S&P 500 reached my initial target of 3,940, and turned out indeed slated for premarket consolidation today. No signs of daily weakness either in tech or value – market breadth is improving. The bottom isn‘t yet in as the washout is still ahead – yes, we‘re still in a larger bear market, and the fundamental dynamics of Fed‘s options to fight inflation while the U.S. is still set to avoid recession in the traditional sense of the word, is setting tone. The weakness in consumer sentiment hasn‘t yet translated into declining retail sales, and the July reprieve at the pump (oil prices serve as a shadow Fed funds rate), would go a long way in helping the Fed regain some of the inflation fighter luster lost. More thoughts beyond this immediate stock market are reserved for premium subscribers.

Q2 2022 hedge fund letters, conferences and more

Find A Qualified Financial Advisor

Finding a qualified financial advisor doesn't have to be hard. SmartAsset's free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes. Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests. If you're ready to be matched with local advisors that can help you achieve your financial goals, get started now.

Let‘s move right into the charts (all courtesy of www.stockcharts.com) – today‘s full scale article features good 6 ones.

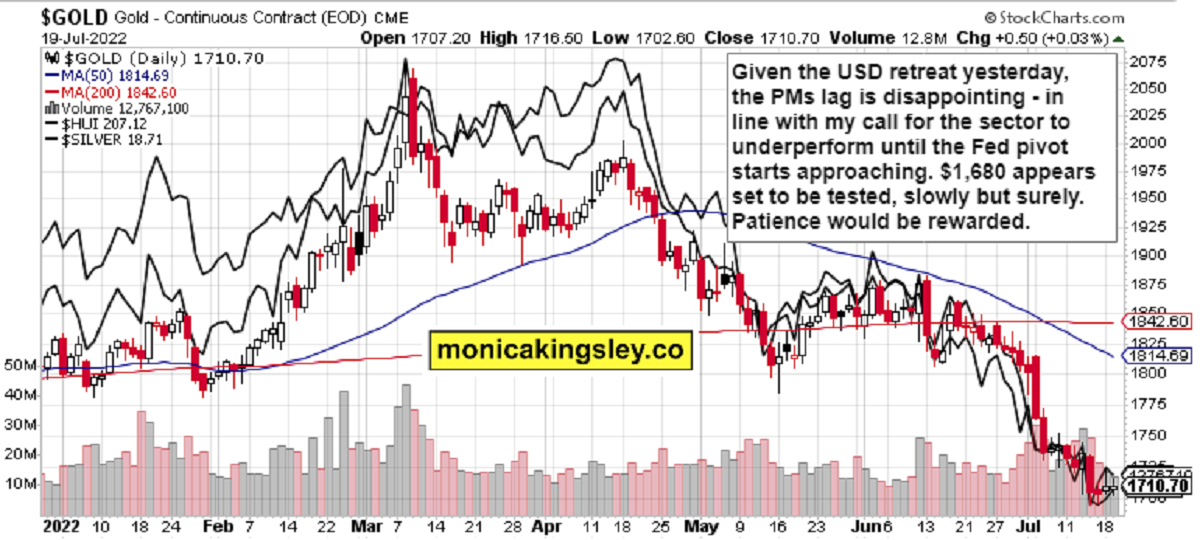

Gold, Silver and Miners

Precious metals haven‘t taken the dollar‘s cue, and that spells more short-term trouble. Not even volume is coming back to gold really. Miners to gold ratio is at least going sideways already – we have quite a few more weeks of tested patience and pain in the metals before the new upleg starts developing.

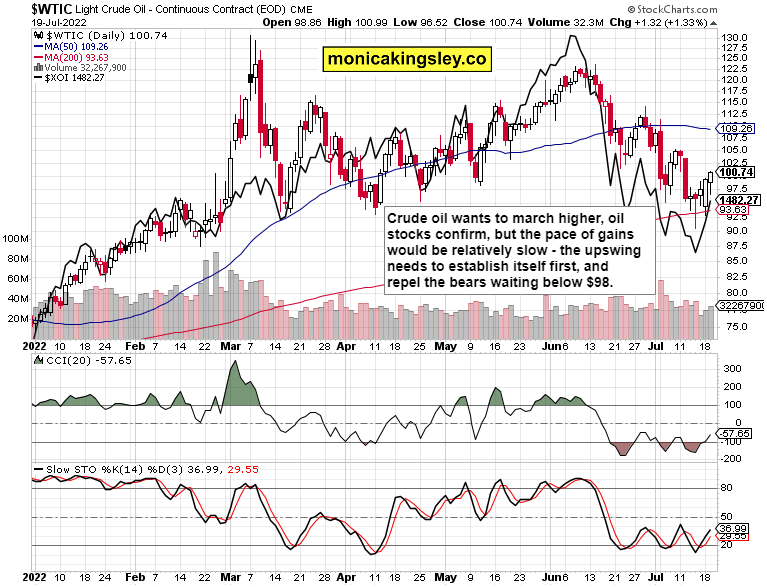

Crude Oil

Crude oil is rising very modestly, and needs more days backing and filling before conquering $105 again. The volume continues favoring the bulls – this week would be good.

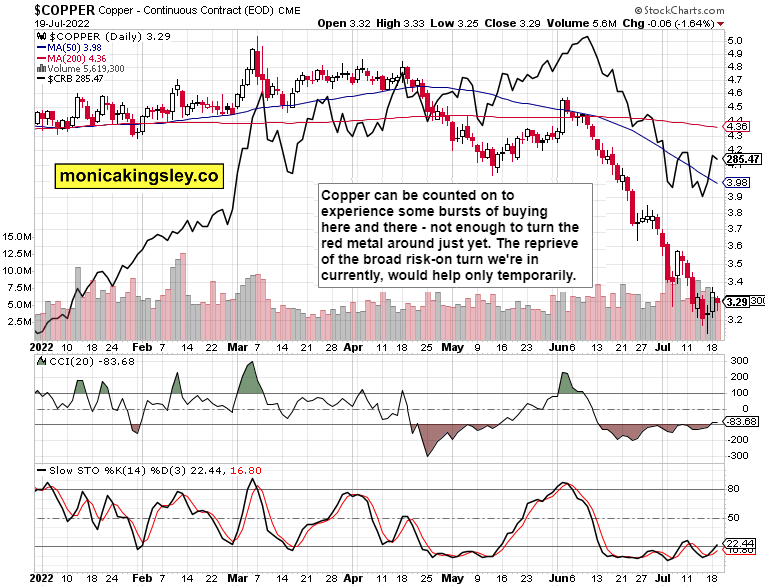

Copper

Copper is turning around only in the short-term. The red metal would participate in the risk-on upswing unfolding, but underperform – it‘s still vulnerable to a takedown.

Bitcoin and Ethereum

Cryptos aren‘t looking bad at all today – probably the key sign is that Bitcoin or Ethereum aren‘t declining. This is another chart (similarly to stocks and bonds) looking for fresh buyers so that the upswing can continue a little longer.

Thank you for having read today‘s free analysis, which is a small part of the premium Monica's Trading Signals covering all the markets you're used to (stocks, bonds, gold, silver, oil, copper, cryptos), and of the premium Monica's Stock Signals presenting stocks and bonds only. Both publications feature real-time trade calls and intraday updates. While at my homesite, you can subscribe to the free Monica‘s Insider Club for instant publishing notifications and other content useful for making your own trade moves. Thanks for subscribing & all your support that makes this endeavor possible!

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

Oil Trading Signals

Copper Trading Signals

Bitcoin Trading Signals

All essays, research and information represent analyses and opinions of Monica Kingsley that are based on available and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make. Investing, trading and speculating in financial markets may involve high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.