Alluvial Fund commentary for the first quarter ended March 31, 2021.

Q1 2021 hedge fund letters, conferences and more

Dear Partners,

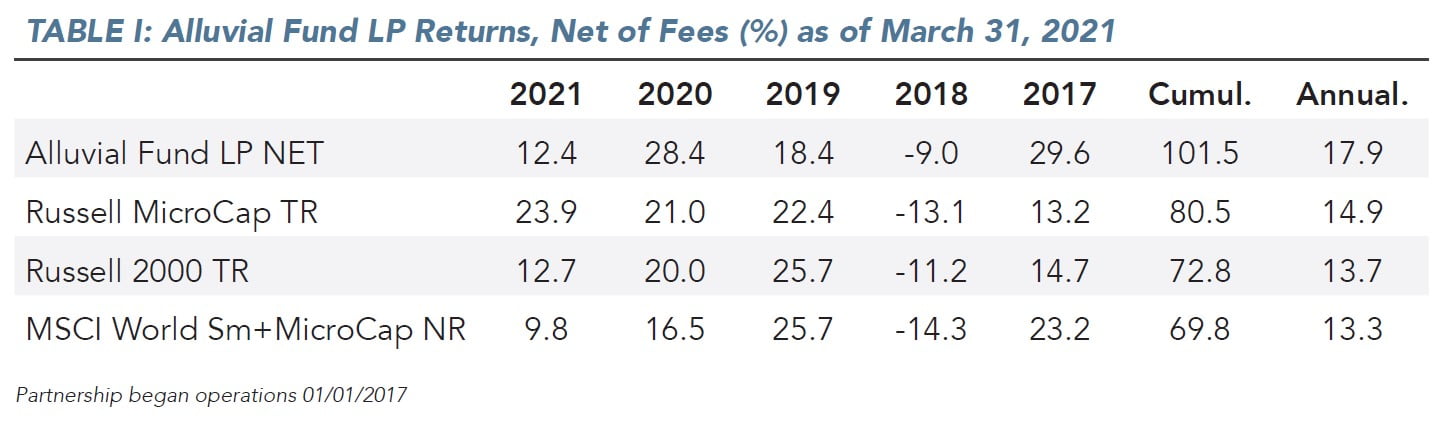

I am pleased to report the year is off to a good start. For the quarter, Alluvial Fund rose 12.4%, in line with relevant benchmarks. We reached an important milestone at the end of March: a 100% cumulative return since inception. Thank you for the opportunity to manage capital on your behalf.

Alluvial Fund's Portfolio Holdings

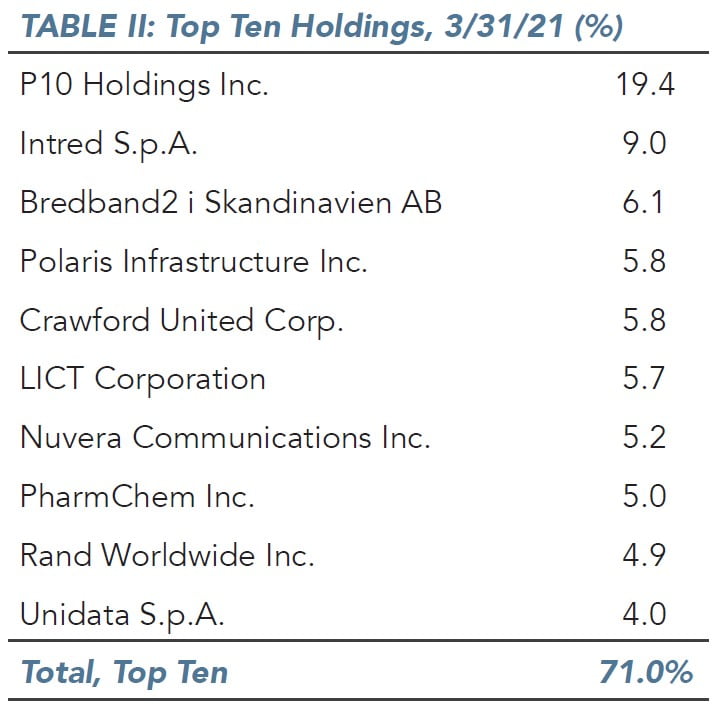

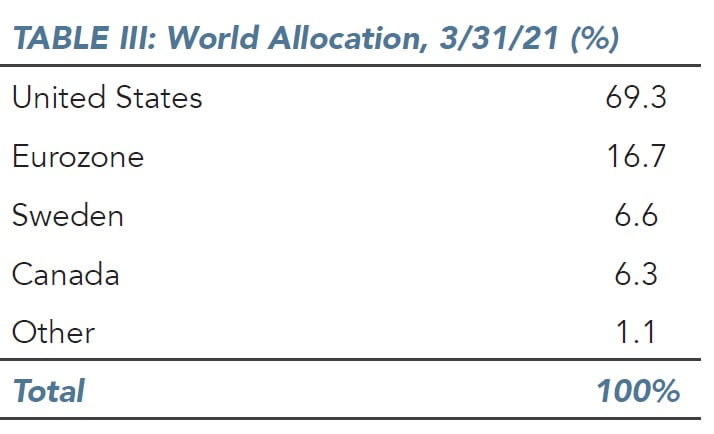

Consistent with the fund’s history, our holdings hew strongly toward tiny producers of steady cash flow with modest or no financial leverage, plus strong insider ownership and alignment. I continue to find a very encouraging number of opportunities, and I could not be more excited for the remainder of the year and beyond. As always, all of my personal capital is invested in Alluvial Fund. I have added to my investment twice this year and will again in May. Discussion of some major and minor holdings follows, as well as a post-mortem of a long-time holding that I sold completely in the quarter.

P10 Holdings

Our largest holdings continue to report excellent operating results, and the market has reacted accordingly. In its annual report, P10 Holdings (OTCMKTS:PIOE) revealed steady progress at all its alternative asset managers, including newly acquired Truebridge Capital and Enhanced Capital. All of P10’s managers are raising capital for new funds this year. The company is evaluating an uplisting to increase the liquidity of its stock and highlight its value. I invite you to peruse P10’s new presentation and shareholder letter, which have lots of great information about its value proposition and strategy. P10 remains our largest holding, but I have been selling as the shares hit record highs this month. I believe strongly in the company’s management and strategy, but I wish to free up cash for other potential opportunities and avoid over-concentration.

Crawford United

Crawford United is once again playing the acquirer, this time purchasing the assets of Global- Tek Manufacturing, a producer of high specification machined components. Another acquisition complete and many more to go. Crawford has no shortage of quality acquisition opportunities. Intriguingly, Crawford United also seems to have plans for an industrial company in my backyard, Ampco-Pittsburgh. In September, Crawford bought nearly $1 million in Ampco-Pittsburgh shares. Crawford United Chairman (pending resumption of the chairman role following a stint as US Ambassador to Ireland) Edward F. Crawford also invested in Ampco-Pittsburgh through a trust he controls. Mr. Crawford has had conversations with Ampco-Pittsburgh about a possible combination of the air handling units of both businesses. A transaction could be extremely beneficial for both companies.

LICT and Nuvera Communications

Our twin domestic rural telecoms, LICT and Nuvera Communications, are trading at all-time highs. Each continues to invest in its network and return cash to shareholders. The market is undoubtedly eyeing an increase in subsidies that may result from any infrastructure bill that is signed into law, but also the attractiveness of fiber assets in an era where highspeed internet is virtually essential for modern life.

Intred and Unidata

It’s good to be an Italian telco. (Unless you’re Telecom Italia.) The Italian market for broadband internet is burgeoning. Italy has longed trailed other major European economies in terms of broadband speed and access but is working hard to catch up. Thanks to companies like Intred, many communities and businesses are gaining access to true high-speed data for the first time. Intred shares were up 53% in the first quarter, but I believe the best is yet to come. Intred continues to expand its fiber network and lease new capacity, both activities with an economic payback period of less than 2 years. Also, the company has tentatively won a tender to supply high-speed broadband to thousands of Italian schools.

Joining Intred in the fund is a newer holding I affectionately think of as “Intred Jr.,” Unidata SpA. Unidata is also a fiber-optic network owner and builder. While Intred operates in Northern Italy, Unidata’s home territory is Rome and the surrounding Lazio region. Unidata is smaller and less profitable than Intred but will follow Intred’s path and grow its margins as it gains scale.

The market has constantly underestimated the earnings uplift that increased scale provides Intred and Unidata. Building a fiber-optic network is expensive. But once it is built, adding and serving customers is cheap. Intred has reached the point where each additional customer’s monthly revenue carries a >60% cash margin. Unidata is not there yet, but there is no reason it cannot achieve similar in time. Shares of Unidata also enjoyed an extraordinary first quarter, up 55%.

Both Intred and Unidata can fund their capital expenditures almost entirely from operating cash flow, and each enjoys a negative working capital cycle. Neither can grow revenues at 15-20% forever, but each has a long period of growth ahead and will settle at a high terminal cash flow multiple based on the quality and necessity of their infrastructure.

Logan Clay Products

Now and then, I like to highlight one of the fund’s smaller holdings. Typically, these are securities that are difficult to buy in size due to the scarcity and illiquidity of their shares. So, I simply buy what I can, when I can. This time around, let’s discuss Logan Clay Products. For 130 years, Logan has manufactured vitrified clay pipe products at its location in Southeastern Ohio. These clay pipes are exceptionally strong and long-lasting, nearly impervious to chemicals and environmental degradation. The popularity of clay pipe solutions in sewer applications has waxed and waned over time, but Logan has profited through it all. From 2011 to 2020, the company was profitable each year and return on equity averaged 13% despite the firm’s significant net balance sheet cash and investments.

Logan has just 72,499 shares outstanding. Alluvial Fund owns 700 of them. As of November 30, 2020 (and adjusted for the dividend paid in February 2021) Logan Clay has $83 per share in net cash. Results were down slightly in 2020 compared to 2019, but Logan Clay still earned $39 per share in operating income plus earnings from property rentals. Excluding one-time income from PPP loan forgiveness, Logan Clay earned $30/share in normalized net income in fiscal 2020. So, what is a reasonable share price for a company with $83/share in net cash and normalized earnings per share of $30? Higher than the last trade of $270, to be sure.

Sadly, shares of Logan Clay products will be even tougher to acquire as time goes on. The firm is non-reporting, which will relegate its shares to the new “expert market” later this year under the SEC’s new rules. Logan Clay shares may qualify for exemption, but investors should not count on it. Should any nervous investors choose to dump their shares before the new rule comes into effect, I will be waiting to buy them for us! I plan to attend Logan Clay’s shareholder meeting later this year. I will report anything interesting that I learn.

Wheeler REIT

Alluvial’s special situations continue to develop positively. Wheeler REIT reported growth in net operating income in the fourth quarter. The company replaced some high-cost debt with cheaper, longer-maturity debt and completed a tender offer for Series D Preferreds. The company has announced a second, larger tender offer for additional preferred shares. Wheeler still faces challenges, but the preferred stock remains well-covered by Wheeler’s asset value and cash flows. I expect continued progress as the year goes on and foot traffic increases at Wheeler’s properties. Wheeler Series D Preferreds are up modestly from our purchase price, while dividends continue to accrue.

Pegroco has not yet restarted dividend payments on its preferred shares, but the company’s operating results are good, and the company has ample liquidity. It is only a matter of time before the company makes good on its obligations.

MMA Capital Holdings

Mistakes were made, and they were made by me. This quarter I sold all remaining shares of one of Alluvial’s longest-held companies, MMA Capital Holdings. We had owned shares in the fund since inception. Over the four years that Alluvial Fund owned MMA, we earned a total return right around 0%. Talk about opportunity cost! So, where did I go wrong? My fundamental error with MMA was a failure to reckon with a breakdown of the management incentive structure. Coming out of the Financial Crisis, MMA was a grab bag of disparate assets with little in the way of ongoing operations. Management, themselves large shareholders, did an extremely impressive job of selling off non-core assets, settling liabilities at discounts to carrying value, and buying back deeply discounted shares by the millions. Shareholders were treated to rapid increases in book value, and the stock followed suit. But that all changed in January 2018, when the company undertook a transaction to externalize its management structure. This should have been a sign for me, a sign with crimson letters flashing “SELL!” The stock market history of externally managed companies is littered with failures. Most trade at significant discounts to stated net asset value because investors rightly judge that external management is in itself a liability.

In an instant, MMA’s motivations changed. Where the company was once focused on optimization and maximizing value for shareholders, it was now focused on “building a platform” and maximizing its balance sheet (which would in turn maximize the stream of fees for its external managers.) Share buybacks slowed to a trickle even as the share price remained well below tangible book value. The company undertook an aggressive expansion of its solar construction lending platform and dedicated nearly all available capital to it. Still, I stuck around and endured years of slow progress and limited tangible book value growth.

My patience already wearing thin, I was troubled by some of the disclosure surrounding the company’s solar development loans in the third quarter 2020 report. Ultimately, I judged the disclosures to be a warning of trouble ahead, and I began selling shares soon after. I sold our last shares in early March, at prices averaging around $23. It hurt selling shares at such a steep discount to what I once saw as intrinsic value, but I had concluded that MMA’s intrinsic value and its possible economic outcomes had become too uncertain to assess with any confidence. It turned out to be a good decision, and auspiciously timed. At month’s end, MMA revealed it would suffer severe loan losses related to the Texas winter storm. Turns out MMA’s loan book is quite a bit riskier than investors had thought. Shares promptly dropped 20%. Would this all have happened without the external manager in place? Possibly. But the presence of a manager with goals and incentives at odds with those of other shareholders made it much more likely.

Though I managed to avoid the most recent insult the company delivered to shareholders, my investment in MMA was a bad one. Worse, it was a bad investment I allowed to go on for 4+ years, during which countless other opportunities sailed by. Every investor makes mistakes. The smarter ones make them quickly and then move on. I pledge to be more critical of worsening incentive structures and to change course more quickly when it becomes clear I am in the wrong.

Administrative Update

Finally, the usual housekeeping matters and a request. The fund’s administrator sent out tax documents and audited financial statements in the last month. Please let me know if you did not receive either of these. I also want to make sure partners are aware that our administrator can create an online login for you to view statements and tax documents if you wish. Contact me for details.

It is still my intent to host an investor day in New York some time in September or October, conditions permitting. I will inform you of the details as I know more. The event will be recorded for partners unable to attend.

I continue to have more investing ideas than Alluvial Fund has capital. If you know anyone who might be a good fit for the partnership (long-term oriented, tolerant of volatility in the pursuit of long-term out-performance, perhaps having a zest for the unusual or obscure) I would greatly appreciate an introduction.

I hope you and your families are well, and that COVID-19 soon feels like a distant, unpleasant memory. I look forward to writing to you again in July. Please do not hesitate to reach out with questions or simply to chat. I look forward to hearing from you.

Best Regards,

Dave Waters, CFA

Alluvial Capital Management, LLC