Alluvial Capital Management commentary for the third quarter ended September 30, 2019.

Dear Partners,

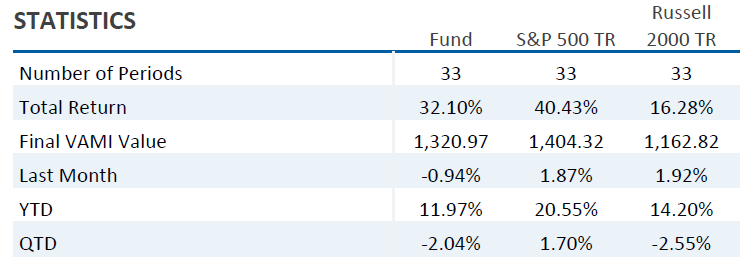

For the quarter ended September 30, Alluvial Fund, LP declined 2.0%, modestly better than the Russell 2000 Index. Year-to-date, the fund remains slightly behind the index. Since inception, the fund has roundly out-paced small-cap and micro-cap indexes but remains behind large-cap stocks.

Q3 2019 hedge fund letters, conferences and more

Alluvial Fund remains focused on identifying opportunities in the overlooked corners of the market where larger funds cannot or will not invest. Our holdings are drawn from the ranks of the illiquid and the little-known and offer exceptional value versus large, liquid stocks. I am equally happy to buy into a liquidation or reorganization scenario as I am an undiscovered growth story. Value takes many forms. No matter the scenario, I continue to express a strong preference for companies with strong balance sheets, healthy margins, durable demand for their products and services, and sensible, well-incentivized management.

With the majority of 2019 in the books, I would call this a moderately frustrating year. The fund’s successes have outnumbered the disappointments, but the market’s attitude toward our average holding has been one of disinterest. To be clear, I expect the market to ignore many developments at our tiny, thinly-traded securities in the short run. Instances where market perception lags economic reality routinely create opportunities for the fund. However, the present market seems particularly uninterested in value creation occurring anywhere besides a short list of high-profile, on-trend companies. There is an expression we use in Pittsburgh and which I imagine is common in many other places: “If you don’t like the weather, just wait a minute.” The same applies to markets. Sooner or later, the market will discover the merits of the assets, cash flows, and growth opportunities our holdings possess.

Syncora Holdings

It finally happened. After spending years undergoing a complex restructuring and rehabilitation, Syncora Holdings announced the sale of its insurance subsidiary. This long-anticipated outcome was central to my thesis for holding shares. Unfortunately, the price Syncora achieved was disappointing. I suspect the company accepted a less lucrative offer over alternatives that could have resulted in a higher price, but over a longer time period or with less regulatory certainty. Even after the acquirer, Goldentree Asset Management, raised its bid in September, the resulting deal value was still a bitter pill for many long-term shareholders. Unfortunately, the structure of the deal does not require a shareholder vote.

Despite the stumble at the finish line, the fund’s investment in Syncora Holdings was an extremely successful one. In a little over two years, Syncora returned greater than 50% with minimal exposure to market risk. My only regret is not buying more, sooner. Syncora is an excellent example of the type of special situation that can arise in complicated, stigmatized securities. Having sold nearly all our Syncora shares, I am working on redeploying that capital into other compelling ideas.

Rural Telecoms

As has become de rigeur in these quarterly updates, I’ll provide an update on the market’s most boring stocks: the rural telecom complex. Our holdings, the largest of which are Nuvera Communications and LICT Corporation, continue to generate huge cash flows and invest these cash flows in next-generation fiber optic networks. They reward shareholders directly with dividends and share repurchases, and indirectly via deleveraging. Both companies participated in the recent FCC spectrum auction, purchasing high frequency bandwidth for future 5G applications.

Shares of Nuvera are hovering around $20. The company’s 2019 cash earnings will be $2.80 or so, measured as GAAP profit plus non-cash intangibles amortization. Net of excess cash, the company’s normalized price-to-cash-earnings ratio is under 7x. I believe a fair value for this defensive, well-capitalized, fiber-rich telecom is at least 12x normalized cash earnings, which would value shares at more than $32. I never know when exactly a company’s shares will converge with fair value, but I am thrilled to hold this highquality company at a double-digit earnings and free cash flow yield.

Shares of LICT Corporation had a great summer, rising to nearly $20,000 before retreating slightly. LICT continues to enjoy the fruits of its aggressive investment in fiber over the last several years with non-regulated broadband revenue growing nicely. The company is also a major beneficiary of the FCC’s A-CAM program. After years of debt reduction, LICT now has net cash on its balance sheet—highly unusual for a telecom! The tremendous strength of LICT’s balance sheet provides the company with optionality. LICT can accelerate its share buyback program, consider a large special dividend, or perform a sizable acquisition. My preference would be for an acquisition, but we will have to wait and see what Mario Gabelli and Co. have in store for us. LICT’s normalized annual free cash flow per share is approaching $1,500. With net cash on the balance sheet and a premier network, LICT shares are an excellent buy anywhere below $25,000. This valuation will increase as time goes on and LICT’s fiber investments mature, or if the company performs an accretive acquisition.

Alluvial Fund also holds smaller positions in Alaska Power & Telephone and North State Telecommunications. Alaska Power & Telephone jumped recently after a mention in Barron’s, but remains far, far undervalued. North State Telecom is a fiber-optic provider in North Carolina’s Research Triangle. After a few lean years, the company’s investment in its network is paying off and cash flows are inflecting higher.

Alluvial Fund’s rural telecom investments make up 18% of our portfolio. These are not the type of holding that will double overnight. It can be frustrating to hold companies like these when the market soars, watching them plod along as Keynes’ “animal spirits” excite the flashier companies and sectors. However, I am highly confident our investments in these steady companies will yield annualized returns of 15-20% for years to come.

P10 Holdings

P10 Holdings is a relative newcomer to the Alluvial Fund portfolio and one of the most interesting and potentially lucrative opportunities I have come across in some time. P10 Holdings is a textbook example of GAAP accounting conventions obscuring underlying profitability. Combine that with illiquidity and non-SEC reporting status and you have a deeply discounted stock.

P10’s history is convoluted. The enterprise was formed from the bankruptcy of Active Power, Inc. In 2017, the company was recapitalized by a team of investors in Texas, and the company’s substantial net operating losses were preserved. P10 industries then bought an interest in a Chicago-based private equity group, RCP Advisors. RCP was founded in 2001 and has attracted nearly $8 billion in capital commitments over its history. P10 purchased the rights to the management fees generated by RCP’s managed funds, with the rights to performance-based fees generated by the funds being retained by the sellers. P10 financed the transaction by issuing 49% of P10 stock to RCP’s owners (again carefully avoiding an “ownership change” for the purpose of preserving NOLs) and issuing zero-interest seller’s notes for the remainder. As cash flows allow, P10 has been replacing the seller’s notes with term loans.

Today, P10 Holdings owns a highly predictable revenue stream that will only grow as RCP launches new funds and grows its assets under management. The asset management business requires practically zero reinvestment, allowing P10 to invest the cash it receives in co-investments with RCP or other opportunities. Because of the way the deal was structured, P10 recorded a large intangible assets balance related to its purchase of RCP: $53 million for management fund contracts, $17 million for tradenames, and $6 million for technology. These $76 million in intangible assets will be fully amortized over the next several years, but the economic value of RCP will not diminish as long as the firm is successful in attracting additional capital for new funds. P10’s free cash flow production will far exceed its reported profits for the years to come.

In 2018, P10 Holdings took in $16 million in operating cash flow following its purchase of RCP. Through June of this year the company has collected another $9 million. Capital expenditure needs are minimal. The company is allowing cash to build on its balance sheet to fund future acquisitions or co-investments. Fundraising efforts have been productive. Revenues associated with legacy funds will naturally decline as these vehicles liquidate, but RCP has already closed on $280 million in new capital commitments year-to-date.

P10 Holdings is capable of producing 18 cents per share in free cash flow this year, and more in future years as RCP’s assets under management grow. The company will not be a cash taxpayer for many years, with over $260 million in federal net operating loss carryforwards and $59 million in intangible assets still to be amortized. At around $1.25, P10 trades at just 7x free cash flow. Shares of P10 have been volatile and may continue to be. After peaking around $1.50 this summer, a few small sellers managed to knock shares down to as low as $1.06 earlier this month. I am happy to say Alluvial Fund was able to take advantage of the sale!

Meritage Hospitality

Of all Alluvial’s holdings, the one that seems to attract the most questioning and brow-furrowing is Meritage Hospitality. “Why do you like it? What’s the attraction? Can this really be a decent business?” Critics of the company fixate on its financial leverage and its perceived exposure to consumer spending and confidence. I do understand the skepticism. Meritage shares have not traded well over the last two years. But I believe critics are missing the larger picture. Meritage’s business model is simple, profitable, repeatable, and scalable. The recipe that allowed shares to rise tenfold from 2011 to 2018 remains intact.

In order to assess Meritage’s business model, we have to look at its most fundamental equation. Meritage acquires tired old Wendy’s restaurants in second and third tier markets (pictured at right as “Classic” Wendy’s) and spruces them up (“Modern” Wendy’s).

Or, it simply builds a new restaurant. The economics are compelling! Per the company, a newly built Wendy’s at current brand standards costs a shade over $2.4 million. That includes the land, building, and fixtures. Once this restaurant is up and running, it will produce cash flow of around $300,000, a 12.5% cash yield on