Poll: Over 70% of U.S. Investors Are Indifferent to President Trump’s Covid Diagnosis

Q2 2020 hedge fund letters, conferences and more

65% of Investors think a Trump victory would be better for financial markets

53% believe the performance of the stock market over the past 4 years will get Trump reelected for second term

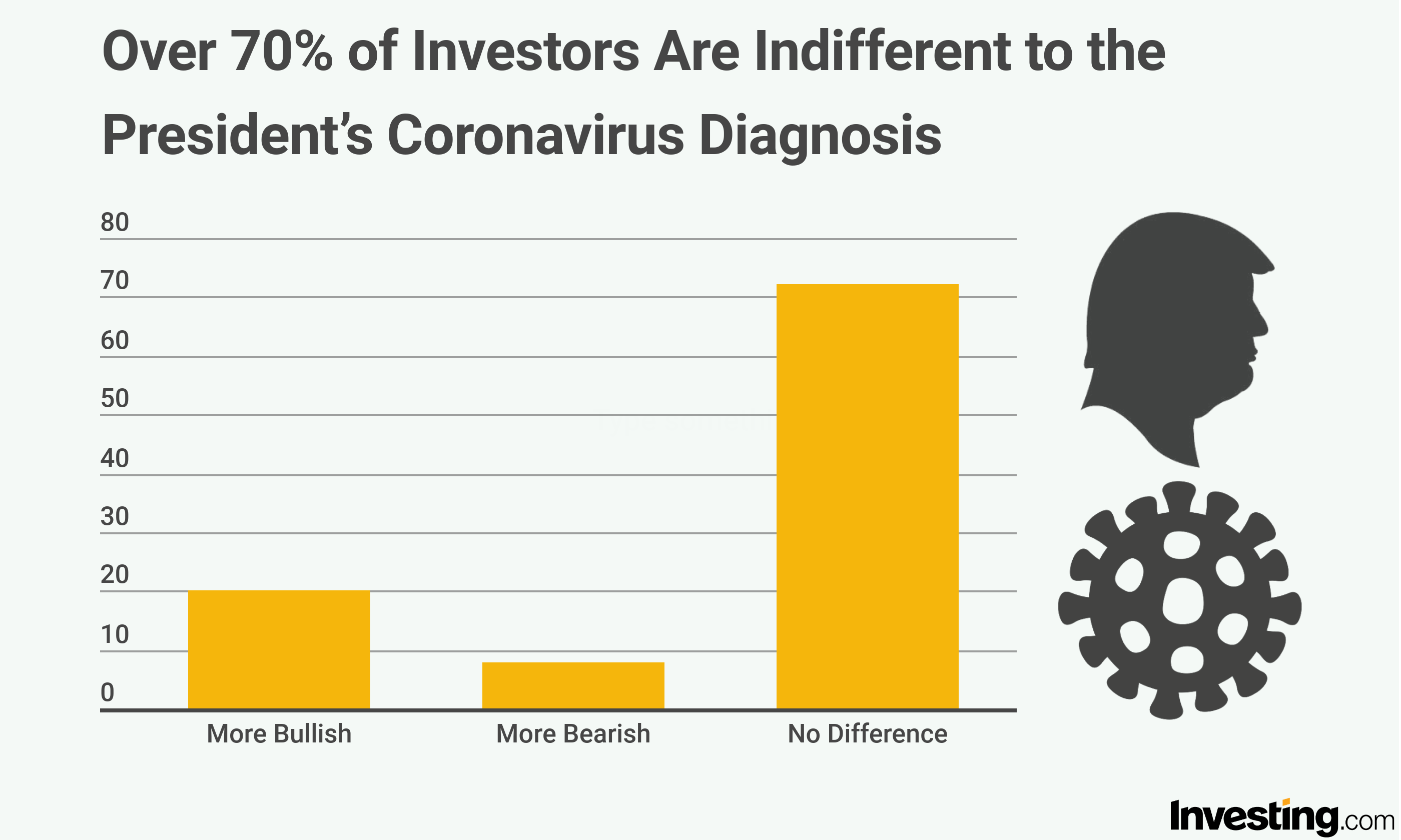

Investors Are Indifferent To The President Trump's Covid Diagnosis

New York, NY, October 9, 2020 – Over 70% of investors are indifferent to the President Trump's Covid diagnosis and see no need to react or change course on their investments. Furthermore, 20% of investors are more bullish, with the President now in recovery from the virus.

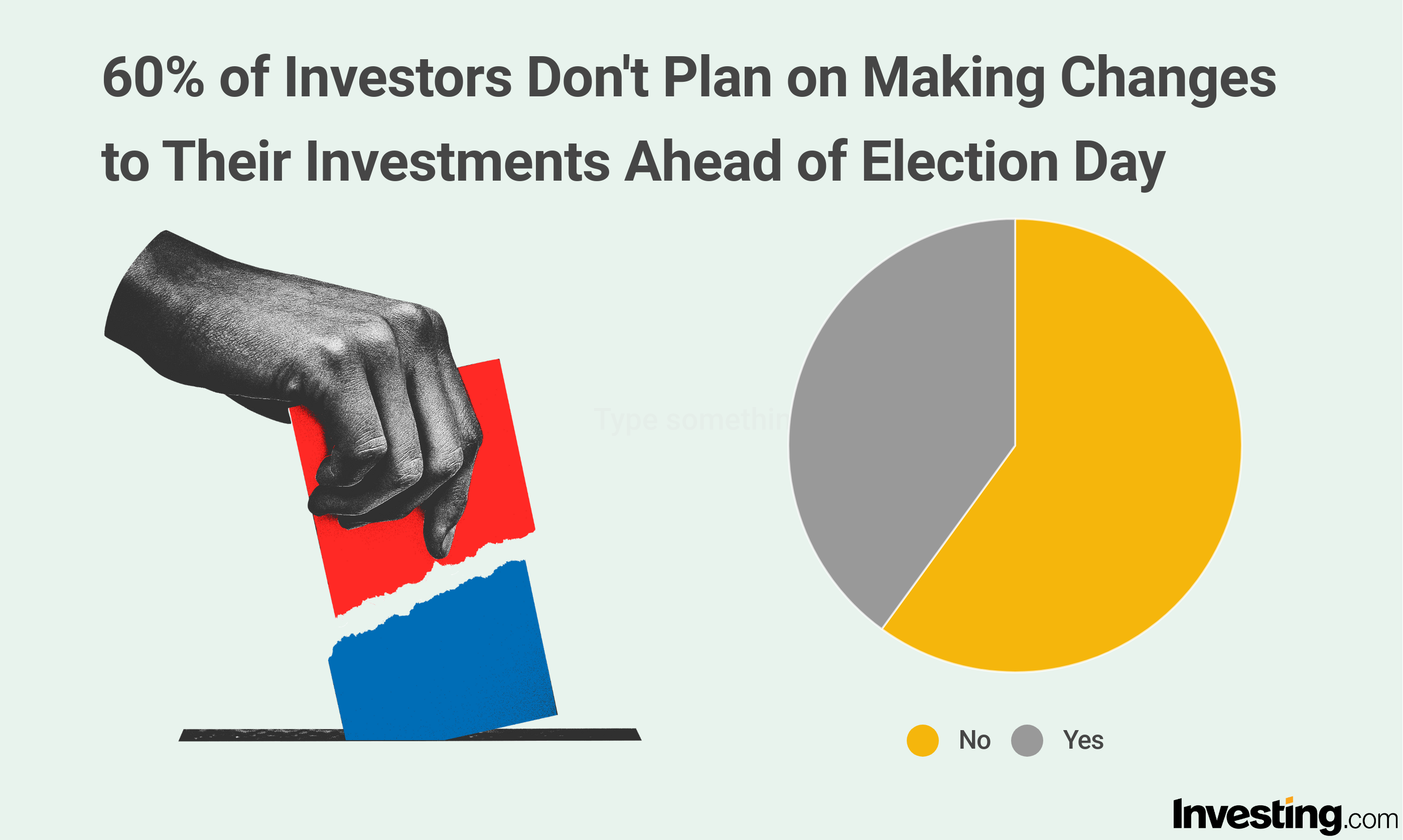

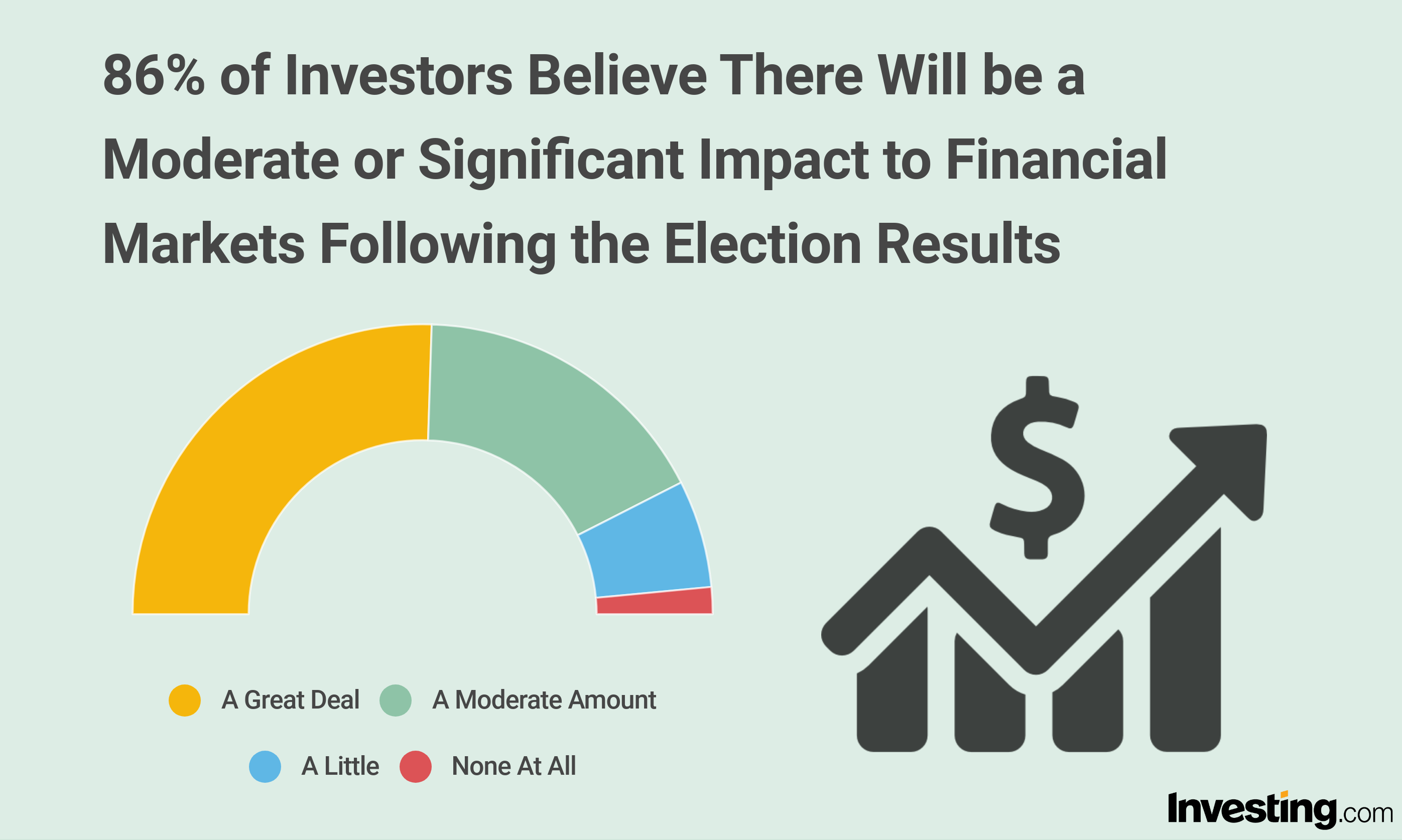

In a survey of 1,164 U.S.-based investors released today by financial markets platform Investing.com, respondents were far more concerned about the time period after the November 3rd election day. Sixty percent of respondents have no plans to make any changes to their investments ahead of election day, while 86% believed there would be a moderate or significant impact to financial markets following the results.

“The initial downward move was nothing more than a knee-jerk reaction to the dramatic headlines,” said Jesse Cohen, senior analyst at Investing.com. “As the hours and days progressed it became clear that President Trump was not in a life-threatening situation, easing worries over a sudden deterioration in his health. Overall, the election result - and whether the winner will introduce a fresh round of stimulus - are far more important factors likely to influence the market in the coming weeks.”

A Trump Victory Will Be A Better Outcome For The U.S. Financial Markets

Investors were also in agreement that a Trump victory would provide the better outcome for U.S. financial markets, with 65% of respondents believing this to be the case and just 16% seeing former Vice President Joe Biden as a better outcome for the markets.

It’s no surprise then, that 53% of investors believe the performance of the stock market over the past 4 years will be the key to Trump being reelected. That said, nearly half of those surveyed believe his administration's response to COVID-19 poses the biggest threat to Trump’s chances of a second term.

No matter the outcome of the 2020 US election, investors do believe the economy is on track to improve with over 60% of survey respondents sharing this sentiment. They were, however, more split on how long it will take for the US economy to show a complete recovery; 43% believed we could see it happen in the next year, while 16% believed it won’t happen in the upcoming term, whether it’s Trump or Biden in the driving seat.

The full story is on Investing.com at: https://www.investing.com/blog/investors-largely-ambivalent-to-president-trumps-coronavirus-diagnosis-288

Methodology: This poll was conducted on October 5-6 based on interviews with 1,164 U.S. adults from Investing.com's user database. The poll has a margin of error of plus or minus 2 percentage points.