Dan Loeb says management pay is “untethered to important performance metrics”

On Thursday, the Fintel platform reported that Dan Leob’s Third Point LLC filed a 13D form with the SEC disclosing ownership of 13.8 million Bath & Body Works, Inc. (NYSE:BBWI) shares, or 6.02% of the company. The fund pushed the company to refresh its board and reduce management compensation in favor of shareholder returns.

Q3 2022 hedge fund letters, conferences and more

Find A Qualified Financial Advisor

Finding a qualified financial advisor doesn't have to be hard. SmartAsset's free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

If you're ready to be matched with local advisors that can help you achieve your financial goals, get started now.

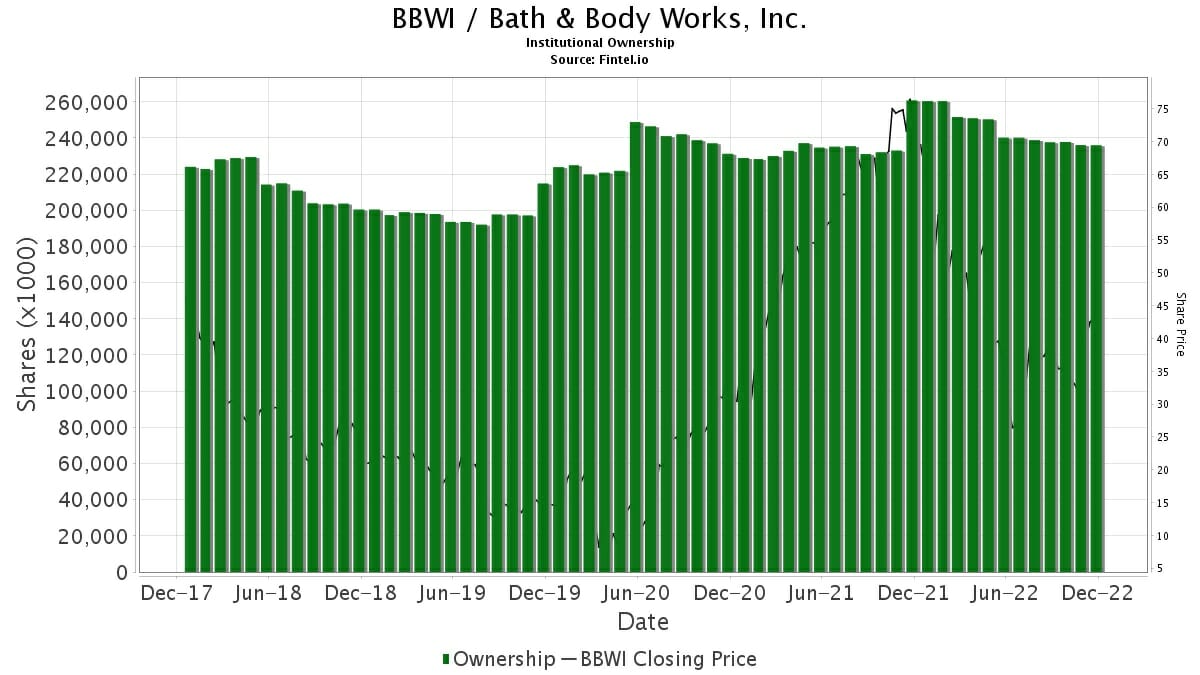

BBWI's stock rose 4% after hours but is down 40% over 2022, cooling off pandemic highs near $80 per share.

In the 13D filing, Third Point questioned "the adequacy of current governance policies" at Bath & Body. The firm, run by high profile activist Dan Loeb, specifically criticized what he described as the company's excessive management compensation. Loeb called executive awards "untethered to important performance metrics" and said he wants a board refresh.

"However, in the event no satisfactory resolution is reached, (Third Point) reserves the right to seek changes in board composition and/or take other measures at or before the company's next annual meeting," it wrote in its filing

Bath & Body Works last updated investors in mid-November during the release of Q3 results. The company outperformed consensus forecasts both s and both profit levels and upgraded full-year profit guidance.

Shares rose 30% in the weeks since the report.

UBS analyst Jay Sole told clients he believes the company's pandemic gains are more sustainable than consensus market sentiment. That should drive sales and margin outperformance, he said. The contrarian report maintained the bank's 'buy' call boosted its price target to $50 from $46.

On average, the street remains bullish on the company with an average consensus 'buy' recommendation and a $50 average target price.

Bath & Body Works is one of the world's leading specialty retailers and home to America's Favorite Fragrances® offering a breadth of exclusive fragrances for the body and home, including the #1 selling collections for fine fragrance mist, body lotion and body cream, 3-wick candles, home fragrance diffusers and liquid hand soap.

For more than 30 years, customers have looked to Bath & Body Works for quality, on-trend products and the newest, freshest fragrances. Today, these fragrant products can be purchased at more than 1,750 company-operated Bath & Body Works locations in the U.S. and Canada and more than 300 internationally franchised locations, as well as on bathandbodyworks.com.

Lone Pine Capital Llc holds 20,630,231 shares representing 9.03% ownership of the company. In it'sitsor filing, the firm reported owning 22,221,713 shares, representing a decrease of 7.71%. The firm increased its portfolio allocation in BBWI by 12.39% over the last quarter.

T. Rowe Price Investment Management, Inc. holds 8,072,722 shares representing 3.53% ownership of the company.

Steadfast Capital Management Lp holds 6,030,732 shares representing 2.64% ownership of the company. In its prior filing, the firm reported owning 6,158,172 shares, representing a decrease of 2.11%. The firm increased its portfolio allocation in BBWI by 45.70% over the last quarter.

Primecap Management Co/ca/ holds 5,887,970 shares representing 2.58% ownership of the company. In its filing, the firm reported owning 5,906,960 shares, representing a decrease of 0.32%. The firm increased its portfolio allocation in BBWI by 30.68% over the last quarter.

What Is The Overall Fund Sentiment?

There are 1110 funds or institutions reporting positions in Bath & Body Works, Inc. This is a decrease of 66 owner(s) or 5.61%.

Average portfolio weight of all funds dedicated to Bath & Body Works, Inc. is 0.2100%, an increase of 6.3853%. Total shares owned by institutions increased in the last three months by 0.55% to 235,894,155 shares.

Fintel's Fund Sentiment Score is a quantitative model that ranks companies from zero to 100 based on Fund Sentiment. Fund Sentiment is important because it tells you if funds are buying or selling - and particularly how the company ranks compared to other companies in the investing universe.

Click to see the Fintel Fund Sentiment Score for BBWI / Bath & Body Works, Inc..

Article by Fintel