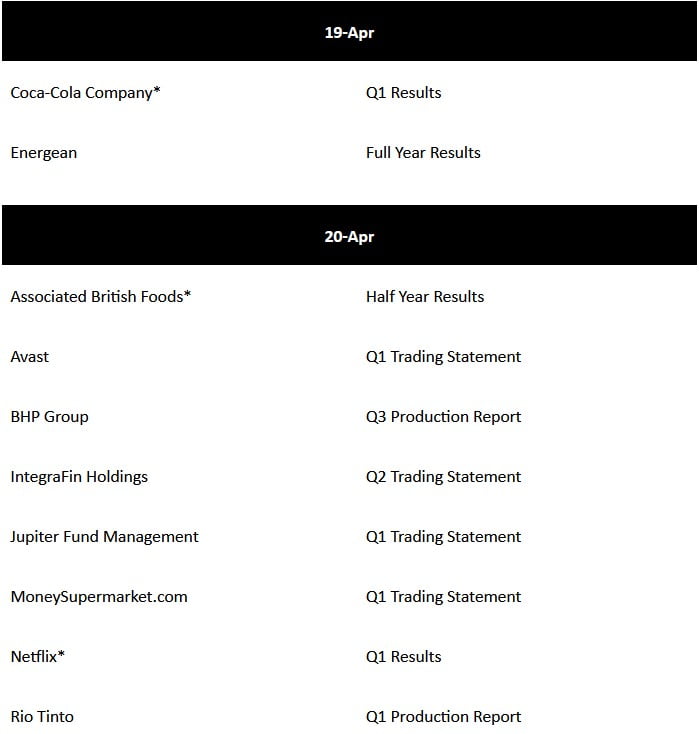

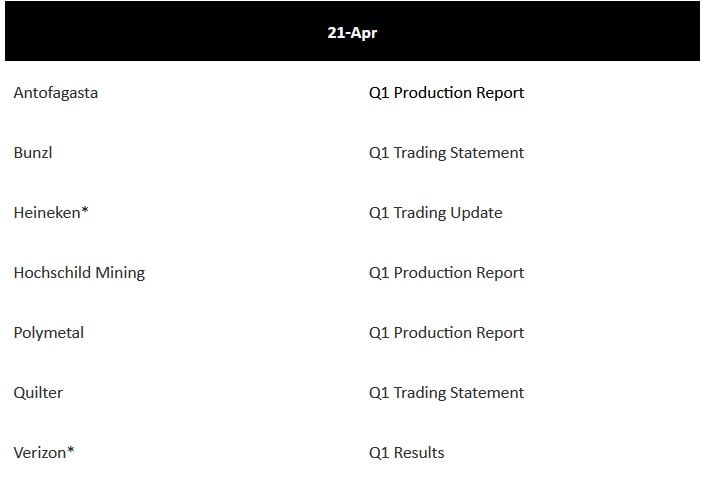

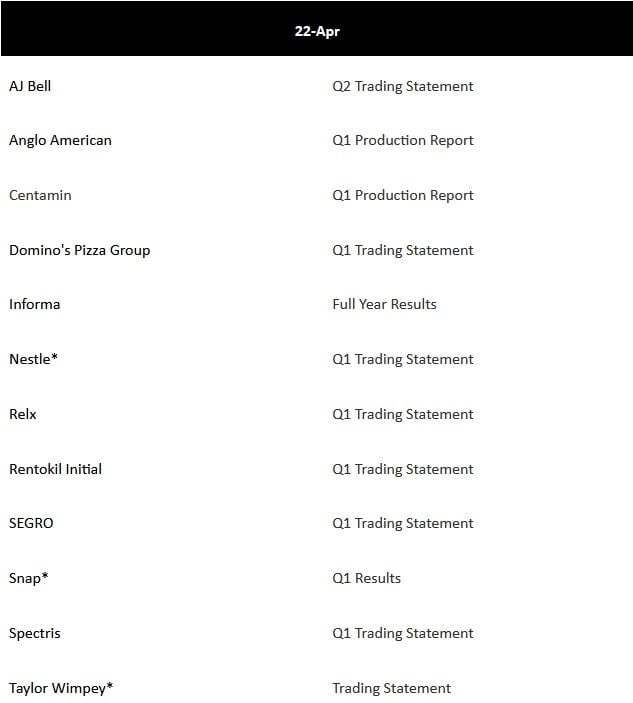

What to expect from a selection of FTSE 100, FTSE 250 and selected other companies reporting next week. Among those currently scheduled to release results:

Q1 2021 hedge fund letters, conferences and more

- Netflix reveals its first set of numbers in what is set to be a crucial year

- Heineken will tell us whether forecasts have changed over the last few months

- Taylor Wimpey should be operating in the top end of guidance as the pent up demand drives a surge in the housing market

- Renokil will show how demand for hygiene products have played out through the pandemic

Netflix, Q1 Results, 20 April

Nicholas Hyett, Equity Analyst

The only number which really matters at Netflix Inc (NASDAQ:NFLX) is subscriber growth. 2020 was a spectacular year for the streaming giant, adding 36.6m new users during the year. The group hopes to add another 6m in the first quarter of 2021 – taking the company to a total of 209.7m paying users. New subscribers mean more cash to create new content, keeping existing subscribers happy and helping recruit new viewers. Eventually the group could reach a tipping point where new money outpaces the need for new content and it starts to generate a sustainable flow of genuinely free cash. That would be a landmark moment, marking the start of potentially rapid profit growth and Netflix has suggested it would look to return the extra cash to shareholders through share buybacks. If that’s to happen, there’s a lot riding on 2021. Lockdowns trapped millions of people at home, boosting demand for streaming services. Netflix needs to hold onto those customers as society reopens and keep content costs under control. Both are things to watch for in Q1 results next week.”

Heineken, Q1 Trading Statement, Wednesday 21 April

William Ryder, Equity Analyst

“All hail the ale! Pub gardens are back open and trading should be picking up for Heineken N.V. (OTCMKTS:HEINY) – at least in the UK. In truth, the UK’s not a big enough market to turn Heineken’s performance around by itself; worldwide progress against the virus is needed. Nonetheless, bars and restaurants around the world should, if all goes to plan and vaccine rollouts are successful, reopen over the course of the next year or so. At full year results Heineken expected business to pick up in the second half of 2021, but recent trading and vaccine developments may have altered these forecasts. Any commentary on this will be essential reading. As society normalises sales are likely to shift back away from supermarkets and shops and back to bars and restaurants. The initial disruption damaged margins, and we suspect there may be further additional costs as we reopen. While brand strength and market share measures are probably more important long term, margins still matter this year.”

Taylor Wimpey, Trading Statement, Thursday 22 April

Laura Hoy, Equity Analyst

“The big unknown ahead of next week’s trading statement is demand. Taylor Wimpey plc (OTCMKTS:TWODF) (LON:TW)’s aggressive land-buying spree during the pandemic was, in our view, a bold strategy that could help it leapfrog competitors through a 2021 recovery. The government’s commitment to supporting the sector by offering 95% mortgages appears to have propped the market up—March house prices rose 6.5% year-on-year. At the full-year, management was expecting volumes to recover to 85-90% of 2019 levels this year. With the deadline for reduced stamp duty payments shifted to October, we’d expect to see the group on-track to deliver at the top end of that range. As completions rise, Taylor Wimpey should be making progress toward its medium-term margin target, between 21% and 22%. As there’s been no further disruption to construction activity, we’re expecting margins to be in-line with expectations at around 19%. Still, cracks could be starting to form. Rising house prices are a good sign that demand is on the rise, but it could make affordability for first-time buyers tricky. That may weigh on Taylor Wimpey, whose average selling price of £288,000 caters to that group. We’re keen to hear how management sees the market panning out and whether the group’s mix of houses is prepared to withstand an uneven recovery.”

Rentokil Initial, Q1 Trading Statement, Thursday 22 April

Steve Clayton, Manager of HL Select Funds

“Rentokil Initial plc (LON:RTO) (OTCMKTS:RTOKY)’s pest control businesses were held back a little by the pandemic, but demand for its Hygiene division grew, because of soaring demand for disinfection services soared last year. Investors will be keen to learn how durable the group believes the surge in Hygiene demand will prove as the pandemic eases and how quickly the all-important US pest control markets can bounce back.”

FTSE 350 companies reporting

*Companies on which we will be writing research

About us

1.5 million investors trust us with £120.6 billion (as at 31 December 2020), making us the UK’s largest direct-to-investor service.

Our purpose is to empower people to save and invest with confidence. We want to provide a lifelong, secure home for people’s savings and investments that offers great value and an incredible service, and makes their financial life easy.

Clients rate our service highly, 90% say we are good, very good or excellent.

Our expert research has been helping investors for almost 40 years through thick and thin – we’ve seen many market downturns.

We make things easy – it takes just five minutes to open or top up an ISA. More clients log into their accounts via our mobile app than through a desktop PC.

In 2018 we also launched Active Savings, an online savings marketplace that lets savers move money easily between banks, to help their money work harder without the hassle.

Our helpdesk is based in our HQ in Bristol. We have a tech hub in Warsaw Poland and around 100 financial advisers based across the UK. We are a financially secure, FTSE 100 company.

For more information: www.hl.co.uk/about-us

Press centre: https://www.hl.co.uk/about-us/press

Investor relations: www.hl.co.uk/investor-relations