Financial health is more important than ever in a post-COVID world, and it certainly seems that more people are concerned with their financial stability than ever before. Much of the reason that financial health is so important to people is that so many have been stuck in credit card debt for a large portion of their life. Many enter the workforce in debt, which makes it that much more difficult to get ahead financially in their life and career.

Q2 2021 hedge fund letters, conferences and more

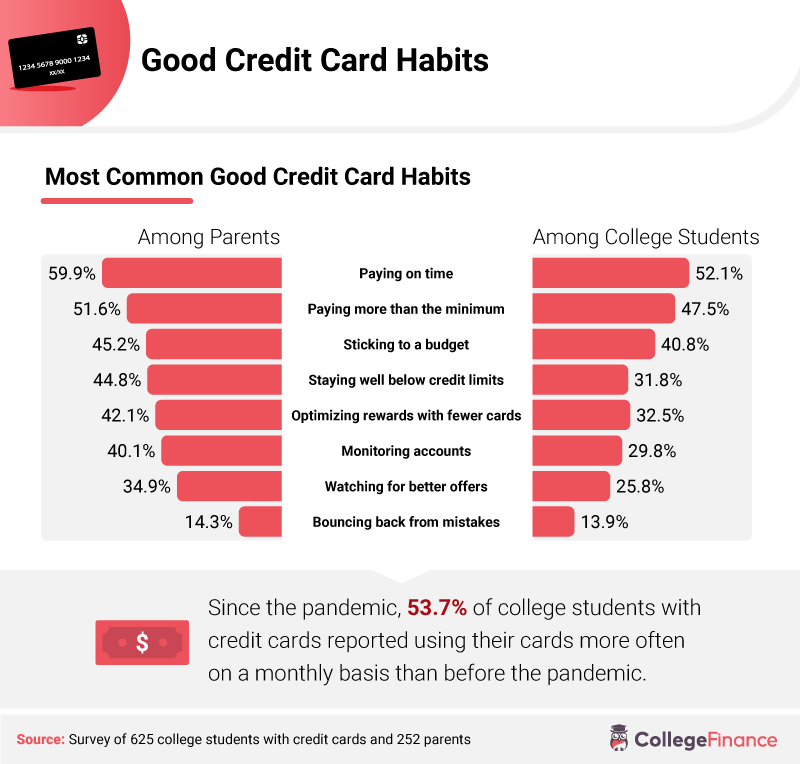

To examine the financial state of college students in America, College Finance surveyed 625 college students with credit cards and 115 without. The results were quite eyebrow-raising and say a lot about the financial position many young people find themselves in today.

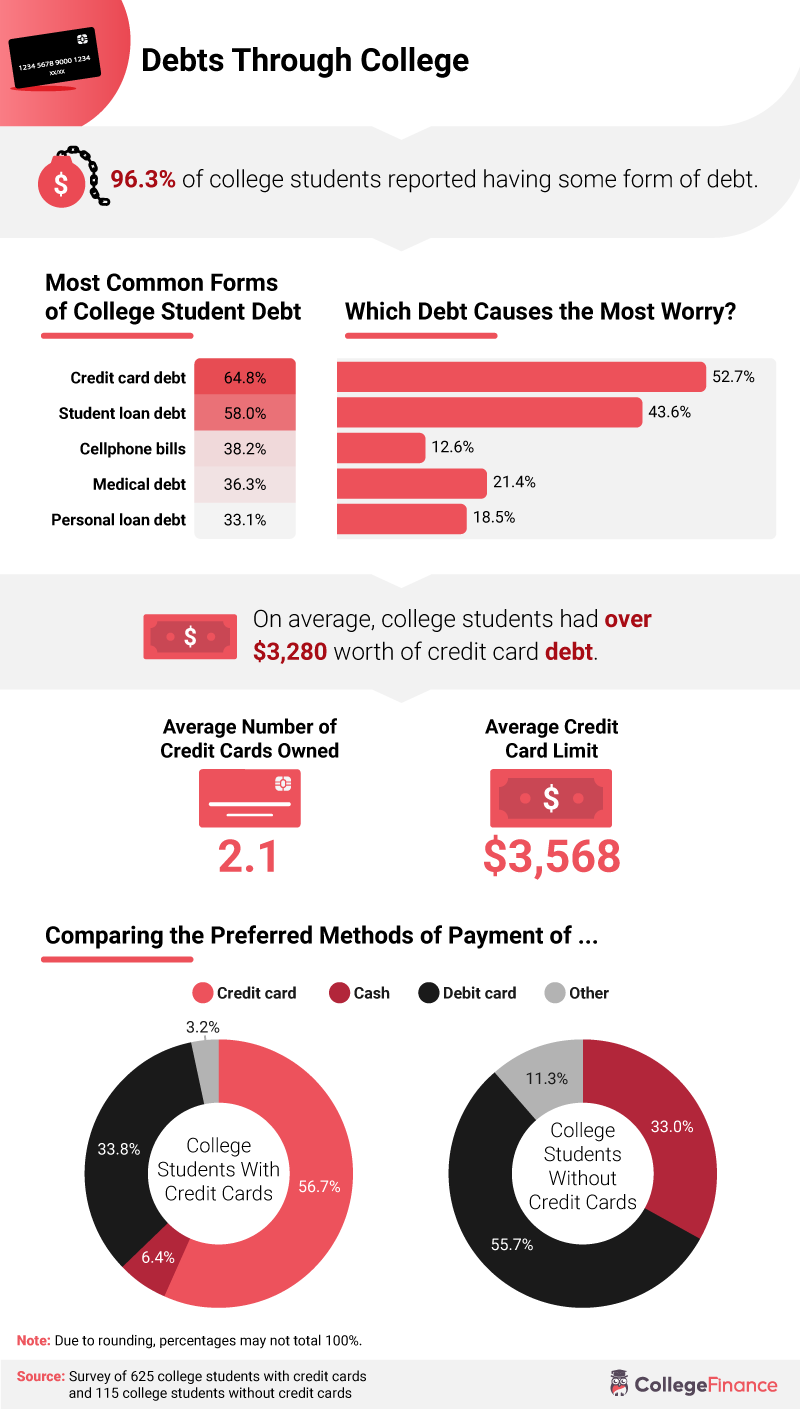

Too Much Debt

According to the College Finance study, a stunning 96.3% of college students have some form of debt, and 64.8% have credit card debt. Other forms of debt that are common among college students include student loans (58%), cellphone bills (38.2%), medical debt (36.3%), and personal loan debt (33.1%). An overwhelming 52.7% of respondents said that credit card debt carried the most worry for them – an understandable sentiment considering that, on average, students had over $3,280 in credit card debt.

The average number of cards owned among respondents was two, and the average limit on those cards was $3,568 – putting the average amount owed in even greater perspective. When it comes to students’ preferred method of payment, 56.7% said they preferred to pay for things with a credit card, while 33.8% opted for a debit card, 6.4% said cash, and 3.2% said another form of payment. For respondents without credit cards, the preferred method of payment was a debit card (55.7%), while 33% said cash, and 11.3% preferred another method altogether.

The Reasons Behind The Cards

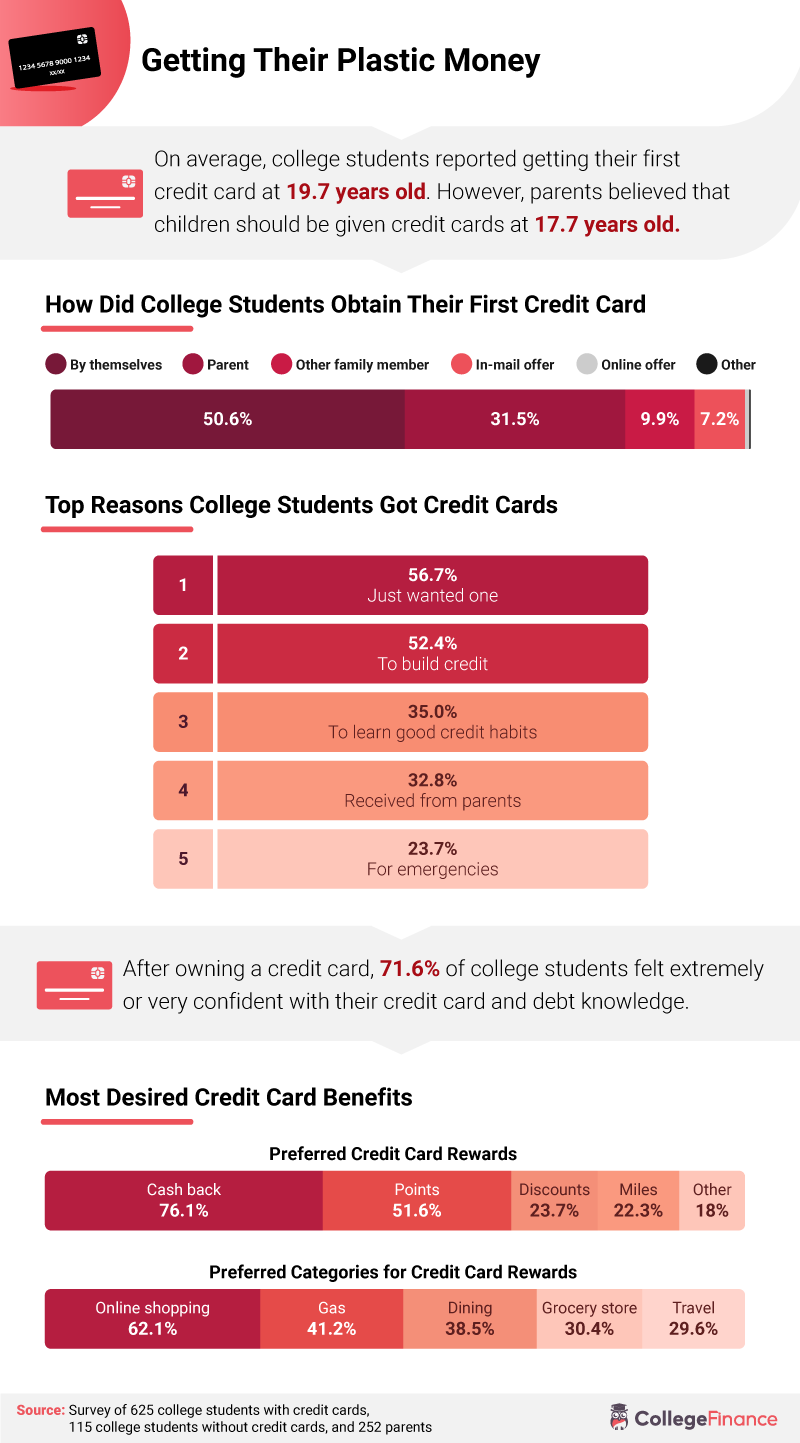

Of course, everybody gets credit cards for different reasons. Some do it to build credit, and others do it to pay for big purchases that they can’t otherwise afford all at once and opt to make payments on those purchases instead. For college students, the reasons can also vary greatly. College Finance asked the 625 respondents with cards about their reasons for getting cards in the first place, and the responses ranged pretty dramatically.

The majority (56.7%) of respondents said they got a credit card just because they wanted one, while 52.4% said they wanted to build credit. Interestingly, 35% said they got a credit card so they could practice good credit habits, while 32.8% said they had it because it was given to them by their parents. Nearly 24% said they procured one for emergencies.

Based on these reasons, did students feel they had a better understanding of debt and credit cards after having one of their own? As it turns out, 71.6% of respondents said they felt extremely confident in their knowledge of both as a result.

How Cards Are Used

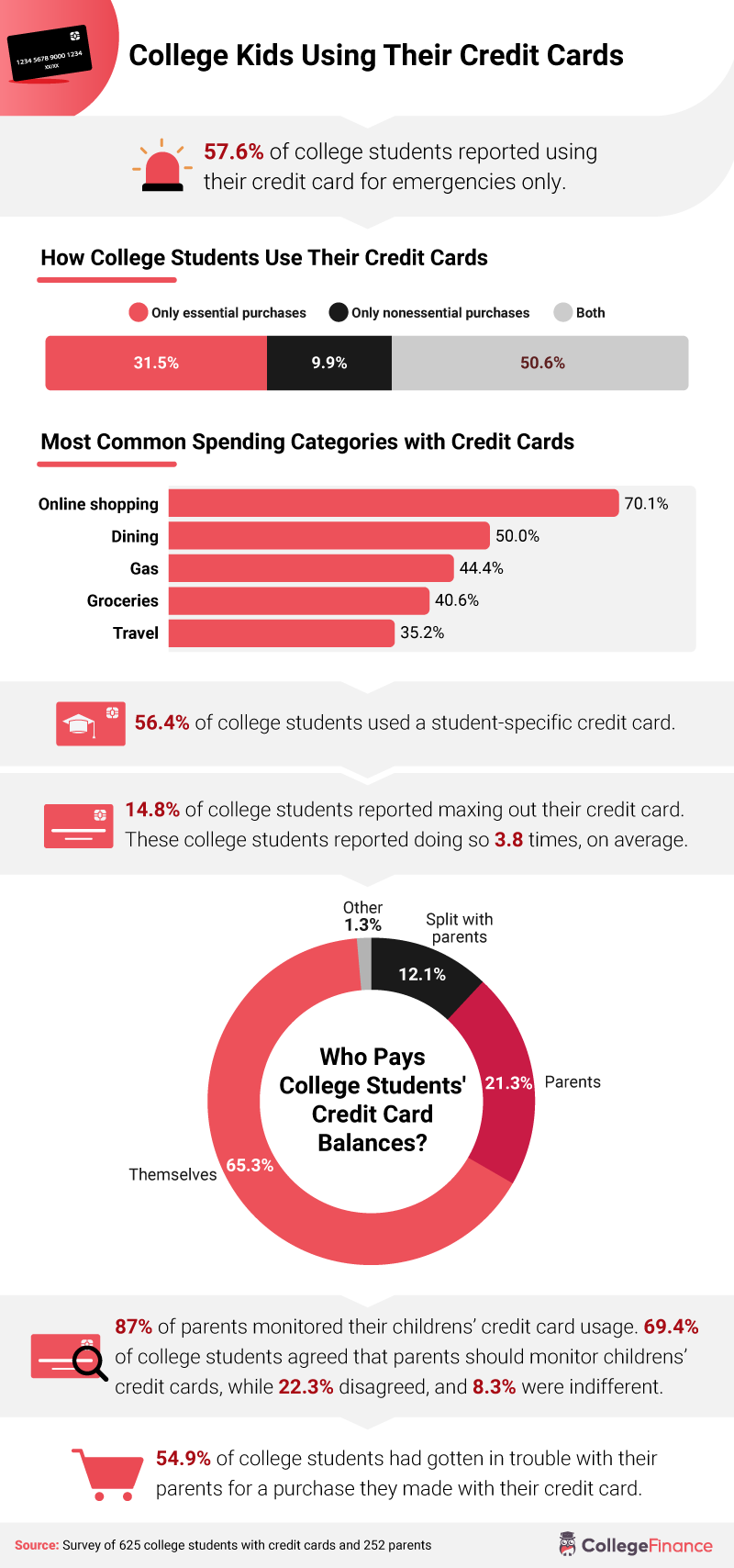

Credit cards can be used for many different purchases, big and small. It all depends on your credit limit, of course, but they can sometimes be good for big purchases that you pay off in increments or even for just getting groceries in advance of payday and then paying off the balance when you get paid. Where people get stuck is if they rack up too much at once and struggle to pay it all down in a timely manner.

That said, prioritizing which type of purchases are designated for credit cards really depends on a number of factors – including your payoff plan and the rate at which you can pay down your balance. For the students surveyed that had credit cards, 31.5% said they used them for essential purchases only, while 9.9% said their cards were for nonessential purchases, and 50.6% cited using credit cards for both.

By far the most common use for credit cards among college students was online shopping (70.1%), while other uses included dining (50%), gas (44.4%), groceries (40.6%), and travel (35.2%).

Maxing out credit cards isn’t an uncommon thing, but managing not to do so is good for your financial health. Do college students grasp enough of an understanding of that not to max out their cards? As it turns out, just 14.8% of cardholding respondents reported maxing out their cards, which is certainly encouraging.

Usage Amid COVID

The pandemic certainly changed the way people look at their finances and made credit card spending more necessary for people due to their finances taking a hit. For college students, it seems that for one reason or another the pandemic had an impact on their need for credit card usage. Almost 54% of respondents with credit cards said they were using their cards more often on a month-to-month basis than they did pre-pandemic.

This might send warning signals to students about their debt, but at the end of the day having a credit card is a valuable resource if you’re responsible with how and when you use it. Ultimately, it seems that college students have joined the ranks of adults of all ages that have found themselves at the mercy of credit cards, for better or worse.