Broyhill Asset Management commentary for the second quarter ended June 2021.

Q2 2021 hedge fund letters, conferences and more

The pessimist complains about the wind; the optimist expects it to change; the realist adjusts the sails. - William Arthur Ward

For the six months ending June 30, 2021, Broyhill generated high single-digit returns that varied depending on individual account asset allocations, legacy positions, and capital flows. Detailed quarterly reports, including account and benchmark performance, portfolio holdings, and transaction history, have been posted to our investor portal.

Since the availability of vaccines was announced in the fourth quarter of last year, our portfolio has appreciated materially, generating strong absolute performance and attractive returns relative to broad market indices. That performance continued through the first quarter of this year. But just as we were starting to enjoy the market's strong tailwinds, those winds reversed course, as the narrative shifted back in favor of overvalued, overloved, story stocks. We can't change the market's narrative or the direction of the wind. But we can adjust our sails to ensure that we reach our destination safely and minimize the risk of being blown overboard.

In this letter, we’ll review our performance through the first half of the year, illustrate what happens when sensible expectations become senseless, discuss how we've adjusted our sails to weather various market conditions, share our thinking behind a new investment, and provide an update on our current investment strategies.

Performance Review

The largest contributors to performance during the first half were existing investments in tobacco and healthcare and new investments in LatAm (detailed in the appendix to this letter).

- Philip Morris (NYSE:PM) and Altria (NYSE:MO) shook off the prospects of a ban on menthol and a potential cap on nicotine and gained 23% and 20%, respectively. We shared our thoughts on these regulations during the quarter, which are available here.

- Analysts continued ratcheting up full-year earnings estimates for Lab Corp (NYSE:LH) and McKesson (NYSE:MCK), driving both stocks steadily higher. Despite strong year-to-date gains, shares of both companies are trading at lower valuations today than before the pandemic as earnings estimates have outpaced their rising stock prices. Notably, consensus estimates for Lab Corp have nearly doubled over the past year as analysts have been slow to recognize the impact of increased testing volumes on fundamentals.

- The story is similar at McKesson where vaccine distribution should continue to provide upside to consensus estimates. Although investors have been hesitant to give the company full credit for today’s “temporary” profits, we think these “temporary” COVID-tailwinds may turn out to be not so temporary. If we are wrong, we believe downside is limited given recent activist involvement and management’s decision to pursue a strategic review to capture the full value of the company’s drug development business.

The largest detractors to performance during the first half were existing investments in Equity Commonwealth (NYSE:EQC) and Dollar Tree Stores (NASDAQ:DLTR) and a new investment in Madison Square Garden (NYSE:MSGE).

- After outlining our investment in Equity Commonwealth in our last letter to investors, the company’s management team promptly stuck a fork in our investment thesis, surprising their shareholder base with an all-stock deal in one of the hottest sectors in commercial real estate. We shared our thinking on the deal with investors here.

- We trimmed our investment in Dollar Tree after the stock’s first-quarter gains, but the company later disappointed investors with weak guidance that fell short of expectations. Despite the recent acceleration in same store sales growth at the Family Dollar banner – which weighed on the stock for years - the consensus is now more concerned with rising cost pressures eating into margins at the moment. At some point, sentiment will be just right.

- We established a position in Madison Square Garden Entertainment (MSGE) during the first half, as shares plummeted following the announcement of the company’s proposed acquisition of MSG Networks. Unfortunately, the stock has continued to decline in the interim as some investors continue to digest the merger while others simply decide to cut and run given the increasingly complexity of the story.

Sensible vs Senseless Expectations

Investors have good reason to be enthusiastic. Growth is booming as economies around the world re-open with plenty of capacity. Policymakers are content to keep the party going with heaps of monetary support and fiscal stimulus. Operating leverage is robust, leading to record margins and 90% earnings growth that is crushing expectations (although the market’s reaction to such extraordinary earnings growth has been less than extraordinary).

But it's not all roses and rainbows. The risk-reward profile for equities has deteriorated as valuations recovered and surpassed record highs. Both interest rates and taxes have more room to go up than down. Lapping last year's record fiscal stimulus is likely to create a significant drag on growth this year. Economic growth is likely to come down, and economic surprises are no longer positive given the spike in expectations.

The market has always been good at reallocating capital from the careful to the careless. Lots of people lose lots of money when sensible expectations become senseless. It would seem that over time, investors have become increasingly senseless as return expectations have steadily increased year after year alongside rising equity markets. Seemingly, the higher equity markets go, the greater returns investors expect. That's just not how this works.1

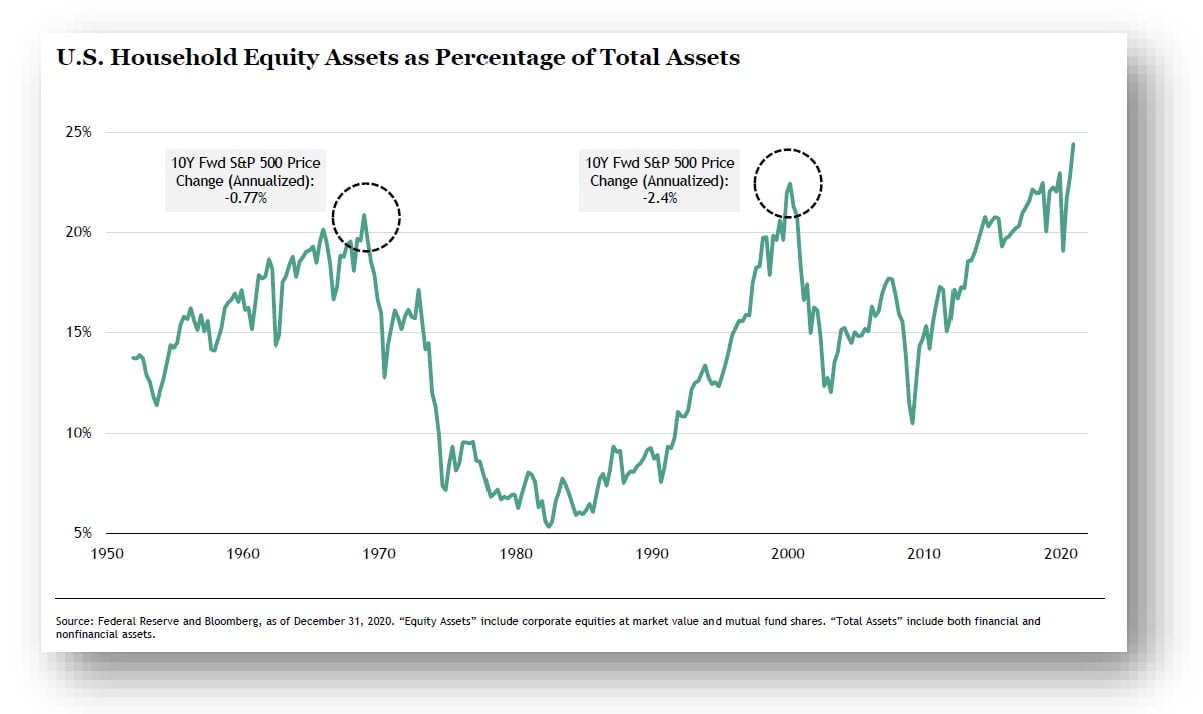

The chart below from a recent Natixis Survey shows that individual investors expect 13% annual real returns (returns in excess of inflation) from their equity investments. A separate survey from Paine Webber and Gallup showed that the least experienced investors expect long-term annual returns of 22.6%. We'll take the under.

For better or for worse, investors appear to be putting their money where their mouths are. Household equity exposure stands at record highs today. And in contrast to elevated expectations, forward returns from these levels have not been pretty.

What does this mean for Broyhill and our investors? It means that even though the market marches steadily higher—scratch that, especially when the market marches steadily higher—we never stop thinking about risk. During times like this, we revamp, refine, and reexamine our thinking every day in order to maximize our odds of success. There is no silver bullet. We must make decisions without the comfort of perfect information. The best we can do is assess all the relevant factors through all the relevant lenses, and as always, we strive to make the best decisions for our clients that we can with the information we have.

We manage money for investors who have worked hard to build their net worth. We work equally hard to keep it by ensuring we have a deep understanding of every business we own. Sometimes we get it right. Other times we don't. But we don't buy stock because someone on the internet said we should. The work is always our own. Not a hot tip poached through a message board.

Today, the businesses we own remain attractively valued despite the recent rally. Valuation dispersion among equity sectors remains high, providing ample opportunity to construct a portfolio much cheaper than the market. Importantly, we have not sacrificed quality for value.

We believe our portfolio companies are better than the average company held in passive benchmarks. In aggregate, our portfolio generates higher returns on capital, enjoys higher margins, and does so with a similar growth profile to the overall market.

So while the market remains broadly expensive and priced to deliver lackluster returns, we take comfort in knowing that we don't own the market. Rather, we own a concentrated portfolio of good businesses trading at attractive prices, with multiple ways to win in the years ahead.

Adjusting Our Sails

The global economic recovery continues to unfold. Vaccine roll-outs are accelerating, economic growth is surging, and loose financial conditions reflect ongoing stimulus. The re-opening, however, will not follow a straight line. It will remain uneven and uncomfortable at times, with speed bumps in the form of new variants, kinks in the global supply chain, and unintended consequences.

Although the economy is unlikely to follow a direct path to normalization, vaccines have proven highly effective in reducing the severity of the virus and limiting hospitalizations. So, the recovery should continue in its zig-zag fashion.

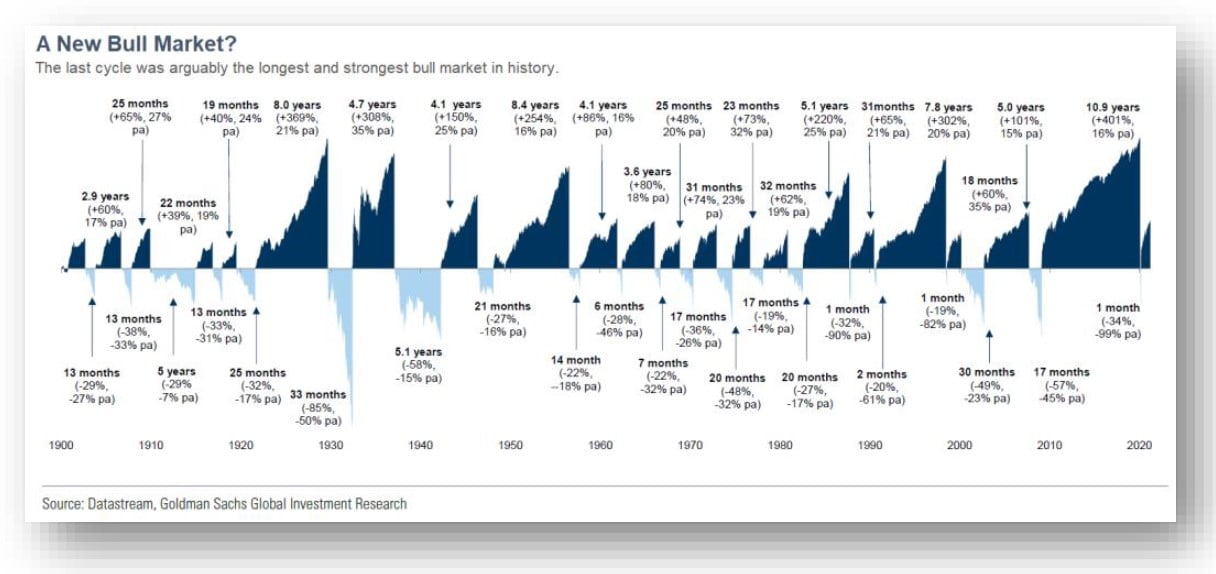

Despite favorable conditions, markets have likely pulled gains from future returns, leaving more volatility and greater dispersion ahead. This would be consistent with historical precedent. On average, valuation expansion has slowed or reversed as economic growth peaked.

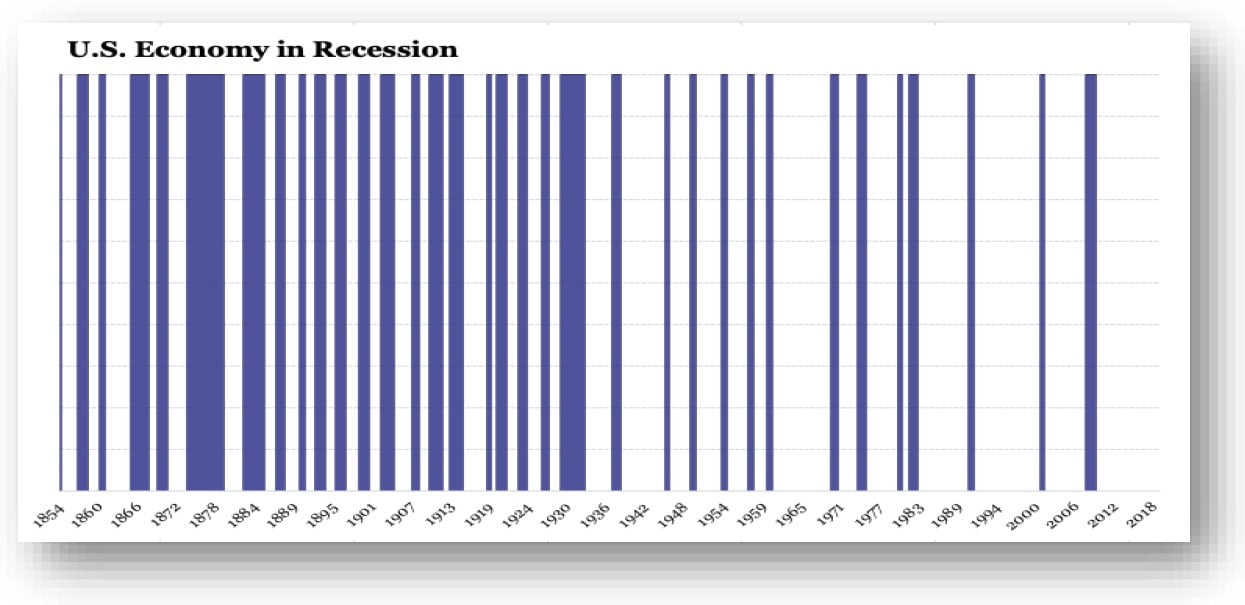

The trickier question, in our opinion, is if this is the start of a new economic cycle or just the continuation of the old one, temporarily interrupted by a global pandemic. The National Bureau of Economic Research (NBER) maintains a chronology of US business cycles, identifying peaks and troughs in economic activity. NBER defines a recession as a significant decline in economic activity that is spread across the economy and that lasts "more than a few months."

The COVID recession was one of the deepest on record. It was also the shortest, lasting all of two months. Despite the brevity of the downturn, NBER’s Business Cycle Dating Committee concluded that the fall in activity was so great that it should be classified as a recession.

We are not particularly concerned with how recessions are documented in the economic history books. But we are interested in their impact on economic growth and asset prices. Recessions are a necessary component of the business cycle. And although they are impossible to predict with precision, we shouldn't be surprised by their arrival. In the 1800s, they occurred about every two years. During the 1900s, the length of the average cycle grew from five years to eight years. Prior to 2020, we had gone more than 13 years without a recession. What's changed?

In a garden variety recession, growth accelerates until the economy begins to overheat and inflation begins to rear its head. Higher inflation prompts the Federal Reserve to raise interest rates until economic growth slows to prevent the economy from overheating. Excesses are purged from the system, providing a clean slate and a more stable foundation for growth to continue.

The Fed's role in managing the economy is analogous to the US Forest Service managing prescribed fires. Controlled burns are an important tool for maintaining the health and safety of a forest. It's the most effective way to remove fuel from the system and protect forests. It's also the only way to restore ecological processes in the forest, such as removing debris to create opportunities for new growth.

Fires are a natural part of the environment, just as recessions are a natural part of the economic cycle. In the wild, trees depend on fire to clear out the competition and release their seeds. Recessions also clear out competition, restoring balance to the economy and reducing leverage. So, the question remains: was a sixty-day downward spiral in economic activity, followed by eighteen months of super-sized monetary and fiscal stimulus, enough to clear the decks? Or are excesses, which grew unchecked for thirteen years without a forest fire, still lurking?

We don't know the answer, and neither does anyone else. But we do know that another recession will occur at some point. And we won’t be surprised when it arrives.

Highly leveraged, overvalued markets levitating on extreme stimulus and high expectations, are particularly susceptible to violent drawdowns. So rather than betting the farm on a continued early cycle recovery, we prefer to focus on rule number one (don't lose money) while trying to make a reasonable profit without violating that first rule.

We are likely entering a more challenging period for financial markets. Investors should prepare to embrace volatility. The dispersion of returns across and within asset classes is likely to widen creating a compelling environment for active management.

Diversification will become increasingly important as hedges remain prohibitively expensive. The majority of passive indices and investor portfolios are heavily skewed towards last decade’s winners. This means markets are increasingly vulnerable to any surprises with respect to these businesses—from regulatory changes to unfavorable tax reform. Contrarians would be well served to look elsewhere for next decade’s winners. To accomplish this, our current portfolio is well diversified across five themes.

Re-Opening Rally. Concerns around the Delta variant are creating opportunities in those businesses that are most exposed to the virus—and in those that have the most to win from a continued re-opening. Consumption patterns were skewed by the pandemic, but they are beginning to normalize as restrictions are lifted. In the latest quarter, international traffic at Mexico's airports (i.e., US leisure travel) was largely unchanged, compared to 2019 levels. The stocks trade on average at 11x 2019 EBITDA or about half of the 22.5x Peak EBITDA recently offered for Sydney Airport.

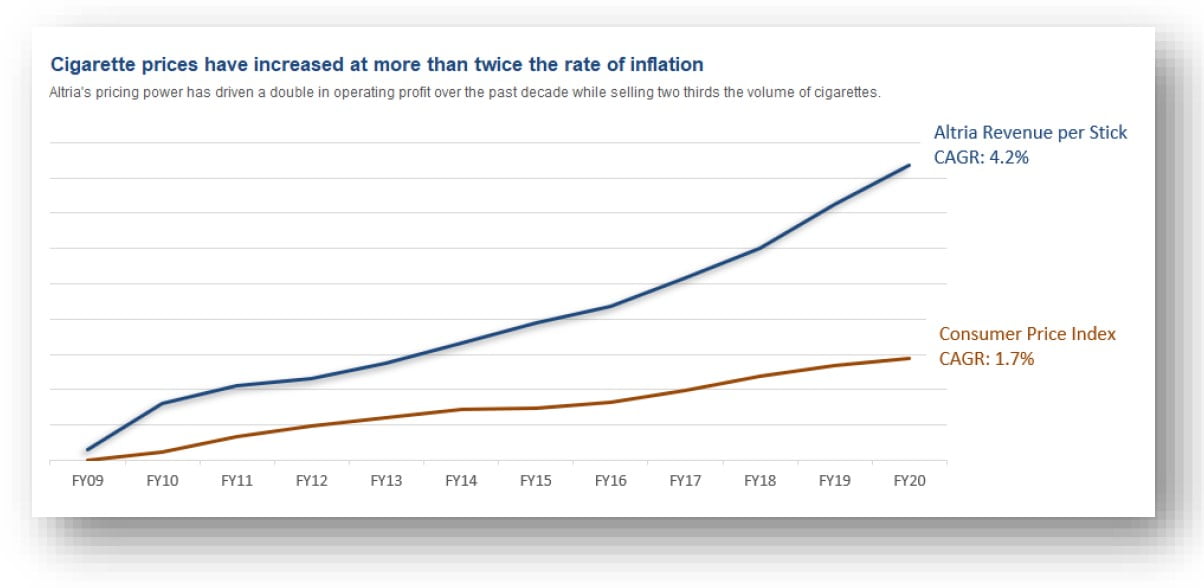

Pricing Power. Companies with pricing power are likely to be re-rated higher if and when inflation continues to pressure input costs. Investors are beginning to appreciate the power of price elasticity, as evidenced by the increase in Altria's multiple this year. Tobacco may be the market's poster child for pricing power as demand is almost entirely inelastic—buying habits remain largely unchanged regardless of price increases. Revenue growth generated by pricing also has a much larger impact on profitability. For reference, just have a look at recent earnings reported by Hertz and Avis.

At the other end of the spectrum, fragile supply chains, tightening labor markets, and surging input costs should squeeze profit margins and compress multiples for below-average businesses.2

Dollar Diversification. We expect the recent flood of monetary and fiscal stimulus to cause a long-term devaluation of the dollar relative to other assets, creating opportunities in real assets and emerging market equities. The combination of declining currencies, declining stock markets, and increasing interest rate differentials has made emerging market cashflows very cheap. We believe LatAm markets are particularly attractive and continue to find compelling opportunities abroad.

Real Returns. Real assets, like infrastructure and commercial real estate, have performed well during inflationary periods,** and are generally under-owned today as inflation protection was not necessary amidst decades of declining rates. As a result, many are attractively valued and poised to benefit from a combination of fiscal stimulus and loose monetary policy. If inflation fears continue to escalate, we expect to see more investors looking for alternatives to the traditional 60/40 portfolio.

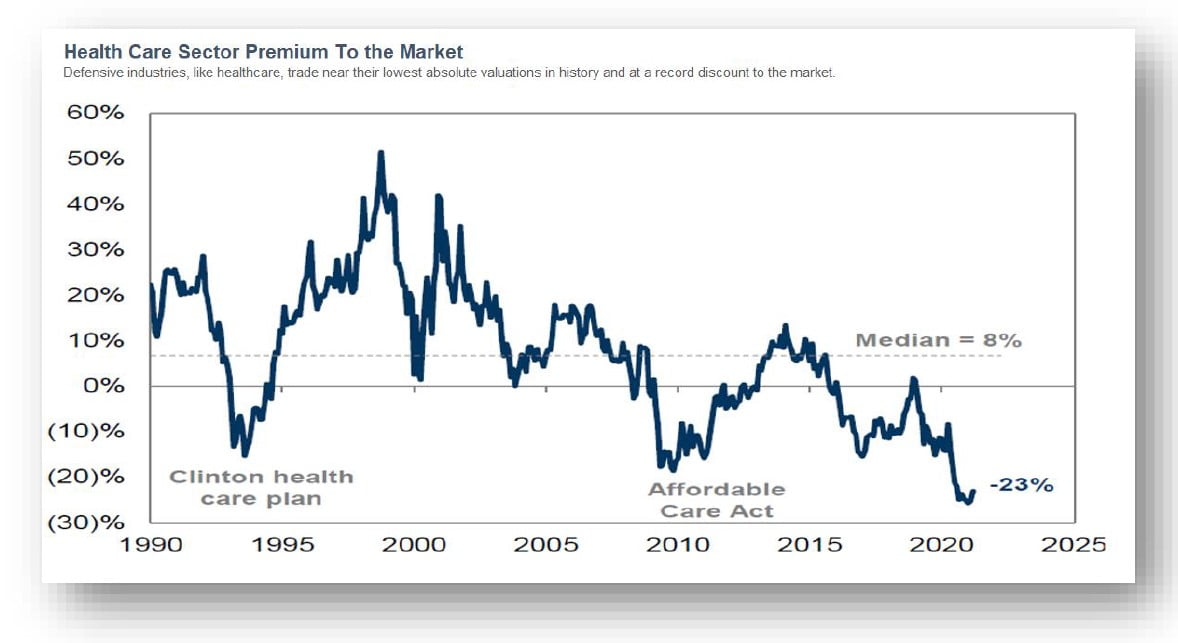

Cash is King. Free cash flow, not total addressable market, will likely define the next decade's winners. Low inflation and falling rates have had an outsized impact on the valuation of growth stocks. At the same time, investors have been enamored with the secular shift towards capital-light business models and the corresponding rise in intangible assets. As a result, many high quality businesses that generate strong and recurring free cash flow are trading at magnificent bargains. Defensive industries, like healthcare, trade near their lowest absolute valuations in history and at a record discount to the market.

Organizational Update

Over the years, we’ve occasionally gotten questions from friends and colleagues regarding our willingness to manage outside capital. When we were founded nearly half a century ago, we were a single family office, so it’s understandable why people today may be uncertain.

We have preferred slow and steady growth, carefully selecting the right clients, rather than gathering assets as quickly as possible. Our business has grown at an equally measured pace. We began managing external capital via SMAs that mirrored our internally managed equity portfolio. In addition to last year's launch of our opportunistic credit fund, we recently made additional strategies available to investors, so we thought it would be helpful to provide a quick summary of our offerings here.

The Broyhill Tactical Equity Portfolio

This is our flagship equity strategy that mirrors the internal portfolio managed for the Broyhill Family. The approach is concentrated, opportunistic, and benchmark agnostic. As a result, we don’t seek to track or outperform an arbitrary benchmark, but rather aim to generate attractive long-term returns with lower risk than broader equity indices. To do this, we periodically employ options and hedges to manage downside risk and often hold large cash balances to damper volatility and provide optionality on tomorrow’s opportunities. The risk/reward profile of our flagship equity portfolio looks less like a long-only index and more like a classic hedge fund—without the two-and-twenty fee structure. Relative to our hedged peers, the strategy has historically offered higher returns with similar downside protection, greater transparency, increased tax efficiency, and lower fees.

The Broyhill Equity Portfolio

For clients with a greater risk tolerance or allocators who prefer to manage cash themselves, we recently launched a fully invested version of our Tactical Equity Portfolio, which allows investors to better align their exposure with their specific needs. After learning of the demand for a strategy with greater market exposure from several institutional investors via platforms like Envestnet and Adhesion, we decided to make the strategy available to existing investors through separately managed accounts. Importantly, this new product will invest proportionately in the same securities as our flagship strategy, grossed up to 100% equity exposure. As a result, it does not require additional resources from the investment team and trading is largely automated alongside our core equity strategy.

The Broyhill Quality Income Portfolio

Broyhill Quality Income is a low turnover, concentrated portfolio of quality businesses with strong balance sheets and sustainable, growing dividends. After incubating the portfolio internally for some time, we recently made the strategy available to clients who seek additional income in a world starved of yield. With asset prices at all-time highs, yields at all-time lows, and risk of rising inflation, Quality Income offers clear benefits relative to a passive equity allocation and is an attractive alternative to bonds. The strategy is designed to appeal to investors who wish to limit their market risk while maintaining exposure to equities; seek a tax-efficient alternative to bonds and other income-producing options; are concerned about the impact of inflation on income generating assets; or want global diversification to complement their domestic equity exposure.

The Broyhill Balanced Portfolio

While many investors look to Broyhill for our conservative approach to equity investment, others have all or most of their net worth invested with us. For these investors, we offer the Broyhill Balanced Portfolio which combines our equity strategy with additional asset classes to provide greater diversification and exposure to alternatives. The strategic equity exposure of our balanced portfolio is 50% and ranges from 25% to 75% based on the opportunity set. The strategy is built on the foundation of our robust network of external managers, with whom we have a long history of collaboration. Through these relationships, we can provide clients with exposure to niche investments like closed-end funds, targeted allocations to emerging market equities, and various alternatives that complement a long-only portfolio.

Bam Credit Opportunities Fund

Broyhill has cultivated and nurtured relationships with external managers for decades, completing rigorous due diligence and selectively investing only with partners we deem best-in-class. Last year, we took the first step in providing qualified investors with direct access to some of these external managers. The BAM Credit Opportunities Fund leverages the hybrid approach to investing employed by Broyhill for a generation, whereby investments in niche external managers are complemented by direct investments in stressed and distressed credit.

If you’d like to learn more about investing with Broyhill, please contact Tim at [email protected].

Bottom Line

They say that crisis creates opportunity. It follows that the bigger the crisis, the bigger the opportunity. More than eighteen months into a global pandemic, investors are just beginning to realize that it can take years for dislocations to normalize and equally long for heavily impacted industries to fully recover. Fortunately for us, the longer it takes, the longer the opportunity set will remain ripe.

Thank you for your continued trust and partnership. We come into the office each day striving to earn it. We are fortunate to have such a great group of long-term investors who place their confidence in us. As always, please feel free to reach out any time with questions. We enjoy hearing from you.

Sincerely,

Christopher R. Pavese, CFA

Chief Investment Officer

Broyhill Asset Management

Appendix: A Passport To Refreshment

Summary

Coca-Cola FEMSA is the largest Coca-Cola bottler in the world, with operations across Latin America and generating 11% of global Coca-Cola company sales volume. Bottlers have historically been well insulated from recession. Consumer thirst for Coca-Cola rarely changes, even in the face of challenging economic environments. The pandemic was a different story as lockdowns shifted sales away from more profitable products, pressuring both average selling prices and overall profitability. But bottlers quickly adapted and as a result, FEMSA’s volumes have already exceeded pre-pandemic levels. The continued reopening of local economies should drive additional volume back to more profitable segments as consumption normalizes. Longer term, rising consumer incomes, higher margin products, and expanded distribution should drive growth for emerging market bottlers. We believe these businesses deserve to trade at a premium to their developed market peers given their superior competitive positioning, greater growth potential, and structurally higher profitability. Despite these advantages, investors can accumulate shares of KOF today at around 7x EBITDA relative to recent transactions valued at nearly 12x EBITDA. We don’t expect that discount to remain as Latin American economies reopen in the coming quarters.

Our Intro To Bottlers

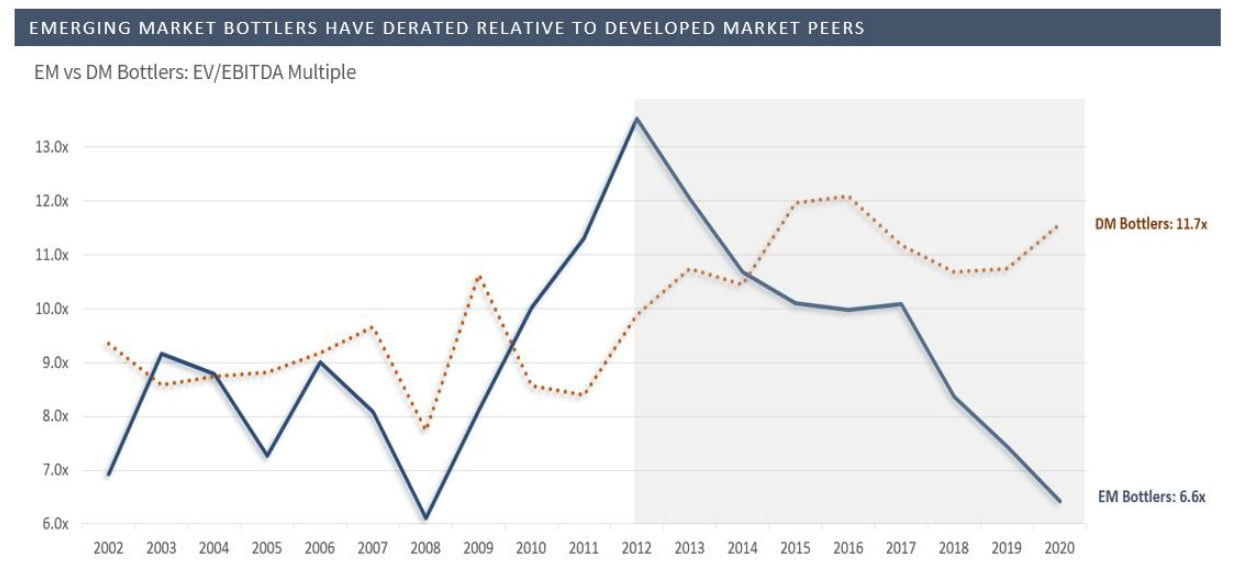

Broyhill has followed the bottling industry for the better part of the last decade, beginning with our 2012 investment in Coca-Cola Hellenic. A few years later, we established a position in Coca-Cola FEMSA, but we have been on the sidelines since 2016. In the five years leading up to 2020, while the S&P 500 gained north of 80% cumulatively, Coca-Cola FEMSA declined 16.5% (including dividends) as the stock’s valuation sunk from a 2016 high of 12x EV/EBITDA to recent lows near 6x EBITDA.

In the fourth quarter of last year, with shares were trading at historically low valuations, we began building positions in Fomento Economico Mexicano (FEMSA) and Coca-Cola FEMSA (NYSE:KOF). We continued buying through the first half of 2021. FEMSA (NYSE: FMX), headquartered in Monterrey, Mexico, operates the third-largest convenience store chain in the world (second only to Japan’s Seven Eleven Holdings and Family Mart). As of year-end 2020, the company had a total network of nearly 20,000 small-format Oxxo stores, making its retail segment, which accounts for 56% of LTM sales, FEMSA’s most important business. The company’s controlling stake in Coca-Cola FEMSA makes up another 37% of LTM sales, and its 15% economic stake in Heineken rounds out the portfolio. While there is a lot to like about the largest network of convenience stores in Mexico, particularly the optionality provided by ecommerce and global payments, this letter will outline our Coca-Cola FEMSA investment thesis, given our greater direct and indirect exposure to the company.

A Brief Industry Overview

Coca-Cola has sat at the top of the global beverage supply chain for a generation. Although the positioning along that chain has shifted over the years, one thing has not changed—the secret sauce of the Coca-Cola company. The soft drink’s recipe, known as the concentrate, dictates the exact proportion of ingredients to produce that indistinguishable flavor. It’s the real thing.

It’s not a coincidence that most of the value in the beverage supply chain accrues to the secret sauce. To maximize its economics, Coca-Cola has sold most of the distribution rights to bottlers around the world, which operate under long-term agreements and provide packaging, sales, and distribution of Coca-Cola’s products.

The Coca-Cola Company generates return on capital about twice the level of its bottlers, and as a result, investors have shown strong preference for the owners over the distributors of the secret sauce. Bottling is far more operational and capital intensive. Capital expenditures typically make up about 6-8% of sales for bottlers versus 3-5% of sales at Coca-Cola. Notably, we think that bottlers have put this capital to good use and have generating positive returns and extending the industry’s long-term growth runway.

So, despite their lower pecking order on the Coca-Cola totem pole, bottlers remain an essential ingredient in the largest non-alcoholic beverage system in the world. That scale is why the system has operating leverage, increased purchasing power, optimized production efficiency, and the ability to spread large, fixed costs across highly fragmented distribution networks.

Nowhere is that scale clearer than in Latin America, where market share and profitability are highest. While the region constitutes little more than 10% of sales, LatAm makes up north of 20% of Coca-Cola’s operating profits.

A Passport To Refreshment

Coca-Cola has nearly 225 independent bottling partners globally, providing global reach with local focus. All of these bottlers contribute to the global system, selling nearly 2 billion servings each day. But demographics is destiny with regard to long-term growth potential. As such, emerging markets offer upside to consumption relative to more established markets.

Within emerging markets, Latin America remains a key region for the Coca-Cola System, making up nearly 30% of global volume. Mexico and Brazil are the most valuable markets, with $52B in sales or nearly 60% of total soft drinks sales in the market. Strong growth in LatAm has resulted in consumption per capita among the highest in the world. In Mexico, for example, consumption is almost twice as high as in the US.

The importance of these markets is magnified by strong operators, the largest of which have leveraged increased scale to generate more attractive returns. LatAm bottler profitability ranks among the highest globally despite low revenue per unit case.

Emerging market bottlers, particularly those based in Latin America, have several advantages relative to their developed market peers.

- Demographics. As incomes grow, emerging market consumers will buy more ready-to-drink beverages. This more attractive product and pricing mix should drive both volume growth and margin gains for bottlers in the region.

- Brand Dominance. Coca-Cola is the undisputed market leader in the region, as the company has leveraged its brand dominance and distribution advantages to monopolize share and thwart competition. For example, in some markets outside of the US, there isn’t even an acceptable option “B” for soft drinks. Pepsi is often discounted as much as 30% and sometimes given away with the purchase of a snack.

- Economies of Scale. The LatAm region represents the greatest share of global Coca-Cola volume sold. The system’s largest and most efficient bottlers are based in the region, which is also one of the most fragmented markets, providing greater benefits to scale, reducing costs per unit, and increasing returns on capital. As Coca-Cola has increasingly relied on a more diversified portfolio mix to drive growth, the scale advantages of LatAm bottlers have enabled them to make sizeable investments in the production, packaging, marketing, and distribution of additional categories, which are often too demanding for smaller operators.

- Distribution Efficiency. The complex distribution system in developing markets makes it challenging, if not impossible, for smaller players to generate acceptable returns. The majority of sales in these markets still occur at small mom-and-pop bodegas and roadside stands in sparsely populated regions, making efficient distribution a challenge, providing additional advantages to the incumbents, and encouraging further consolidation.

And last but certainly not least, despite their superior growth opportunities and structurally enhanced profitability, emerging market bottlers trade at record discounts to developed market bottlers. We would argue that these businesses deserve to trade at a premium to their developed market peers given the structural advantages outlined above.

The Opportunity

Coca-Cola FEMSA, based in Monterrey, Mexico, is the largest Coca-Cola bottler in the world, led by CEO John Santa Maria. The company is controlled by two strategic investors, FEMSA and Coca-Cola, who own 47% and 28% of the float, respectively.3

The company commenced operations in 1979, when a subsidiary of FEMSA acquired sparkling beverage bottlers in Mexico City and the surrounding area. In a series of transactions since 1994, management acquired new territories, brands, and other businesses across Mexico, Argentina, Central America, Colombia, Venezuela, and Brazil.

Bottlers have historically been well insulated from recession. Consumer thirst for Coca-Cola rarely changes, even in the face of challenging economic environments. During the financial crisis, for example, Coca-Cola’s volumes in the region were up mid-single-digits in both 2008 and 2009. The pandemic was a different story as lockdowns prevented consumers from buying “on premise” and “on-the-go” products, pressuring both average selling prices and overall profitability, even as underlying demand remained stable. As consumers took fewer shopping trips and favored cheaper formats, supermarkets and hypermarkets gained share over restaurants and sports venues.

Despite the challenges, the LatAm region was still the best performing market in the Coca-Cola System, and LatAm beverages performed better than other discretionary categories during the pandemic. Mexico’s less coercive approach increased mobility relative to more restrictive economies (which has also benefited the region’s airports). At the same time, bottlers quickly responded by adapting their portfolios, optimizing their packaging, and gearing their channel mix towards at-home consumption.

As a result, FEMSA’s volumes have already exceeded pre-pandemic levels. And the continued reopening of local economies should drive additional volume growth towards the on-trade segment as “on-the-go” consumption normalizes. Although higher commodity prices remain a headwind, the shift in product mix towards higher ticket formats should more than offset input cost inflation, driving higher margins and greater profits for the next several quarters. Longer term, we see multiple opportunities for the company to drive growth and multiple ways for shareholders to win.

- Ongoing efforts to develop and consolidate new markets should continue to enhance scale and drive earnings growth.

- FEMSA’s leading position in the core Mexican market (where it holds 70% volume share of soft drinks in its territories) should benefit from a rebounding US economy, strengthening its ability to further push mix and pricing.

- Brazil, where FEMSA accounts for nearly half of the country’s volume, offers significant upside potential, as per capita consumption ranks among the worst in the region.

- A shift towards higher priced products and higher margin offerings should improve sales and profit per unit, enhancing total company operating margins. FEMSA’s pipeline of product innovation includes new formulations, bottles, sizes, and packaging.

- The consensus underappreciates the long-term growth potential of new offerings. In July, FEMSA updated its existing framework with Coca-Cola allowing the distribution of new categories. A renewed distribution agreement with Heineken in Brazil also provided greater flexibility to produce and distribute complementary beverages. The company’s recently announced acquisition of Brazilian brewer Therezopolis demonstrates management’s enthusiasm for expanding its alcoholic beverage and paves the way for FEMSA to become a total beverage company.

- The expansion of FEMSA’s portfolio to include alcoholic beverages should boost overall company volumes and profitability. Alcohol sales are almost entirely complementary to FEMSA’s existing business as there is little overlap between the selling beers and selling soft drinks. Additional volume drives operational efficiencies and increases the density of delivery routes, driving further benefits to scale and margin gains.

Bottom Line

We believe investors should reward predictable, non-cyclical businesses with defensive product mixes and economies of scale with premium valuations, as steady top-line growth can drive meaningful long-term margin expansion when costs are largely fixed.4 FEMSA is the largest Coca-Cola bottler on the planet with excellent corporate governance, strong leadership, and a pristine balance sheet, yet the company trades at a similar valuation to dying department stores.

Investors can accumulate shares of FEMSA today around 7x EBITDA, a valuation near historical lows on both an absolute and relative basis. At current levels, we think the odds of permanent capital loss are unusually low, given the company’s structural advantages, competitive positioning, and long-term growth opportunities. Conversely, a re-rating towards a more normal valuation range, would represent significant upside.

We note that Coca-Cola Europacific Partners recently bid ~ 12x EBITDA for Coca Cola Amatil (the leading bottler in Australia), in line with where bottlers have transacted over the past decade. Applying that same multiple to FEMSA’s TTM EBITDA, would put the stock about 75% higher. Using our base case assumptions for earnings 3-5 years out would imply a valuation about twice as high. We don’t expect today’s prices to remain around current levels for long, particularly as Latin American economies reopen in the coming quarters.