Effissimo Capital Management scored an important victory in a shareholder vote at Toshiba after investors approved its proposal seeking the appointment of independent persons to investigate allegations of wrongdoing at last year’s vote. A second proposal by Farallon Capital Management for a vote on the company’s capital allocation policy did not pass.

Q4 2020 hedge fund letters, conferences and more

"Toshiba sincerely accepts the shareholders’ holistic opinion. We will sincerely cooperate in the investigation with the investigators… and will strive to ensure further transparency in operation," the company said in a statement. Effissimo said in a press release that "support for the proposal demonstrates shareholders’ strong commitment to protecting their most fundamental right - the right to vote."

Several press reports and Effissimo claimed that some shareholders were pressured to vote with Toshiba management last year, while Toshiba’s voting tabulator Sumitomo Mitsui Trust, which also has a banking relationship with Toshiba, failed to count some votes. Attention will now turn to the investigation, which should be over by the end of May. Read an in-depth analysis of the situation here.

Activism Chart Of The Week

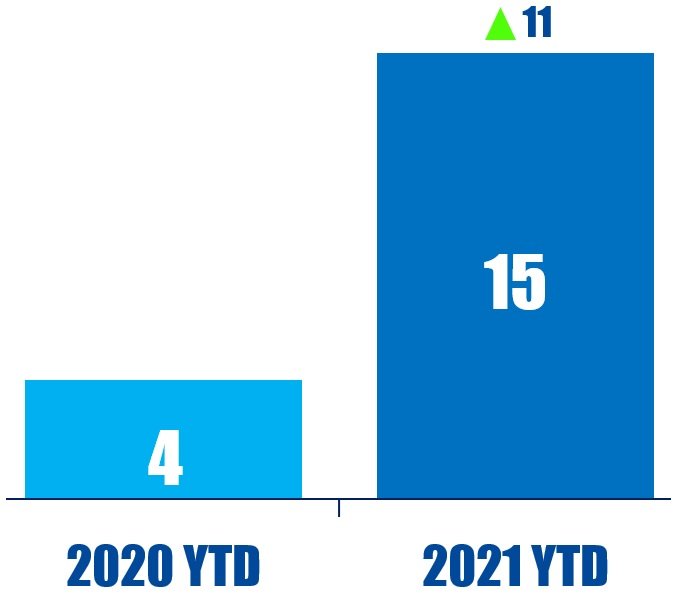

So far this year (as of March 18, 2021), U.S.-based companies have been publicly subjected to 15 business strategy-related demands, up from four in the same period last year.

Source: Insightia (Activist Insight Online)

What’s New In Proxy Voting

U.S. Securities and Exchange Commission (SEC) Acting Chair Allison Herren Lee announced staff are conducting a review of Form N-PX, with the aim of increasing the transparency of fund manager voting.

Lee expressed concerns that SEC regulations "have not kept up with this new landscape of institutional investor-driven corporate governance." The SEC is currently developing methods by which to increase the transparency of fund manager voting using existing data sources, including the possible creation of a website to publicly present voting information for retail investors.

A new rule could potentially involve standardizing voting disclosures, structuring and tagging data for easy access, and facilitating more timely disclosure so investors "can act quickly to reward fund managers that best match their needs and expectations."

"It’s hard to see how retail investors can formulate an accurate and reliable picture of how a fund votes on ESG issues when they are forced to parse voluminous forms that often use bespoke shorthand for shareholder proposals," said Lee in the statement.

Proxy chart of the week

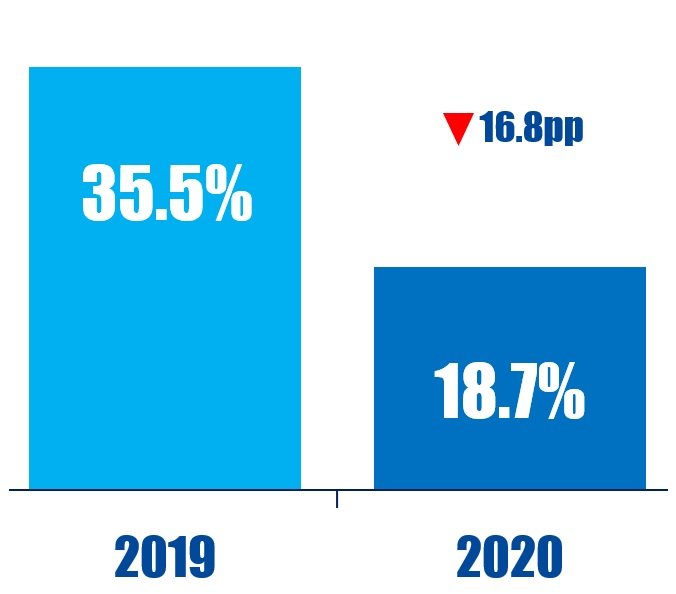

Investor support for shareholder proposals in Australia fell from 35.5% in 2019 to 18.7% in 2020.

Source: Insightia (Proxy Insight Online)

What’s New In Activist Shorts

Plug Power received a letter from Nasdaq explaining its failure to file its 2020 annual report with the U.S. Securities and Exchange Commission renders the company non-compliant with the stock exchange’s listing rules.

Plug Power has until May 17 to file its annual report but if it is unable to, the company can submit a plan to regain compliance with Nasdaq listing rules that could grant it another 180 calendar days to regain compliance, should the stock exchange accept. In that instance, Plug Power would have until September 13 to regain compliance.

Plug Power missed its extended March 16 deadline to file its annual report after announcing the need to restate its financial statements for 2018 and 2019, as well as quarterly filings for 2019 and 2020.

In January, Kerrisdale Capital Management disclosed a short position in the company, calling its green hydrogen energy hopes a "pipe dream." Citron Research and Spruce Point Capital Management have also taken short positions in the stock.

Shorts chart of the week

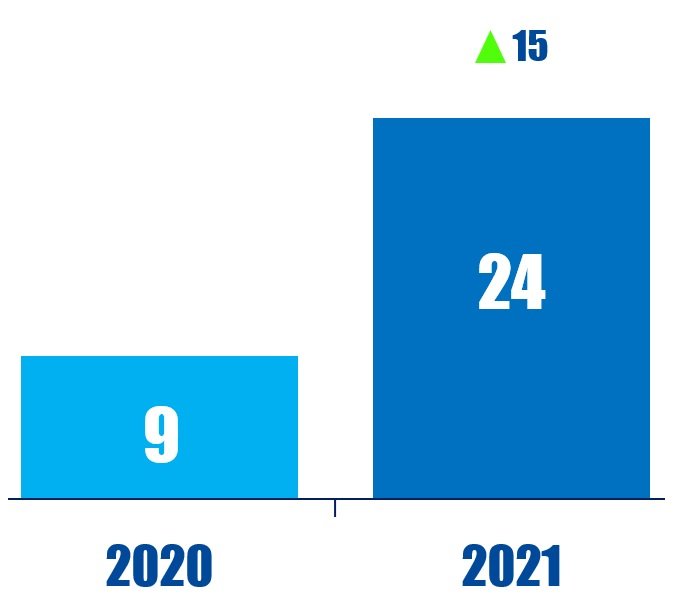

In the 12 months ending March 19, 2021, Hindenburg Research has publicly subjected 24 companies to an activist short campaign, up from nine in the same period last year.

Source: Insightia (Activist Insight Shorts)

Quote Of The Week

This week’s quote comes from Alicia Ogawa, an expert on Japanese corporate governance, in an interview with Activist Insight Online. Subscribers can read our in-depth article here which previewed the shareholder vote on Effissimo Capital Management's demand for an independent investigation into last year’s annual meeting at Toshiba.

“Things are generally going in the right direction, and then you have this big black eye on the face of japan that you should do something about.“ – Alicia Ogawa