It’s no secret that the wave of fintech companies is here to stay. They are deemed as the great disruptors and an industry that’s seen to grow exponentially. Fintech is an industry that has completely reshaped the financial sector and has helped people with all aspects of their finances.

Q2 2021 hedge fund letters, conferences and more

But a sector within the fintech ecosystem that has been gaining popularity is the lending sector. Fintech lending companies allow people to borrow money in the fastest and simplest way.

For the unbanked and uninformed, this new process might come as a surprise to them - that there are certain companies that can approve and give out loans in a matter of hours to days. This is also known as loans with fast approvals.

So go to get everyone up to speed, we’ll be discussing 13 fintech lending companies to look out for this 2021.

What Is Fintech Lending?

Whether you like it or not, digital transformation is happening to all business sectors. As constant innovation happens in the technology space, it has now made its way to the financial industry.

The space has been on a tear for years now that top financial and business publications like ValueWalk and Fangwallet have their finger on the pulse to catch some new innovations within it.

The industry has successfully disrupted the traditional banking processes that seem too old and outdated. Financial technology or fintech lending uses online technology to provide finance for both businesses and individuals. The processes involved in lending which would take a couple of weeks in traditional banks will now take only hours or days with these fintech lenders.

Fintech lenders offer both short and long-term loans with fast approval and release of the money. They aren’t as strict and slow as traditional banks.

That’s why more and more people turn to fintech lending companies if they need to borrow capital to fund their personal needs or business problems.

13 Fintech Lending Companies To Watch Out For

-

SoFi

SoFi is one of the top lending companies in the industry because of its low rates and no fees on personal loans. The reason why SoFi is a top choice for people is that the company offers a whole lot of benefits for its borrowers. Plus cybersecurity isn’t an issue since once the money arrives at SoFi’s partner banks, it is FDIC insured up to $1.5 million.

SoFi gives their clients financial planning advice, member discounts, and will guide them on their estate planning.

SoFi also encourages its borrowers to refer friends to earn cash as well.

And as virtual events become increasingly more interesting, SoFi gives advice on career, employment, and college finances for students virtually.

-

Better

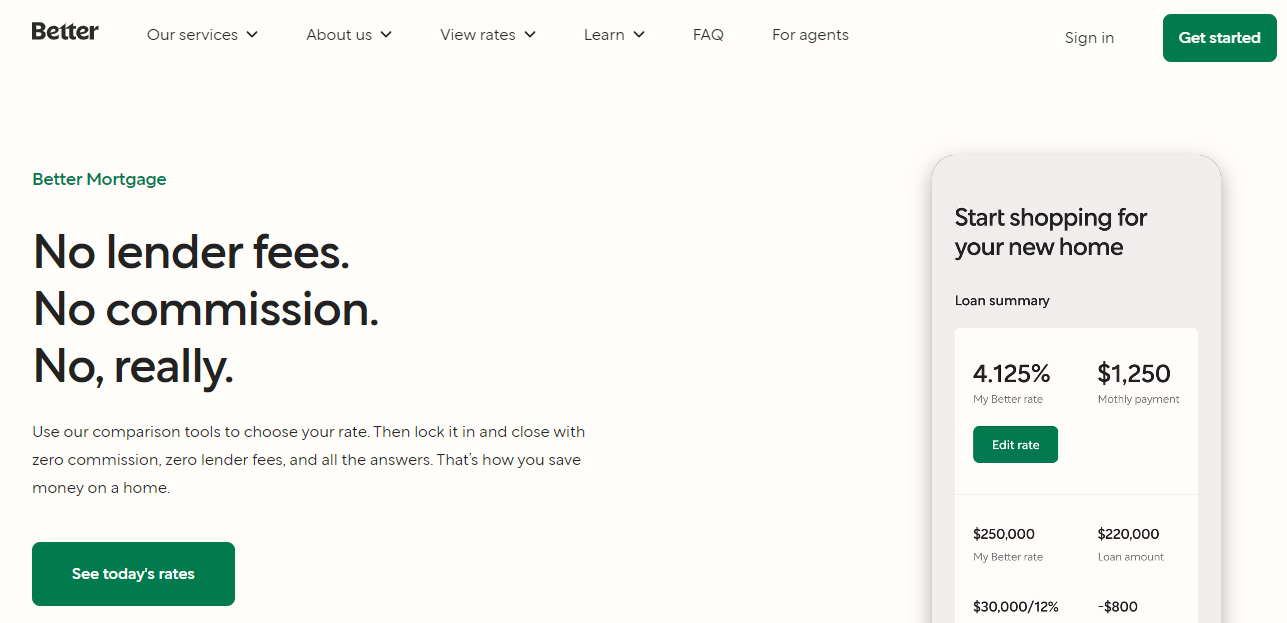

Better was launched in 2016 and is a direct lender that provides online mortgage financing. Right off the bat, Better displays its proposition to its clients - no lender fees and no commission.

The fintech company provides its clients with a quicker and simpler mortgage process with competitive rates. Its platform allows borrowers to access and complete their mortgage papers in the comfort of their own homes.

What separates Better from its peers are the types of loans it offers:

- Conventional mortgages

- Fixed-rate mortgages

- Adjustable-rate mortgages

- Jumbo loans

- Refinancing

With Better offering competitive rates and online mortgages processes with a more convenient experience, some deem the company as a better choice than Chase or Bank of America.

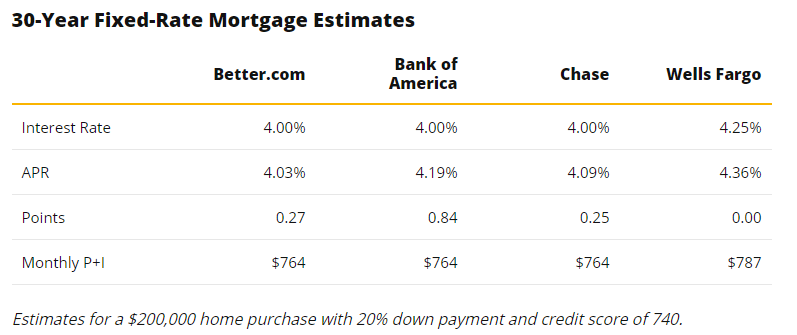

Take a look at this comparison table made by ValuePenguin and observe the rates.

As you can see, Better’s rate isn’t too far from the rates of traditional banks. But as the years pass, these costs will add up, and will ultimately show how borrowers will be able to save more with Better.

-

Lending Club

Lending Club is a peer-to-peer lending platform that started way back in 2007. The company has amassed 3 million members to get over $60 billion in personal loans for them to pay down debt and other financial needs.

Debt.org even mentioned that the company is the largest online lender for personal loans in the United States. The majority of the purpose for the loans in Lending Club would be refinancing a home, paying off credit cards, and others.

Lending Club allows borrowers to create unsecured personal loans between $1,000 - $40,000. The loans offered here are usually pursued by borrowers that have good to excellent credit and a low debt-to-income ratio.

-

Funding Circle

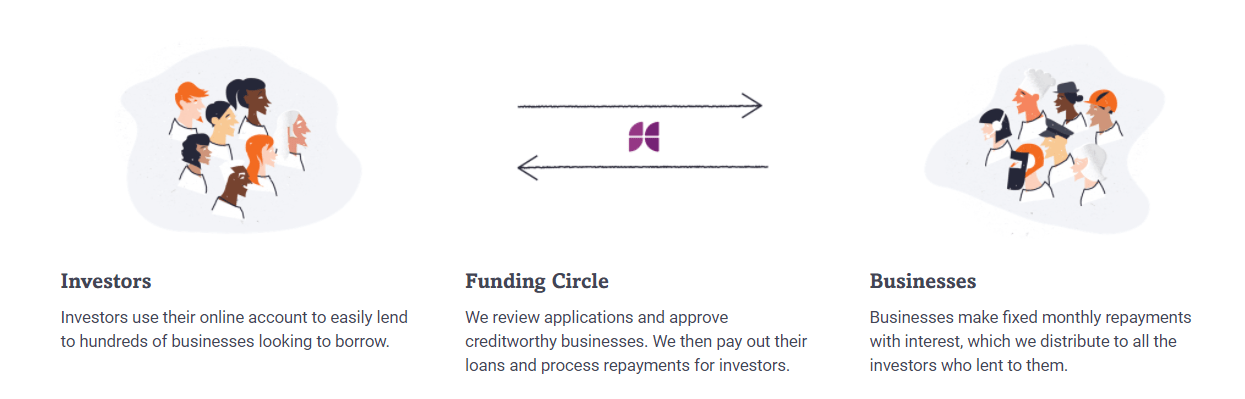

Another peer-to-peer platform in this list is Funding Circle. The company allows investors to lend money directly to small and medium-sized businesses. It has helped businesses in over 700 industries to access the capital they need.

The platform can be of great help for businesses that need funding for project management tools, sales tools like predictive dialers, or businesses that needs to onboard new employees like brand designers or sales representatives. Whatever growth strategy funding is needed in a business, Funding Circle can surely help.

As mentioned on their website, Funding Circle has already loaned out $15 billion to 100,000 small businesses globally.

Funding Circle is one of the largest online small business loan providers and is also one of the best-capitalized lending platforms in the world. Other than that, the company is also listed on the London Stock Exchange under the ticker symbol FCH.

The company works by connecting creditworthy businesses with people, investors, or organizations that lend out money.

It’s also easy for both parties (lenders and borrowers) to do business with Funding Circle since it’s backed by great reviews and global legitimate companies in the industry.

-

LendUp

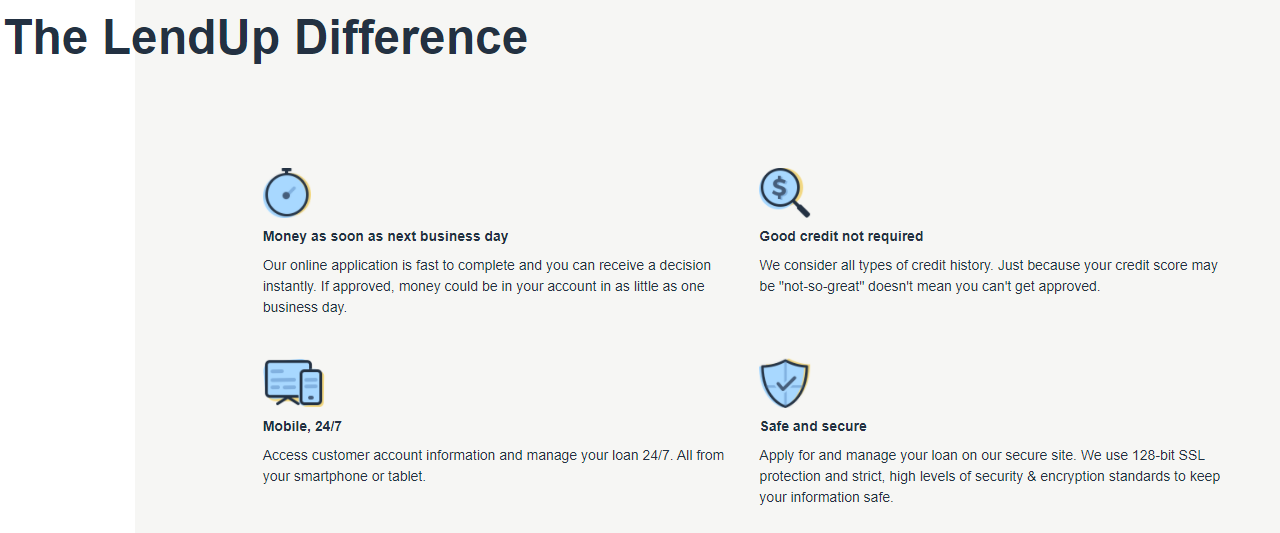

LendUp is a platform where people who have low credit scores can borrow money. The company offers quick applications and instant decisions any day of the week.

Unlike other fintech companies, LendUp can put money in your account in as little as one business day - given that all of the processes and application are done correctly.

LendUp also provides services for people who can’t borrow money in banks because of their credit standing.

The company’s purpose is to provide anyone with a path to better financial health. And with this goal, funding people wouldn’t be enough. Giving them study resources or teaching financial literacy can greatly help them to be financially wiser and smart.

And that is exactly what LendUp did. The platform also offers courses that can improve their client’s financial status.

Here are some courses they offer:

- Credit Building Unveiled

- Know Your Credit Rights

- The True Cost of Credit

- Roadmap to Your Credit Report

- Build Your Credit: Ladder to Success

- How To Protect Yourself Online

- Pay Yourself First

- Better Budgeting

- Benefits of Your Credit Card

- Beating Credit Card Risk

- What’s Up With Your Finance Charges?

- Building Your Financial Future

- Your Finances: A Tool for Life

-

Affirm

Affirm is a fintech lending company that lets you shop without being deep in debt. It keeps you out of unhealthy debt by offering fair and transparent credit so you can pay overtime for the things you love.

The company offers affordable monthly payments at a pace that you can choose - this can be in 3, 6, or 12 months. With this, Affirm gives you control. It also shows you right from the start how long you’ll pay and how much.

Affirm prides itself in its saying “What you see is what you pay”. Unlike other lending businesses, Affirm doesn’t have any surprise or hidden fees. They are true to their word when they say their service is simple and a transparent way to shop.

To use Affirm, consumers shop at their favorite stores and select Affirm at checkout. Affirm partners with a variety of brands that sells clothes, lingerie, shoes, electronics, fitness gear, accessories, language courses, coding lessons, 3D printing, and many more. It is said that Affirm has partnered with 400+ online stores.

To avoid any scams, upon account creation with Affirm, it will perform a ‘soft’ credit check just to verify identity and determine eligibility for financing. Interests associated with Affirm loans can vary between 10 - 30 percent APR simple interest.

-

LendingTree

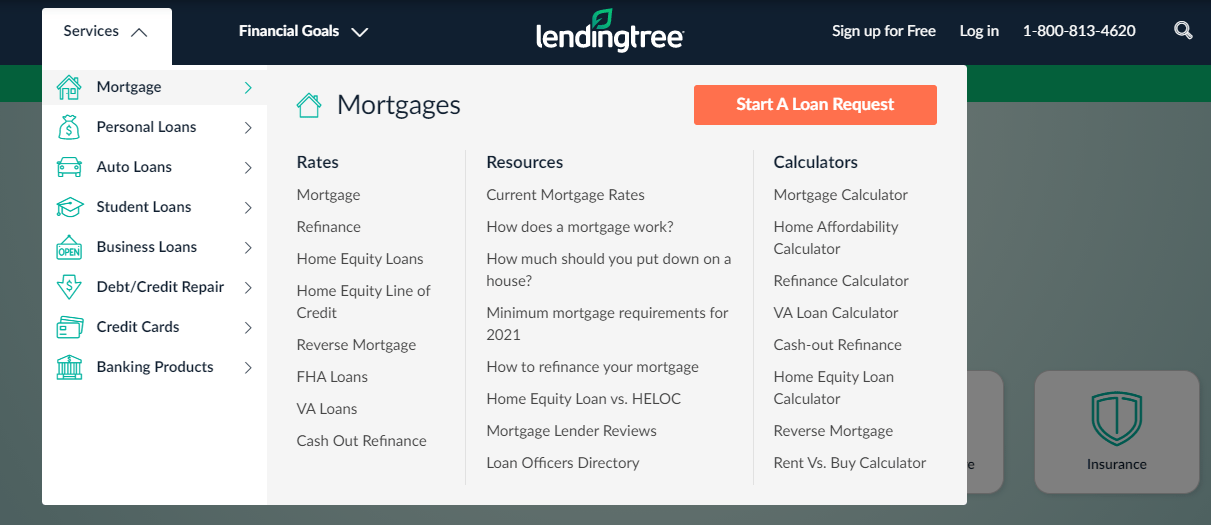

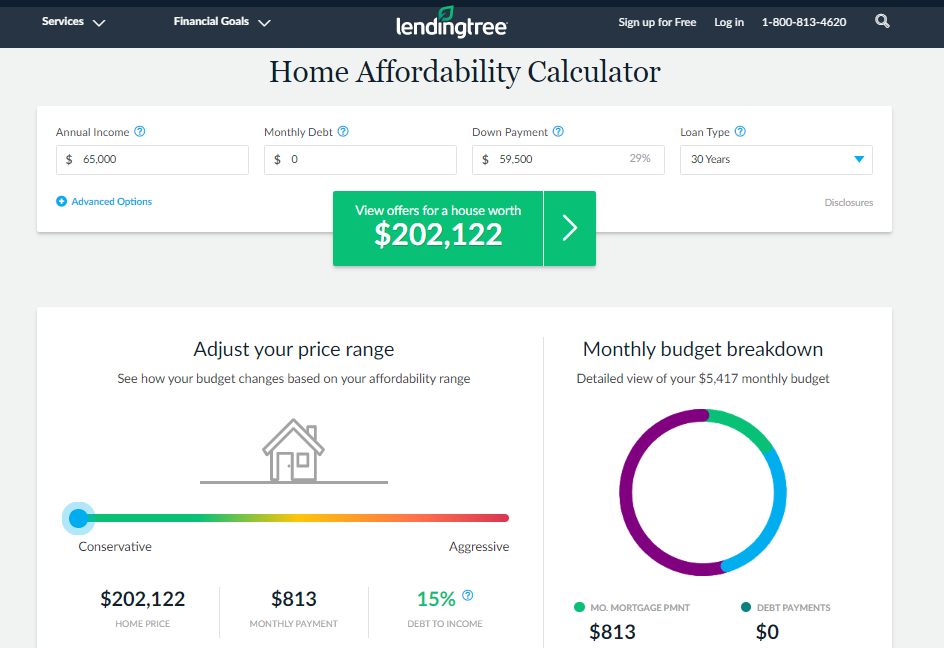

LendingTree connects consumers to lenders who compete for your business. What LendingTree does is take the consumer’s information and submits it to banks and brokers within its network.

LendingTree’s unique selling proposition is that when banks and brokers compete to give out a loan, they will lower the rates for you to pick them over the competition. This then gives their clients the best possible deal out there. They won’t be forced to go with high interest rates because now they have multiple choices to choose from.

Another reason why LendingTree is one of the top businesses in its industry is because of the number of services that it offers.

As you can see, LendingTree has services ranging from mortgages, personal and auto loans, student loans, credit cards, to even business loans.

With the number of services and benefits that LendingTree gives, any savvy borrower who’s knowledgeable can walk away with a better deal than what other companies offer.

LendingTree is also home to engaging graphs, charts, tables, and visuals you’ll see on any fintech lending company website. These customizable graphics allow prospects to see firsthand the type of deal they’re getting with.

-

Avant

If you’re having trouble qualifying for a personal loan at a bank, then consider going with this company.

Avant’s mission is to lower the cost and barriers of borrowing for everyday people. The company offers personal loans for middle-income borrowers that need help with financial problems like unexpected expenses, home improvement/repair, and high-interest debt.

Avant compared to traditional banks has a more lenient credit requirement. The company prefers borrowers with credit scores of around 580 and above. Allowing a fair credit score to get a loan means a higher APR. But the borrower can receive the funding in just one to two days.

Loans range from $2,000 to $35,000 and the APRs vary from 9.95%-35.99%.

A great feature that Avant presents is its flexibility in repaying them which makes the company a good option for people who can’t go for a traditional payment plan.

-

Lendio

When small businesses get rejected for loan applications, they can always count on Lendio. Lendio believes that small businesses deserve a shot when it comes to funding.

Lendio understands that every big company was once small. And sometimes, when these small businesses get rejected, they trade their big ideas for ordinary ones because they don’t have the capital to fund them.

These small businesses could have the best Saas marketing campaign or is in need to buy a chat plugin to attend to a broader customer range. But since they don’t have the capital, they’d just forget about their idea for growth. Lendio doesn’t want this to happen, the company understands that a little funding can go a long way - it can determine the trajectory of a business.

Lendio has facilitated more than 300,000 small business loans. These loans were to fund business employee growth, business equipment, or opening up a second shop.

To really help small businesses, Lendio has made its lending processes fast and easy. Borrowers don’t need to have a bank at all. Other than its quick application, Lendio connects borrowers to more loan options than anyone else.

Lendio also understands that for some businesses, lending through a fintech company may seem like a daunting task especially when it’s their first time. So when applying, Lendio gives borrowers a dedicated personal funding manager.

This funding manager will walk the borrower through different loan options, what their needs are, and what the perfect loan is for your business.

-

Kabbage

Kabbage provides all the tools a small business needs for it to grow. It has been so efficient in the fintech lending industry that the global financial service company, American Express, acquired Kabbage in 2020.

The fintech company is perfect for business owners that need cash immediately and don’t mind paying higher rates for the speed. An example of this could be a client who does Amazon selling that needs to expand its inventory for the upcoming season or an eCommerce store owner needing cash for his affiliate marketing campaign.

The application process doesn’t require any paperwork, all the borrower needs to do is to connect its business checking account.

Other than quick processes, business owners who can’t get a loan in the bank because of bad credit can turn to Kabbage. Before making a lending decision, Kabbage allows you to determine your credit limit and fees.

Kabbage can fund from $500 to $250,000 in working capital for small businesses. Its repayment terms are also flexible and let you choose between 6 to 12 months.

-

OnDeck

One of the most prolific online small business lenders is OnDeck. It has been around since 2007 and has been growing and helping businesses ever since. The company offers two types of business loans: short-term loans and revolving lines of credit.

One of the best features that OnDeck has is its fast transactions and processes. In just under 10 minutes, you can already apply with OnDeck and receive a decision on that same day. This application process is much faster than its peers in the industry.

OnDeck also boasts of a staggering 80% return client rate. That’s because if their client takes another loan, the company waives all remaining interest on the current loan.

This type of lending process is great for businesses that need quick cash to finance their short-term business needs.

-

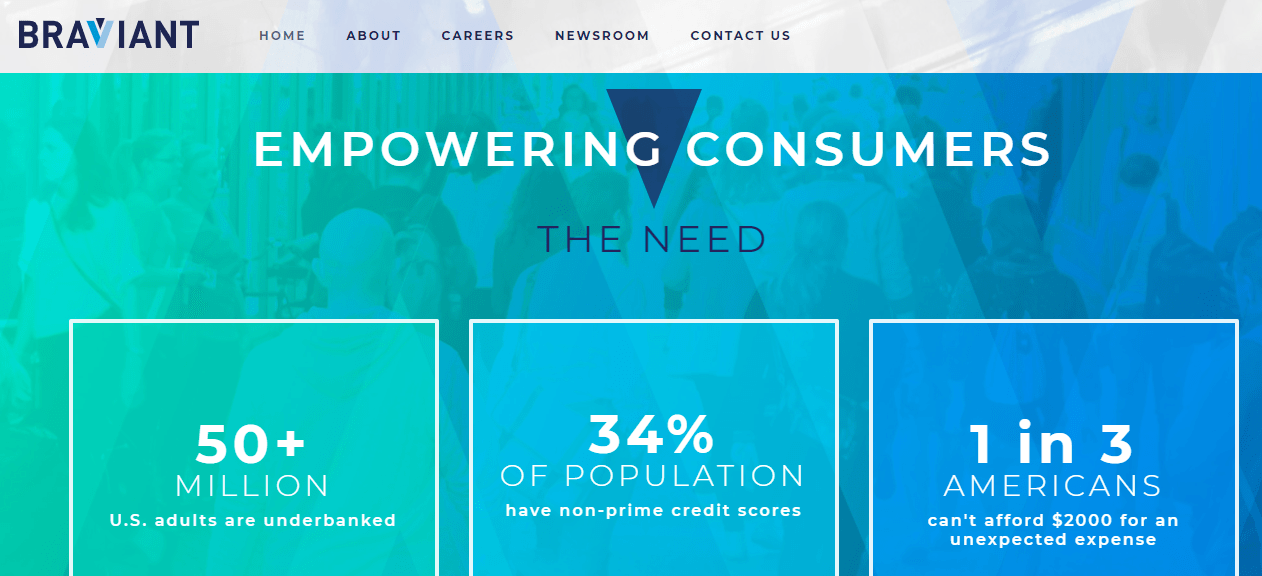

Braviant Holdings

Braviant Holdings is a fintech lending company that gives funding opportunities for unbanked people. The company’s vision is a world without credit barriers. Braviant Holdings understands that there are instances that we need to see past credit scores and these borrowers are humans also that have their own set of needs.

The company is making their vision a reality by building proprietary decision models that looks beyond the traditional credit score. These models allow the company to accurately assess a person’s true ability and willingness to repay.

-

Prosper

Prosper was the first peer-to-peer lending marketplace in the United States in 2005. Being in business for quite some time now, the company has facilitated more than $19 billion in loans to more than 1 million people.

Borrowers can apply online for a fixed rate and fixed-term loan between $2,000 to $40,000. Prosper decides on which applicants to qualify by using a risk-rating system that takes into account credit history and debt-to-income ratio.

Borrowing through Prosper gives them the option to change the payment date, apply with a joint loan, and a variety of loans to choose from.

But Prosper isn’t only benefitting the borrowers. Institutions and individuals can also invest in loans and get attractive returns. Prosper is the one that handles all loan servicing on behalf of the matched borrowers and investors.

Conclusion

With fintech lending being one of the biggest trends in the fintech industry, it looks like these companies are here to stay.

And they’re staying for good reason. People who can’t qualify in traditional banks can finally get funded. Plus, with the rise of these companies, they’ll have more options to choose a loan that they’re comfortable with.

Other than choosing interest rates and payment plans, fintech lenders move faster than traditional banks. What takes a few weeks in banks can be done in a matter of days in fintech lenders.

Overall, fintech lending companies have benefitted both borrowers and lenders.

About the Author

Christian Cabaluna is a finance blogger at awesomex™ with 5+ years of first-hand experience. When he is not writing in his favorite coffee shop, Christian spends most of his time reading (mainly about money-related topics), cooking, watching sitcoms, visiting beaches, and catching beautiful sunsets.