Dan Loeb’s letter to Third Point investors for the first quarter ended March 2022, discussing the top five winners for the quarter; Shell PLC (NYSE:SHEL), EQT Corporation (NYSE:EQT), Macro A, Macro B, and Zendesk Inc (NYSE:ZEN).

Dear Investor:

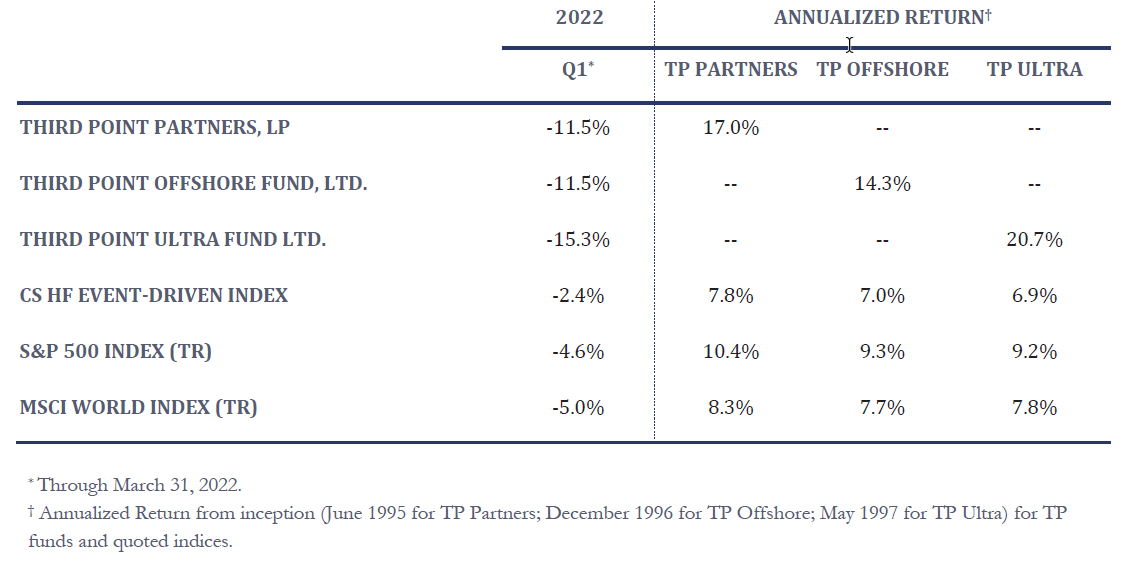

During the First Quarter, Third Point returned -11.5% in the flagship Offshore Fund and

-15.3% in the Ultra Fund. Assets under management at March 31, 2022 were approximately $16.0 billion.

Q1 2022 hedge fund letters, conferences and more

The top five winners for the quarter were Shell plc, EQT Corp., Macro A, Macro B, and Zendesk Inc. The top five losers for the quarter were SentinelOne Inc., Intuit Inc, Upstart Holdings, Inc., Rivian Automotive, Inc., and Cie Financiere Richemont SA.

Review and Outlook

We adopted a significantly more defensive posture in the portfolio during the First Quarter and in April, reflecting our concerns about valuations in the current interest rate environment, geopolitical uncertainty, and emerging weakness in important global economies. Today, our net exposure is lower and buying power higher than at any time during the last 10 years. Our beta-adjusted net equity exposure dropped from 75% at the start of the year to 41% at the end of Q1 to 23% as of yesterday. As part of this shift, we exited several large equity positions and both trimmed exposure to and substantially hedged our second largest and most volatile position, SentinelOne. We reduced the leverage we employ in the Ultra fund from 1.3x to 1.15x.

We also believe that the best defense is a strong offense. As we said in our last letter, the path to wringing out the excesses in the financial system will be bumpy and create clear winners and losers before we hit “normalization” (whatever that means in today’s environment). This makes it appealing to short stocks and so we added to our single name shorts during Q1, replacing some of our baskets and market hedges.

Beginning with our large investment last fall in Shell plc, we have found interesting opportunities in energy and other cyclical stocks. We initiated positions in oil and natural gas companies in Q1, as well as in other materials companies that we believe will benefit from inflation, supply shortages, and the adoption of EVs and other renewable sources of energy. US oil and gas companies are particularly interesting; as a result of ill-conceived energy policies enacted by governments in most developed countries (including the US), both commodities will be in short supply relative to demand. The negative effects of these bungled policies were compounded by well-intentioned but disastrous ESG initiatives that together resulted in a dearth of new investments in the sector. These companies will largely return their cashflow to shareholders via debt paydowns, share repurchases, and cash dividends. In most cases, the companies we have invested in will return in excess of 20% of their market capitalizations annually for several years should strip prices remain close to current levels.

Q1 2022 hedge fund letters, conferences and more

We are pleased that these steps substantially protected the funds against further losses in April, a month in which we turned in a loss of approximately 1% versus losses of 8% and 13% for the S&P and NASDAQ indices, respectively. We essentially sidestepped the sharp market sell-off last month, which positioned us to take advantage of idiosyncratic, event-driven names and cyclical stocks like those described above. Even after dramatic declines, it is difficult to call a bottom in the high-growth, high-valuation end of the tech sector, especially given that many of these companies relied on stock-based compensation and controversial accounting and reporting techniques. It appears that many of the companies which used this type of compensation to attract employees may have retention difficulties, leading to increased dilution for future stock grants or increased cash wages, which could weigh on margins for analysts who rely on adjusted measures rather than old-fashioned GAAP. We fear Soros’s theory of reflexivity will come into play should such a spiral ensue.

Further Thoughts

The 1982 non-narrative film, “Koyaanisqatsi” takes its name from the Hopi word meaning “life out of balance.” The prescient film juxtaposes striking images of nature with urban scenes depicting the imbalances created by modern technology, set to a haunting soundtrack by Philip Glass. Forty years later, this film and soundtrack make an apt backdrop for today’s investment environment.2 “Koyaanisqatsi” neatly captures current market conditions which are, in many ways, a reaction to imbalances.

I have written before about how stories are the essential way that humans try to make sense of a complicated world filled with vast amounts of complex information.3 In doing so, we typically filter out most information to string together a story that explains the cause and effect of disparate events around us. In primitive times, stories invoked spirits to explain natural phenomena, which logically led to behaviors like ritual sacrifices to appease the deities and regain a sense of equilibrium. As humans evolved, we developed the scientific method, which uses facts and evidence as guideposts, but even that is subject disagreement, as seen over topics ranging from nutrition to disease control to climate change.

Q1 2022 hedge fund letters, conferences and more

Debates and explanations about markets and securities are no different. To be an investor is to live constantly at the intersection of story and uncertainty. We build our mental models, frameworks, and processes to try to accurately price securities and overlay them with a story about the economic, geopolitical, and psychological factors that frame the backdrop to value them. We create data-driven stories to explain our differentiated view of a security that is out of balance within its sector or asset class to justify a variant perception that we think will generate alpha. Sometimes, however, investors might create a framework that seems sound only to discover that the method is actually no better than a system to “win” at Russian Roulette. The key, of course, is to change your framework when the environment changes. Even the most sophisticated quant investors employing hundreds of PhD mathematicians and physicists find that their models can fall short due to the ever-changing topography of the surface area of relevant data.

Since I started Third Point 27 years ago, I have seen many investors (including myself) stumble after years of success because they did not adapt their models and frameworks quickly enough as conditions shifted. I have said before that they don’t ring a bell when the rules of the game are changing, but if you listen closely, you can hear a dog whistle. This seems to be such a time to listen for that high-pitched sound.

Position Updates

Shell plc

We have continued to add to our position in Shell, as it trades at the same deeply discounted multiple today that it did last year due to a move up in commodity prices. We are engaged in discussions with management, board members, and other shareholders, as well as informal talks with financial advisors. We have discussed various alternatives with the aim of both increasing shareholder value and allowing Shell to effectively manage the energy transition. We have reiterated our view that Shell’s portfolio of disparate businesses ranging from deep water oil to wind farms to gas stations to chemical plants is confusing and unmanageable. Most investors we have discussed this with agree that the company would be more successful over the long term with a different corporate structure. Discussions among the parties have been constructive and will be ongoing since stakeholders clearly see these corporate changes as instrumental, particularly if Shell wishes to become a leader in the energy transition rather than be left behind as a tarnished legacy brand.

Q1 2022 hedge fund letters, conferences and more

Beyond our discussions around corporate structure, there have been two important developments since our last update. First, Shell announced a plan to redomicile its headquarters to the UK and create a single shareholder class. This move allows greater flexibility to modify its portfolio (either through asset sales or spin-offs) and allows for a more efficient return of capital, specifically via share repurchases. Second, fundamental and geopolitical events have highlighted the strategic importance of reliable energy supplies, especially in Europe. Shell’s LNG business, the largest in the world outside of Qatar, will play a critical role in ensuring energy security for Europe. In our view, the value of this business has increased dramatically since our original investment.

While Shell continues to trade at a large discount to its intrinsic value, with proper management we believe the company can simultaneously deliver shareholder returns, reliable energy and decarbonization of the global economy. We look forward to continued engagement with management and other shareholders and to more strategic clarity from the Company.

Glencore

Third Point initiated a long position in Glencore PLC (LON:GLEN) in Q1. Glencore is a diversified miner that supplies copper and nickel, two metals that will be critical inputs for the transition to renewable energy. Renewable energy assets require between three and 15 times the amount of copper compared to conventional power generation, and electric vehicles have about five times the amount of copper as internal combustion engine (“ICE”) vehicles. Nickel is a key ingredient for batteries for electric vehicles and energy storage. We believe that these two metals are undergoing a substantial acceleration in demand that will outpace supply growth as miners maintain capital discipline after a decade of poor returns. Nickel prices have already begun to price in scarcity, and we see similar potential in copper over the next few years as electric vehicles replace ICE vehicles and the renewable generation buildout occurs.

Q1 2022 hedge fund letters, conferences and more

For many years, Glencore’s production of thermal coal has deterred ESG-conscious investors from owning the company despite its transition-essential elements. However, since the devastating Russian invasion of Ukraine, there is an increasing recognition that companies like Glencore are strategically important assets for Western democracies, as they can use their coal assets to help bridge Europe’s transition away from Russian energy. Glencore’s previous liability has arguably become essential for Europe as it awaits future renewable electricity supplies and the coming US LNG export expansion, which will take at least three to five years, even with the current urgent imperative to do so. This year alone, Glencore’s coal business is set to generate approximately 10% of the company’s market cap in free cash flow.

Other factors, including the current tight and volatile commodity environment that will benefit Glencore’s storied trading business and the expected settlements for prior misconduct with the U.S., U.K., and Brazil, should make the stock more investable. With a new management team in place, an improved ESG profile, very strong cash returns to shareholders, and government settlements, we believe that Glencore can close the substantial 28% discount at which it trades to other global miners.

PG&E Corporation (PCG)

We continue to see immense value and potential in our position in Pacific Gas & Electric, which emerged from bankruptcy just two years ago. PG&E Corporation (NYSE:PCG)'s new CEO, Patti Poppe, has transformed the organization, creating a new leadership and safety culture around a talented, committed, and dynamic executive team that is rethinking the way the Company addresses the energy needs of Northern Californians. California is at the forefront of the new energy transition with aggressive renewable procurement goals and high electric vehicle adoption, yet the state faces escalating climate change risks due to extreme drought conditions and wildfires. These conditions present unique challenges to utilities operating in the state. Patti and her team have brought new and creative solutions to these challenges with her focus on a lean operating system and an ambitious undergrounding plan.

Q1 2022 hedge fund letters, conferences and more

In April, PG&E Corporation reported a straightforward and uneventful set of a results, delivering on its promises to customers and investors. As investors, we celebrate that simplicity. At current prices, the Company trades at under 12x 2022 consensus earnings compared to the utility index average of 21x and below its closest California peer, Edison International, at 15x. While there is an overhang from shares to be monetized by the PG&E Fire Victim Trust, PG&E will benefit from the reinstatement of a cash dividend in 2023 and if, as hoped, it is included in the S&P 500 index. Over the next year, we think PG&E will continue to re-rate towards industry averages while also growing earnings at an industry-leading 10% per year. In this type of market environment, the financial equation of consistent earnings growth and multiple re-rating makes for a wonderfully boring story and a solid anchor for our portfolio as Third Point’s largest position.

ConsenSys Software

We remain active investors in the evolving digital asset ecosystem, with a focus on companies driving the next generation infrastructure of an increasingly decentralized economy. During the First Quarter, we participated in a follow-on round for an existing portfolio company, ConsenSys Software (“ConsenSys”). Led by Ethereum co-founder Joe Lubin, ConsenSys has established itself as a leading platform for both consumers and developers to access Web 3.0. Their products serve as the primary points of access to the Ethereum ecosystem as well as a host of other protocols such as Polygon (another Third Point-backed company). As a consumer, if you’ve bought an NFT, engaged in DeFi, accessed a Play-To-Earn game, or touched a DAO, you have most likely used ConsenSys’s market-leading digital wallet product, MetaMask, which experienced parabolic user growth in 2021. Monthly Active Users (MAUs) through March 2022 increased over 30x versus 2020 and have nearly tripled since August 2021. As a developer, ConsenSys’s Infura tooling suite is one of the dominant Ethereum development platform, helping more than 430,000 builders across the lifecycle from smart contract creation to testing and deployment of Blockchain IP.

We believe this is just the beginning for the team at ConsenSys. We invested in their Series C in November 2021, which raised $200 million at a $3.2 billion valuation, and in their most recent Series D in March, which raised an additional $450 million at a $7 billion valuation. Web 3.0 is still in its infancy and given their product suite is deeply embedded in every layer of the stack, we believe ConsenSys is among the best positioned to continue to capture users as the decentralized economy and web goes more mainstream. We are pleased to partner with Joe and the entire ConsenSys team (and have also joined the Board) to help drive their mission of making Web 3.0 universally easy to use, access and build.

Q1 2022 hedge fund letters, conferences and more

Business Updates

We recently welcomed two new team members to Third Point.

Sapir Harosh: Sapir will join Third Point Ventures in May to open our Tel Aviv office. She was most recently a Principal at Pitango, Israel’s largest venture capital fund, with over $2.5 billion under management. During her time at the fund, Sapir was involved in over 20 investments in early-stage tech start-ups, overseeing eight of them from sourcing to transaction. She was an observer on the boards of seven companies. Sapir began her career while serving in the Israeli Defense Force’s elite 8200 unit, where she was the recipient of the Unit Commander’s Award of Excellence for her efforts. She is the youngest board member of the 8200 Alumni Association, where she founded the Young Alumni community. Since founding the community in 2015, she has overseen all operations including providing opportunities, employment options, networking, and events to the 4000 community members who, in return, give back by promoting entrepreneurship and technology to Israeli society. She holds a B.Sc. in Software Engineering and was named one of Forbes Magazine’s “30 Under 30”, an annual list of the most influential people under 30 in Israel.

Jonathan Chen: Jonathan is an analyst focusing on public markets health care investing. Prior to joining Third Point, he worked at TPG Capital, where he focused on private equity investments in healthcare. Before joining TPG, he worked in the Private Equity Group at Goldman Sachs. Jonathan graduated from Columbia University with a B.A. in Economics and a concentration in Statistics.

Q1 2022 hedge fund letters, conferences and more

Sincerely,

Daniel S. Loeb

CEO & CIO

See the full letter here.