Shakespeare once wrote, “all that glitters is not gold.” One meaning for this is that although something appears attractive on the surface, it might not be as valuable as you think. Aptly said, this can apply to gold investments as well. Although gold ownership can come in many forms, not all forms are considered equal. So when you consider whether you should buy paper gold or physical gold bullion, it is important to know what each is truly worth and if it aligns with your goals.

Q1 2021 hedge fund letters, conferences and more

What Happens if I Buy Paper Gold?

According to any investor, you always want to have a plan for your investing purposes. The first question to consider is: are you buying for the short or long-term? This is the very first question because those who buy for short-term trading, from a day or week basis up to a few months, may prefer paper gold. Paper gold allows investors to gain immediate and easy access to the gold market. Some forms of paper gold include ETFs and futures contracts:

- A gold ETF is a commodity fund that trades similar to stocks. They are made up of assets that are backed by gold, but you do not own gold if you own any part of an ETF.

- A gold futures contract trade on exchanges where both parties agree on a price that you can take delivery on in the future. For example, a futures contract that expires in August means that you can take physical possession of the gold in the contract at the price you agreed on months before. You also do not need to pay this amount in full upfront.

Gold benefits from being rare and precious, but paper gold derives its value in a different way. Instead of trading above the gold spot price with premiums, gold ETFs mostly trade at spot. Plus, you can potentially enjoy an immediate profit from the spot price if it moves up since paper gold is very liquid.

Risks of Holding Paper Gold

There are benefits to holding paper gold. However, it comes with very different risks in comparison to physical gold bullion. For starters, the paper gold market tends to be more volatile in comparison to physical gold bullion. This is because its value is based on how demand is currently acting. You may have bought a share of a gold ETF for just $20, but it is possible that the price you bought drops overnight. Consider gold ETF shares like stocks in this case.

Secondly, since paper gold is not physical gold ownership, you have no choice in what type of gold your paper represents. If you decide to take delivery of your gold, there are limited options. For something to be considered “Good Delivery” for a futures contract, there are very specific parameters. Something like an American Gold Eagle coin will not come to your door if you choose to accept delivery. You may wind up with gold that you do not actually enjoy owning.

2021 1 oz Gold American Eagle $50 Coin BU Type 2

Next, holding paper gold on a yearly basis comes with higher costs than you might anticipate. You will most likely be charged the expense ratio, which is an annual fee that pays for management expenses. This might be required on top of the commission for buying and selling. Since this adds up annually, this might be more costly than physical gold bullion.

One of the biggest risks with paper gold is the fact that intermediaries are involved. If you buy paper gold and it turns out that the company managing the paper gold declares bankruptcy, you might not be able to expect much of a return on your investment. Additionally, these intermediaries can be dishonest about their reserves and oversell the ETF without backing up each share with gold.

Buying Gold Bullion

Physical gold bullion comes in many forms and is an immediate trade. The most common purposes for buying physical gold is to:

- Guard against inflation.

- Protect against loss of buying power with fiat currency.

- Secure returns from stocks, especially those that are turning negative.

- Hedge against economic/geopolitical volatility.

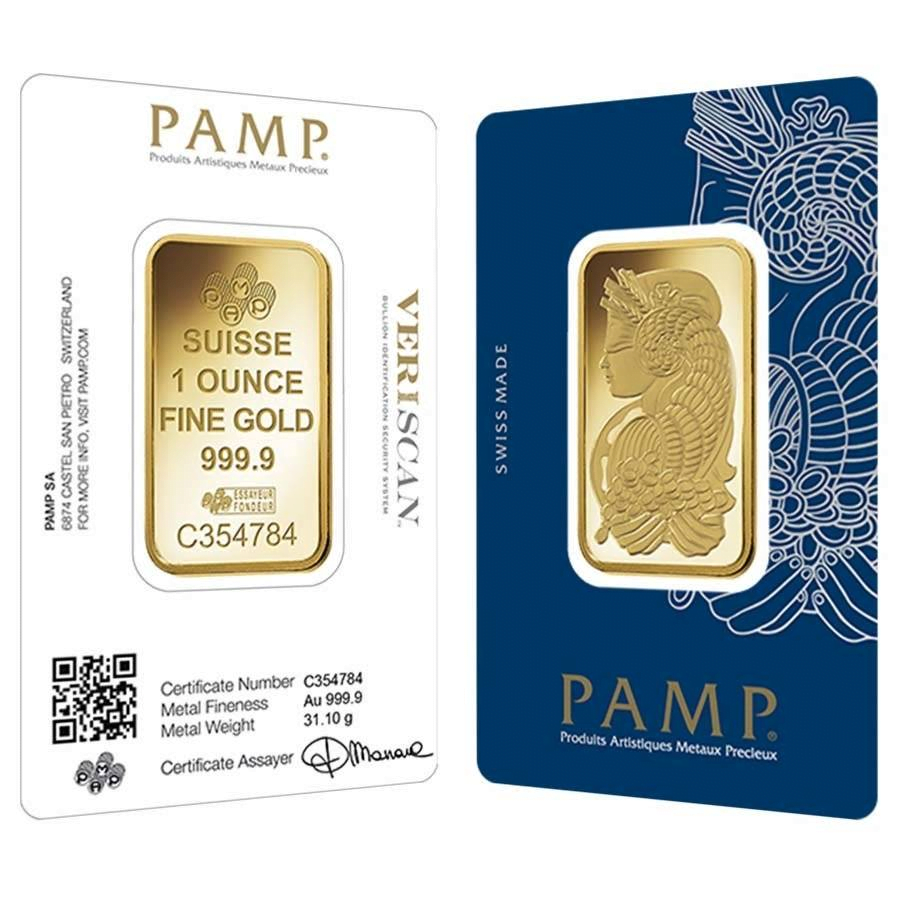

Once you lock in a price for gold bullion, you must pay it in full and take delivery. However, physical gold bullion trades above the spot price of gold because of refining, manufacturing, and distributing costs associated with getting your gold bullion bar to you. This may appear to be more expensive than paper gold, but you have control over what you buy. You also do not need to pay for extra costs in the long term.

1 oz Gold Bar PAMP Suisse Lady Fortuna

Premiums account for the process it took to get your gold coins or other forms of bullion to you. This spans from the raw gold refinery to the private or sovereign mint, then to the dealer and to you. After that, there are distribution and storage costs for holding your bullion before it gets to you or your storage unit.

But owning physical gold offers many advantages even if there are more upfront costs. There are many options to choose from, and you hold it as a tangible asset. There does not have to be a middle man at all after you take ownership. Plus, storing your bullion might be easier than you think at home, and gold is always in demand in some way. You will most likely not need to look far to find a buyer! All you need to worry about is buying from a reputable source and taking care of your physical gold.

Which is Better? Buy Paper Gold or Physical Gold Bullion

Perhaps you are still on the fence. At a glance, it comes down to this: buying physical, you pay premiums. Buying paper, you are not. But you still need to account for the costs associated with holding paper gold year over year and the risks associated with both forms of gold investing. So, buying and holding long-term is better for physical gold bullion, whereas paper is better for short-term trading if you can trust the intermediary.

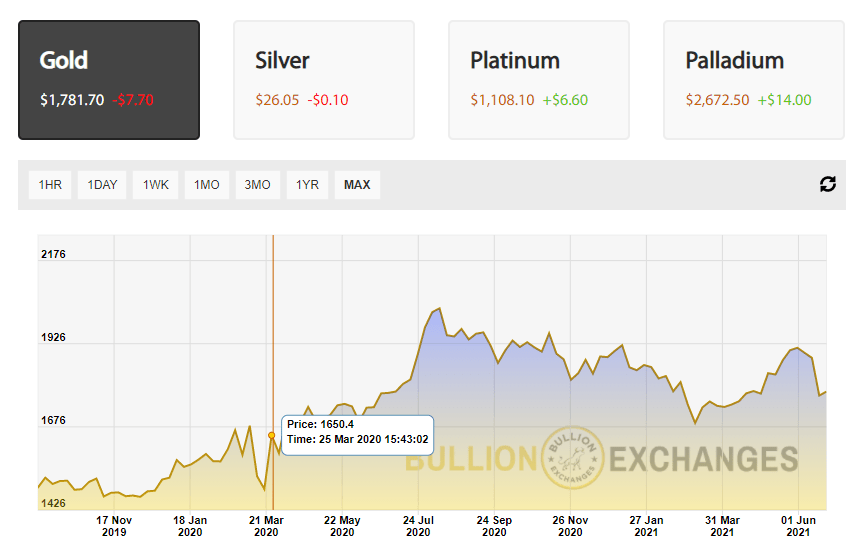

In 2020, the pandemic forced three Swiss refineries to temporarily close. This included Valcambi Suisse, PAMP Suisse, and Argor-Heraeus, which account for a third of the world’s global annual supply. This springboarded the spot gold price from $1,500 to $1,660 within a few days. What this meant at the time was people trading paper gold futures basically had limited liquidity. At that time, investors faced the risk of not being able to take physical delivery because of the limited supply of Good Delivery bars. This caused a panic. Mints stepped in, however, to strike Good Delivery bars to help cover futures contracts. One included the Perth Mint.

Later, in 2021, gold ownership continues to be important in an increasingly inflationary environment. Gold has a limited supply, whereas fiat currency does not. This is also why cryptocurrency exploded this year: it is an easily accessible and instant investment that offers an alternative to currency. Plus, it is more known among younger investors. Weakening fiat is great for gold and silver, and it is proving to be great for cryptocurrency as well.

Gold is known for swinging back and forth, but it remains an asset that trades steadily and always has demand. Whichever method you choose, keep your goals in mind and decide on what risks you are willing to take.