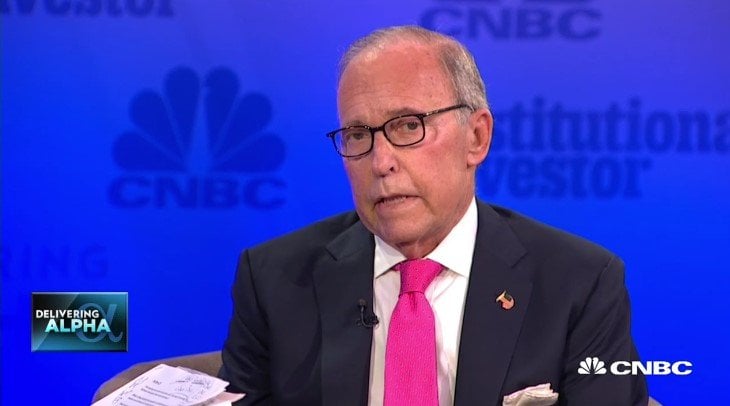

First on CNBC: CNBC Transcript: National Economic Council Director Larry Kudlow Speaks with CNBC’s “Closing Bell” Today

WHEN: Today, Tuesday, January 22, 2019

WHERE: CNBC’s “Closing Bell”

The following is the unofficial transcript of a FIRST ON CNBC interview with National Economic Council Director Larry Kudlow on CNBC’s “Closing Bell” (M-F 3PM – 5PM) today, Tuesday, January 22nd. The following is a link to video from the interview on CNBC.com:

[REITs]Q3 hedge fund letters, conference, scoops etc

The full interview with National Economic Council Director Larry Kudlow

WILFRED FROST: Welcome back to the “Closing Bell.” The market selloff accelerated on the news the White House canceled a trade meeting with China this week. In a first on CNBC interview, we’re joined by National Economic Council Director Larry Kudlow. Larry, great to see you. Thank you for joining us.

LARRY KUDLOW: Thank you, Wilfred. Appreciate it.

WILFRED FROST: So let’s start with that market moving story, Larry. Our own colleague Kayla Tausche reporting a couple of hours ago that the U.S. canceled an offer from the Chinese to meet with two of their trade party, because there’s not been enough progress. Is that true? And what was the factor behind the cancelation of the meeting?

LARRY KUDLOW: With respect, the story is not true. Right at the top, Wilfred, the story is not true. There was never a meeting —

WILFRED FROST: There was never a planned meeting that was canceled? Or there just wasn’t a cancelation and there’s still a meeting that will take a place?

LARRY KUDLOW: That is correct. There was never a planned meeting. Look, the big meeting, that everyone’s you know, moving towards, will be Vice Premier Liu He. He’s coming at the end of the month, as I think everybody knows. That will be a very important meeting, that will be a principle’s meeting and everyone was looking towards that. There were no other intermediate meetings scheduled. Look, we are in constant communication with the Chinese officials. Okay? That’s part of our negotiations. I don’t know where people got this idea. I’m here to deny it. You know, let’s have more reporting. Fewer novels, please. Okay? The story is unchanged. We are moving towards negotiations. These will be, as I’ve said before, the broadest and deepest scope of negotiations with China in history. Okay? And President Trump as you know has pressed the case hard. Alright? We have got unfair trading practices. We have got IP theft issues. We have got structural technology issues. Ownership issues as well as tariff and nontariff barrier type issues. President Trump has pressed this case and is working with President Xi. There is good chemistry between them. I saw it in Argentina and so forth and so on. The meetings held in Beijing at the deputy’s level covered all the ground, absolutely all the ground. And as I said, also, Vice Premier Liu He is coming here with his top deputies and we will engage. That’s the story. There’s no cancelations. None. Zero. Let me just try to put it to rest.

WILFRED FROST: Okay. Larry, well, listen. We hear that loud and clear. The issue of IP, you mentioned it yourself and forced technology transfer, it’s often seen as the most tricky issue and difficult issue to get sorted. Has there much progress there or is that still a long way off?

LARR KUDLOW: Well, look. There is a fulsome discussion, Wilfred. That’s the key point. Put on the table, as I have said, the scope of the things is deeper and broader than anything we have had before. So the discussion is there. The discussion points are there. I acknowledge the degree of difficulty. But it is a crucial point. For the United States side. Look, President Trump has said, he’s been rather optimistic about the China trade talks, but they have to be in America’s interests. And in order to achieve that goal, we have got to deal with these vexing problems of IP theft and the forced transfer of technology. The lack of American ownership of its own companies in China, cyber interference with various corporations along with various tariff and nontariff barriers. So, we are looking at this in great detail, Wilfred. And as I said, this is the — you know, the deepest we have ever gone I’m not here to predict. That’s up to President Trump and what he can accept and not accept. I’m just saying it’s all on the table and we will see how it comes out, particularly the meetings at the end of the month, which I think are going to be very, very important myself. I think that’s going to be determinative of the future and what progress we make.

MORGAN BRENNAN: Larry, this is Morgan. Investors are certainly listening to what you have to say right now. We’ve got the Dow –

LARRY KUDLOW: Morgan?

MORGAN BRENNAN: Yep. Go ahead.

LARRY KUDLOW: Morgan, let me — I don’t mean to — there’s a little bit of a lag here. I want to add one more very important point regarding these talks. Enforcement is absolutely crucial to the success of these talks. Enforcement. Ambassador Bob Lighthizer, our lead trade negotiator, also Secretary of the Treasury Steven Mnuchin said this a million times, I’ve said it: enforcement. Promises are great, but enforcement is what we want. Things like deadlines and timetables and full coverage of the various structural issues we have just discussed. So please put that in your quiver of issues. Enforcement is going to be vital. Will it be solved at the end of the month? I don’t know. I wouldn’t dare predict. But I just want to make sure people understand how important that is to put it on the table.

MORGAN BRENNAN: I’m glad you brought up enforcement, Larry, because that has been such a key issue not just for this administration in your talks with China but in previous administrations, as well, that have tried to handle the issues and really arguably failed. How do you enforce? What is the methodology? And how would you like to see that played out in a trade deal?

LARRY KUDLOW: Well, I’m not going to get into details. You know, these are very complex issues. They’re also historical issues, as you suggest. So let me stay away from the details. But, you know, I’m an ex-Ronald Reagan guy. I was here in the Reagan administration many, many years ago. He coined a phrase “Trust but verify.” I’m sure you’ve heard of it. That’s going to apply in the China trade talks. And I’ll leave it up to Mr. Lighthizer and his team and others to walk through the details of this. But enforcement has to be worked out. And again, I think part of that story is going to be deadlines, right, that’s very important. And nothing is open ended forever so we’ll wait and see. It is not my job to negotiate here or elsewhere for that matter, but to put it on the table how important it is to us. It has to be — end of the day, every time I talk to the President it has to be in America’s interests. It has to be in the interest of American workers and farmers and ranchers and small business people and our entire economy. Unfair trading practices have to come to an end. Reciprocity has to take over. These are difficult issues but they can be solved and they must be solved to have a good trade deal.

WILFRED FROST: And, Larry, are you and the president feeling a little less lenient towards China given the rally we have seen in equity markets since Christmas Eve? Does that give you more cover to push harder on those key tricky issues that you have just mentioned?

LARRY KUDLOW: Oh, I don’t like that phrase, Wilfred. You’re my buddy but I don’t like that phrase: “less lenient.” I don’t know what that means. These are crucially important issues for our economy I presume for the Chinese economy, also, listen, let me say this. These are pro-growth issues. You know, one thing I want to kind of get in here, two years at the two-year mark of the Trump administration, our economy is growing at a 3% plus rate. We just had new news, industrial production, business equipment spending and so forth last Friday. Retail sales strong. Holiday spending strong. We can go through as much as of that as you want. But my point is this: we argued that lower tax rates, we argued that rolling back onerous regulations, we argued that opening up the energy sector, we argued a number of these reforms are pro-growth and would generate much faster economic activity than we have seen in, I don’t know how many years. Maybe a couple of decades to be honest with you. Excluding the first quarter 2017, which is President Obama’s last quarter, we’re basically grown at 3% plus at an annual rate for 7 quarters. And I’m proud of that achievement. And along the way, we have had record increases in blue collar employment and blue collar by the way — their wages are rising faster than the white collars. Not higher but faster. I think that’s very important. The unemployment rate is way down. All of the different demographic groups showing the lowest unemployment in many years. We are proud of that. And in my judgment, although we will have a glitch with respect to the temporary shutdown, the economy is very strong. The private sector is very strong. And I know there’s a lot of pessimism out there. I do not share that pessimism.

MORGAN BRENNAN: Larry, let’s talk about the shutdown for a minute. The partial shutdown. We are really in unchartered territory with this going on for a month now. Steve Liesman last week reported that the administration had doubled its estimate of the economic impact, looking at contractors and sort of the ripple effects. How are you thinking about that as this continues on in record territory right now? Could that economic impact get worse?

LARRY KUDLOW: Well, look. All I’ll say is this. It’s a shutdown issue. It’s a temporary issue. Okay? And whatever we may lose, whatever we may lose in the first quarter — and by the way, the first quarter’s always a problem because of bad seasonals, but putting that aside — I acknowledge, I acknowledge that we’ll lose some in the accounting of gross domestic product. Okay. I do not acknowledge that the fundamental economy will be adversely affected, at all. This is temporary stuff and when the shutdown comes to an end and the negotiations are satisfactorily completed for the administration and others, we will get it all back. My own view, some may disagree but I’m strong on this, we will see a snapback right away. We’ve been through this before, I acknowledge it’s longer than it’s been sometimes in the past. I lived through these in the Reagan years, it also happened in the ’90s. There will be virtually an immediate snapback. That is my judgment, Morgan.

WILFRED FROST: Larry, whatever the cause of the change in tone was, is the president pleased to see the Fed softening up its stance and rhetoric toward rate hikes in the year ahead?

LARRY KUDLOW: Well, I think there’s a coming together here where the latest Fed statements regarding “patience,” I like that word, “patience,” I don’t want to have to define it too closely the Fed is an independent agency. We are not trying to break any walls down. The president had his point of view. A lot of people, myself included, think the president’s point of view was absolutely correct. What you’ve got here again from low tax rates and a big regulatory rollback, you have got a supply side growth going on in the economy. We are producing more goods and services, factories and manufacturing and so forth. That is not inflationary. More people working is not inflationary. Producing more business investment and increasing our nation’s capital stock, ay probably the best rates in 20 years, couldn’t possibly be inflationary. So, therefore, the president has point of view that there is no inflation but strong growth. I think is correct. That’s just my personal opinion. Now, again, the Fed is independent. I understand that. Nobody’s breaking the walls down. That’s never been the purpose. But it sounds to me like the Federal Reserve has come around, more closely to that view and I want to commend in particular not only the Fed Chairman Jay Powell but also Fed Vice Chairman Richard Clarida. Mr. Clarida has given some illuminating speeches on this subject. More people working, more factories being built, better trade deals to protect Americans such as the U.S.M.C.A. – that is not inflationary and actually, the data points show the inflation rate if anything is coming down lower in the last, what four, six, seven quarters. So the Fed is the Fed. We’ll see where they go. I like the word patience.

WILFRED FROST: Larry, great to see you. Thank you very much for joining us.

LARRY KUDLOW: Thank you. Appreciate it very much.

WILFRED FROST: Larry Kudlow there. We should mention the market did bounce off the comment from Larry that there have been no cancelation of trade talks with China, making the point there was never a physical meeting scheduled for this week that was – ever existed to be canceled. The Dow down 386 points at the moment. We had a jump – a little bit pullbacks. But the difference is down 1.5% or so — off the session lows.