Dan Loeb’s letter to Third Point investors for the fourth quarter ended December 2022, discussing his new long position in AIG.

Dear Investor:

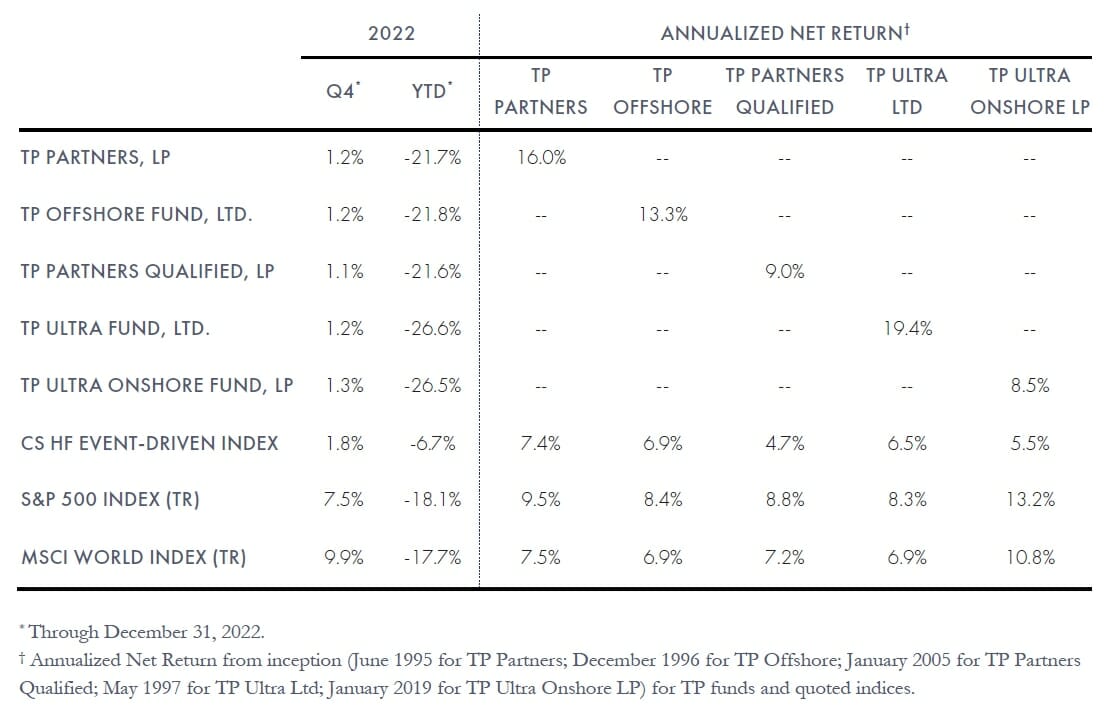

During the Fourth Quarter, Third Point returned 1.2% net in the flagship Offshore Fund and 1.2% net in the Ultra Fund. Assets under management on December 31, 2022 were approximately $12.6 billion.

Q4 2022 hedge fund letters, conferences and more

Read the full letter here.

The top five winners for the quarter were Pacific Gas and Electric Co. (NYSE:PCG), Bath & Body Works, Inc. (NYSE:BBWI), Twitter, Inc. (NYSE:TWTR), DuPont de Nemours, Inc. (NYSE:DD), and TJX Companies, Inc (NYSE:TJX). The top five losers for the quarter were SentinelOne, Inc. (NYSE:S), Private A, Cano Health, Inc. (NYSE:CANO), Amazon.com, Inc. (NASDAQ:AMZN), and The Walt Disney Co (NYSE:DIS).

New Position: AIG

Third Point initiated a position in American International Group Inc (NYSE:AIG) during the Fourth Quarter. AIG is a global P&C insurer that, until recently, held a life insurance subsidiary, Corebridge. AIG has undergone a massive overhaul since the global financial crisis.

The current executive team, who started in 2017, has made significant progress turning around the P&C insurance operations that previously suffered from unprofitable underwriting, significant loss volatility, and inadequate reserving.

Over the past five years, AIG has professionalized the underwriting team, meaningfully reduced gross limits, restructured its reinsurance programs, and pruned the portfolio for profitable growth. As a result, AIG’s P&C operations have gone from an unprofitable 117% combined ratio in 2017 to a 92% combined ratio in 2022 and have seen seven consecutive quarters of favorable reserve development.

Alongside the operational turnaround, AIG is repositioning itself as a pure-play P&C insurer via the IPO of Corebridge which was completed in September 2022. This is an important catalyst for the business.

First, we expect that $11 billion of proceeds from the sell-down of AIG’s remaining Corebridge stake will be primarily redeployed towards share repurchases, resulting in an ability to buy back a quarter of the company over the next two years.

Second, there is an opportunity to streamline the corporate expense base with the simplification of AIG’s business as AIG no longer operates within the conglomerate structure that historically governed its operations.

Today, AIG trades at 1.1x book value (excluding Corebridge) compared to pure-play global P&C insurance peers which trade at a 50% multiple premium. AIG’s strong fundamental operating results coupled with the catalysts following the separation of Corebridge position should help AIG close that substantial valuation discount.

Q4 2022 hedge fund letters, conferences and more

Equity Position Update: Bath & Body Works Inc.

We initiated a position in Bath & Body Works earlier in the year that we added to significantly in the Fourth Quarter. The company, which sells personal care and home fragrance products, separated from Victoria’s Secret in late 2021 and has struggled to find its footing in the public markets. Bath & Body Works was challenged by the normalization of trends following the pandemic, but also suffered from execution hiccups that made matters worse.

On the operations front, the company spent much of 2022 without a permanent CEO, cut guidance multiple times given inventory and cost pressures, and did a poor job communicating meaningful increases in the company’s cost structure as a standalone business. On the capital allocation front, the execution of an accelerated share repurchase program was sloppy at best.

Equity Position Update: Colgate-Palmolive Co.

Colgate remains one of the firm’s largest equity positions. The company offers defensive growth at a reasonable valuation, and we continue to see the potential for shares to deliver attractive risk adjusted returns over the next several years.

Fourth Quarter results were disappointing. The company missed on gross margins, guided 2023 well below the Street, and took another large impairment charge on its portfolio of skin care brands. The price action on the day of the print (down 5%) was extreme and perhaps reflective of growing investor frustration that the company has failed to sustainably grow earnings over the past decade.

Equity Position Update: DuPont de Nemours Inc.

We recently increased our investment in DuPont, a specialty chemical company run by legendary value creator Ed Breen, who is leading a corporate transformation. In November, DuPont divested its most cyclical and lowest margin business segment, Mobility & Materials, to Celanese for $11 billion, or 14x 2023e EV/EBITDA. Following the divestiture, the improved DuPont trades at 11x 2023e EV/EBITDA, which represents a ~30% discount to its peer group.

Q4 2022 hedge fund letters, conferences and more

Equity Position Update: Pacific Gas & Electric Co.

As we enter our fifth year as investors in PCG, first as bondholders and then as shareholders, we remain as enthusiastic as ever about the company’s potential. Even with a 63% increase in the share price over the past six months, we believe the Company remains significantly undervalued with a risk-reward skewed almost entirely to the upside.

Patti Poppe is one of the most talented CEOs in America today and we expect her team will be able to consistently deliver on their 10% medium term earnings growth forecast. In addition to improved management execution, this trajectory is significantly de-risked by supportive legislative initiatives (a 10-year undergrounding plan and extension of Diablo Canyon) and improving regulatory certainty via positive cost of capital adjustments and the 2023 General Rate Case.

Credit Update

Credit markets struggled in 2022 as increasing interest rates caused sharply lower bond prices, and duration – long the bondholder’s friend – became an enemy. The 30-year US Treasury declined 35%.

Spreads were volatile during the year as the hard landing/soft landing debate raged and AAA spreads in particular blew out during the year as high-quality buyers stood down in the face of rate volatility. The higher AAA spreads hurt the economics of leveraged structured credit products and temporarily froze the CLO market, the largest buyer of leveraged loans.

Q4 2022 hedge fund letters, conferences and more

Business Updates

We recently welcomed one new team member to Third Point.

Melanie Schwagerl:Melanie Schwagerl joined Third Point in 2022 with a focus on structured credit. Prior to joining Third Point, Ms. Schwagerl spent three years at Credit Suisse on the Mortgage Finance team. Before joining Credit Suisse, she worked at Moody’s Investors Service. Ms. Schwagerl graduated from Wake Forest University with a B.S. in Mathematical Economics.

Sincerely,

Daniel S. Loeb

Read the full letter here.