GlassHouse Research’s short report on Columbia Sportswear Company.

Q3 2020 hedge fund letters, conferences and more

Who is GlassHouse Research? GlassHouse Research (GHR) purpose is to expose public companies that have been taking advantage of US GAAP as well as IFRS accounting for their benefit. We seek to find companies where GAAP (or even worse, non-GAAP) earnings are deviating from true economic earnings of the target firm.

Overall, we search for evidence of a “culture of fraud” within public companies.

Initiation of Columbia Sportswear Company (COLM) with a Target Price of $45.29 (51% downside)

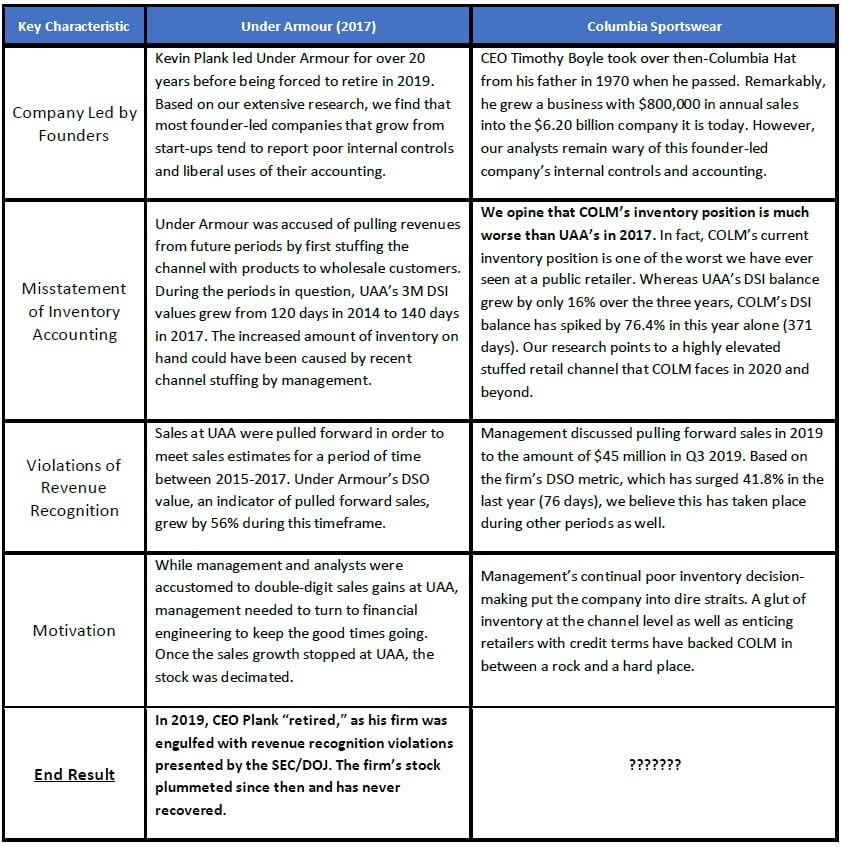

Our analysts find related accounting red flags between Columbia Sportswear Company and Under Armour (2017). In fact, GHR believes COLM is at risk of revenue recognition and channel stuffing concerns well beyond that of UAA in 2017.

- COLM currently has one of the worst inventory positions in all of retail: As such, we calculate that mgmt. has delayed writing down over $225 million of inventory (28% of total inventory).

- COLM’s inventory channel is stuffed: Contrary to sell-side analysts who follow COLM, our research reveals that COLM’s wholesale partners are currently stuffed with product and will be hesitant to purchase inventory going forward. These retailers account for 58.6% of COLM’s total sales in fiscal 2019.

- Columbia Sportswear Company positioned for failure in COVID environment: Management looks to be waiting for things to get back to normal instead of adapting to the new COVID environment. In terms of e-commerce sales (11% of sales in 2019), we see that the company has fallen far behind industry leaders such as Lululemon and Nike.

- Accounting irregularities are littered throughout COLM’s financials: Similar to the recent Under Armour debacle, GHR sees elevated red flags at COLM that point us to revenue recognition fears. Moreover, extending credit terms to failing partners and spiking prepaid expense lead us to believe management has been playing games with its financials.

- Valuation is irrational: Columbia Sportswear Company’s stock price remained fairly flat throughout a turbulent 2020. Based on the analysis laid out herein, we believe that fair value of COLM stands at $45.29, or 51% downside.

Key Similarities Between Columbia Sportswear Company and Under Armour

GlassHouse juxtaposes both Columbia Sportswear Company and the past indiscretions of their peer Under Armour. Based on our research, we believe COLM is in an ominous accounting position, akin to Under Armour in 2017. The end result for UAA was charges of revenue recognition violations by the SEC and DOJ, but most importantly, the stock price dropped over 75% from all-time highs as a result of management’s malfeasance.

Columbia Incompetence Puts the Company in Dire Straits

GlassHouse Research first came across Columbia Sportswear Company (COLM) in our screens in 2019, when the company was riding high in a banner year. COLM grew the top line quarter after quarter and management painted a rosy picture, with new corporate plans such as CONNECT, C1, and X1. However, underneath all the revenue gains and promises of margin expansion, our analysts found reason to believe that most of the gains were artificial in nature, or in other words financially engineered. Outsized inventory metrics, unusually high gross margins, pull-forward of sales, extension of credit terms with wholesale customers, spikes in prepaid expenses, and new disclosures and risk factors detailed in the 10-K lead us to believe that 2019 gains were primarily a farce.

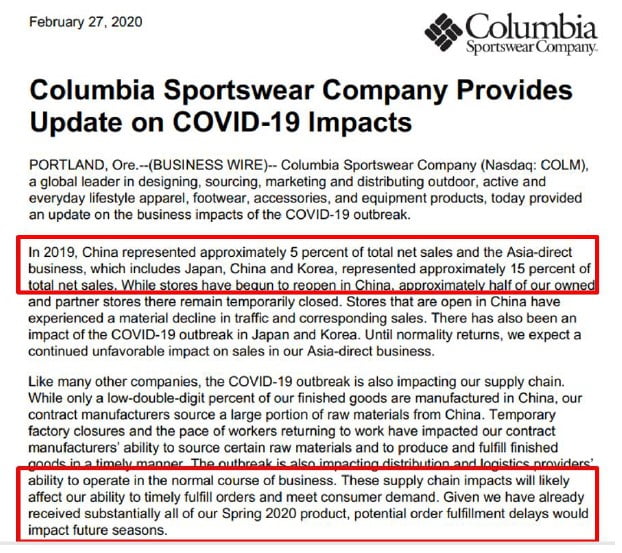

Then, COVID-19 began to rear its ugly head in early 2020, impacting China and much of Asia. While the virus spread in Asia, Columbia Sportswear Company management quickly weighed their options as their supply chain was disrupted. On 02/27/20, the company put out the following Press Release placating investors’ fears that its business would be impacted:

Management was not concerned about the coronavirus’ impact on sales outside of Asia, focusing on procuring new inventory for fall 2020 and beyond. Two weeks later, Columbia Sportswear Company had to reverse course, shuttering its stores in North America as the virus spread throughout North America.

Based on management comments made in later analyst calls, we believe that during this short period, COLM doubled-down on their inventory procurement as management panicked at the thought of diminished 2020 sales due to insufficient finished goods. This backfired against the company in future periods; our research shows that many of COLM’s retailers chose to cancel their orders, leaving Columbia Sportswear Company with bloated inventory and a stuffed channel. By the time management realized there would be substantially reduced foot traffic and sales throughout the world, it was too late.

Management downplayed its massive amount of inventory currently held on hand and has told a sensational tale of wholesalers chomping at the bit for refreshed inventory receipts in H2 2020. However, based on retailers’ comments and current inventory positions, we believe management will need to impair/markdown over $225 million worth of inventory in upcoming periods.

Management’s ineptitude and liberal use of accounting has set the company up for complete failure in the new COVID-19 retail environment. While retailers with a large online presence like Nike and Lululemon have thrived, it appears that COLM management has set itself up for failure.

Unlike accruals manipulation, inventory manipulation generates real cash costs. Relative to the optimal inventory level, producing excess inventory increases the carrying costs (storage, insurance, transportation, etc.) and the likelihood of inventory obsolescence, spoilage, and write-downs. – Managing Earnings by Manipulating Inventory Cook, Huston, Kinney 2007

COLM Inventory Diagnostics are Among the Worst in Retail

- Registering a bifurcation from its peers and channel retailers, Columbia Sportswear Company’s inventory increased by 6.7% YOY to $806.9 million as of 06/30/20, the highest absolute level ever reported by the company by far. This contrasts with 3M sales, which fell by an astonishing 39.8% YOY to $316.6 million.

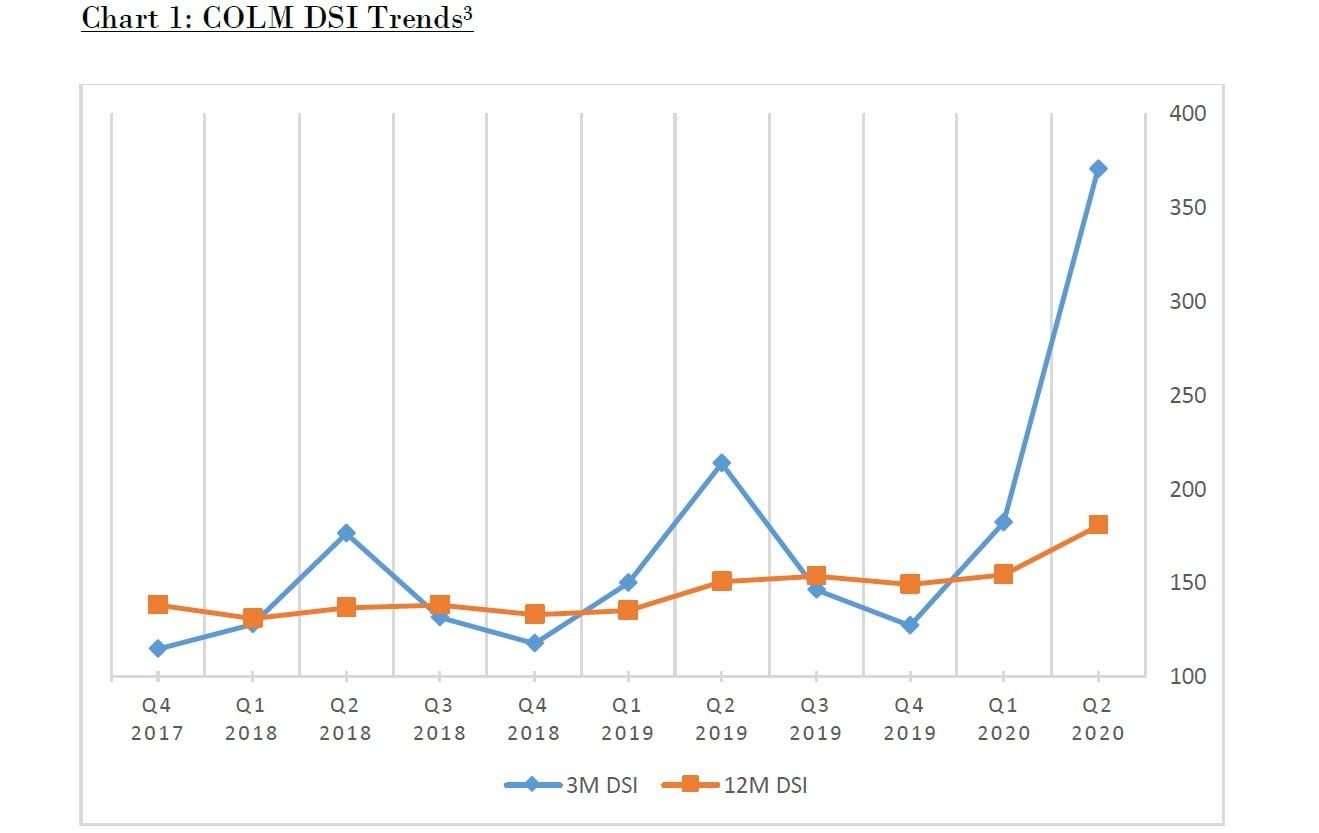

- While many of COLM’s peers either took appropriate provisioning or clamped down on inventory receipts in the last two periods, Columbia Sportswear Company was caught flat-footed. As a result of continued inventory purchases into H1 of this year, quarterly days-sales-of-inventory (DSI1) spiked by 73.4% YOY to 371 days, currently one of the highest in retail. Twelve-month DSI followed this trend, increasing by 19.5% YOY to 180 days, representing a new all-time high for the sportswear company.

- Analyzing inventory relative to quarterly sales, we find that the current inflated value of 254.9% (an all-time high), has risen from only 143.7% a year ago. Longer-term trends portray a similar trend, increasing by 324 bps YOY to 29.4% of 12M sales.

- Management has undoubtably blamed the glut of inventory and raised diagnostic metrics on the pandemic. However, we see a mismanagement of inventory and provisioning, notwithstanding COVID-19. Management’s ineptitude regarding heightened inventory purchases going into 2020 remains the crux of our thesis.

- When we analyze inventory relative to normalized sales2, the metrics, although improved, reveal a problem at Columbia Sportswear Company. For example, normalized 3M inventory-to-sales still increased by 960 bps YOY to 153.3%, representing the second-highest ratio recorded in the history of the company. Normalized DSI values reveal a similar trend, increasing by 18 days to 232 days, representing a five-year high.

- Chart 2 on Page 8 shows that while normalizing sales/COGS improved Columbia Sportswear Company’s inventory metrics, excess inventory still remained within the company. DSI levels have increased in a stair-step fashion since 2017, revealing management’s unwillingness to provision for inventory obsolescence, like many of its peers have.

COLM Needs to Impair $227.1 Million Worth of Excess Inventory

While the entire retail industry faced inventory headwinds in H1 2020, many of Columbia’s competitors chose a different route than our target company. COLM’s competitors were busy in Q1 and Q2 because they cancelled supplier purchase obligations immediately, marked down their inventory to fair market value with significant losses, and/or sold through a material amount of inventory through e-commerce and digital channels. Chart 3 (Page 10) demonstrates how much of an outlier Columbia Sportswear Company is regarding its outsized inventory position.

Management tried to assuage sell-side analysts and investors’ fears about its over-procurement in early March by stating that their wholesale partners had cleaned their inventory and would be ready to purchase in great numbers come fall.

The problem with this theory is twofold. First, even if inventory is viewed relative to future sales (using analyst estimates), inventory still spikes to five-year highs of 48.3% and 29.5% of 6M and 12M forward sales, respectively (see Chart 4, Page 10). Moreover, retailers seem to be stuffed with COLM inventory from a product perspective, as discussed later in the report.

With COVID-19 on the rise again in Europe and certain parts of the United States, we believe that retailers will continue to be stringent with their inventory procurement in H2 2020. Delaying product purchases will crush Columbia Sportswear Company in two ways: 1) highly diminished sales from retailers as they take a wait-and-see approach to the pandemic, and 2) a need to impair millions worth of inventory that no one will take off its balance sheet.

Finally, it is obvious to our analysts that after COLM management realized the massive error of its bloated inventory purchases, it decided to pump the breaks in late Q1 and Q2. For example, the firm reported purchase obligations from suppliers of $505.0 million at the end of Q1 2020. This amount was in line with historical norms for COLM. However, just one period later, this amount plummeted to only $232.9 million in purchase orders, as COLM scrambled to cancel their orders from suppliers.

But the damage appears to have been done — even with the decline in supplier orders, inventory still ballooned to $806.9 million, the highest balance on record for COLM. Pressured by retailers earlier in 2019 to obtain inventory for seasons over 18 months out, the same retailers have now cancelled most of their orders with COLM, leaving them high and dry.

Calculating the Impact:

Basing our calculations on a normalized 12M DSI ratio of 151 days (previous year’s value), we reverse-engineered what we believe is the correct amount of inventory Columbia Sportswear Company should currently carry. We estimate that COLM’s normalized inventory balance should stand at $579.8 million (versus $806.9 million currently). Consequently, GlassHouse analysts believe that $227.1 million of excess inventory needs to be impaired, marked-down, or written-off in future periods, putting all the recent TTM operating profits at risk ($224.9 million). With expected inventory of $579.8 million in the period, this represents a 23.3% YOY decline, more in line with COLM’s 39.8% YOY revenue decline and COLM’s retailers (as discussed later).

So far, management has been obstinate to impair a meaningful amount of inventory as it believes the inventory can be salvaged in future seasons at full price. In fact, we learned that management only charged approximately $6 million for inventory obsolescence in the latest period (only 2.6% of our estimate), which deviates materially from peers. We believe this is a form of earnings management to cosmetically maintain gross margins in current periods.

Gross Margins Remain Unsustainably High Versus Retail Channel

Analyzing gross margin trends at the retail channel, we find that most retailers took material inventory obsolescence write-downs in Q1 and Q2. As a result, gross margins fell dramatically within the industry (see Chart 5, Page 12). While COLM’s gross margins only fell by 362 bps and 201 bps YOY to 47.8% and 46.2% in Q1 and Q2 2020, respectively, the decline in retailers was much more pronounced. We calculate that retailer gross margins fell on average by 1,179 bps and 437 bps YOY. Contrary to the litany of sell-side analysts who follow Columbia Sportswear Company, we believe these retailers’ demise is a harbinger of things to come for COLM at the wholesale level.

Additionally, most retailers took substantial hits to their stock price when the degradation of gross margins was disclosed. This is where we believe most the sell-side analysts get it wrong when it comes to COLM. As discussed, most believe that COLM’s retailers’ inventory books are lean and will be eager to buy more in H2 2020; we disagree wholeheartedly. Furthermore, analysts believe that gross margins will remain fairly flat in H2 2020, then report expansion in H1 2021. Due to compressed sales and increased provisioning over the next year, we believe reaching these gross margin estimates will be near impossible.

When asked about gross margins during the back half of 2020 in the Q2 2020 earnings call, CFO Jim Swanson appears to be highly sanguine about the situation, stating:

I think it's going to be largely dependent upon the consumer and consumer demand and the promotional environment from an overall retail standpoint. As you look at our first half gross margin, most of the drivers that are in there are COVID related. Among them were some fairly significant inventory provisions that we've made, given our excess inventory position. Assuming the environment doesn't get worse, I wouldn't anticipate that, that continues to be a headwind in the latter part of the year.

While Mr. Swanson appears to ease analysts’ fears about a degradation of gross margins, we find it highly unlikely that the firm will be able to increase margins. It also of note that Mr. Swanson gave these comments on July 30th when COVID-19 cases appeared to pass their apex in the United States and were miniscule in Europe. However, in the last month, cases have increased as the world appears to be bracing for a second wave (see Exhibit 1).

Columbia’s Current Retail Channel is Stuffed

Columbia Sportswear Company has one of the worst inventory positions in retail. Not only has COLM management figured out a way to stuff its own retailer channel with products pre-COVID-19, it also figured out a way to purchase an exorbitant amount of finished goods, only to have wholesale customers cancel orders. Management has been way off on inventory positioning in terms of its customer demand, dating back to 2018. It was almost comical for our analysts to go through each earnings call and see how far off-base Mr. Swanson and Mr. Boyle were in their assessment of future demand environments.

But let us start at the beginning.

In 2017, management came up with “Project CONNECT” to “drive sales, capture cost of sales efficiencies, generate SG&A expense savings, and improve marketing effectiveness.” However, this project impacted inventories as well. In response to an analyst who questioned the company’s inventory growth in 2018, CEO Tim Boyle stated the following:

But one of the things that the company has in its favor is an enormously strong balance sheet frankly. We can have a higher return on the balance sheet by investing in inventory where it's appropriate. So we've done a lot of work around Project CONNECT to level load our factories, which is going to increase the – a percentage – a certain percentage of the inventories that we carry at certain times of the year when comparing. And to answer your question about cancellations, actually, it's been quite the opposite. So we're very comfortable with the inventories where they are, and we believe we're in great shape to keep the business growing (Q2 2018 Earnings Call).

While management kept inventory turns in check throughout 2017, they have now changed their strategy through Project CONNECT to hold a larger amount of inventory on hand to satisfy suppliers, which is where COLM’s inventory demise began. The firm spouted off double-digit percentage gains in inventory over the next seven consecutive periods.

Based on comments made by Mr. Boyle, Columbia Sportswear Company seemed dead-set on keeping an outsized amount of inventory on hand throughout 2019, as the firm was ill prepared for the 2018 winter season:

Based on the exquisite year that we had in 2018 and beginning of 2019, where inventory levels were compressed. We ran out of inventory in certain categories.

And so we probably got a little ahead of ourselves. But as our business is a high percentage of repeat products, where we have a significant business and so those – that merchandise has been, as I said, on orders that we have for our wholesale customers as well as inventory that we'll be placing in our outlet stores. (Q4 2019 Earnings Call)

On top of the outsized inventory on hand, management felt pressure from wholesale partners to procure inventory earlier in the supply chain. From the firm’s 2018 10K filing, Columbia Sportswear Company states the following:

Demand Planning and Inventory Management

As a branded consumer products company, inventory represents one of the largest and highest risk capital commitments in our business model. We begin designing and developing our seasonal product lines approximately 12 months prior to soliciting advance orders from our wholesale customers and approximately 18 months prior to the products' availability to consumers in retail stores. As a result, our ability to forecast and produce an assortment of product styles that matches ultimate seasonal wholesale customer and end-consumer demand and to deliver products to our customers in a timely and cost-effective manner can significantly affect our sales, gross margins and profitability.

After this excerpt, Columbia Sportswear Company’s accountants and lawyers added the following, which was new to the current 10K report:

The demand planning process has become more complex as an increased proportion of the forecast is for in-season replenishment that is not confirmed until later in the selling period. Failure to achieve our demand planning goals could reduce our revenues or increase our costs, or both, which would negatively affect our gross margins and profitability and could affect our brand strength…

We use those advance orders, together with forecasted demand from our DTC businesses, forecasted wholesale order cancellations, reorders and replenishment orders, market trends, historical data, customer and sales feedback, and other important factors to estimate the volumes of each product to purchase from our suppliers around the world. The competitive landscape with our suppliers has resulted in our efforts to extend our buying periods and to procure products earlier in the seasonal period.

We believe the extended procurement period has presented a significant risk to a legacy outerwear company such as Columbia Sportswear Company. The strategy of buying inventory earlier in the supply chain process is what would ultimately become a disaster in 2020. COLM found itself in a conundrum. The company faced greater pressure to replenish inventory on demand from its retailers, while simultaneously attempting to appease manufacturers by placing orders well before demand was confirmed.

On top of the absurd inventory strategy employed by management in 2019, the company continued to execute more blunders as they: 1) doubled-down on inventory purchases in March before the pandemic hit the U.S., and 2) heightened the use of extending credit terms to retailers to entice purchases, which stuffed their retailers with bloated product.4 Both strategies blew up in their faces in 2020. Now, for the first time, Columbia is discussing inventory that will be sold over several years, not months. (Q1 2020 Earnings Call):

Timothy P. Boyle

As it relates to carryover inventory, as you know, the bulk of our sales are through fairly long historical products and we have good visibility on that merchandise, and we have some carryovers that we'll be selling over the next several years. We're going to be focusing on inventory turns and liquidity, an area where we really never had to manage with the kind of precision we're going to be working with in the future.

Our main thesis speaks to management incompetence relating to inventory procurement time and time again. While other competitors and retailers over-provisioned excess inventory, cancelled orders and cleaned their books, Columbia Sportswear Company appears to be happy with the status quo.

Management also believes that its wholesale customers will purchase products at historical levels in H2 2020, greatly deviating from peers’ strategies. Here again is CEO Boyle in the latest earnings call:

Timothy P. Boyle

Certainly. Well, our order book was essentially complete in January of 2020 for fall, prior to the pandemic real – hit in Europe and North America. And since then, that order book has compressed slightly, not a tremendous amount. But what we've seen is, frankly, an opportunity where we have inventory present where we believe that, frankly, later in the season, there will be a likely shortage of inventory in winter products. Many of our competitors canceled all orders for merchandise coming in from Asia in winter. And we were very selective in terms of how we work that effort. And so my feeling is we're in the right position with inventories today matching our order book.

Our analysts scoured every public retailers’ comments regarding inventory purchases in H2 2020. We have no idea where Mr. Boyle is getting the notion that there will be an inventory shortage. We believe H2 2020 will be a rude awakening for a company that continues to make all the wrong decisions.

Retailers Hesitant to Purchase Finished Goods in H2 2020

Our research points to Columbia’s heavy reliance on their retail channel to move product and increase sales. We find COLM’s wholesale revenues grew by 10.6% to $1.78 billion in 2019. Furthermore, the company reports that 58.6% of sales originated from their wholesale customers in fiscal 2019. While this percentage split stayed steady at 57.4% in Q1 2020, the ratio fell to 50.5% in the latest period as retailers cut back and cancelled purchase orders from Columbia.

As detailed in our above analysis, management believes that they will be able to sell through the current glut of inventory on hand onto its retailers in H2 2020. Much of this theory is based on comments made by retailers discussing their clean/lean inventory levels going into the fall season. While most retailers have admitted to clean inventory levels heading into the fall, we believe this is due to write-downs from an accounting perspective and not a physical one. Retailers seem reluctant to purchase inventory for the fall season in a weak demand environment.