Alluvial Fund commentary for the second quarter ended June 30, 2021, discussing their new investment in Copper Property CTL Pass Through Trust (OTCMKTS:CPPTL).

Dear Partners,

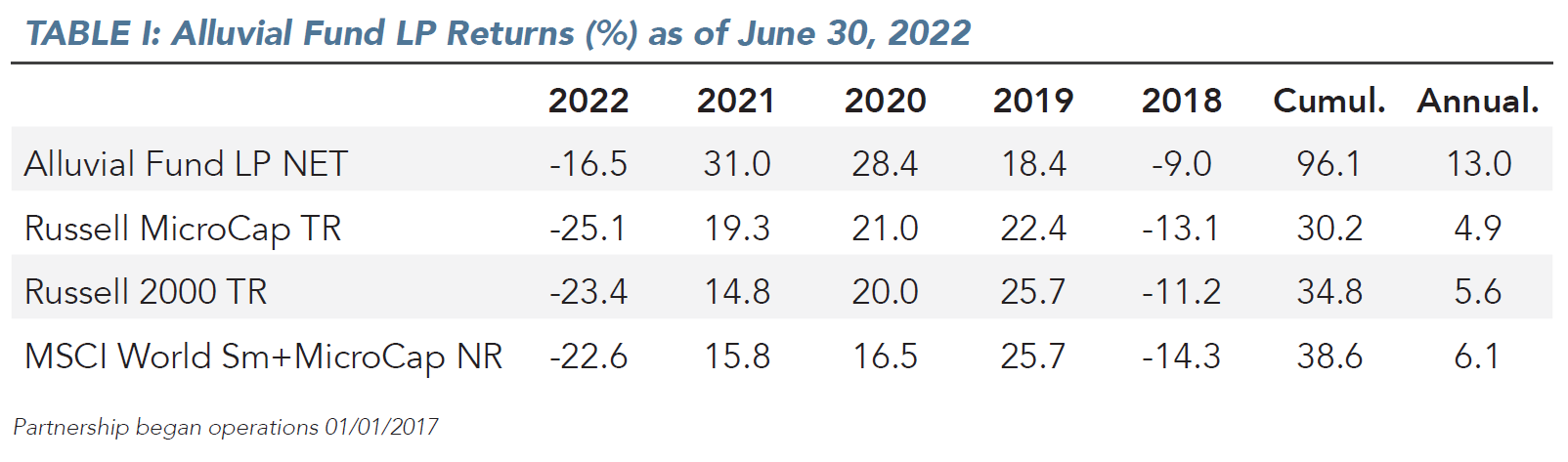

Alluvial Fund declined 9.9% in the second quarter and is down 16.5% year-to-date. By contrast, the Russell Microcap Index lost 19.0% this quarter and has fallen 25.1% in 2022. It’s ugly out there. At the halfway point of the year, global stock markets have recorded one of their worst performances in modern market history. Fortunately for us and in keeping with the historical pattern, Alluvial Fund has managed to avoid a portion of the decline. Our holdings, with their robust balance sheets and durable cash flows, have fared far better than the hyper-growth (and hypo-profit) story stocks that investors bid to dizzying heights last year. Nevertheless, our holdings are public. They rise and fall on the whims of investors. And investors sure are a capricious bunch. When mounting stress and fear cause the stock market to tumble, our holdings are not wholly unaffected.

Q2 2022 hedge fund letters, conferences and more

I don’t worry about falling stock prices. I don’t enjoy them by any means, but they don’t keep me up at night. What I do worry about is permanent loss of capital. There are a variety of ways to achieve a permanent loss, but at the heart of each is the same error: over-paying. There’s a school of thought, a very popular one at present, that says investors should spend all their time identifying the market’s highest quality companies and ignore all the rest. And that once these paragons of virtue are found, nearly any price can be paid for their shares and a good outcome assured. I am not a subscriber. I am willing to invest in average or even sub-par businesses, provided they are priced so modestly that a large margin of safety exists. A company does not have to dominate its industry, invent the next iPhone, or become a global household name for shareholders to earn an outstanding return. Indeed, a company can do all these things and still deliver only middling returns if the achievements were priced in from the beginning. I would rather spend time finding situations where the market’s expectations of a company are so low (or barely exist at all) that even modest success means a much higher stock price. It’s much tougher to over-pay for a company where the market expects little than to over-pay for one from which the market expects continuous and unbounded success. Now, investing in low expectations companies and securities is not for the impatient. But neither is Alluvial Fund.

The Rundown

Our portfolio’s holdings are relatively unchanged from last quarter, but multiple companies reported meaningful positive developments. The market doesn’t care, but that is the normal state of affairs during bear markets. When the fear subsides, fundamentals will matter once again.

P10 Inc.

In June, I attended the P10 Inc (NYSE:PX) shareholder meeting in Dallas. Co-CEO Robert Alpert presided and did a fine job providing an overview of the company’s initiatives and fielding questions from the handful of investors in attendance. I asked if P10 were considering how to add permanent capital vehicles to its assets under management, and the answer was an enthusiastic “Yes.” So I was pleased to see the company announce a large indirect investment in Crossroads Impact Corp. Crossroads will serve as a growing source of permanent capital for P10’s impact investing platform, Enhanced Capital. The upshot is additional high-margin, recurring revenue for P10.

P10 has traded down this year in sympathy with other alternative asset managers. However, the firm continues to grow its base of contractually guaranteed fee revenue. A murkier economic outlook makes fund-raising more challenging, but it will not permanently dampen P10’s prospects. Shares are worth at least $18 (50% upside from here) and more if the company can execute on acquisition opportunities.

Unidata S.p.A.

If there is a bull market to be found, it may be in grim headlines from Europe. Energy woes. A looming recession. Resigning premieres. It comes as no surprise that investors have done an about face on several of our European holdings despite dirt cheap valuations and long-term industry tailwinds. But a continental recession, even a deep one, will not bring the expansion of broadband internet in Italy to a halt. Unidata SpA (BIT:UD) keeps on hustling to build out its network, and the customer list keeps growing. Most recently, Unidata announced a joint venture with an infrastructure fund to codevelop and manage one of Italy’s first energy efficient data centers. Creative moves like this will enable Unidata to roughly double its cash flow by 2025. I expect shares to reach €100 well before then.

Garrett Motion Preferreds

Garrett Motion Inc (NASDAQ:GTXAP) is an exercise in patience. Just as it seemed the global automotive market was about to recover to pre-COVID production, along came Russia, inflation, and the threat of recession. Still, the company is making great strides in improving and simplifying its balance sheet. In June, the company redeemed the rest of the Series B preferred shares it issued to Honeywell when it exited bankruptcy in 2021. With the Series Bs out of the way, Garrett Motion is free to dedicate its cash flow to continued deleveraging or share buybacks. At some point in the next year or two, the conditions will be met for Garrett Motion to convert these preferreds and simplify their capital structure. If the market stubbornly refuses to value Garrett Motion shares at a reasonable price, I believe the company will pursue a sale or merger. Until then, our preferred shares will continue to accrue dividends at an attractive yield. The preferreds are worth at least $15 today, and possibly $20 or more if the company can reduce leverage and/or buy back shares and the automotive market recovers.

Pegroco Invest AB Preferreds

As expected, Pegroco Invest AB (STO:PEGRO-PREF) has resumed paying quarterly dividends on its preferred shares. However, the company has yet to pay out the arrearage that built up while COVID ravaged the economy. This arrearage continues to build and now exceeds SEK 24 per share. At SEK 110, Pegroco preferreds offer a distribution yield of 8.6%, with investors to receive an additional dividend of 22% of the trading price at some point in the future. Pegroco’s asset value covers the preferred and dividends in arrears several times over, and Pegroco has recently taken steps to monetize a few investments and build liquidity. Pegroco is an example of a special situation that has worked very well for Alluvial Fund, but we’re not quite done here.

TIM S.A.

Poor TIM SA (WSE:TIM). Despite continued excellent results, shares have been trashed as the Polish construction market slows. The market now values TIM at just 4x my estimate of operating income as of June 30. Citing poor market conditions, the company announced it would delay the planned IPO of its e-commerce logistics company 3PL. TIM has gone from “very cheap” to “wildly cheap” this year. The market is too focused on near-term headwinds in TIM’s electronic components distribution business and is missing the continued growth and huge market opportunity at 3PL. Management apparently agrees and has announced a repurchase plan covering 14% of TIM’s shares outstanding. With Polish investors as morose as they have been in years, it could take time for TIM shares to rebound. But the market cannot ignore TIM’s profitability and growth forever.

Introducing Copper Property CTL Pass Through Trust

We have a new holding in Copper Property CTL Pass Through Trust (OTCMKTS:CPPTL). That’s a bit of a mouthful, so we’ll call it “CPT.” CPT is a highly attractive liquidation opportunity. CPT was created out of the JC Penney bankruptcy to own a variety of JC Penney’s store properties and distribution centers. CPT is a liquidating trust tasked with selling off all 146 remaining properties within three years and distributing monthly net rents received until then. These properties are on an 18-year triple net master lease to New JC Penney. The reorganized JC Penney is well-financed and profitable.

CPT’s market capitalization is $956 million. The trust has a small cash balance and zero debt. Gross annual rents from JC Penney are $111 million. After the cost of management fees and sales effortrelated expenses, the trust distributes nearly $100 million to holders annually. This 10%+ yield is simply too high for a geographically diversified collection of commercial properties on long-term triple net lease to a good quality tenant. Today trust units are changing hands at around $12.75. Ultimately, I expect us to receive liquidation proceeds of $18 or more within three years, plus $1.30 per share in annualized distributions for an internal rate of return of at least 20%. The faster that CPT winds up, the better the outcome. Know anyone who wants to buy some real estate?

Expert Market Fireworks

Since last year’s SEC rule change that effectively eliminated public quotation of non-SEC reporting securities, we have continued to hold a select few of the affected stocks, viewing them as quasipermanent holdings. These are high-quality companies with competent, well-aligned management teams. The kind of holdings you can tuck away in a portfolio for a decade or longer with full confidence that the value of your investment is growing at an attractive rate. I know we won’t often hear from these companies, but they will occasionally surprise us with positive developments. It’s an exciting day when an annual report from one of them shows up in my mailbox.

This month’s entertainment came in the form of an annual report from Boston Sand & Gravel. The company had an excellent year, earning $80 per share in operating profit. The balance sheet couldn’t be stronger with $250 per share in net cash and at least $100 per share in non-core real estate it is preparing for sale. Shares most recently changed hands at $610. Boston Sand & Gravel will have ups and downs, but its strategic location within the city limits of Boston ensures it will enjoy steady demand for its products for decades to come. If sold, Boston Sand & Gravel would fetch at least $1,800 per share. It won’t be sold any time soon. But even families adamantly against selling sometimes change course when a generational transition happens or a seller simply makes a generous offer. That’s what happened with Ash Grove Cement a few years back. Until then, we will enjoy a growing stream of dividends and a more and more profitable and valuable Boston Sand & Gravel under the experienced leadership of the Boylan family.

Another Alluvial Fund expert market holding making waves is Cuisine Solutions, an innovator in food technology. Unlike a lot of “innovators,” Cuisine Solutions manages to be highly profitable while dedicating millions to research and development. The company has spent the last few years constructing new state of the art facilities to produce its sous vide items for sale at Costco and Starbucks, and for use by several airlines and restaurant chains. Turns out it wasn’t just a few eccentric investors who noticed. In June, Bain Capital stepped up to invest $250 million in convertible preferred stock, valuing Cuisine Solutions at over $1 billion. Bain’s investment provides ample capital for expansion and sets the company on a path to an IPO and exchange listing in a few years. To my amazement, we have been able to acquire quite a few additional Cuisine Solutions shares since the announcement at prices 60% below the conversion price of Bain’s investment. I expect to Cuisine Solutions to reward us richly in the coming years. Until then, if you see their products somewhere, give them a try! You won’t be disappointed.

Concluding Thoughts and Updates

As I stated at the beginning of this letter, it’s ugly out there. Given the prevailing uncertainty, investors are reluctant to commit new funds to any companies facing short-term headwinds. But that’s not all bad. The market is offering us a chance to invest in many different companies at shockingly low multiples of profits a few years out. That doesn’t mean these same shares won’t experience further declines, or that they will regain all their lost ground quickly once economic sentiment and conditions improve. Investor confidence, once it is gone, takes time to return. But I have little doubt that buying shares of high-quality enterprises at mid-single digit multiples of 2025 earnings or free cash flows will prove as rewarding as ever over a reasonable time frame. I have been very willing to “provide liquidity” to some panicky sellers in stocks I know well, and I expect these purchases will work out very well once some of the fear subsides.

I thank you for your confidence in Alluvial Fund. This month we welcomed our largest investment by a new partner in multiple years, and several other new and existing partners stepped up with additional capital for investment in the quarter. I continue to hold my entire investable assets within Alluvial Fund.

I welcome questions from partners about our portfolio and strategy. Please do not hesitate to reach out by phone or e-mail. Expect to receive details about an upcoming webinar in the next few weeks.

Best Regards,

Dave Waters, CFA

Alluvial Capital Management, LLC