception to the one-person investment committee for a pair of brothers who co-manage a fund. They are attracted to platform businesses, businesses with strong network effects, and businesses with high incremental margins. They are fishing in very attractive waters. In my opinion, these brothers are so talented that it would have been irresponsible not to invest with them. It may comfort you to know that selectively breaking the rules can lead to very positive outcomes in investing. For example, the godfather of value investing, Benjamin Graham, violated several of his tenets for position sizing, holding period, and valuation metrics for his 562-bagger investment in Geico. I made my exception based on an overwhelming amount of evidence, and I would do so again if presented with another opportunity that compelling.

This pace of investment will never be repeated and was only possible because I have been collaborating with four of the new managers for several years – essentially an extended diligence period. Remember, I am trying to collaborate and invest with the smartest people that I can find. This desire has existed since the beginning of Greenhaven Road, and these relationships have been cultivated for years.

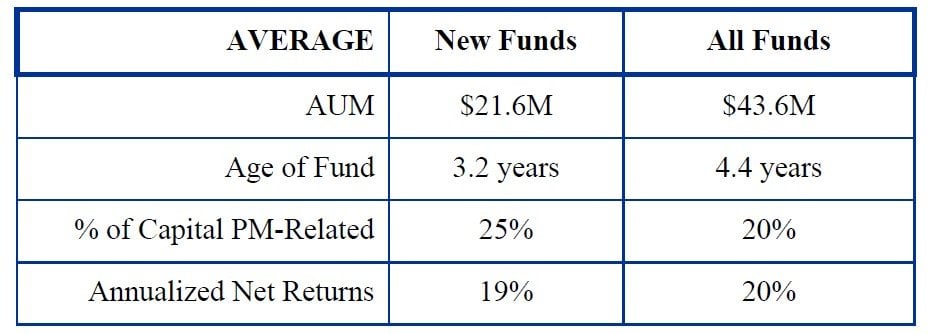

Some relevant statistics on the funds are as follows:

It is worth pointing out that a 2014 Morningstar study found that more than half of the 7,700 mutual funds analyzed had zero personal investment by their PM. Our funds have an average of $8M in capital related to the PM. This comparison is not quite apples to apples as we are including family members, but highlights that across the board there is significant “skin in the game”. Also worth noting, the above table excludes Greenhaven Road Capital Fund 1, where the Partners Fund is also currently invested. I am charging no management fees or incentive fees on that investment and am instead using Fund 1 as a place to “park” money and reduce our initial cash balances. (Over time, the future expected allocation to Greenhaven Road Fund 1 will be zero.)

Along with this letter, I have also attached the most recent letters for the five new managers. Please do not forward them without our express permission. They are provided to you as an LP to gain additional transparency into who the managers are, what they own, and how they think.

PARTNERS FUND DINNER

Last fall, Chuck Royce bounced into my office with the idea to have a Partners Fund dinner because it would be “fun”. At our core, Chuck and I both love to hear about stocks, think about stocks, and talk about stocks, so the logic of having fun by combining our LPs plus really talented managers was irrefutable. As the dinner approached, I have to confess, there were moments of terror. I was taking all of the limited partners I had welcomed into Greenhaven Road over seven years and inviting them to meet 12 of the smartest investors that I could find. The plan was to showcase the managers (who on some level are competitors), facilitate introductions to my investors so they could consider investing directly in the underlying managers, and pay for it all along with gifts to attendees. The dinner was not without risks, but in my heart I knew that the event was well worth hosting.

I am trying to play the long game here, focused on generating returns, not gathering assets as quickly as possible. The Partners Fund is about identifying incredibly talented investors, but it is also about building an ecosystem. Fostering this ecosystem requires trust built over time. I made a conscious decision that I would embrace my competitors and invest capital, share ideas, and provide exposure to great limited partners (mine). If done properly, deeper partnerships will form with and between the managers over time (yes, the name of the fund has multiple meanings), and all parties will enjoy the lollapalooza.

The evening consisted of idea pitches from each manager followed by dinner. Given the number of managers, each was constrained to 5 minutes and had to suffer a brief introduction from me. The themes that I tried to hammer home to the attendees were:

1) The unlikeliness of overlap.

Ideas included a Korean tire company, Italian nanocap media company, Swedish hotel turnaround, nanocap software, pawnshop operator, boutique tobacco company, stub of a public company, healthcare technology company, and a wind energy SPAC.

2) The embedded asymmetry of the ideas.

Nobody was presenting a company trading at 12x earnings that could go to 14x earnings. Each investment had some version of limited downside with very substantial upside.

3) How fortunate I was to be able to interact with the underlying managers.

These are managers that do the work and know their companies. Their track records are not luck.

At dinner, I encouraged LPs to sit with the managers they found most interesting. I also explicitly indicated that any desire or interest to invest directly with an underlying manager (outside of the Partners Fund) was fine with me. If our mission was to build the largest FOF possible in order to clip the most management fees, our approach would be far less collaborative. I believe there are enough ideas and capital to go around. To date, there have been approximately 7 investments that I am aware of between our LPs and the managers.

My views on the dinner started in line with Chuck’s: it would be fun. I then migrated to terror, and am pleased to say I ended with satisfaction. The dinner was a small first step towards building an ecosystem of likeminded LPs and Portfolio Managers who can be stronger working together as “Partners” than trying to go it alone.

FINAL THOUGHTS

I know the Partners Fund is symbiotic with my Greenhaven Road Capital main fund, and we have foundational pieces for success. But like the companies we invest in, we will need to execute and need a little good fortune. Thank you for joining me on this journey, and I will work hard to grow your family capital alongside mine.

Sincerely,

Scott Miller