Alluvial Fund LP commentary for the month of August 31, 2018.

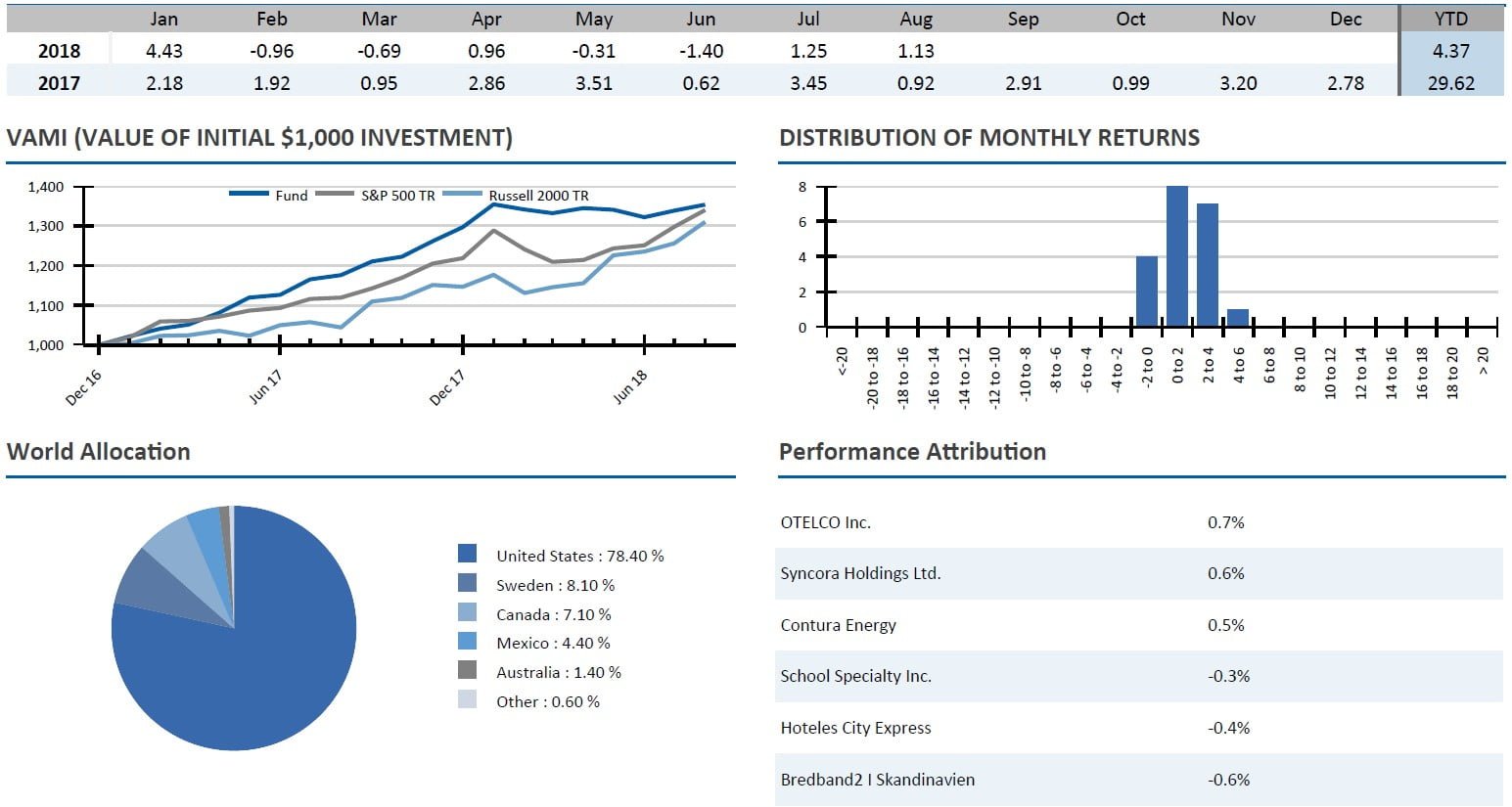

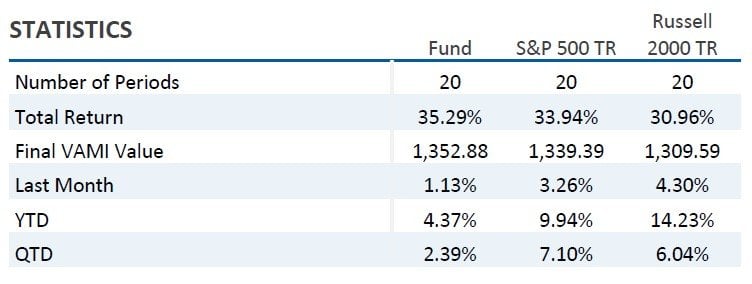

Alluvial Fund LP was up 1.1% in August. Year-to-date, Alluvial has returned 4.4% versus 9.9% for the S&P 500 and 14.2% for the Russell 2000. Since inception, Alluvial Fund, LP has returned 35.3% compared to 33.9% for the S&P 500 and 31.0% for the Russell 2000.

Alluvial Fund LP is a value investing partnership with a focus on small companies and obscure securities, both domestic and international.

Q2 hedge fund letters, conference, scoops etc

Partnership Profile

Alluvial Fund LP is dedicated to identifying and profiting from deeply mis-priced securities in the US and abroad. Alluvial Fund focuses on small firms, thinly-traded issues and special situations, seeking to identify value that the market has yet to notice. The partnership's goal is to compound its partners' capital at superior rates over the long term.

Manager's Commentary

Investors took notice of positive quarterly results at Otelco, Contura Energy, and Syncora Holdings, bidding up all three. Meanwhile, nervousness concerning election results in Sweden caused our Swedish holdings to decline.