Livermore Partners letter to investors for the third quarter ended September 30, 2019.

End of cycle seems inevitable – Livermore pulls back in Q3 but remains up 65% percent thru 2019.

Q3 2019 hedge fund letters, conferences and more

To Partners:

Third Quarter proved difficult for us given the challenging macroeconomic landscape and our extremely strong performance thru Q2. Still, we remain on track to have our best year since 2016. We lost 7% percent in the quarter as energy, gold, and industrials all took it on the chin. Yet, through Q3, and even with the pullback, Livermore Strategic Opportunities, LP has returned 65.53% in 2019. Our event-driven catalyst approach continues to outperform, and I feel as a fund, we are hitting our sweet spot.

As far as the economy goes, there seems to be two economies at play. One is the consumer, which is vibrant and has purchasing power given the strong jobs market and lower leverage of their personal balance sheets. Then there is the trade war, causing many corporations to hold off on new purchases and thus, business inventories are building. This is affecting industrials the most but there are signs of potential deep value forming. Which will allow Livermore Partners to profit from select beaten down equities to invest in.

Overall, we are well-positioned to take advantage of opportunistic value situations on stocks that become oversold, overlooked, or just un-loved. This is especially true in the new paradigm of decreased research by investment banks and lack of support from larger institutions. This dichotomy allows for the sharp-eyed stock picker to find compelling situations which tend to be forgotten or left for dead. Something we have historically done well. Great examples have been Glencore, Entertainment One, and many others. Which have doubled over the years.

In the Quarter, markets witnessed a further rise in gold and gold miners followed by a sudden sell-off. We used this opportunity to de-risk our book by selling down gold holdings to lock in profits. We have almost doubled our investment in many of our companies in just the past 12-months… Mainly, Torex Gold (TXG), Detour Gold (DGC), and Highland Gold (HGM). Our Activist position in Detour Gold (along with financier John Paulson) worked extremely well from our entry of near $11.00 CAD just last Fall. Today, Detour is over $20 CAD a share and Livermore paired the position down to reflect gains and alpha generation.

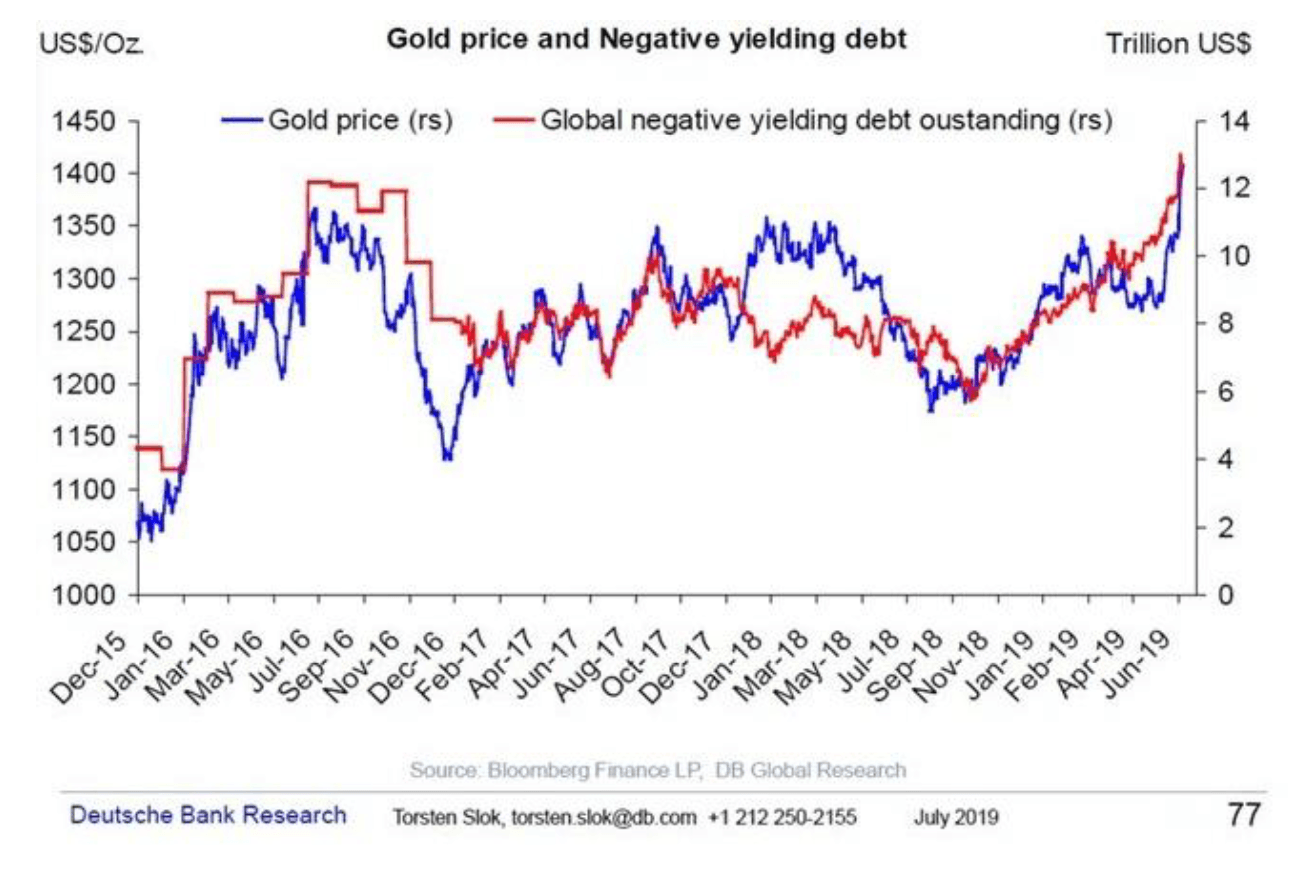

We do remain bullish on gold and view it as a currency trade. Global deficits around the world are expanding at an alarming pace and debt as a percentage of GDP is inflating like a beach ball. Even in “high growth” countries such as China, where 6% GDP growth now seems a stretch. What’s more troubling, negative yielding debt is at a high and as that factors into gold, you will see how tightly correlated gold tracks. As per the diagram listed below.

Given this phenomenon, and as we expect this path to continue for some time to come, we will hold a high allocation of gold in the portfolio.

On individual and select portfolio holdings, we had mixed performance. As described, the Quarter was impacted by pullbacks in many of our best performing stocks. Which are London-listed Jadestone Energy (JSE.LN), Burberry (BRBY.LN), Banc of California (BANC) and Gold (GLD) and gold miners. We offset some of the weakness by aggressively selling short companies where we feel the valuation and business model doesn’t equate anything close to its true intrinsic value.

Livermore has been short shares of Tesla (TSLA), Shopify (SHOP), Germany payments processor Wirecard (WDI.DE), Investment bank Goldman Sachs (GS) as well as SaaS player MongoDB (MDB) and high-flyer, Roku (ROKU). Wirecard has been our second largest short position given the ‘smoke” of accounting irregularities that have plagued the company for years. The stock had rebounded with a large investment from SoftBank and we used it as our entry to short the stock in Q2. We added further into Q3 with more evidence of a global slowdown and further questions emerged into their finances. The Financial Times has written extensively on the subject and we saw the potential of strong downside to the shares given its opaque and aggressive accounting. Which is derived from several business units booking questionable revenues.

Wirecard

We profited from Wirecard and all shorts during the Quarter with exception of TSLA. Which actually rebounded to the mid 200’s from it’s low in May of 2019. If you recall, we closed out our short position in Tesla in May at 190 (locking in a 40% percent gain) but re-initiated in Q3 as it rallied from its oversold condition in Q2. We are sticking to our thesis that Tesla is in a “distorted reality” (*see footnote) and eventually, the rubber will hit the road.

*Distorted Reality-Psychologists use the term “cognitive distortions” to describe irrational, inflated thoughts or beliefs that distort a person's perception of reality. (i.e. Tesla is a profitable self-sustaining enterprise with GAAP profitability).

On other matters of the fund, we continue to look to grow our asset base and implement new and exciting event-drive and value focused investments. Our performance reflects our nimbleness and focus. To help strengthen the team, we recently added to our Advisory Board in David Gould. David comes to us from LetterOne Holdings. He has an outstanding business acumen that will be extremely useful as we identify and look to invest in global corporations. His history of helping manage an extremely successful $20 Billion enterprise with businesses ranging from Energy to Finance is perfect for Livermore and how we uncover unique situations. I want to welcome David. We will continue to add strong-minded individuals as we grow.

On the public relations front, Livermore continues to make a name for itself in the financial world. Here is a link to a recent BNN Bloomberg interview we gave in the Quarter. Centering on the current landscape and how we are positioned.

Overall, we feel 2019 has been very successful for the fund. Our goals are to position ourselves for higher volatility and select special situations. We have yet to run an activist campaign in 2019 and yet, we are starting to witness opportunities to deploy our skillset to unlock value. I hope to discuss in more detail in 2020 as we raise fresh capital and implement new positions. But for now, we are focused on ending the year strong. It is imperative not to get caught up in short term performance and structure the portfolio with a balanced approach. We are defensive today and yet have faith the portfolio’s value-based investments have strong upside.

Our investors are the bloodlines of our business. So I am very thankful for all the support and will continue to work as hard as possible to reward patient capital. We have done very well in a relatively short span but there is always more we can do. Therefore, I will never lose sight.

Sincerely Yours,

David Neuhauser

Founder/Managing Director

Livermore Partners

www.livermorepartners.com