Citco – one of the world’s largest asset servicers with $1.5tn in AuA—noted previously that if GPs didn’t revolutionize their firms’ day-to-day operations, there could be significant negative impact on their ability to attract and maintain capital at a time where global private market assets are ballooning.

Q2 2021 hedge fund letters, conferences and more

In a newly released report, Citco have shown that this pressure is set to continue. Whereas Preqin predicts global PE assets to double to $9.1trillion by 2025, consensus from Citco’s research shows this is dependent on GPs rolling out more secure data integrations and more collaborative workflow platforms.

“The Future of Private Equity Fund Administration 2025,” provides a guide to PE managers on how to keep up with intensifying operational expectations, and better win and maintain mandates from tomorrow’s LPs. Key examples include:

- Simplifying data collection, as a firm’s accounting providers multiply

- Ensuring secure information transfer via modern communication tools

- Installing end-to-end payment security to defeat fraud

- Using digital AML/KYC platforms to smooth the subscription process

Introduction

Two years ago we wrote a white paper on the four key changes happening in the private equity industry’s operating models.

How communication was moving from unstructured and insecure to structured and digitised. How process specialisation was being driven by growth. How low levels of automation presented opportunities for disruption. How globalisation was driving the need for standardisation.

With a robust uptick in digitization driven by these factors over the last two years, we are now starting to see consensus appear in the industry around the operating models of the future.

After interviewing our subject matter experts, we saw a consistent convergence in the digitisation plans around a 2025 date, a time when the majority of their clients would have digitised/data driven workflows in their area. It led us to believe that, in 2025, operating models will be led by two main principles:

Data Integrations

Driven by the need for automation and cybersecurity, structured data exchange will be the norm by 2025. Structured inputs are critical to enabling process automation. Moving data exchange from insecure tools, such as email, to encrypted processes is key to maintaining security.

It applies both ways, managers must supply administrators with structured inputs and admins must provide managers with structured outputs. In general, the theme is more data and linkages. Everything will require more data points, attributes and ways of linking payments to deals, such as ESG ratings. Each event will need more tagging and the ability to link through the systems will be key.

One of the most important enablers of this will be golden record data – for example, holding a record of a deal, a director, an expense, or capital event – which is fed downstream to all parties involved is the foundation on which automation is built.

Collaborative Platforms

The private equity industry has, at its heart, flexibility – an ability to have the right setup for any investment opportunity or investor need. This flexibility requires that many processes are collaborative efforts between managers, lawyers, accountants and investors. By 2025, we will be using a set of tools that digitise these interactions, keeping track of who is working on what, the data input and the review status. These platforms will structure, authenticate and guide the process of creating golden data. Examples will include an online subscription tool that structures the gathering of investor information and an invoice management tool that extracts data from PDFs and uses it to power online approvals and payments.

The Citco group of companies (Citco) has many years’ experience helping private asset managers from around the world digitise their operating models. In this primer, we explain the details behind models we have built for our clients and hope that readers will see the applicability to their businesses.

The operating model of 2025 is starting to come into focus. Many of the leaders in the private equity industry have spent the last few years putting in place the foundations of these new ways of working. They are now starting to see the rewards from their efforts.

-

Defeating Fraud on Investment Payments

A greater focus has been placed on end-to-end security of payments as the private equity industry has grown in size and complexity.

The need to securely capture payment details and approvals without a reliance on Excel and email is critical to avoiding fraud.

During time sensitive processes such as investment acquisitions, having a single payment system which tracks all payments in real time can make the difference between settling on the due date and multi-day delays.

Citco enables this protection for its clients by providing a single treasury system that manages all bank accounts and centralises settlement instruction and payment approval.

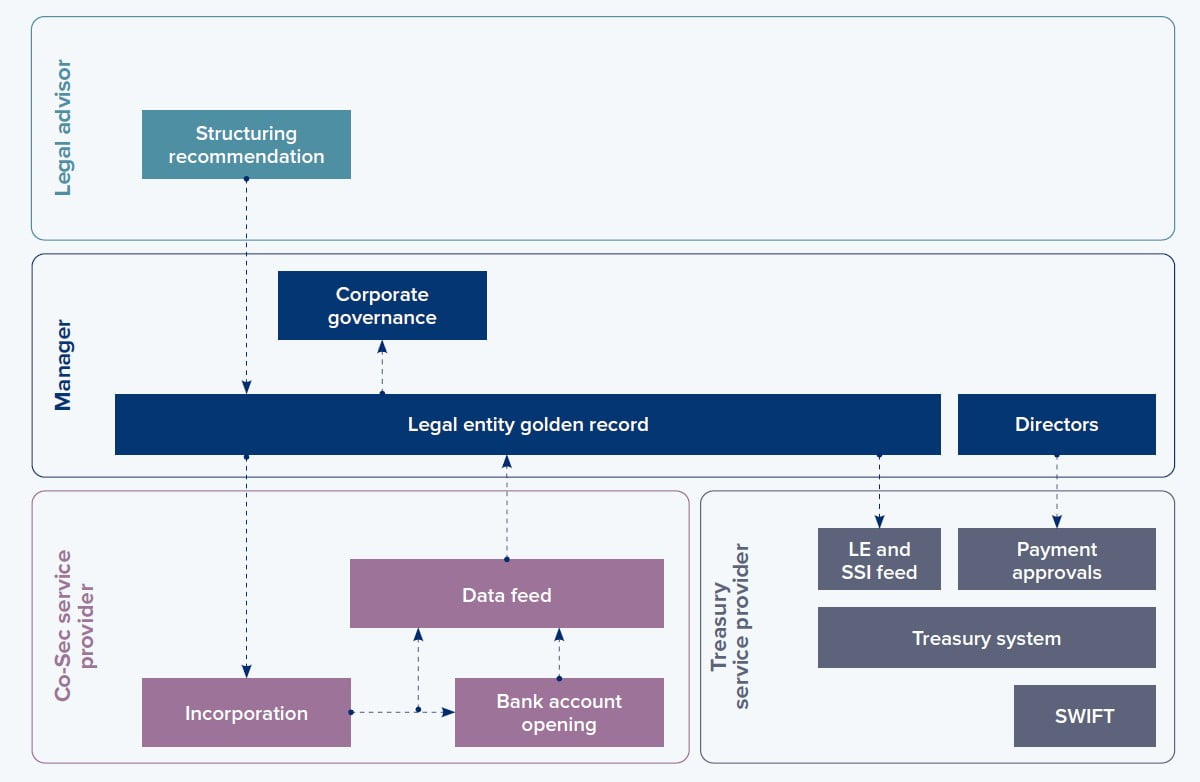

- Lawyers recommend structures to be created.

- Manager needs a system of record for all entities, existing or in setup; for example, with directors, meetings, legal records and bank accounts.

- The individuals completing co-sec work must ensure resulting data populates a legal entity golden record, helped by the manager.

- This allows managers to ensure control around corporate governance; for example, a director has left and we know exactly which entities he has resigned from and when, or who must sign to open a new bank account for a particular entity.

-

Automate Accounts Payable

Accounting has historically relied on emails, PDFs and physical signatures. In our new remote, global, tech-led world, this has changed.

For example, the correct set of tools and data integrations can automate accounts payable by flowing an invoice all the way from receipt, through approvals to payment and accounting, in a secure and automated fashion. This reduces the risk of fraud and frees up staff time.

Citco provides this automation to our clients with an automated connection to our proprietary accounts payable system and an API-driven interface for clients’ accounts payable systems.

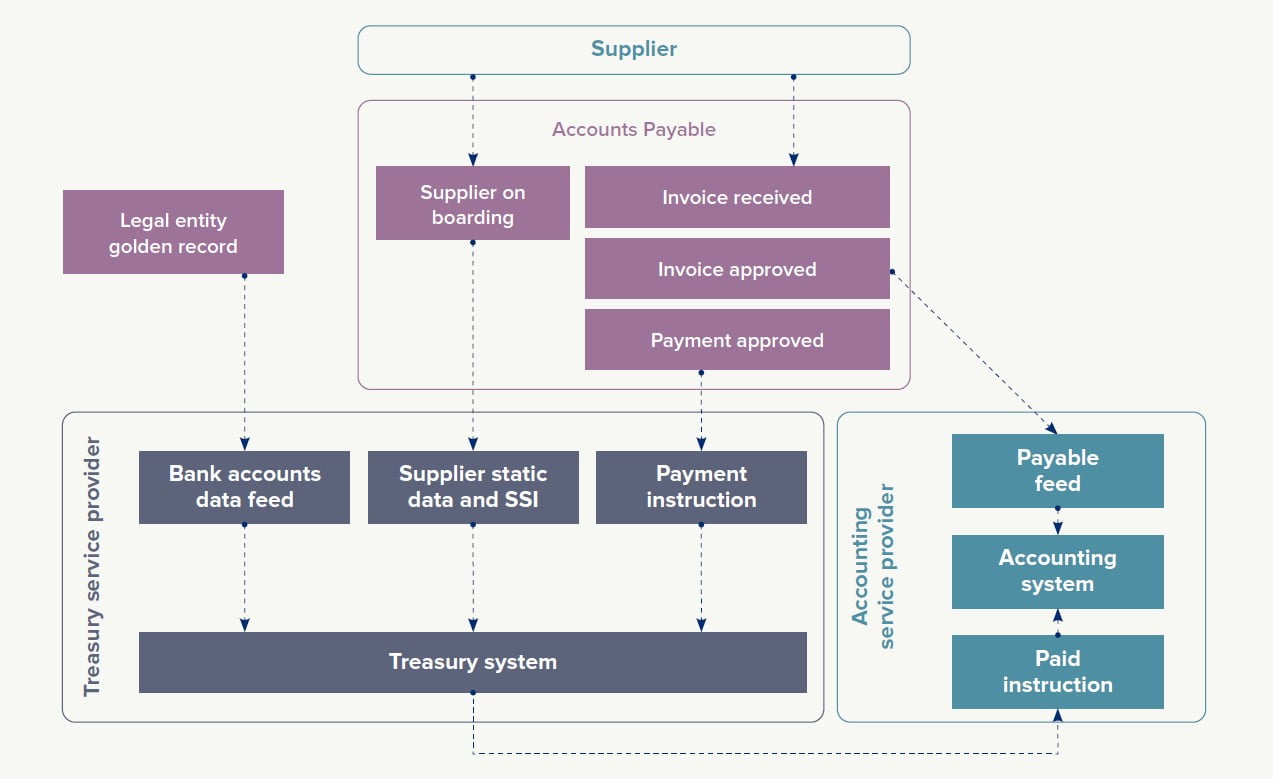

- A formal setup process for a supplier is required to ensure suitable due diligence has occurred. This process must also ingest payment details and supply them to the payments system to be stored as SSIs.

- A digital process for ingesting invoices, extracting data and obtaining approvals must exist.

- The invoice data, plus digital approvals, should be systematically combined with the SSIs in the treasury system to create a SWIFT payment into the network.

- This avoids the risk of fraudulent instructions and simplifies controls over access to bank accounts.

- Data sent to the accounting platform should be from the same sources and routes.

Read the full report here by Citco.