“In 20Q3, physical gold demand remained under pressure with losses across nearly all sectors. Coupling Covid-19’s severe toll on the global economy and a record high gold price, consumption was dragged sharply lower,” comments, Cameron Alexander, Precious Metals Research Manager, Refinitiv. “However, looking ahead while considering the underlying macroeconomic conditions such as economic headwinds, the low interest rate environment, ongoing tensions between the United States and China, rising inflationary expectations and the looming second wave of COVID-19, remain highly favourable for gold in the medium-to-long term.”

Q3 2020 hedge fund letters, conferences and more

Refinitiv Metals Research - 30% Physical Gold Demand Slump; All-Time Price High Reached in August

Highlights

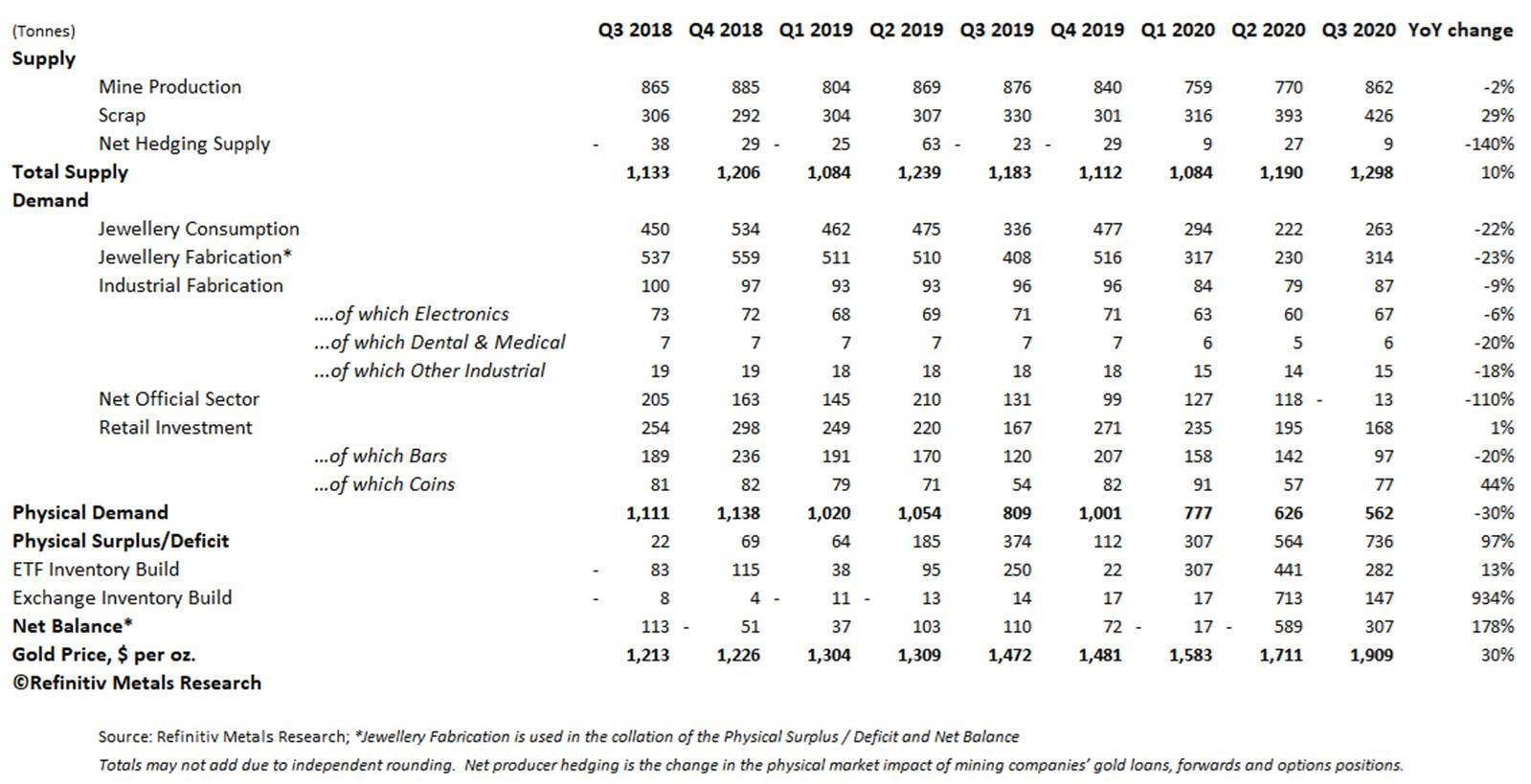

- Total physical gold demand slumped by 30% in the third quarter, with all the major sectors, apart from official coin fabrication, recording YoY declines.

- Jewellery fabrication remained the worst impacted sector, dragged lower by the economic impacts of the COVID-19 pandemic and record gold prices.

- Central banks shifted to net sellers for the first time since Q4 2010.

- Gold ETPs recorded the third consecutive quarter of inflows, albeit at a slower pace in the third quarter, with YTD inflows far exceeding the record annual gain seen in 2009.

- Mixed investment activity for the quarter, with demand for gold bars slumping by 20% to the lowest quarterly level since the financial crisis of 2008/09 as Asian investors took profits, while Official coin fabrication surged by 53% as fears around the COVID-19 crisis and the global market turmoil saw resurging interest among the retail investors.

Gold recorded a spectacular performance during the third quarter, soaring to an all-time high of $2,067/oz in early August, driven by escalating fears over the global economic downturn caused by the COVID-19 pandemic and massive stimulus measures introduced by central banks around the globe in an attempt to lessen the impact. Gold averaged $1,909/oz in the third quarter, up by 27% from the previous three months and 30% above the level seen over the same period of last year.

Meanwhile, physical demand recorded another poor performance in the third quarter, tumbling by 30% year-on-year to an estimated at 562 tonnes. Jewellery fabrication remained the worst affected segment, with global offtake contracting by 23% to a total of 314 tonnes. Despite many markets re-emerging from severe lockdown restrictions prevalent for most of Q2, demand remained poor across all the key regions. Countries continued to battle against the COVID-19 pandemic, which took a serious toll on the global economy, unemployment rates, household incomes and consumer demand. Jewellery offtake in the world’s two largest gold consuming markets, China and India, dropped by 7% and 21%, respectively, battered by weak economic conditions, along with a record high gold price. It is worth adding, however, that the rate of decline was less pronounced than the one seen in the previous two quarters as economies started to re-open after the lockdown.

Demand For Gold In Industrial Applications Dropped 9% YoY

Demand for physical gold in industrial applications recorded a 9% year-on-year drop in the three months to September, with double-digit percentage declines in dental and other industrial & decorative offtake. That said, demand from the electronics industry seems to have rebounded from the previous quarter, particularly from the automobile industry as manufacturing resumed, although remained some 9% down year-on-year.

Turning to retail investment, which is the sum of physical bars and all coins, demand was marginally up year-on-year, as a strong rebound in official coin fabrication was largely offset by poor physical bar investment. Official coin fabrication surged by 53% to nearly 72 tonnes as fears around the COVID-19 crisis and the global market turmoil, along with the improved gold outlook saw resurging interest among the retail investors, driving premiums to unprecedented levels. Meanwhile, demand for gold bars slumped by 20% to just under 97 tonnes, the lowest quarterly level since the financial crisis of 2008/09. The regional analysis, however, reveals some interesting and contrasting findings between the East and the West. The 20% drop was largely attributed to a poor performance in Asia, where investment demand plunged by 59% over the three-month period.

Central banks shifted to net sellers for the first time in nearly a decade, with net sales estimated at just under thirteen tonnes for the third quarter. The shift was driven by an absence of purchases from Russia and China, as well as a significant rise in gross sales as countries continued the battle against COVID-19, which has taken a severe toll on the global economy, with perhaps some also taking advantage of the gold’s astonishing price performance in recent months. Gold ETPs witnessed another quarter of strong demand, estimated at over 280 tonnes, with total inflows over the nine-month period estimated at over 1,000 tonnes, up by 60% from the record annual gain seen in 2009.

Turning to supply, mine production slipped by 2% to an estimated 862 tonnes. While the rate of decline is a lot less pronounced than in the previous quarter, many mines continued to operate at restricted capacity in order to maintain COVID-19 safety restrictions. Global scrap supply rebounded by 29%, with scrap flows rising in all the key regions, as many businesses returned to normal operating capacities, with supply further helped by record high gold prices. With total supply rising by 10%, while demand remaining subdued, the gold market registered an even bigger physical surplus in the third quarter.

Looking Ahead

The underlying macroeconomic conditions such as economic headwinds, the low interest rate environment, ongoing tensions between the United States and China, rising inflationary expectations and the looming second wave of COVID-19, remain highly favourable for gold in the medium-to-long term. It is in the near term that we are likely to see increased volatility, choppy trading and fluctuations in the stock markets and the gold price, particularly in the run up to U.S. presidential elections. That said, while we may see gold consolidating or being caught up in a broader sell-off in the short term, gold should be the one to benefit from growing risks revolving around the second COVID-19 outbreak and the global economic turmoil and we may well see the yellow metal hit a fresh record before the year-end. The gold price is forecast to average $1,784/oz in 2020.

Quarterly World Physical Gold Supply and Demand (tonnes)