Horos Asset Management letter to investors for the first quarter ended March 31, 2019.

Dear co-investor,

We ended an important quarter of recovery in the markets, after the strong correction at the end of 2018. In this (almost) year of life of Horos, our co-investors, despite the high volatility of the markets, have continued to trust our work, increasing their number month after month. Our thanks to the more than 2,100 co-investors who make this project possible.

Q1 hedge fund letters, conference, scoops etc

After a series of quarterly newsletters that we could define as “general” in nature, this quarter we would like to talk in detail about one of our main investments: AerCap Holdings N.V. (NYSE:AER). We were pleased to present this investment idea recently at the Value Spain investor event. We thought it would be an useful exercise to put the general ideas into this letter so that you can understand our analytical work even better.

As always, we thank you for your confidence and remind you that we are available whenever you may wish to contact us. We will be happy to help.

Yours sincerely,

Javier Ruiz, CFA

CIO

Horos Asset Management

The Revenge Of The Irish

Waves will rise on silent water - Irish Proverb

AerCap Holdings's history is the history of the aircraft leasing industry. For this reason, it is worth briefly reviewing the main milestones reached in this sector over the last fifty years. Aircraft leasing was “invented” in the 1970s by the International Lease Finance Corporation (ILFC) in the United States and by Guinness Peat Aviation (GPA) in Ireland. Both companies became outstanding leaders in the industry and maintained their position for decades. However, under the direction of CEO Tony Ryan, GPA pursued a policy of uncontrolled growth in order to become the largest lessor in the world, without regard for the financial and management risks taken to achieve it. While ILFC focused on larger, highly solvent customers, GPA accepted customers from all over the world, including airlines in Africa and South America. For a while everything seemed to go smoothly. However, in the financial sector, when you take on financial and investment risks, you end up paying the consequences. GPA was no exception to this rule.

In the 1990s, after the resounding failure of its IPO and as the global economy entered a recessionary period, GPA collapsed as a business. Many of its customers stopped paying their lease and banks stopped financing the company. Without access to credit, GPA began cancelling orders for new aircraft and the crisis grew bigger and bigger. Finally, the company restructured the business and was forced to sell part of its fleet to GECAS, the aircraft leasing division of General Electric, thus becoming a much smaller business. After changing its name and shareholding several times, what remained of GPA was bought in 2005 by the private equity manager Cerberus and, with that, became AerCap Holdings.

And what happened to ILFC during those years? As GPA suffered the consequences of its terrible management in the 1990s, ILFC established itself as the undisputed leader in the industry and was bought by insurance giant AIG. However, like its parent company, ILFC assumed significant financial risks during the credit bubble era of the 2000s. AIG was rescued by the U.S. government in 2008 and ILFC, years later, by AIG itself. Finally, after years of trying to float ILFC to get liquidity and after an unsuccessful sale to a Chinese group, ILFC was acquired in 2014, in a stroke of fate, by AerCap Holdings. So, in the end, the Irish “won” the game and, more surprisingly, AerCap Holdings was formed with the merger of the two inventors of the aircraft leasing business.

Understanding the business

You do need a big platform. It is not a case of just showing up with capital. You have to be able to move assets around the world - Aengus Kelly, CEO AerCap Holdings

AerCap Holdings's business is relatively simple to understand, which does not mean that it is easy to run, as we have learned from our review of this industry’s history. Without going too deep, AerCap Holdings borrows money from Capital Markets, as well as from financial institutions, and uses that money to buy aircraft from major manufacturers (Boeing, Airbus or Embraer) or sometimes from the airlines themselves through sale-and-leaseback operations. AerCap Holdings then leases the aircraft to the airlines, usually for periods of 10 to 12 years, and then tries to either re-lease the aircraft (they have a useful life of 25 years) or sell them on the secondary market.

Airlines obviously find leasing very attractive because it gives them greater flexibility in managing their fleet and greatly reduces their balance sheet risk (risk of the aircraft's future value, for example). As a result, the market share of aircraft lessors continues to grow, concentrating around 40% of the global aircraft fleet in the hands of these players.

These good prospects of the industry have meant that the market has not stopped gaining new players and has fragmented enormously in recent years. Of the more than 150 companies in the sector, only nine have a fleet of aircraft worth more than ten billion dollars. With an estimated value of more than thirty-five billion dollars1 AerCap Holdings is, in terms of fleet value, the largest company. Far larger than other major players such as GECAS and Avolon.

AerCap Holdings's fleet consists of over 1,400 aircraft, if we include the orders it has in its portfolio for the coming years. In this industry it is very important to actively manage the fleet, holding aircraft that are in high demand by airlines. For this reason, AerCap Holdings concentrates its orders on the most fuel-efficient, new technology aircraft. In particular, the bulk of orders are for Airbus' A320neo and Boeing's 737 MAX. The latter model is unfortunately on everyone's lips following two fatal accidents - one in Ethiopia (Ethiopian Airlines) and the other in Indonesia (Lion Air).

As a result of these accidents the aircraft is banned by the airport authorities until Boeing demonstrates its safety. It is still too early to know what impact this will have on the industry and, in particular, on AerCap Holdings. However, it is important to note that AerCap Holdings has practically signed leases for 100% of the aircraft orders it has placed until 2020 and, from the moment the lease is signed, the airline must pay for it, regardless of whether or not the plane flies. On the other hand, as it does not yet have to face the outstanding payments for these orders, the potential positive aspect of the delay in aircraft deliveries would be the liberation of some of AerCap Holdings’s financial resources that it could use to increase its already generous share buyback.

Additionally, the bulk of AerCap Holdings's orders are narrow-body aircraft, as they are more liquid (easier to buy and sell) than wide-body aircraft. This is because, on re-lease to another airline, wide body aircraft need more significant reconfiguration taking up to six months to complete, in contrast to narrow-body aircraft that require about two months for reconfiguration. In addition, narrow-body aircraft provide airlines with greater route flexibility, which is why their fleets as a whole have more narrow-body aircraft.

Finally, it is important to note that the weighted average life of the leases signed by AerCap Holdings is seven and a half years, one of the highest in the industry, which gives AerCap Holdings a great visibility of results.

What we like

We’re reinvesting the revenue from these aircraft sales at a premium over their book value in order to fund a significant amount of share buybacks at a discount - Aengus Kelly, CEO AerCap Holdings

Once we've explained how AerCap Holdings's business generally works, we're going to go over the four aspects of this investment that we like the most. In particular, we are attracted by the structural growth of air traffic, the company's global platform, the economies of scale of the business and, last but not least, the excellent capital allocation by its management team.

1. Structural growth in air traffic

Global air traffic has grown steadily in recent decades, doubling every fifteen years or so. That this growth has taken place despite the fact that we have suffered several crises, wars, attacks and epidemics, shows its resilience. In fact, growth is expected to continue at rates of 3.5% per year for the next twenty years2. What factors will contribute to this future growth? On the one hand, the propensity to travel3 remains several times lower in countries such as China (0.4) and India (0.1), if compared with countries such as the United States (2.6) or the Eurozone (1.5). We should therefore expect some convergence over time as China and India continue their economic development and their middle class continues to grow.

On the other hand, airlines have managed to improve the productivity of their fleets to historically high levels in recent years, greatly increasing the number of seats and flight hours of each aircraft. From these levels, it seems difficult for productivity to continue to increase, and so, in the future, we should expect a greater correlation between the growth in air traffic and the demand for aircraft by airlines.

2. An unparalleled global platform

AerCap Holdings has the largest platform in the industry, with some two hundred customers and a presence in approximately eighty countries. The large size of the platform gives AerCap Holdings a virtually unrivalled information advantage in the industry. It should be noted that AerCap Holdings signs a lease every day and sells or buys an aircraft every two days. You could say that AerCap Holdings knows all the transactions that take place in the industry.

However, it is not only the size of the platform that gives AerCap Holdings an information advantage. This platform, perfectly greased, enables AerCap Holdings to have an enormous execution speed in its transactions, which means that the company is able to recover planes from customers in trouble and reallocate them to other customers at a rate that the rest of the players in the sector find difficult to match.

3. Significant economies of scale

Due to its size, AerCap Holdings is one of the most important customers for major aircraft manufacturers. For this reason, Airbus or Boeing are happy to grant AerCap Holdings significant discounts on aircraft purchase prices. The fact that AerCap Holdings is the largest lessor for the Airbus A320neo and the Boeing 787 family reflects its importance to these companies.

Additionally, the scale allows AerCap Holdings to access the Capital Markets to seek financing which is vital in this industry. Until a few years ago, leasing companies relied heavily on bank financing to manage their business. When the economic cycle reversed banks stopped lending money and many industry players struggled to refinance their debt and even ended up going bankrupt. With this access to the Capital Markets, AerCap Holdings, like other large companies, gets a more stable alternative source of financing. In addition, AerCap Holdings is one of the few companies in the sector that has achieved an investment grade credit rating, which gives the company even more flexibility, as it is a larger and deeper market than the high yield market.

4. Allocating capital

As we have reiterated on countless occasions, a company's management team can make the difference for its shareholders, by generating or destroying value (profitability) for them. Since the beginning of Aengus Kelly's term as CEO in 2011, AerCap Holdings's book value per share has grown at an annualized rate of 22%, creating extraordinary value for its shareholders. It is therefore a management team that has more than demonstrated its importance to AerCap Holdings. We think three factors explain this huge value creation: the acquisition of ILFC in 2014, the (aggressive) share buyback programs, and the strong alignment of interests between management and shareholders.

- The acquisition of ILFC in 2014

The acquisition of ILFC was a transformational move for AerCap Holdings, positioning the company as one of the most important players in the industry by quadrupling the size of its aircraft fleet. In addition, the acquisition gave it access to what was possibly the order book with new technology aircraft most sought after by airlines. All this at very attractive purchase prices (0.5x BV and 0.85x EV/Fleet value), driven by AIG’s urgent need to sell ILFC. It is indicative of the the attractiveness of the movement that, on the day of the announcement of the acquisition, AerCap Holdings's shares registered increases of 50%.

- The (aggressive) stock buyback programs

On occasions when AerCap Holdings shares have traded at a discount to their book value, the management team has aggressively repurchased shares, generating enormous value for its shareholders. Thus, from 2011 to 2013, they bought back almost 25% of the company's shares and since 2015, they have bought back more than an additional 35%. Not only that, the most interesting thing about this buyback is that they are financing it with the sale of mid-life aircraft, much in demand in the market, at a premium over their book value. In other words, AerCap Holdings is selling aircraft at a premium to buy back aircraft at a discount. It is, as you can imagine, a movement that we love as shareholders of the company.

- The management team’s skin in the game

Finally, we believe it is essential, especially in the financial sector, to have a management team that has skin in the game (we recommend that you read our annual letter in which we talked about it in detail). Both at the incentive level and at the level of investment in company shares, we can say that the AerCap Holdings team meets this important requirement. It should be noted that Aengus Kelly, CEO of the company, owns about 2.5% of the shares (equivalent to $150 million), so he has a personal interest in doing a good job of allocating capital and this is reflected in the evolution of the shares.

What the market fears (and we don't)

The risk of any group of investors is that they only pay attention to what they already agree with - Michael Mauboussin

When investing in a company, it is just as important or more important to delimit the risks that the market fears, to analyse whether they are risks that can be assumed (possible scenarios, probability of their occurrence, etc.) and whether the company's stock market value reflects these risks. In the case of AerCap Holdings, we have detected five potential risks disregarded by the market:

1. Demand risk:

The current environment of trade wars, a strong dollar or oil volatility may not be the most ideal for airlines and this probably explains, in large part, the number of airline bankruptcies in 2018. However, we cannot lose sight of the reality of this business: every year dozens of airlines go bankrupt. It's not a new phenomenon. If you don't know the industry, you may be surprised to learn that a third of these bankruptcies occur in Europe, not exactly an emerging region. Without going into great detail, the enormous fragmentation of the industry in Europe and the presence of consolidated low-cost players, create a very complicated and unsustainable competitive environment.

If there are always airline bankruptcies, how do you protect a lessor like AerCap Holdings from this risk? On the one hand, we have already commented on AerCap Holdings's global platform, which allows it to greatly diversify the risk among two hundred customers and to be very agile in relocating aircraft. On the other hand, AerCap Holdings follows a very strict risk management policy, requiring maintenance reserves and deposits from customers with a lower credit profile. Finally, this industry has a regulation that favours the recovery of aircraft in the event that an airline goes bankrupt. In spite of all the bankruptcies in the sector, AerCap Holdings has maintained over the years utilization rates of its fleet close to 100%.

2. Supply risk:

Another of the market's recurring fears is that that the main aircraft manufacturers may produce more aircraft than the industry can absorb. However, we think that reality is very different from what one might imagine. Aircraft deliveries have historically grown at very stable rates, far from the cyclicality that one might assume. If we think about it, it makes all the sense in the world. After all, we are talking about a duopoly, made up of Boeing and Airbus, which operates under a “no white tail” manufacturing policy. On the other hand, it is very important to point out that 45% of the planes that will be supplied in the next twenty years will be used to replace planes that are going to disappear when their life ends. Therefore, we don't see big risks on this side and, if anything, we are finding them in the other direction, with recurrent delays in deliveries due to problems with some engines and, additionally, due to the case of Boeing's 737 MAX.

3. Competition risk:

Possibly one of the most significant. The great attractiveness of the sector has caused the market to become more and more fragmented over time. Because it is impossible to order from the main aircraft manufacturers (there are queues of almost 10 years for some models), these new players have concentrated, in particular, on the market for sale-and-leaseback and the market for purchasing second-hand aircraft. To give you an idea of how crowded this market is, situations have been reported in which eighty lessors, I repeat, eighty lessors, were bidding for the same aircraft. This is truly crazy and has greatly reduced the profitability of this type of operations.

Another important source of competition comes from tourists in the sector. We are not talking about the ordinary tourists you may have in mind, but institutional investors who, in the absence of “safe” alternatives returns, have decided to try their luck in the aircraft leasing business. Although short-term prospects may be good, these players lack a global platform of guarantees and the experience to manage a fleet of aircraft, so many of them will suffer in the future when the market is strained.

AerCap Holdings is not participating in this nonsense and remains focused on its order book for the latest generation of aircraft. In addition, as we have commented, it is taking advantage of the situation to sell mid-life aircraft to these thirsty players at prices above their book value, to buy back aircraft at a discount.

4. Residual value risk:

An important factor to take into account is the risk of loss of value of an aircraft, by unanticipated factors that generate a fall in demand. For this reason, it is important to actively manage the fleet, as AerCap Holdings does, orienting it towards the most attractive aircraft for airlines. As mentioned above, AerCap Holdings is purchasing the most efficient new technology aircraft and, moreover, mostly narrow-body aircraft.

On the other hand, and this is more important than it may seem, AerCap Holdings follows a very conservative aircraft depreciation accounting policy, thereby reducing the chances of unpleasant “surprises” in AerCap Holdings's valuation of its aircraft.

5. Financial risk:

Along with the competition, it is possibly the other big risk for this business. What happens if the credit market collapses and interest rates start to rise significantly? As with other risks, discussed above, the reality may be very different from what we think. The first thing we need to be clear about is that airlines have never enjoyed such good financial health. The second thing is that aircraft lessors have never been managed more prudently than they are today (at least at the level of major players in the sector).

But focusing on AerCap Holdings, how do you protect yourself from this potential risk? To begin with, unlike banks, AerCap Holdings does not operate its balance sheet with asset-liability mismatches, i.e. it does not finance itself in the short term to invest in the long term. This operation allows banks to reduce their cost of financing, increasing the profitability obtained, but assuming enormous risks, since financing can disappear at any time. In the case of AerCap Holdings, debt and lease flows expire at similar times, so this risk practically disappears. On the other hand, AerCap Holdings maintains ninety percent of its financial cost at a fixed rate and the variable part is combined with variable leasing, and so a rise of rates would not impact it so directly. In fact, in environments with high rates, airlines find it less attractive to buy aircraft, which benefits lessors.

Therefore, although all of these risks are relevant to AerCap Holdings's business, we think they are perfectly manageable and certainly do not explain the very attractive valuation the company is currently trading at.

A bomb-proof valuation

Dhandho. Heads, I win; tails, I don't lose much! - Mohnish Pabrai

Now that we know the strengths of AerCap Holdings, as well as the potential risks, it remains to be seen why the price is attractive enough to invest in the company and, to this end, we have carried out three valuation scenarios:

1. Positive scenario: the company continues to buy back shares, maintaining a financial leverage of 3.0x (Debt to Equity Ratio), in line with the high leverage range given as guidance by the company. In addition, we assume that AerCap Holdings should be valued at 1.2 times its book value. With all this, the company shares should be revalued by about 140% in three years.

2. Base scenario: is the scenario that we assume to be most likely. In this case, the company continues to buy back shares, but with a financial leverage of 2.7x, in line with the low leverage range used as a guide by the company. As for the multiple at which it should be trading, we think 1.1 times its book value would be fair. With these assumptions, the company shares should be revalued 100% in three years.

3. Negative scenario: Same as base but giving the company an exit multiple of 0.8 times its book value (AerCap Holdings has historically traded around 1.1 times). A very conservative valuation which, however, continues to show an attractive three-year potential of 50%.

In short, we are faced with an investment idea where it appears difficult to lose money, thanks to a brilliant management team, some interesting competitive advantages and very limited risk. This is why it is one of the main positions of our Horos Value International fund.

Current Affairs

Regarding the most outstanding news of Horos, this quarter we have continued our work in communicating our project and investment philosophy. On the one hand, our managers Alejandro Martín and Miguel Rodríguez took part in one of the morning meetings organized by Abante Asesores (read summary), where they explained our project and investment philosophy. On the other hand, they participated in the Meeting with Investors in La Coruña, an event organised by Ortega & Lodeiro.

We would also like to highlight the following collaborations with the newspaper ABC (read interview), Libertad Digital (watch video) and the digital meeting “Why invest in value in 2019” for the newspaper Expansión (read meeting).

Horos Value Iberia

The fund can invest up to 20% in holdings listed in Portugal and at least 80% in holdings listed in Spain. In addition, it can invest up to 10% in Spanish or Portuguese companies listed on other markets.

Horos Value Iberia returned 4.8% in the first quarter, compared to its benchmark index, which returned 9.1%. Since its inception on 21 May to 31 March, the fund's cumulative return has been -8.9%. In the same period, its benchmark performance was -5.8%. The results achieved in such a short period of time are merely anecdotal and should be considered as such. As an indication of the importance of long-term investment, the annualised return obtained by an investor who has accompanied this management team since its inception would be 13.53% compared to 7.31% for its benchmark (for more information, see the appendix at the end of this document).

In this quarter, the holdings that have made the most positive contribution are Renta Corporación and Aperam, two companies that were heavily penalised by the market in the final part of 2018. We continue to see significant appreciation potential in both, so we are keeping them among our fund's top investments.

On the negative side, Elecnor and Greenalia stand out. There's nothing to say in the case of Greenalia. Its better relative performance in 2018 possibly explains this worse evolution in the beginning of 2019. In the case of Elecnor, the company faces a potential sanction from the CNMC.

The fund's portfolio had two entries in the quarter (Alantra Partners and Global Dominion) and one exit (Grenergy Renovables).

Alantra is a global financial company, with a presence in more than twenty countries, and is mainly dedicated to asset management and investment banking services. Being a financial business, it is very important that it be led by a management team that allocates its capital well. In the case of Alantra, its incentive system and shareholding ensure that the capital is well allocated, as demonstrated by the creation of value achieved for its shareholders. We have known the company for years (this management team invested in it in 2013 and divested in 2018). After a period in which the valuation seemed demanding to us, the good evolution of the business, together with the correction of 30% experienced from its highs, has once again provided, in our opinion, an interesting investment opportunity.

Global Dominion is a family-owned global provider of technology services and solutions, as well as specialised engineering. Being a low margin business, it is an essential requirement that the management team always focuses on business efficiency, and one that Dominion more than meets. In addition, the history of creating value through acquisitions at attractive prices and an orderly growth strategy demonstrates the good work of this management team. Like Alantra, Dominion is a company that we have known for a long time and one that, after a somewhat erratic evolution of its stock price, has returned to gives us an attractive investment window.

In terms of outflows, we liquidated our investment in Grenergy Renovables following its excellent performance in the stock market over the period and its relatively lower potential compared to other portfolio alternatives.

At the end of the quarter, the fund's theoretical potential for the next three years was around 64%, equivalent to an annualised return of 18.0%. For the calculation of this potential, we performed an individual study of each holding that makes up the portfolio. These theoretical returns are no guarantee that the fund will perform well over the next three years, but they do give an idea of how attractive the current time is for investing in Horos Value Iberia.

Portfolio Structure

At the end of December, the portfolio of Horos Value Iberia comprised 26 holdings and was concentrated in two important topics. On one hand, over 70% of the part invested from the portfolio comprises companies that we have known for years that are managed by families with an important presence in the shareholding (which guarantees an alignment of interests with shareholders).

The second block (13%) is made up of companies that have been forgotten or even "hated" by the investment community, because they have historically been unsatisfactory for shareholders, but that are very attractive to invest in today.

Horos Value Iberia also invests in Horos Value Internacional (4.7%). In this way, the potential of the Iberian fund is increased, increasing the quality of the portfolio and generating greater value for our co-investors in the long-term. Of course, NO commission will be charged on that percentage invested in the house funds.

Finally, the liquidity of the fund at the end of the quarter was below 3%.

Main Positions

Meliá Hoteles (7.1%, family-owned): hotel group with a presence in over 40 countries, of which the Escarrer family controls 52% and has been a shareholder for over 60 years. The company is the leading hotel chain in Latin America and the Caribbean and is the largest global player in resorts and “bleisure” (a combination of business and leisure). Meliá's objective is to migrate to an asset-light business model, which focusses on the management of hotels without owning them. Currently, hotel management accounts for nearly 30% of EBITDA and they expect to reach 50% in seven years. The interesting thing about this investment lies in the valuation of its hotel assets, (much higher than its current market capitalisation, which allows us to take the hotel management business “for free”) and what this business can contribute to the company in the future.

Renta Corporación (6.6%, forgotten): the company, focussed on acquiring real estate assets for transformation and sale, has gone through a restructuring process, both financial and business (they use options to purchase the properties to be reformed), which avoids the risks to the balance sheet that are typical of this industry. In addition, it has reached an agreement with the Dutch pension fund APG to manage its SOCIMI specialised in residential assets. This SOCIMI has the goal of reaching 1,500 million euros in assets and Renta Corporación, in addition to owning 3% of the SOCIMI, charges a 1.5% fee for its management. Finally, it should be noted that we are working hand in hand with a professional and highly experienced management team, which has been able to restructure its business toward a model of high returns on capital employed.

Ercros (6.2%, forgotten): company forgotten by analysts due to the complicated situation it experienced a few years ago. It is an industrial group dedicated to the production of chlorine derivatives (necessary, for example, for the manufacture of PVC), intermediate chemicals (formaldehydes, glues and resins, etc.) and pharmaceuticals (raw materials and intermediary products). After almost ten years of continuous decline in demand for PVC, the capacity shutdowns of the sector in recent years, together with the additional restriction of supply that is taking place, following the ban by the European regulator on the use of mercury technology in chlorine production processes, gives us reasonable expectations for a good evolution of this industry in the coming years.

Catalana Occidente (5.6%, family-owned) This insurance company has an excellent history of creating value for its shareholders, thanks to the attractive acquisitions they make on a regular basis. Its management team carries out a very conservative management of the business, operating with combined ratios lower than those of the industry, as well as of the balance sheet, as it always has a significant excess of reserves. We believe that the current prices at which the company trades do not reflect the profitability of the business or its good capital allocation.

Sonae Capital (5.4%, family-owned): it is a Portuguese investment vehicle managed by the Azevedo family, which owns real estate assets and operates in the tourism, energy and industrial sectors. The company seeks to invest in Portuguese niche companies that may have an export potential. We believe that the value for the sum of parts of the different businesses is substantially higher than Sonae's current market cap.

Horos Value Internacional

Our international portfolio can invest without geographical restrictions in most of the world's stock exchanges, including the Iberian market. Therefore, Horos Value Internacional has the best investment ideas that this management team currently finds available.

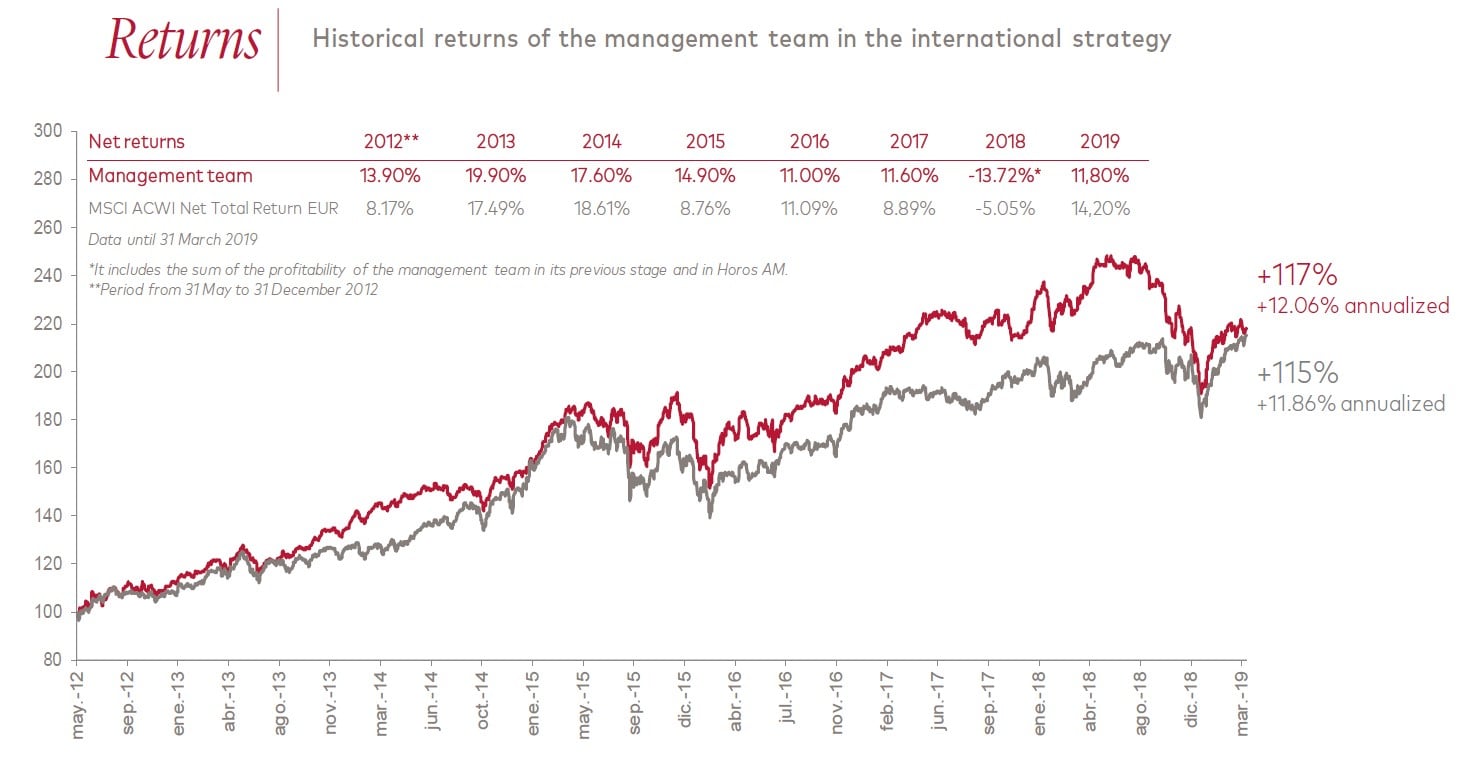

Horos Value Internacional returned 11.8% in the fourth quarter, compared to its benchmark index, which returned 14.2%. Since its inception on 21 May to 31 December, the fund's cumulative return has been -10.9%. In the same period, its benchmark performance was 4.5%. The results obtained in such a short period of time are merely anecdotal and should be considered as such. As an indication of the importance of long-term investment, the annualised return obtained by an investor who has accompanied this management team since its inception would be 12.06% compared to 11.86% for its benchmark (for more information, see the appendix at the end of this document).

In this period, the holdings that have contributed most to the fund's portfolio are LSL Property Services, Teekay Corp. and AerCap Holdings Holdings. In the case of the latter two, their good evolution in the period can be explained precisely by the poor progress at the end of 2018 (at which time we took advantage to increase our position in both companies). More striking is the case of LSL, the property appraisal and real estate agency company in the United Kingdom, which has maintained excellent stock performance despite the terrible situation facing the industry, as can be seen from the progress of the business of Countrywide and Foxtons, its main listed competitors. Having a conservative management team, aligned with shareholders and focused on cash generation explains this good evolution.

On the negative side, BMW is notable. Like the rest of the industry the German car manufacturer is suffering the disruptive impact of electric and autonomous vehicles. At the end of March, BMW announced a significant reduction in its profit forecasts, due to the necessary increase in technology costs to manufacture these vehicles, as well as currency fluctuations. In addition, sales in countries such as China are suffering a significant drop, after years of continued growth. The uncertainty of Brexit adds further pressure to the sector. Nevertheless, we think that the current assessment includes these challenges and BMW's position should defend it better against them.

The international portfolio has had one entry during the period (Borr Drilling) and one exit (Baikowski).

Borr Drilling is an oil services company specialised in jack-up platforms. Established in 2016, Borr Drilling has been acquiring modern platforms at very attractive prices, taking advantage of the weakness of the industry in recent years and the need of some players in the sector to sell. As with Ensco, the other platform company in our portfolio, we think the industry is entering a tipping point where oil companies' investment will begin to normalize and, as a consequence, the fees for using platforms will start a significant recovery. It should be noted that this is a company with which this management team has achieved returns of 60% in the past and in which we are now investing at even more attractive prices than at that time.

In terms of exits, we sold our position at Baikowski, an investment “inherited” by spinning-off from PSB Industries, where we are also shareholders.

At the end of the quarter, the theoretical potential of the international strategy for the next three years was around 126%, equivalent to an annualised return of 31.2%. For the calculation of this potential, we performed an individual study of each holding that makes up the portfolio. These theoretical returns are no guarantee that the fund will perform well over the next three years, but they do give an idea of how attractive the current time is for investing in Horos Value Internacional.

Portfolio Structure

The portfolio has 32 holdings and four blocks that account for the bulk of it. The main one is made up of companies linked to raw materials (30%), especially uranium, stainless steel and oil. Another important block is the one that includes forgotten emerging stocks (21%) or stocks scarcely followed by the investment community, mainly from Asia. Investment in technology platforms (11%) with powerful network effects that are still trading at very attractive prices and in UK companies (13%), impacted by the Brexit, would be the other two important investment blocks.

Lastly, the cash position of the portfolio at the end of the quarter stood at 9.1%.

Main Positions

Keck Seng Investments (6.0%, forgotten emerging company): is a Hong Kong family company founded in the early 1940s by the Ho family, owner of 75% of the vehicle, so its interests are aligned with those of its shareholders. The holding company specialises in the ownership and management of hotels in the United States, China, Japan, Vietnam and Canada. Keck Seng also has an important residential portfolio in Macao that we expect will benefit from the recent opening of the bridge that connects Hong Kong with this city. The poor liquidity of the share or the fact that the assets are valued at acquisition cost on the balance sheet have contributed to a market inefficiency, which in our opinion is unjustified.

AerCap Holdings Holdings (5.1%, others): one of the world's leading aircraft lessors. This is a business with a high recurring revenues and good future prospects, given the expected growth in aircraft production and demand for the coming years, mainly derived from the needs of developed economies and the expected growth of emerging economies. Although this is a business with significant financial leverage, we believe that the stability of the revenue streams generated by the business, as well as the correct capital allocation in recent years, acquiring ILFC at very attractive prices in 2014 or repurchasing shares at a significant discount, justify investing in a company that achieves historical ROEs of 12% and is trading today with a significant discount on its book value.

Uranium Participation Corporation (4.8%, raw materials): The investment vehicle that buys and stores uranium for later sale. Given our positive outlook for uranium prices and the limited cost structure of this vehicle, we have decided to concentrate our investment in this type of company (we are also shareholders in Yellow Cake, a similar vehicle listed in London) and renounce, at these prices, exposure via mining companies, where we would have to assume a greater risk of loss in an adverse scenario, as well as operational risks linked to the management and development of projects and mines.

Asia Standard International (4.8%, forgotten emerging company): is a Hong Kong investment and property development group that invests in prime areas of Hong Kong as well as major cities in China. More specifically, Asia Standard focusses on real estate development, rentals, hotels and travel, as well as financial instruments related to this activity. The bulk of the ownership is controlled by the Poon family, thus, like Keck Seng, the management team is fully aligned with its shareholders. A complex shareholding structure, as well as an accounting valuation of the assets at acquisition cost far removed from reality, lead to an extraordinary undervaluation of this stock.

Teekay Corp. (4.7%, raw materials): is a holding company that owns shipping companies that use methane carriers (Teekay LNG), tankers (Teekay Tankers) and offshore services (Teekay Offshore). Teekay Corporation owns approx. 32% of Teekay LNG, the world's largest liquified natural gas shipping company by fleet size. Teekay Corporation, for the management of Teekay LNG, charges a fee that increases depending on the distribution of cash that Teekay LNG makes. Today, Teekay LNG's cash distribution is low (although it has risen 36% by 2019) due to the objective of deleveraging the company, which hides from the market the value of the increase in distributions we expect for the coming years.

This article first appeared on ValueWalk Premium