According to a new analysis by S&P Global Market Intelligence, specialty finance private equity and venture capital transaction activity is making a resurgence in 2021 after a standstill caused by COVID-19, as increased financial technology (fintech) adoption drives growth in the sector, Brandon Hollis, a financial services senior analyst at RSM US LLP, told S&P Global Market Intelligence.

Q2 2021 hedge fund letters, conferences and more

Specialty finance companies, which originate loans and other products for consumers and commercial clients, are leveraging fintech to better respond to new market opportunities and changing customer demands.

"Given the influence of fintech, the profile of the traditional specialty finance company is shifting," Hollis said. "They are increasingly becoming more innovative, flexible and forward thinking. This creates investment opportunities in the sector as capital is often needed to generate and execute the innovative strategies of these companies."

Key Sector Deals

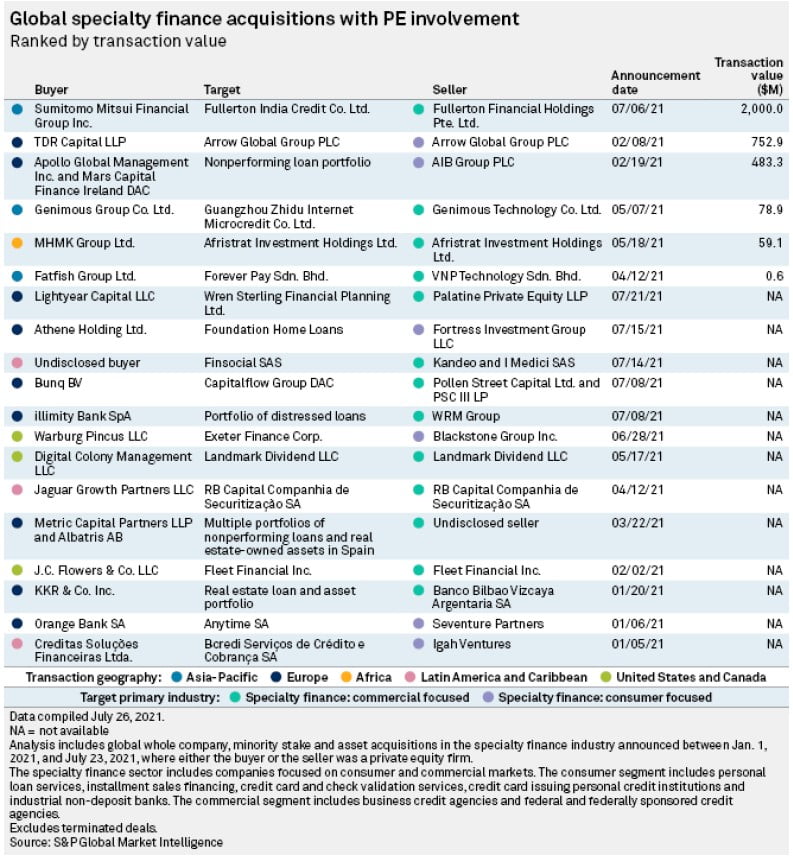

A total of 19 private equity buyout deals have been struck in the sector since the start of 2021. Based on disclosed transaction value, announced deals amounted to roughly $3.37 billion as of July 23, according to Market Intelligence data.

A high-profile deal announced in June is the planned acquisition of auto finance company Exeter Finance Corp. by an investor group led by Warburg Pincus LLC. The deal would mark an exit for The Blackstone Group Inc.

Apollo Global Management Inc. also agreed to buy a nonperforming loan portfolio from Irish bank AIB Group PLC in a roughly $483.3 million transaction made public in February, while KKR & Co. Inc. acquired a real estate loan and asset portfolio from Spanish bank Banco Bilbao Vizcaya Argentaria SA in a deal announced and finalized in January.

In July, Fullerton Financial Holdings Pte. Ltd. and Fortress Investment Group LLC announced their respective deals to exit Fullerton India Credit Co. Ltd. and Paratus AMC Ltd., doing business as Foundation Home Loans. Sumitomo Mitsui Financial Group Inc. will buy Fullerton India Credit for about $2 billion, while Foundation Home Loans will be acquired by Athene Holding Ltd.

Key VC Deals

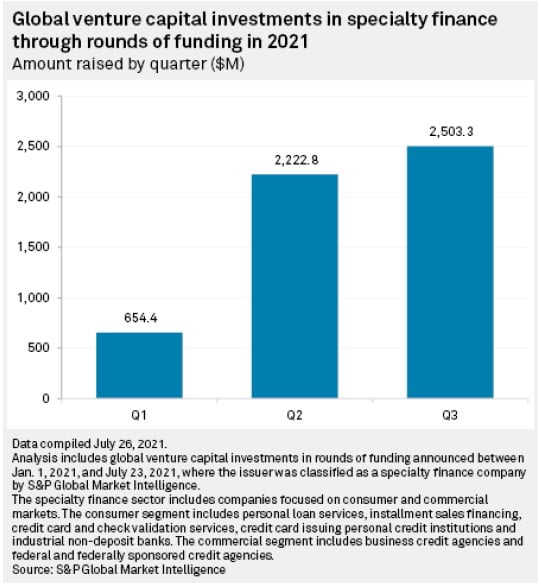

On the venture capital front, specialty finance businesses garnered roughly $5.38 billion in global funding rounds year to July 23. Of that total, approximately $2.88 billion was raised during the first half and about $2.50 billion was secured in July alone.

Generate Capital Inc., a specialty finance business focused on clean energy and infrastructure, accounted for the bulk of the huge July investment figure by attracting $2 billion in a funding round during the month that saw participation from Harbert Management Corp.

Across the Atlantic, Danish smart payment card company Pleo Technologies ApS pulled in $150 million in a July series C funding round co-led by Bain Capital Ventures and Thrive Capital.

In Asia, nonbanking finance company Ess Kay Fincorp Ltd. closed a roughly $45.8 million series E funding round from TPG Capital LP's TPG Growth arm and other investors in May.

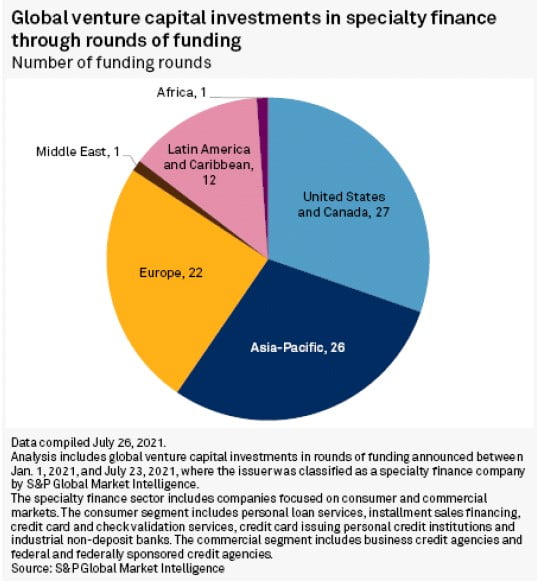

During the period, the majority of venture capital transactions were in North America with 27 funding rounds.

Market Outlook

Emerging segments of the specialty finance market are expected to create more opportunities for PE investment.

The clean energy and electric vehicle financing segments are likely to see significant growth in the near term, given evolving consumer buying behaviors spurred by increased social awareness and greater emphasis placed on investments in these areas due to the current political climate, Hollis said.

Changing generational attitudes about credit and an increasing need for financing options when making large retail purchases are also spurring growth in point-of-sale financing as shown by the emergence of the buy-now-pay-later segment, he added.

PE investment in the overall sector, however, could face challenges related to operational and compliance demands.

"As a specialty finance company grows with PE investment, it will likely require increased investment in its control infrastructure to be effective. Compliance will be a challenge because of the dynamic regulatory environment in specialty finance and the need to ensure that the specialty finance company is able to understand those changes, deploy solutions, or pivot strategy if needed to remain compliant," Hollis explained.

Article By Pam Rosacia and Annie Sabater, S&P Global Market Intelligence

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.