A dividend king is a company that has managed to increase dividends to shareholders for at least 50 years in a row.

Q3 2020 hedge fund letters, conferences and more

There are only 30 such companies in the US, and perhaps a couple more in the rest of the world. It is not a small achievement to have been able to reward long-term shareholders with a dividend raise for over half a century.

Over the past 50 years, some calamities experienced include:

- Seven Recessions since 1967

- The Vietnam War

- The oil crisis in the 1970s

- Stagflationary 1970s

- Double digit interest rates in the 1980s

- Fall of the Soviet Union in 1991

- 9/11 in 2001

- The Dot-com bubble bursting in 2000

- The housing bubble bursting in 2007 - 2008

- ZIRP and NIRP since 2009

- The Covid-19 Pandemic

Throughout this calamity each of those businesses managed to grow earnings, and raise the dividend to their long-term shareholders. If you are looking for a long-term shareholder base, the best way to build it is by paying those owners more every single year. This is a simple, but novel idea for corporations to embrace.

We had two new additions to the list in 2020. There were no companies that left the list. These actions brought the number of companies to 30, from 28 at the end of 2019. This is a record since we started tracking the list of dividend kings in 2010.

When I first came up with the idea for the list of dividend kings in 2010, there were only eleven companies on it. While our 2020 list includes 30 companies,

Last year, I had to remove Target, since its streak of annual dividend increases was only 49 years. I am pretty confident that the retailer will hit 50 years in a row by next year. Other websites show Target as a dividend king, when its press releases and the dividend history on its website show a 49 year track record of annual dividend increases.

The new addition for the current year include:

- Black Hills Corp (BKH)

- MSA Safety (MSA)

These were consistent with my predictions from last year. It is a testament to the predictable nature of their businesses, not in my forecasting abilities.

I expected to add National Fuel Gas (NFG) for this year's list. However, upon further research, I realized that it has only raised dividends for 49 years in a row. That's because the company failed to raise dividends in 1971.

I did some research on historical changes of the Dividend Kings list, which you may find interesting. I reviewed the evolution of the dividend kings prior to 2007 in the article, which has not been done by anyone else.

Since 2010, there have been only two companies that have left the list. One, Vectren (VVC) was acquired. The second, Diebold (DBD), kept dividends unchanged, but ultimately ended up cutting them.

The 2020 Dividend Kings List

The companies in the 2020 dividend kings list include:

| Company Name | Symbol | Sector | Years Dividend Increases | 10 Year Annualized Dividend Growth | Dividend Yield | Share Price |

| ABM Industries Inc. | ABM | Industrials | 53 | 3% | 1.92% | 38.50 |

| American States Water | AWR | Utilities | 66 | 9% | 1.82% | 73.82 |

| Black Hills Corp. | BKH | Utilities | 50 | 4% | 3.72% | 60.83 |

| Commerce Bancshares | CBSH | Financials | 52 | 6% | 1.64% | 65.96 |

| Cincinnati Financial | CINF | Financials | 60 | 4% | 3.14% | 76.35 |

| Colgate-Palmolive Co. | CL | Consumer Staples | 57 | 7% | 2.06% | 85.64 |

| California Water Service | CWT | Utilities | 53 | 3% | 1.72% | 49.48 |

| Dover Corp. | DOV | Industrials | 65 | 9% | 1.62% | 122.03 |

| Emerson Electric | EMR | Industrials | 64 | 4% | 2.63% | 76.82 |

| Farmers & Merchants Bancorp | FMCB | Financials | 58 | 3% | 2.06% | 726.96 |

| Federal Realty Inv. Trust | FRT | Real Estate | 53 | 5% | 4.86% | 87.22 |

| H.B. Fuller Company | FUL | Materials | 51 | 9% | 1.24% | 52.33 |

| Genuine Parts Co. | GPC | Consumer Discretionary | 64 | 7% | 3.21% | 98.37 |

| Hormel Foods Corp. | HRL | Consumer Staples | 54 | 16% | 2.08% | 47.18 |

| Johnson & Johnson | JNJ | Health Care | 58 | 7% | 2.79% | 144.68 |

| Coca-Cola Company | KO | Consumer Staples | 58 | 7% | 3.18% | 51.60 |

| Lancaster Colony Corp. | LANC | Consumer Staples | 58 | 9% | 1.77% | 169.33 |

| Lowe's Companies | LOW | Consumer Discretionary | 58 | 19% | 1.54% | 155.82 |

| 3M Company | MMM | Industrials | 62 | 11% | 3.40% | 172.73 |

| Altria Group Inc. | MO | Consumer Staples | 51 | 10% | 8.64% | 39.83 |

| MSA Safety Inc. | MSA | Industrials | 49 | 6% | 1.15% | 149.44 |

| Nordson Corp. | NDSN | Industrials | 57 | 15% | 0.77% | 203.81 |

| Northwest Natural Gas | NWN | Utilities | 65 | 2% | 4.01% | 47.92 |

| Procter & Gamble Co. | PG | Consumer Staples | 64 | 6% | 2.28% | 138.87 |

| Parker-Hannifin Corp. | PH | Industrials | 63 | 13% | 1.32% | 267.26 |

| Stepan Company | SCL | Materials | 53 | 9% | 1.05% | 116.16 |

| SJW Corp. | SJW | Utilities | 53 | 6% | 1.95% | 65.60 |

| Stanley Black & Decker | SWK | Industrials | 53 | 8% | 1.52% | 184.31 |

| Sysco Corp. | SYY | Consumer Staples | 50 | 5% | 2.52% | 71.29 |

| Tootsie Roll Industries | TR | Consumer Staples | 52 | 4% | 1.16% | 30.97 |

Note: The prices and yields are as of November 30, 2020

There are three companies which are set to potentially join the elite list of dividend kings by the end of 2020. These companies have a 49 year record of annual dividend increases:

- National Fuel Gas (NFG)

- Illinois Tool Works (ITW)

- Target (TGT)

- Universal Corp (UVV)

- Becton Dickinson (BDX)

- W.W. Grainger (GWW)

- PPG Industries (PPG)

- Tennant (TNC)

A few companies like Target and Illinois Tool Works will be ready to join in 2021. Same goes for Universal Corp.

This track record is a testament to the stability of the underlying businesses that generated the earnings growth necessary to grow the dividend for half a century (and longer). This track record is an indication of a business that is relatively immune to outside shocks. This resilience throughout the period manifests itself into the long stretch of dividend increases, spanning over half a century.

While these companies are not investment recommendations, I post them as examples for further study by serious dividend investors. Studying the businesses, their industries, could give you clues as to the type of business that can flourish over a half of a century.

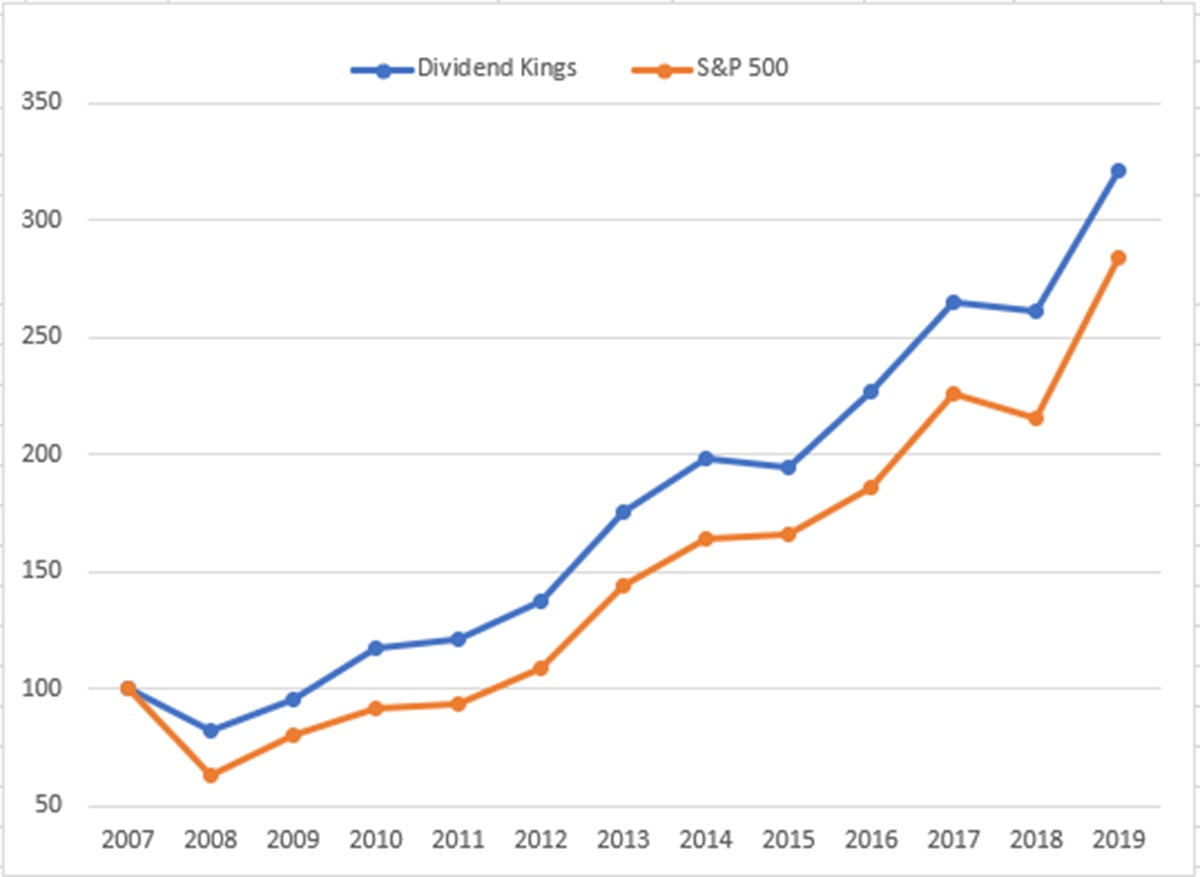

If you had invested an equal amount in the dividend kings list starting at the end of 2007, and made updates along the way, along with re-balancing annually to an equal weighted position, you would have done well. The dividend kings list did better than S&P 500 over time, although it did not best it every single year.

I will update this chart at the end of 2020. Please stay tuned.

As I mentioned above, I have been compiling the list of dividend kings since 2010. To view the historical changes in the list, please follow the links below:

- Dividend Kings List For 2019

- 2018 Dividend Kings List

- Dividend Kings List for 2017

- Dividend Kings for 2016

- Dividend Kings List for 2015

- The Dividend Kings List for 2014

- The Dividend Kings List Keeps Expanding in 2013

- Eleven Dividend Kings, Raising dividends for 50+ years (2012 list)

- Ten Dividend Kings raising dividends for over 50 years (2010 list)

- Evolution of the Dividend Kings List Before 2010

- Historical Performance of the Dividend Kings List

Thank you for reading!

PS Note that Parker-Hannifin's track record is based upon dividend payments for its Fiscal Year rather than the Calendar Year. The fiscal year runs from July 1 to June 30.

Therefore, the FY 2015 dividend was $2.37/share ( one dividend payment of 48 cents/share plus three dividend payments of 63 cents/share).

The FY 2016 dividend was $2.52/share ( four dividend payments of 63 cents/share).

The FY 2017 dividend was $2.58/share ( two dividend payments of 66 cents/share plus two dividend payments of 63 cents/share).

Because of the use of Fiscal Years, rather than Calendar Years, I excluded Parker - Hannifin from the first list of dividend kings that I compiled in 2010.

Update: 06/17/2018

In early 2018 I listed Target as a dividend king incorrectly with a 50 year history of annual dividend increases. Upon reviewing the dividend history for Target on the company’s investor relations website, I agree that it has only managed to boost distributions for 47 years in a row ( which is not a small achievement either). Therefore, I am downgrading it back to dividend champion status. Hopefully in three years it can become a dividend king. The lesson for this paragraph is to trust, but always verify the numbers you see. In addition, you should always do your own research and only invest in what makes sense for you. Blindly following others is frequently a mistake.