Apis Deep Value Fund commentary for the first quarter ended March 31, 2021.

Q1 2021 hedge fund letters, conferences and more

Dear Partners,

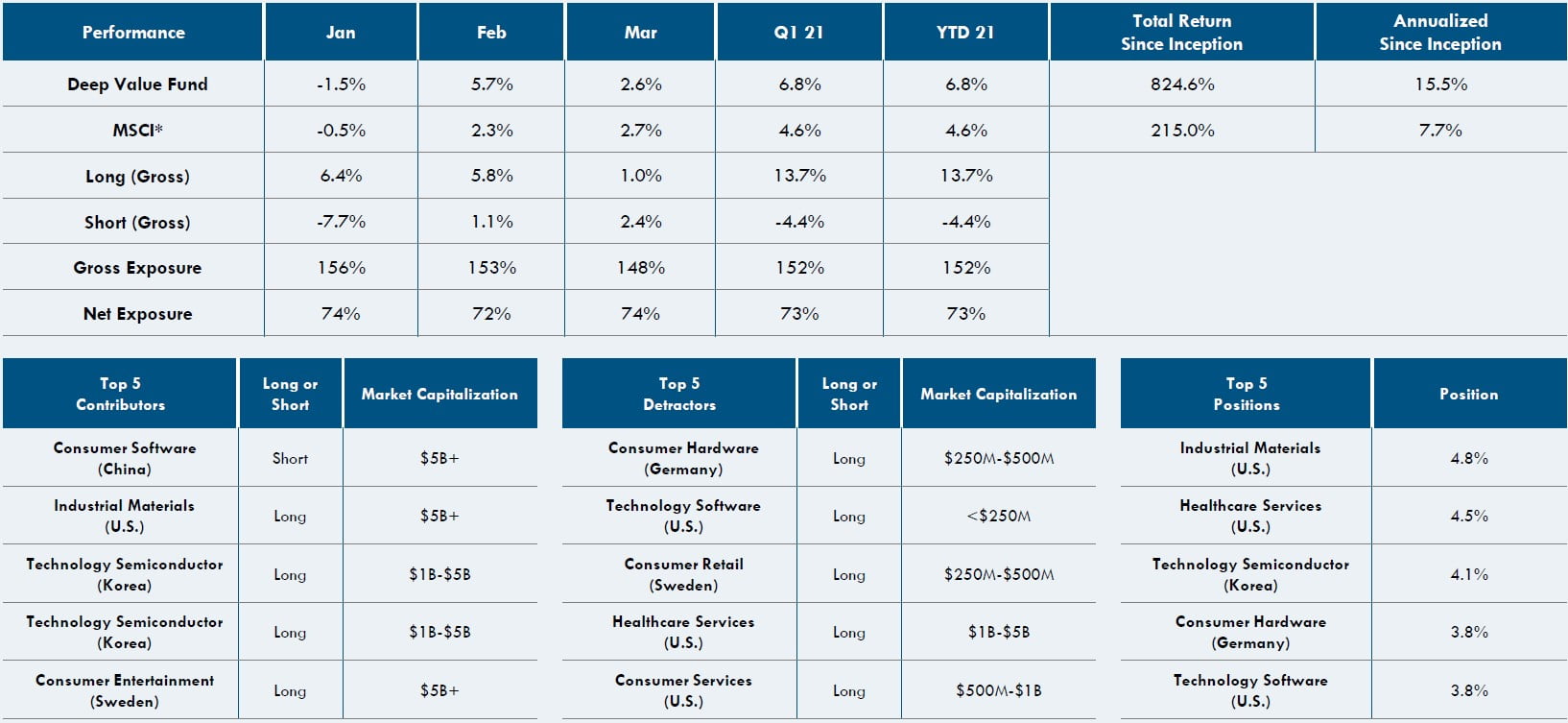

Our Deep Value Fund was up 6.8% net in Q1 2021. During the past quarter, our longs contributed 13.7% (gross), while our shorts detracted 4.4% (gross). At the end of March, the Fund was approximately 74% net long with the portfolio 111% long and 37% short.

Performance Overview (Gross Returns)

The year has started out well for the Deep Value Fund with returns exceeding benchmarks, despite lower portfolio exposures. While investment themes from last year mostly carried into 2021, our move into more cyclical and industrial areas were timed well. February and March saw gains from both our longs and shorts, although on the short side the gains were not enough to offset the impact of the wild short squeeze felt in the last week of January.

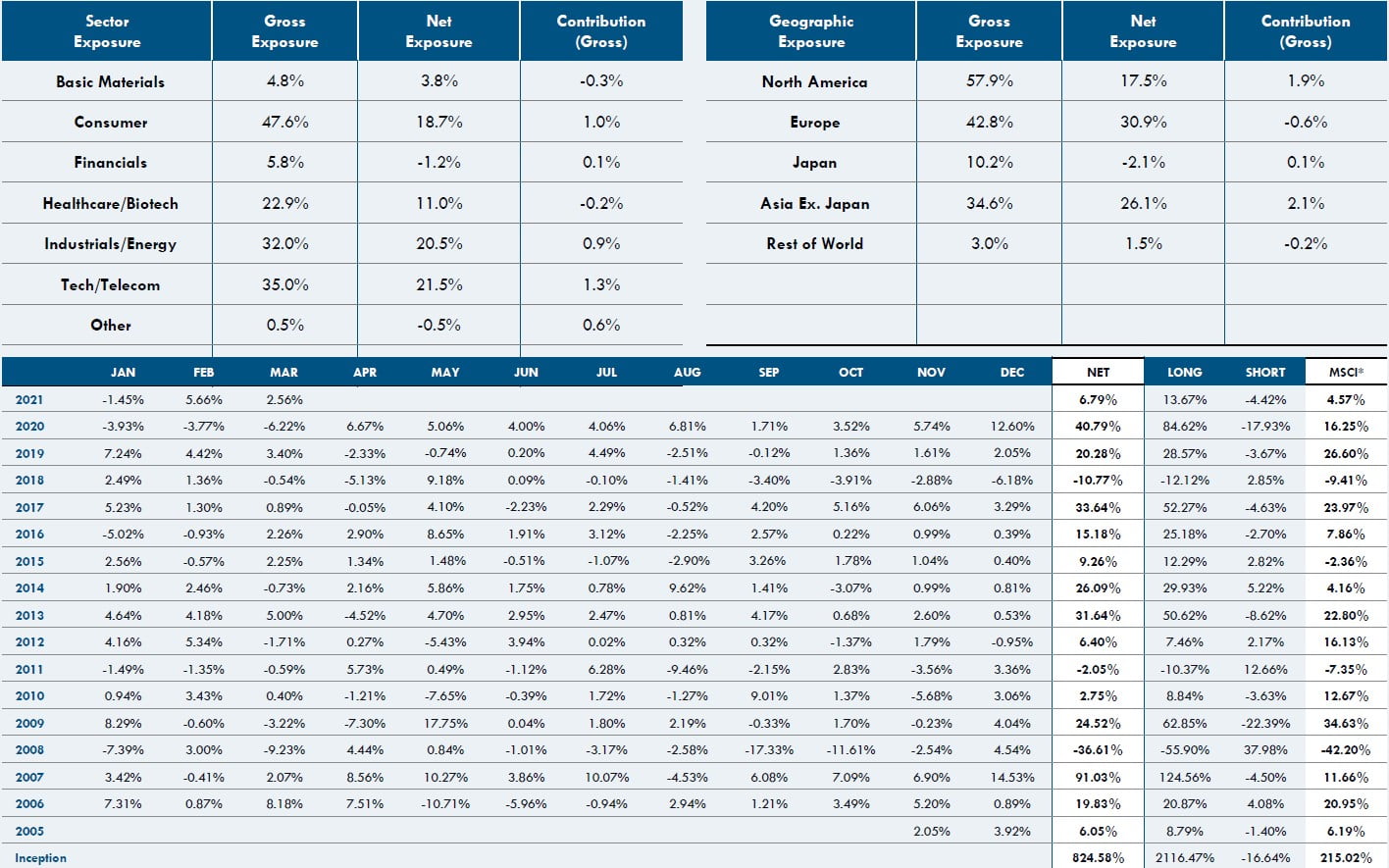

Regionally, Europe led the way during Q1 adding 6.3% to gross returns while Asia ex-Japan also deserves mention, adding over 3.3%. Stock-picking was also strong as all sectors contributed positive returns, particularly Consumer (2.8%) and Technology (2.6%).

Notable winners on the long side were MaxCyte (LON:MXCT) which contributed 2.2% (highlighted below), CDON, a Swedish e-commerce company (adding 1.8%) and long-held names such as Darling Ingredients (NYSE:DAR) (1.2%), Evolution Gaming (STO:EVO) (1.2%), and Tokai Carbon (TYO:5301) (1.1%). Magnachip (NYSE:MX) (Korea) also added over 1.0% to returns on a takeover offer from private equity. Long detractors were primarily some of last year’s winners such as Gravity and Rush Street Interactive, with both declining about 0.7% each. On the short side, GSX TechEdu deserves mention. GSX started the year around $50 (per share) and climbed to over $140 in January, only to close out the quarter at about $33. Had we held the same position throughout the quarter, it would have been a nice contributor to performance, but risk management forced us to realize some losses during the epic January short squeeze. Near quarter-end, GSX plummeted when it was revealed it was part of an engineered squeeze undertaken by the now infamous Archegos Capital. Why multiple brokers would provide five times leverage to someone (who, by the way, previously pleaded guilty to wire fraud and insider trading1) to help engineer a short squeeze in a fraudulent Chinese company is beyond disappointing. Shame on all involved. Shorting is hard enough as is without our own brokers working against us.

Portfolio Outlook, Positioning And Investment Highlights

Check out the investment highlights here.

As always, we encourage your questions and comments, so please do not hesitate to call our team here at Apis or Will Dombrowski at +1.203.409.6301.

Sincerely,

Daniel Barker

Portfolio Manager & Managing Member

Eric Almeraz

Director of Research & Managing Member