Small businesses have been through a rough year. Many experienced never-before-seen events because of the pandemic. Many businesses had to shut down due to stay at home orders and many unfortunately had to close their doors permanently. It’s important for businesses to prepare themselves for any changes that could impact their business.

Q1 2021 hedge fund letters, conferences and more

How Small Businesses Are Preparing For Future Threats

AdvisorSmith, a leading resource for small business and insurance content conducted a survey to see what businesses have been through, see what risks they faced, and how they plan on preparing for future threats.

They served 1,000 small business owners and asked if they had any insurable events happen in 2020, whether they filed a claim, and if they had business insurance.

Their results found that three in four (76.2 percent) respondents reported experiencing an event in 2020 that could have led to an insurance claim, while one in four (23.8 percent) respondents did not experience any insurable event.

Of the insurable events that were reported, the most common at 32 percent was burglary, theft, fraud, and other crimes.

Common Insurable Events

The other common insurable events that occurred to small business owners were: employee injury (31 percent), client complaint or contract dispute (28 percent), and cyberattacks, data branches, or hacks (27 percent).

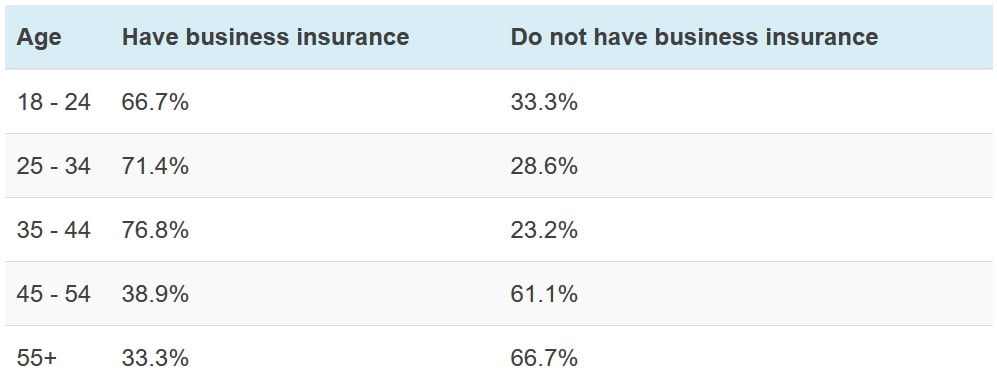

The survey also found that of the 1,000 small business owners, only two in three carried business insurance. Older business owners (aged 45+) were far less likely to carry business insurance than their younger counterparts.

Of the other age groups, 33 percent of business owners ages 18 to 24 and 28 percent of 25 to 34 years old did not have insurance.

Dr. Robert Hartwig, clinical associate professor of finance and co-director of the Risk and Uncertainty Management Center at the University of South Carolina’s Darla Moore School of Business, weighed in on why younger business owners may be more likely to carry business insurance.

Borrowing For A Start Up

“One likely factor is that young business owners may be borrowing to start up their business. If so, their mortgage lender will require them to carry commercial property insurance and perhaps other types of insurance as well,” said Dr. Hartwig. “Older business owners may no longer have outstanding mortgage debt.”

Of the businesses who filed a claim in 2020, only one in two small companies did so. The survey showed that women were 1.6 times less likely to file a claim than male business owners.

Given the challenging economic climate small business owners faced in 2020, it’s no surprise that the survey showed that nearly 3 in 4 (74.1 percent) small business owners planned on purchasing business insurance or increasing their business insurance coverage in 2021.

To view the complete results of the survey, visit https://advisorsmith.com/data/small-business-claims-statistics/.