Hidden Value Stocks issue for the second quarter ended June 30, 2022, featuring an interview with Old West Investment Management, discussing their latest value idea, Bunge Ltd (NYSE:BG).

Introduction

Welcome to the June 2022 (Q2) issue of Hidden Value Stocks.

The format of this issue is a bit different from past issues. On the first few pages, we have our usual updates from previous issues of Hidden Value Stocks. There’s also some extracts from the Voss Value Fund’s first-quarter letter to investors. Voss believes furniture retailer Williams-Sonoma, Inc. (NYSE:WSM) is deeply undervalued, and it could see explosive growth over the next few years as its business-to-business arm expands.

The second half of the issue contains some highlights from a recent investor conference, the London Value Investor Conference, where Boyar Value presented three of its favorite ideas.

We hope you enjoy this issue of Hidden Value Stocks, and if you have any questions or comments, please feel free to contact us at [email protected].

Sincerely,

Rupert Hargreaves & Jacob Wolinsky.

Q2 2022 hedge fund letters, conferences and more

Updates From Previous Issues

Steven Kiel’s Arquitos has been profiled a couple of times in Hidden Value Stocks. The firm focuses on finding uncovered smallcap ideas that the rest of the market appears to be overlooking.

In the firm’s first-quarter 2022 letter to investors, it highlighted its two latest ideas, Goedeker and ALJ Regional Holdings. Here’s what the Kiel had to say about these stocks in his quarterly investor update:

“We own the warrants of an online appliance retailer called Goedeker (NYSEAMERICAN:GOED). Shares and the warrants have been crushed in the last year. In the beginning, they declined due to a capital raise and acquisition. More recently, shares have been hurt by concerns over the supply chain and future demand. While these concerns are not unwarranted, they are totally overblown, leading to a very attractive valuation for the company. This “headline risk” has scared away many investors, providing us with a multi-bagger opportunity. Emotional arbitrage doesn’t mean there isn’t bad news. There typically is. It means that the market is pricing in the worst-case scenario when the chances of that occurring are very low. With Goedeker, we can take advantage of that exaggerated pessimism in an even more asymmetric way through outstanding warrants of the company that don’t expire until 2026. The company has promised to buy back shares and will have a great opportunity to do so after it reports its first-quarter results in May.

We have a few holdings relying on information arbitrage. Sometimes the information is readily available but simply overlooked because of the size of the company, which is why our holding in ALJ Regional Holdings (NASDAQ:ALJJ) is currently so mispriced. They have sold off most of their existing businesses and have a cash pile which they will likely put to work in a shareholder-friendly way. Shares are severely mispriced until their next quarterly report is released and their specific plans for the cash are announced. However, the information is out there in other filings and previous public statements and actions. We are highly likely to see at least a 40% gain in shares in the near term—and possibly more—with limited downside risk.”

Old West Investment Management’s Latest Value Idea

In the current market, any fund manager that has been able to achieve a positive return is certainly worth noting. That’s why Old West Investment Management, LLC deserves a mention in this issue.

For the first quarter of 2022, Old West’s investment portfolios returned between 12% and 18% for separately managed accounts. Limited partner returns ranged between 14.5% and 23%.

Old West first appeared in Hidden Value Stocks in March 2018. The firm recommended Zedge Inc, which jumped 420% over the next three years. The firm also highlighted two of its favorite uranium stocks in the March 2019 issue, NexGen Energy Ltd (TSE:NXE) and Energy Fuels Inc (NYSEAMERICAN:UUUU). These stocks went on to return 240% and 103%, respectively.

The firm’s latest idea is the agribusiness, Bunge. Here’s what Old West had to say about the opportunity in its first-quarter letter to investors and partners:

“Bunge Ltd (pronounced BUN-GEE) Ltd (NYSE:BG) is one of the biggest agribusinesses and food companies in the world. There are four worldwide companies that dominate the sector, the others being Archer-Daniels-Midland Cargill, and Dreyfuss. One of our favorite ways to screen for new ideas is following insider buying. When I saw the Form 4 filed by new Bunge CEO Greg Heckman, his purchase of $9 million of BG stock intrigued me. My initial thought was the company gave him the stock as a signing bonus. I contacted BG Investor Relations and asked whether it was a signing bonus or did Heckman actually write a check for $9 million. IR assured me it was his own hard-earned money that he invested in the company he was about to run.

Heckman was a long time executive at Conagra Foods who obviously sensed opportunity at BG. One of his first moves as CEO was to move the company’s HQ from New York to St. Louis, right in the middle of America’s breadbasket. BG had been plagued for years with poor decisions by underperforming management. Heckman’s decision to move to St. Louis was indicative of a no nonsense style and he would commence cutting expenses and selling non-core assets.

BG’s operations stretch from farmer to consumer. The company is a leading producer of oilseeds, vegetable oils and protein meals. They are a global grain processor, seller of packaged vegetable oils, producer of wheat flour, baking mixes and dry milled corn products. BG also produces sugar and ethanol in Brazil. The company’s core operations consist of Agribusiness, Edible Oil products, Milling products, and Fertilizer segments.

The Agribusiness segment is an integrated global business involved in the purchase, storage, transportation, processing and sale of ag commodities. The ag operations are located in North and South America, Europe, and Asia-Pacific.

The Edible Oil products segment sells vegetable oils and fats, including cooking oils, shortenings, margarines, mayonnaise, and specialty ingredients.

The Milling products segment includes businesses that sell wheat flours, bakery mixes and corn-based products. These operations are located in North and South America.

The Fertilizer segment is involved in producing, blending and distributing fertilizer products for the ag industry in South America, with operations in Argentina, Uruguay and Paraguay, and port facilities in Argentina and Brazil.

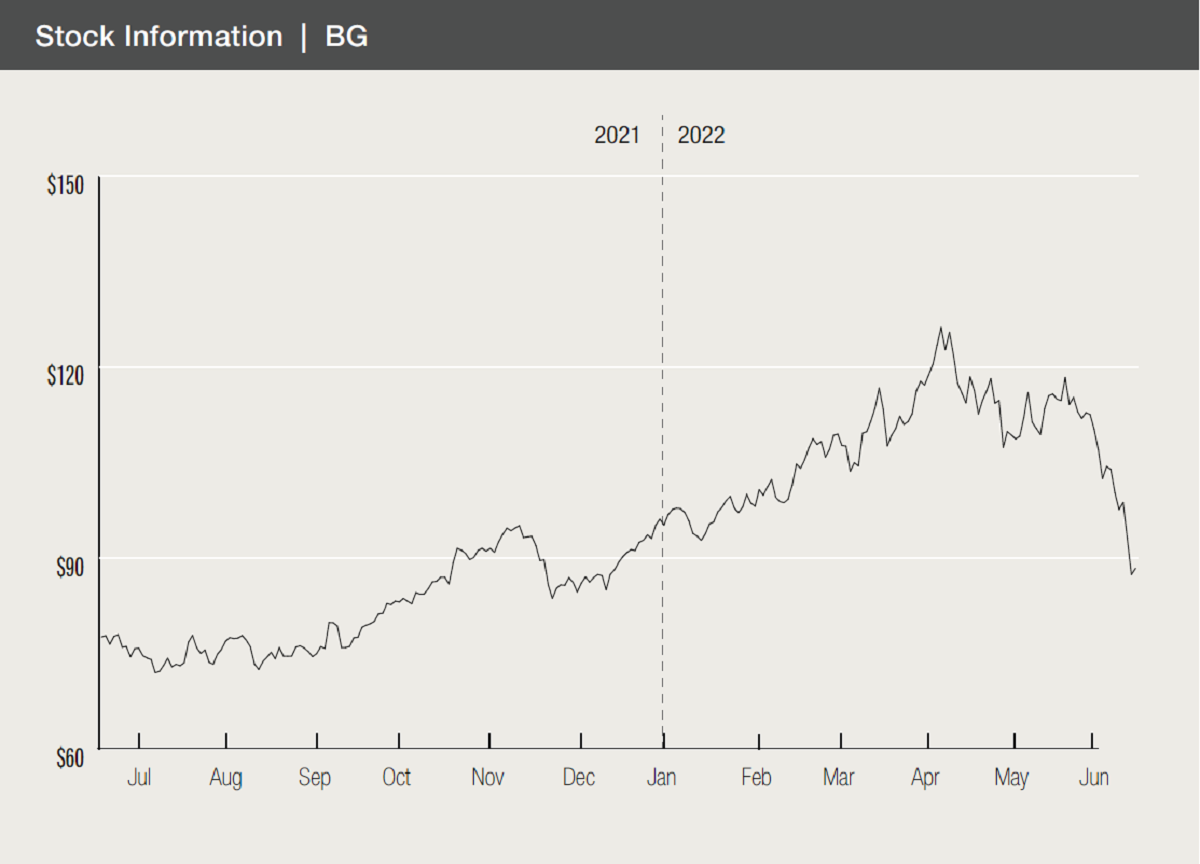

We first purchased BG shares in June 2020 for $44 per share. At the time the company’s stock was trading at 10 times earnings, the market cap was $5.8 billion and the stock had a 5% dividend yield. Today the stock trades at $124 per share, has a market cap of $16 billion and the P.E. ratio has fallen to 9 as earnings per share have grown to $13 per share versus $4.50 when Heckman took over. CEO Heckman has done a masterful job of turning around the company. When EVERYONE is clamoring to buy tech stocks based on a multiple of revenue, our contrarian streak draws us to companies with strong balance sheets and steadily growing earnings. BG has $4 billion of net debt, a leverage ratio of only 1.6 and a current dividend yield of 1.8%. Earnings have been growing at over 50% per year since Heckman became CEO.

The war in Ukraine will have a dramatic effect on food supplies. Worldwide wheat and corn production will be severely affected by the war, and since BG’s operations are heavily tilted to the Americas, BG will benefit from shortages and high prices. In investing you are oftentimes surprised by an unknown event, and we have had them in our favor and against us. When the price you pay has a margin of safety built into it, the chances of getting hurt are minimized. A rule of investing that I believe in is “never sell a great company.” Greg Heckman may very well make Bunge a great company, which means we may own it for a very long time.”