What if you found yourself in a situation at work where you were consistently getting the job done, taking responsibility, balancing your work load and being one of the most reliable employees, yet none of those things were taken into account for employee reviews and promotions? What if the system was rigged so that you had no access to accomplishing things that mattered for reviews, even though you were working hard and meeting every deadline?

Q3 2021 hedge fund letters, conferences and more

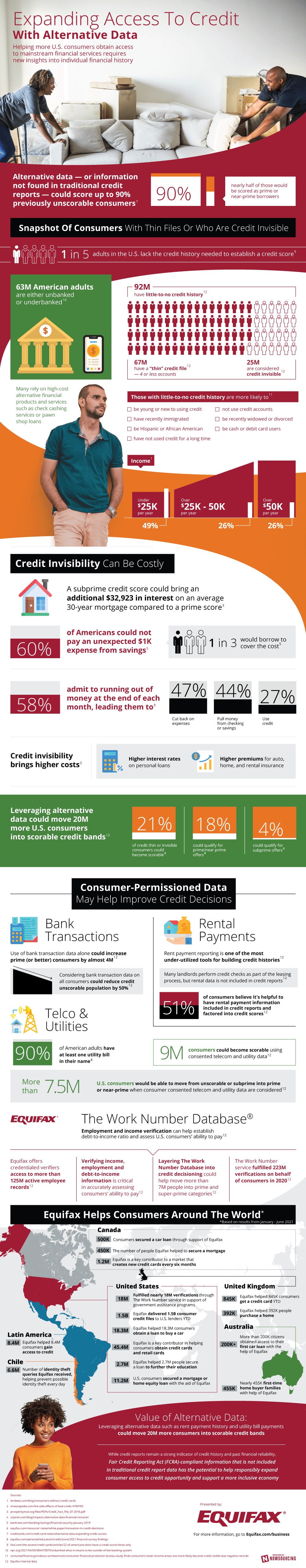

Unfortunately, that’s very much the way our credit reporting system currently works. There are only certain things that are included in traditional credit reports and millions of financially responsible Americans just can’t get a foot in the door to begin building credit. In fact, one out of every five Americans simply lack enough credit history to register for credit scoring. Millions of Americans are considered credit invisible, and millions more have a thin credit file or have a nearly non-existent credit history.

Access To Credit

The majority of those who struggle to begin building a credit profile are those who are young or new to credit, use mostly debit cards or cash, have no credit cards, are recent immigrants, Hispanic or African American, or newly widowed or divorced. Lacking a good credit score can bring hardships on these individuals as they try to get ahead financially, and in turn, these hardships can often perpetuate the issue of not being able to get financial help that would enable them to build credit.

For instance, 60% of Americans say that they would not be able to cover an unexpected expense of one thousand dollars. For individuals with a poor or invisible credit rating, that can mean they need to use expensive financial services such as check cashing or pawn shop loans. These services are not only expensive, but they can be risky as well as the hit they take on the wallet can ultimately cause more of an issue than the initial expense.

In order for “credit invisible” individuals to be able to break through the barriers, traditional credit reports need a serious facelift. By including alternative data such as utility payments, phone payments, and rental payments, 90% of credit invisible persons could be seen, and accurately assessed for the first time. Not only that, but almost half of them would prove to be prime or near prime borrowers.

Just because a person doesn’t have a credit history doesn’t mean they are financially irresponsible. It’s time for credit reports to be more inclusive to reflect a more complete picture of an individual's financial status.

Infographic source: Equifax