Emerging Value Capital Management letter to investors for the third quarter ended September 30, 2019.

Dear Partners and Shareholders,

EVCM Fund net returns to investors are shown in the following table.

Q3 2019 hedge fund letters, conferences and more

"Be fearful when others are greedy and greedy when others are fearful" -- Warren Buffett

Q3-2019 Overview:

Q3 was a flattish quarter for us. Investor remain concerned about escalating tariffs between the US and China and a slowing global economy. Trying to forecast and react to short term economic swings is not a reliable path to strong returns. Rather, we seek to invest for the long term in some of the best businesses in the world when they trade for materially less than they are worth.

In the short run our portfolio is not immune to an economic slowdown and subsequent stock market decline. However, we think an economic slowdown would actually enhance our long term returns since most of our portfolio companies, leaders in their respective niches, would use the slowdown to capture market share and increase their economic moat.

During the quarter we:

- Re-invested in Aimia as the company trades for 60% of NAV, is looking to make an acquisition and has a group of activist investors working to upgrade its board and management team.

- Trimmed our positions in Alibaba, Facebook, JD.com and Alphabet as all four stocks traded higher.

- Added Wells Fargo and reduced Bank of America in our basket of large cap financials.

- Increased our investments in Interactive Brokers and in Holmes Place Israel.

- Closed our short positions in Tesla and USO ETF.

Our top ten longs and shorts at quarter end are listed in the following table:

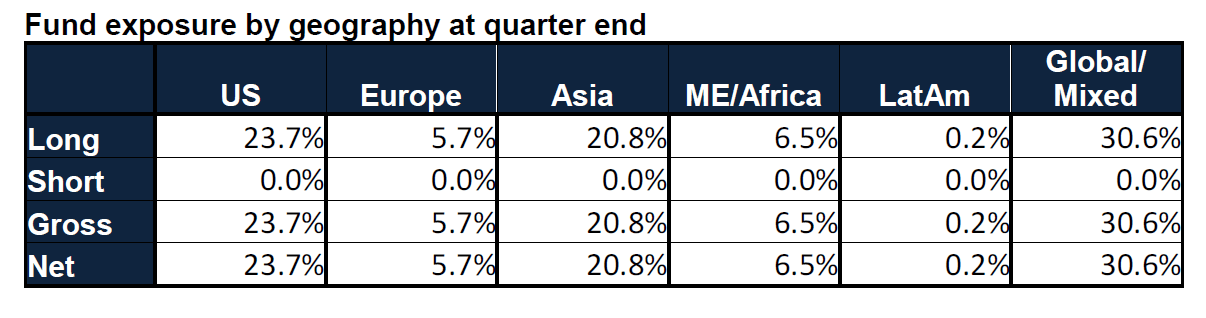

Below, we will go into greater detail on some of these positions. As of quarter-end, we were 87.6% long and 0% short. Our overall net exposure level of 87.6% reflects the compelling investments we are finding in global stock markets.

Brief discussion of some of our investment positions:

Holmes Place Israel

Holmes Place owns Israel’s largest and best known chain of gyms, fitness and wellness centers. They currently have 42 locations across all of Israel with 133,000 active members that pay a monthly membership fee ranging from around 0 ILS to 300 ILS per month. Consumer surveys in Israel show that Holmes Place is the best known and most recognized gym brand in the country with second place “Studio C” far behind.

The Israeli fitness market is extremely fragmented with gyms, fitness centers, studios and country clubs across Israel generating annual industry wide revenues of almost B ILS and growing at 6% to 8% annually. The top operators in Israel combined have only about 7% market share with “mom and pop” single locations comprising the remaining 93% of the market. We therefore expect continued industry consolidation (already underway) for the foreseeable future.

Brand recognition, access to capital, proven gym formats, global know-how and economies of scale position Holmes Place to be the leading consolidator of this growing industry. We project 12% annual revenue growth and 15% annual EBITDA growth for at least the next decade. Combined with EBITDA multiple expansion from 7 to 10, the stock could potentially generate a 20% IRR over the next decade.

Basket of Korean Preference Shares

We invested in a basket of 15 carefully selected Korean Preference shares. The current average price discount in our basket between our Preference shares and their respective common shares is above 50%. We know of no other case in financial markets where very similar pairs of securities trade at such a huge price discount/premium to each other.

Geopolitical events including tensions with North Korea and China have kept South Korean stocks cheap. We think investors have been slow to appreciate the market reforms that have taken place in Korea over the past few years. Continued economic growth, technological innovation, rising dividend yields and additional government reforms are bullish for Korean stocks in general and for our basket of exceptionally cheap Korean Preference shares in particular.

In 2015, the management of Samsung Electronics, confirmed our investment thesis by stating they consider any price discount above 10% to be a buying opportunity for Korean Preference shares. Making reasonable assumptions for stock market appreciation, dividend yields and a narrowing of the price discount between common and Preference shares shows our basket has the potential for over 100% upside to our estimate of fair value.

Interactive Brokers

Interactive Brokers offers the world’s lowest cost and most technologically advanced securities brokerage services. It is consistently ranked as the best broker by various investing publications. By relentlessly focusing on automation of back office tasks and expanding into ever more markets, the company has created a significant cost and coverage advantage over competing brokerages. Over the next decade, IBKR can disrupt the traditional brokerage industry and capture a large market share. We think Chairman Thomas Peterffy is an exceptionally good manager and his incentives are aligned with long term shareholders.

Advantages for customers switching to Interactive Brokers include a lower cost of trading, access to many foreign stock markets, a low cost of borrowing funds, receiving interest on cash balances, an order book that does not get sold to high frequency traders and receiving payment for lending out shares. We think these advantages are compelling and are particularly excited to note that IBKR is the only noninstitutional US broker to support trading in Israel.

IBKR’s stock declined recently as several US based brokers started offering zero commission trades to retail customers. Those brokers will still earn money from selling customer order flow and from other fees such as high interest rates on margin loans. We expect little impact from these moves on IBKR since it caters to a more financially sophisticated and more active customer base that appreciated the many advantages offered by IBKR. Currently trading for 18 times 2019 earnings with the potential to continue disrupting the brokerage industry and grow profits 15% - 20% annually for the foreseeable future, we think IBKR is a bargain.

Concluding Remarks:

Having just completed a full review of our portfolio, we feel confident that we own an exceptional collection of businesses from around the world trading for well below their economic values. With few exceptions, the companies we own continue to grow their businesses, widen their moats and increase their intrinsic values which speaks to our expected future returns.

Thank you, our investors and shareholders, for your continued trust and support of EVCM fund. I continue to work tirelessly to protect and grow our capital. Please don’t hesitate to call with any questions, thoughts or comments.

Sincerely Yours,

Ori Eyal,

Managing Partner