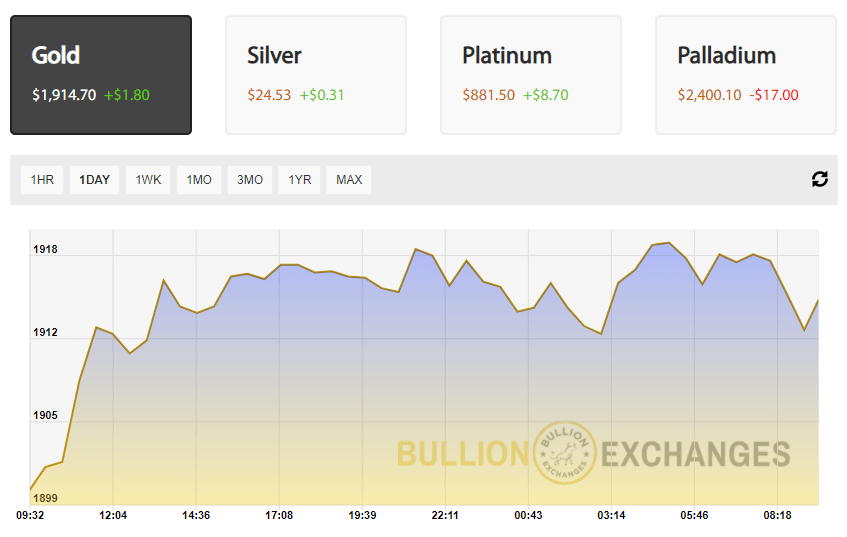

The current price of gold this week saw ups and downs, but it is now on the rise. The main contributors to this increase include the rising COVID cases around the world, the uncertainty around the election, and the continuing lack of a stimulus package. Earlier this week, the spot gold price’s low was $1896 on October 13th. This sudden plunge moved into a steady reverse, and the gold spot price today opened around $1912.

Q3 2020 hedge fund letters, conferences and more

What Changes the Gold Spot Price Today?

Gold dipped below $1900 on October 13, oddly coinciding with an uptick of 0.7% on the Volatility Index. The next near-term downside price objective for gold futures lie around $1851. On the upside, the December gold futures should show solid gains above $1939.40.

There are multiple factors impacting the gold spot price today. The main ones to consider are the lack of US stimulus, the uncertainty of the election, unemployment, rising economic conflict with China, and the strong rise of US retail sales.

How Do Retail Sales Affect the Gold Price Now?

The gold price now, at the time of writing, maintained its position above $1900 despite the strong rise of US retail sales in September. Higher retail sales go to show that more Americans are shopping despite the pandemic. Therefore, what this could mean is there is more spending power than what was once initially thought. What this means in the long run, according to some economists, is that this data means a speedier recovery could be possible.

The gold spot price today, however, opened in the green. Perhaps this is because investors are looking to the near future uncertainties. Katherine Judge, a senior economist at CIBC, noted that retail sales numbers revealed consumer spending is 4% above what it was before the pandemic. But, Judge also pointed out that consumers still recognize unpredictable risks at this time:

“Despite the heightened uncertainty around further fiscal support, American consumers still have spending ammunition left in the tank, as demonstrated by the still elevated savings rate. However, downside risks remain, as the rise in Covid cases lately could hold back spending on services, particularly restaurants.”

The Gold Price Now, Unemployment, & The Stimulus Bill

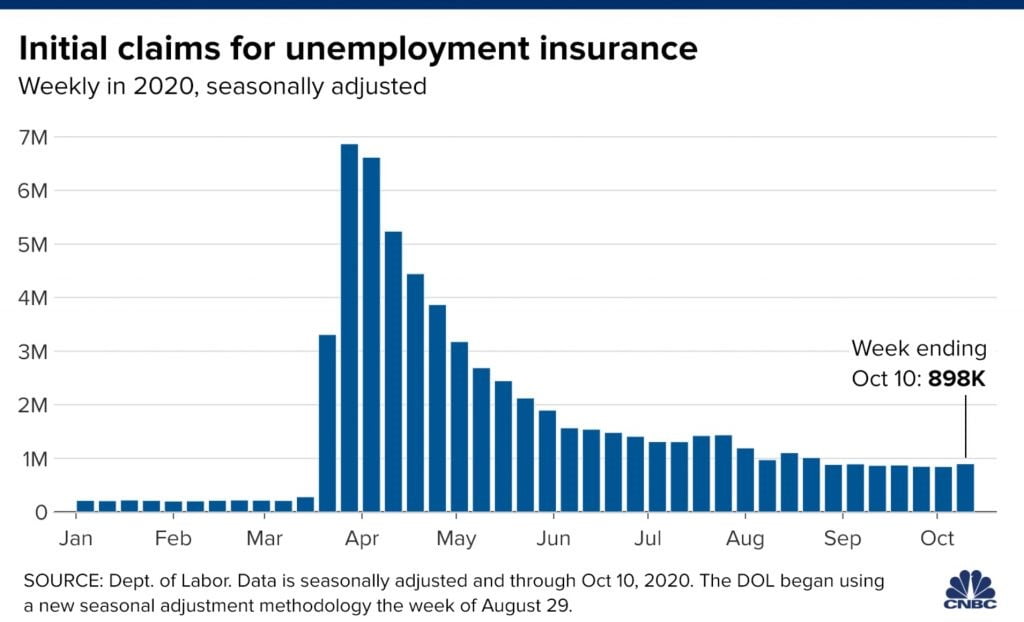

Unemployment intertwined with COVID-19 effectively harmed the global economy. Although unemployment numbers mostly remain the same weekly, the number of total unemployed has yet to drastically decrease. Last week, 898,000 more Americans applied for unemployment. This increase is actually the highest level since the middle of August.

Source: CNBC

According to CNBC, “The unemployment rate has come down to 7.9% but is still more than double its pre-pandemic level.” Basically, there is a recovery in the process. The recovery is by no means fast, and day-to-day news impedes the optimistic view of the economic recovery. Because of this volatility and high-risk environment, the gold spot price today fell down to a low of $1904.

Furthermore, European cities like Paris and London are reinstating lockdown measures. This demonstrates that COVID-19 is still very much not under control, and further talks of fiscal stimulus in Europe bolsters that conclusion. More European stimulus could potentially bolster the gold spot price even though the US pressed pause on stimulus package talks.

The first stimulus checks made it to Americans in April, and included the promise of a follow-up check. But, the US has yet to see the government come through on the second check. Since the election is upon us, the promise of a stimulus check seems to dangle just out of reach. As a result, many Americans are discouraged about the stimulus check reaching them before the election. Consequently, the price of gold started lower on Thursday from this news, but it steadily grew to a high of $1919 after the close. The gold price kept its head above $1900 for the most part this week.

China’s Potential Influence on the Spot Gold Price

A development that not many investors might be aware of is new reports about Chinese legislation. Apparently, China may be looking to “punish” nations by restricting accessibility to rare mineral deposits and precious metals. The National People’s Congress will review this drafted legislation, which could be accepted and implemented as soon as 2021. This mandate could have serious ramifications for western manufacturers and strengthen the current price of gold. If the supply of gold is interrupted, the gold price may quickly spike and remain high.

Right now, China already has a few practices in place to impede access to precious metals. Export quotas and selling primarily to manufacturers with locations in China reveal that. Therefore, this new legislation on top of preexisting measures might make gold and other precious metals even more difficult to attain. While the gold spot price today has yet to majorly respond to this, China’s influence weighs significantly on economists’ minds as they consider the future of the gold price.

The publisher of the Felder Report newsletter, Jesse Felder, remains long on gold. The gold spot price today is nearly double its price from the last five years. Felder, however, asserts it is still cheap when considering equities.

“The gold price relative to the Dow Jones Industrial Average would seem to suggest it is not expensive at all. In fact, to match the valuation peak it reached about a decade ago, gold would need to double again...”

For the past few months, gold analysts mostly conclude that gold has much more space to grow than what investors may currently realize. So, if the gold price now seems too volatile and discouraging, it may benefit you to look towards the future and consider what moves you need to make as 2021 looms over us.

Main KW. Synonyms: "" & "spot gold price".