Oil prices fluctuated on fears of a recession and a contraction in demand. What are the main figures to observe in this critical month?

Crude oil prices hovered between red and green on Thursday after two days of steep losses this week, still plagued by fears of a global economic recession that could threaten demand but also supply cuts in a tight market.

New Lockdown and Restrictions for the Chinese Panda

On the Asian continent, several million people may again suffer from strict restrictions because of China’s “zero-Covid policy” because of this epidemic rebound, which raises fears of the return of restrictions in Shanghai a month after the lifting of a long and grueling lockdown.

Q2 2022 hedge fund letters, conferences and more

Find A Qualified Financial Advisor

Finding a qualified financial advisor doesn't have to be hard. SmartAsset's free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes. Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests. If you're ready to be matched with local advisors that can help you achieve your financial goals, get started now.

In the most pessimistic scenario imagined by JP Morgan, Russia could slash its crude oil production by 5 million barrels per day in retaliation to a price cap being considered by the G7, according to an article published by Reuters on Monday.

Inflation + Recession = Stagflation? Economic Indicators to Be Followed Next…

As we have seen volatility increasing, here are the main concerns that the markets will be facing within the next few weeks.

Technically, if we take the strict definition of recession, the United States has already entered a recession since last week, on the 1st of July, since they have just had two consecutive quarters of negative gross domestic product (GDP).On the other hand, I personally believe that central banks’ tools are indeed very limited given the context of supply-driven inflation. On the European side, the cost of debt for Southern European countries would become unbearable with higher interest rates – which could eventually trigger a fragmentation of the Eurozone, which is why I can understand that Lagarde is not feeling very comfortable in her shoes right now.

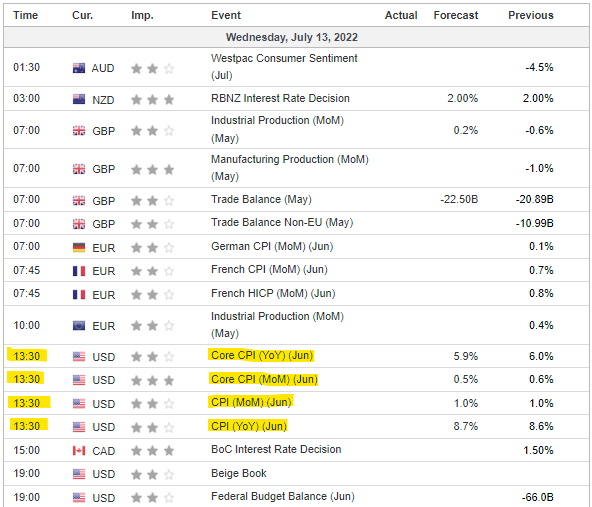

There are some figures to look at this month – as July could be a critical month – so it could shape what the next 6 months are going to be like:

- Watching earnings estimate costs could give us an indication of the earnings season (15 Jul-31 Aug) for Q2 and, therefore, how badly companies are going to be impacted.

- Important date: 13 of July – 1:30 PM London Time / 8:30 AM New York Time – US Consumer Price Index (CPI) data for the month of June to be released. Will it be larger than May figures? No doubt, traders will carefully observe whether the peak of inflation is behind, or simply not yet… If it is lower, then there will be sense of relief (a rather positive sentiment), the US Fed then wouldn’t have to hike much. If not, then the volatility would increase on negative sentiment, with another peak on the Volatility (or Fear) Index (VIX) causing a drop for markets (in particular, the stock exchange) much lower, and consequently the Fed would have to hike further, etc.

Anyway, it is likely that the second half of 2022 will not be bullish, and central banks are not going to come to the rescue of investors with an easing monetary policy anytime soon.

Fundamental Analysis

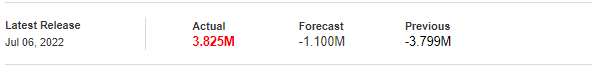

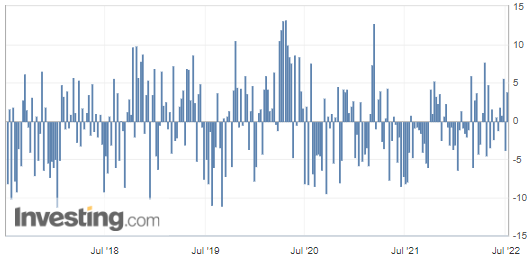

On Wednesday, the American Petroleum Institute (API) released their weekly oil stock figures.

U.S. API Weekly Crude Oil Stock

The weekly commercial crude oil reserves in the United States rose to +3.825M barrels while the forecasted figure was just about -1.100M, according to figures released yesterday by the US American Petroleum Institute (API).

US crude inventories have thus increased by over 3.825 million barrels, which firmly shows a slowing demand and could be considered a strong bearish factor for crude oil prices. This figure could also signal a drop in fuel consumption. As a result, demand is now dropping as well despite the ongoing context of energy supply cuts.

(Source: Investing.com)

WTI Crude Oil (CLQ22) Futures (August contract, daily chart)

RBOB Gasoline (RBQ22) Futures (August contract, daily chart)

Brent Crude Oil (BRNQ22) Futures (August contract, daily chart) – Represented by its Contract for Difference (CFD) UKOIL

That’s all, folks. Happy trading!

Like what you’ve read? Subscribe for our daily newsletter today, and you'll get 7 days of FREE access to our premium daily Oil Trading Alerts as well as our other Alerts. Sign up for the free newsletter today!

Thank you.

Sebastien Bischeri

Oil & Gas Trading Strategist

The information above represents analyses and opinions of Sebastien Bischeri, & Sunshine Profits' associates only. As such, it may prove wrong and be subject to change without notice. At the time of writing, we base our opinions and analyses on facts and data sourced from respective essays and their authors. Although formed on top of careful research and reputably accurate sources, Sebastien Bischeri and his associates cannot guarantee the reported data's accuracy and thoroughness. The opinions published above neither recommend nor offer any securities transaction. Mr. Bischeri is not a Registered Securities Advisor. By reading Sebastien Bischeri’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Sebastien Bischeri, Sunshine Profits' employees, affiliates as well as their family members may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.