It’s been over a month since the first case of the coronavirus showed up. Since then, the deadly virus has claimed hundreds of lives and infected thousands of people worldwide. However, if a recent report is to be believed, then the impact of the coronavirus, or we could say, the panic it created worldwide, including on the financial markets, may be easing.

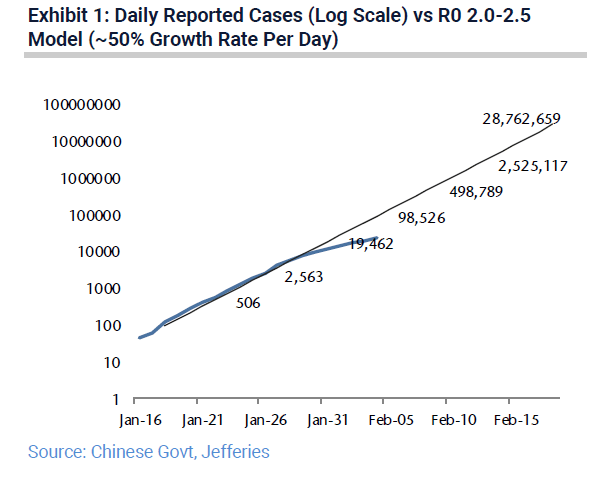

A recent report from Jefferies notes that the logarithmic number of new Coronavirus cases has come down from R0 of 2.0 to 2.5. Also, the report says that “other behavioral measures of panic also seem to be receding.”

Something similar was echoed by Cowen analysts, who in a report earlier this week noted that the new suspected cases as of Monday were still at about 5000 per day, but “we now think the slowing may be temporary, artificially driven by improved testing.”

More testing facilities are allowing patients to confirm more quickly if they are infected with the virus or not. This, according to the report, could be resulting in “artificial slowing” of the suspected cases.

Also, Cowen analysts noted that the number of infected people outside China is pretty small. About 99% of the confirmed cases are still from China. In comparison, 66% of SARS-related cases were from the country of origin (also China).

However, talking about if the worst is over, the research firm says it is too early to tell. Though suspected cases outside China are showing slow growth, the confirmed cases may rise and “easily worsen” in China.

Jefferies analysts, on the other hand, are suggesting investors should watch two critical dates – next Monday, when companies are set to reopen, and the following Monday (Feb. 17th), when schools are scheduled to open. Both of these dates will give a good idea about the strength of the virus.

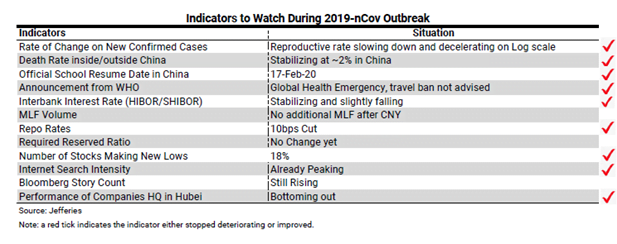

Indicators to watch for

In terms of the impact of the coronavirus, including on the financial markets, Jefferies has listed economic, market and behavioral data points “to watch for when investors can feel that the worst of the Coronavirus is behind them.”

Some of these indicators are Death Rate inside/outside China (stabilizing at about 2% in China), Repo Rates, Interbank Interest Rate (stabilizing and slightly falling), Rate of Changes on New Confirmed Cases, Announcement from WHO, Required Reserved Ratio (no change yet), Internet Search Intensity (already peaking), and Performance of Companies HQ in Hubei (bottoming out).

As per the analysts, most of these indicators “seem to have either stopped deteriorating or improved.”

Further, the analysts note that the “narrowing disconnect” between the Chinese stock market and the commodity markets could also be a sign that the worst “is over in terms of the rate of infections but they are still debating.”

Analysts also believe that the Taiwanese market could serve as a good measure of the impact of the coronavirus. A significant number of Taiwanese companies have manufacturing on the mainland.

Jefferies analysts suggest investors keep track of these indicators to know early on if the impact of the coronavirus, including on the financial markets, are easing or not. Moreover, analysts also recommend an investment tip for investors. As per the analysts, investors should watch for valuation measures that are not as dependent on earnings. Such a strategy would help investors to bottom fish.

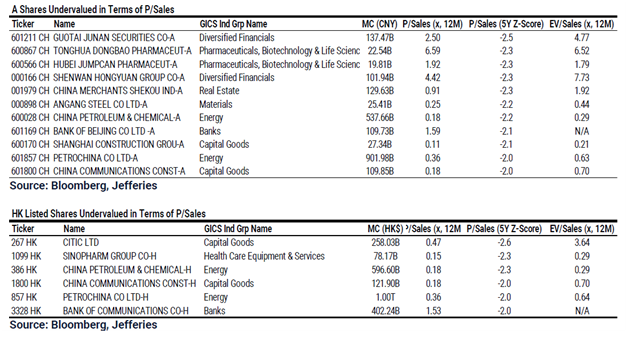

Analysts suggest looking for companies with attractive Price to Sales or EV to Sales. To help investors make a pick, analysts have also listed a few China A-Share and H-Share companies based on the above two metrics. Below is the list of companies:

In terms of the country wise financial impact of the coronavirus, Reserve Bank of Australia (RBA) Governor Lowe recently said that uncertainty and suggested developments need to be monitored closely. Nomura Holdings, however, believes that there was “no sense of panic in the governor’s comments.”

For Thailand, a separate report from Nomura notes that the coronavirus and further delay in the budget could pose “increasing downside risks” to the country’s growth outlook. Bank of Thailand (BOT) expects the 2020 GDP growth may be below its forecast of 2.8%.

For Indonesia, Nomura maintains their 2020 GDP growth forecast of 5.1%. However, the research firm acknowledges “rising downside risks due to the coronavirus outbreak.”

For Japan, Nomura analysts estimate the virus to have -0.5ppt impact on the GDP for the first quarter (Jan-Mar). For full 2020, analysts estimate an impact of just over -0.1ppt.