Hayden Capital commentary for the first quarter ended March 31, 2019.

Dear Partners and Friends,

Our portfolio recorded its best quarter since inception, after recovering from a rough end to 2018. Over the last three months, it seems the market found its footing again versus the panic selling we saw in December and when certain issues even had trouble catching a bid. Some of this was aided by the Fed, which signaled it would take a long pause in raising interest rates further.

Q1 hedge fund letters, conference, scoops etc

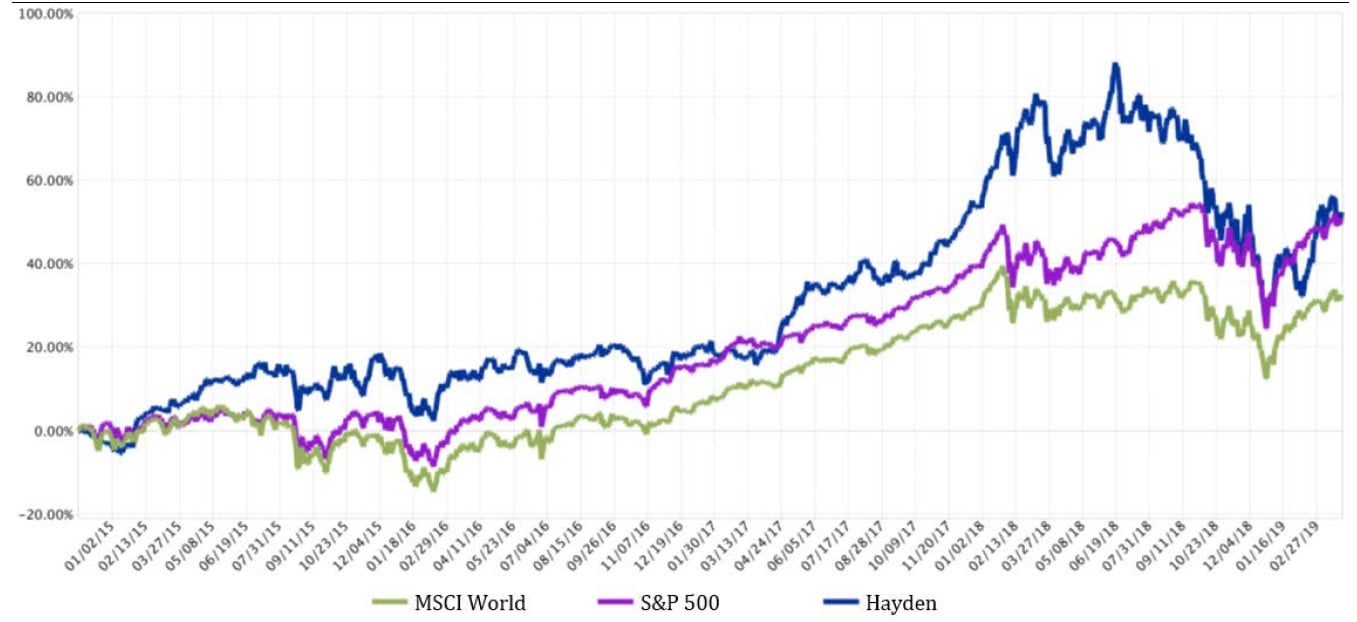

Over the first quarter of 2019, our portfolio appreciated +14.73% (net of fees) vs. +13.65% for the S&P 500 and +12.45% for the MSCI World Index. Our cash levels continued to decrease, reaching another low of 5.10% average during the quarter.

Performance Since Inception

A large use of cash was increasing our Sea Ltd (NYSE:SE) investment, which we first began buying last September, into a full position. The company continues to show evidence of a “right to win” in its category, and is discussed in further detail below.

Q1 hedge fund letters, conference, scoops etc

Two quarters ago, I mentioned our use of tracking positions as a tool for implementing new ideas (LINK). Our partners will remember the rationale for taking on these small positions earlier in the research process, was due to near-term catalysts which I feared would cause shares to appreciate substantially before we were able to answer the couple remaining questions on our list. Mitigating this uncertainty, the prices were low enough that even if we didn’t like the answers we found, I felt we could quickly reverse our decision and exit with little risk of loss.

It seems that judgement was correct, with both Sea Ltd and Carvana each having appreciated close to 100% over the last six months. This return helps our short-term performance metrics, but I’m honestly far more excited by the cause of the result – both companies have given indications that have notably de-risked the investments, and the market has reflected this higher certainty with a higher multiple.

Carvana indicated it doesn’t plan to raise any more equity or debt to fund the business, relying solely on its ABS program (LINK), as well continuing to rapidly take market share from competitors and proving out the pent up demand for this type of service. Shopee, Sea Ltd’s marketplace business & primary use of capital, is increasing its take-rates and close to reaching profitability in its key markets of Taiwan and Indonesia – indicating their confidence in the strength of their business’ network effect and stability of their market share (LINK). In both cases, we’re starting to see signs of investor debate shifting from that of sustainability (“will this business be able to raise funding and survive over the long-run?”), to questioning the size of the advantage in the business model vs competitors (“is this business better vs. competitors, and if so, how quickly will it grow?”).

Both of our original tracker positions are now full positions. It’s possible that partners will see more, selectively chosen, tracking positions in future years – although it’s certainly no guarantee they’ll work out as well as the latest two. Having said that, it’s a “tool” I’d like to reserve space for in our investment process “toolbelt”.

Finding Value in The Enchanted Forest

“When you live in the Enchanted Forest you don’t need to make money, when you go public you do, and these companies have all decided, yes, now is the time that we want to make money, and to show how serious we are we are going to go public and kick off the training wheels of venture-capital subsidies. If you are a public investor worried about whether these unicorns will ever actually make money, the most reassuring fact may be your own reputation for short-termism. If they weren’t serious about pivoting to profitability, it would be silly for them to leave the forgiving venture capitalists of the Enchanted Forest for the windswept plains of the public markets.” - Matt Levine, Bloomberg Money Stuff (March 27, 2019)

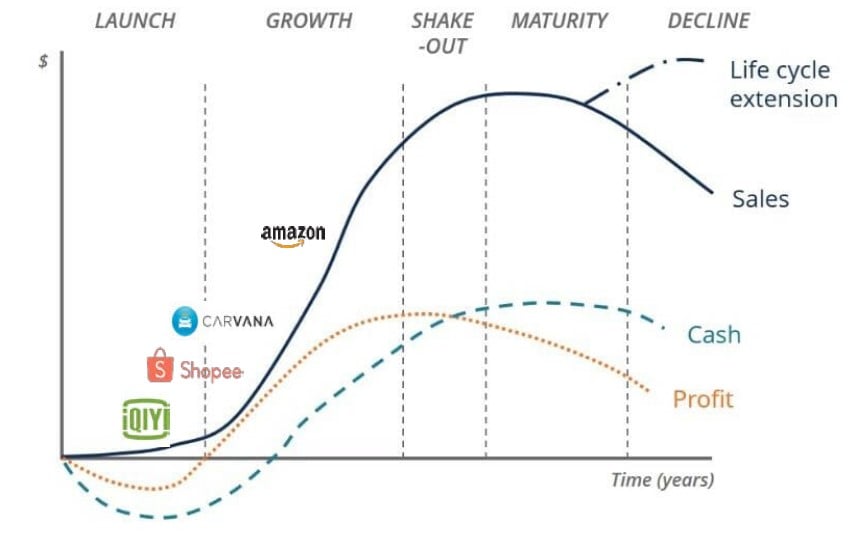

Partners will notice that over the past year, we’ve been wading into investments in earlier-stage businesses and relatively recent IPOs (for example: iQiyi, Carvana, Sea Ltd). Some may be wondering, have we completely lost our minds? Are we that masochist, that we’re yearning for a 2000-style tech bubble implosion? Obviously, the answer is no… instead, this segment of the market attracts us precisely because other investors have this fear, resulting in it becoming one of the most inefficient spots within our investment universe today. Simply, so long as we pick our spots carefully, it’s where we can find the most opportunities for us to add value as active investors.

Much of this dynamic, is due to the way investors in the US are trained. Under the teachings of “traditional” value investing, many of these currently loss-making companies would fall into the “too hard” pile. Yes – it’s very tough to predict the future, and as such the range of potential outcomes is wide. As such, often many of these companies are completely written-off by the most sophisticated investors – especially by those who don’t specialize in technology-related investments or who feel most comfortable in the far-right of the S- Curve (the mature segment of the curve), where “value” is obvious in the financial statements.

But just because the range of outcomes is wide, doesn’t always mean the outcomes will be negative. It’s possible to have a wide-range, of predominately positive outcomes.

The Business Lifecycle (S-Curve)

Some of Hayden’s earlier-stage investments

To understand our approach in this segment of the market, it’s helpful to understand our thesis and the types of companies we’re looking for. Simply put, we’re looking for companies that position themselves in the center of their ecosystems, and act as a “tax” or “toll collector” among all the participants involved. As the company grows larger, over time it has the ability to “control” other participants in its ecosystem, acting as its regulator or dictator, and is able elicit its own terms (think Netflix, and its growing power over studios and talent. Or Amazon and its power over third-party merchants).

The key difference though, is that we’re seeking benevolent dictators who take these tax proceeds, and reinvest it back into the ecosystem’s infrastructure for the betterment of all participants (Lee Kwan Yew’s impact on Singapore is a great example of this). Corrupt dictatorships who keep all the tax revenue for themselves, and buy gold Lamborghinis and 300-ft Yachts, never end well.

By reinvesting into the ecosystem’s infrastructure, the inhabitants are willing to pay ever-higher taxes, since the services they receive in return are more valuable than if they were to do it themselves. The incentives for all stakeholders are aligned.

For example, merchants are willing to pay Amazon’s >15% take-rate, since the ready-made pool of customers Amazon provides is worth it vs. the company trying to source its own traffic. Amazon keeps its end of the bargain, by taking these proceeds and investing heavily into its Prime service to keep customers happy and “locked-in”. Another example of this, is NYC vs. low-tax jurisdictions like Alaska. Despite the higher-tax rate, businesses and individuals still choose to locate in NYC, because of the access to talent, infrastructure, and greater business opportunities that the city provides.

Business models with these characteristics are easier to predict at an earlier-stage, since there are KPI’s that can give indications that the company is on the brink of a “tipping point”. These models are almost always winner-take-most, where moats are based upon network effects, and so crossing this tipping point is the most important gauge of whether a company / investment will be successful4.

We’re looking for the moment when the “flywheel” kicks in and becomes self-sustainable (note, even after the flywheel is self-sustainable, it’s possible companies will still try to make it “spin faster” with subsidies, with the goal of building the network above its organic growth rate. This results in companies that are loss-making at the moment, but are also high-probability winners). Once that occurs, monetization and excess profits are a very easy step to take.

If you look at our earlier-stage investments, they all share the commonality of being very close to that tipping point. For example, iQiyi has close to 100 million paid subscribers, and is starting to obtain more favorable rates for the shows it produces versus smaller competitors. Simultaneously, the industry’s overall content costs are set to decline (signaling decreased bargaining power among suppliers, as well as favorable government regulation), with cost per episodes declining from RMB 15M per episode to RMB 8M per episode (LINK). These dynamics bode well for profitability in future years.

Sea Ltd’s Shopee division is also exhibiting evidence of reaching this tipping point, with subsidies such as free shipping being scaled back this quarter, and commission rates increasing across the board (see Shopee section below). It’s a strong signal when an ecosystem starts raising taxes on its inhabitants (especially since there’s a viable alternative ecosystem in the form of Alibaba’s Lazada) – it means they’re extremely confident merchants gain far more value from their platform vs. competitors, and as such will remain sticky.

But gauging how close the “tipping point” is, is only step #1. It’s also important to ensure the company continues creating value for inhabitants, well beyond gaining the dominant position. This is where market expectations vs. business momentum comes in.

Momentum is real in business, just like it is in nature (note, this is different than price momentum)5. We all know Newton’s first law of motion, whereby “An object in motion, stays in motion, unless an external force is acted upon it” (LINK).

On Earth, objects in motion eventually stop, due to friction. But assuming no other factors, this slowing process occurs gradually instead of abruptly6. In business, this friction comes from law of large numbers, whereby a business’ momentum will inevitably slow and eventually cause it to reach maturity. There’s no such thing as an infinite addressable market or avoiding the law of diminishing returns (LINK).

The flip side though, is that it’s highly unlikely a business will slow from 150% y/y organic GMV growth (what Shopee grew at in 2018) to 0% y/y growth within a couple years, for example. Let’s imagine in order for a company to it to control and dictate its industry, it necessitates growing to 2x its current size. Given the recent momentum mentioned, this is a very easy outcome to underwrite7. Investing isn’t that easy though, as market participants are often smart enough to recognize this, and will price the shares accordingly (although for Shopee, this wasn’t the case…).

More often, the market’s main concern is with the external forces that can push-back against the company, and prevent it from reaching that tipping point at all. In business, that’s usually in the form of well-capitalized competitors – but it can also take the form of government regulation, internal corporate politics, natural disasters, and more.

External forces are harder to predict, and this is where the scuttlebutt research comes in. It requires talking to employees, merchants, customers, merchants of competitors, etc. to piece together the information. This type of information isn’t “obvious” and doesn’t show up in the financials until after the fact (and share prices have moved up accordingly). It’s a different research process, that’s based on soft-data points and understanding the incentives of the players (the Shopee section below, illustrates some of this process). As such, it’s is tough for most investors who are used to only conducting desktop-based work, and will only invest after the value is evident in the financial statements (i.e. “show me” investors).

All the information gathered is centered around answering one question: are the external forces getting stronger or weaker, or perhaps even shifting its aim to be directed at another competitor? Since we’ve already researched and proven the organic business momentum is strong and demand for the company’s offerings is real, the only thing that can get in its way are external forces.

The output of this research process, is often anecdotal evidence based on interviews, or “soft” data such as engagement metrics or the distribution of the merchant base (do the top 1% of sellers make up 99% of sales, or is the platform’s value more evenly distributed across sellers) that don’t have a direct correlation with financial metrics.

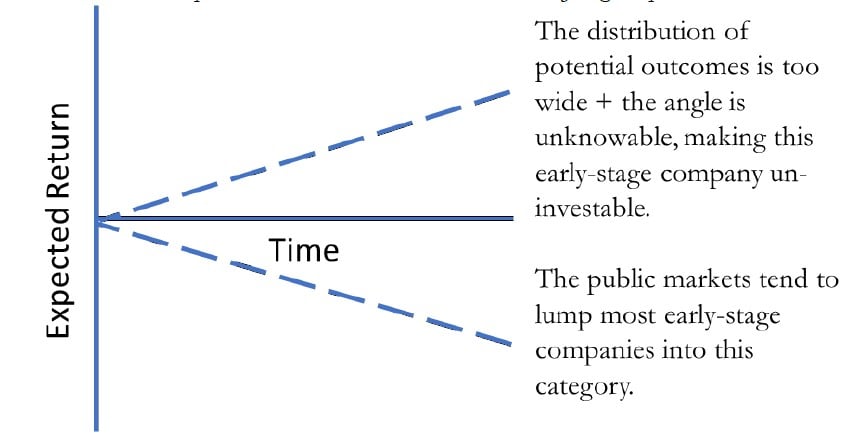

These investments are harder for most investors to underwrite, since 1) it requires having specialized knowledge as to what KPI’s are early indicators of a “winning” platform, and 2) having the confidence that a “winning” platform will translate into attractive profits. Luckily for us, the market often lumps all these companies into the same “too hard” or “unprofitable and bleeding cash, so it’s of zero value” bucket and the expectations bar is quite low. These are the situations that attract us.

Additionally, by answering these questions, we’re hoping to understand the distribution of outcomes. As mentioned earlier, just because there’s a wide-range of outcomes doesn’t mean that the outcomes are negative. Or put another way, in this segment of the market, it may be easier to gauge the “angle” of the outcomes, rather than the “width” of the outcomes.

Public Market’s Assumed Return Distribution for Early-Stage Companies

The distribution curve public market investors tend to bucket most early-stage companies into

Expected Returns for Hayden’s Early-Stage Companies

The distribution curve for select early-stage companies, that we find as attractive investments

No doubt there are certain crazily valued companies based on hype (WeWork, Lyft, Zoom, all come to mind), where the market thinks the distribution is the latter, when it will likely be the former. But for the companies we’re interested in, expectations are very low since the market is primarily focused on “will the business even reach profitability and survive” (a question based on our research, we can gain confidence in), and can’t even begin to contemplate “how valuable will this platform and ecosystem become in the future”.

Based on the outlined process above, if we are right on the first question, we’ll likely make a very attractive return – once the break-even / business “viability” are evident in the financials, the position is “de-risked” and “investable” for the broader investment community, and the market assigns a higher multiple to the shares. Once the company is the clear leader, assuming our underwriting was correct, our future profits will then come from [how quickly x how much] the company can create value for participants in the ecosystem.

Portfolio Updates

Sea Ltd (SE): As mentioned above, we took our second tracker from last fall, into a full-sized position in Sea Ltd this quarter. Sea (SE) is the leading Southeast Asian gaming and e-commerce company, currently valued at a ~$11 Billion market cap and listed in New York. Sea and Tencent have also had a long relationship (since 2010), with Tencent now owning a third of the company.

Garena

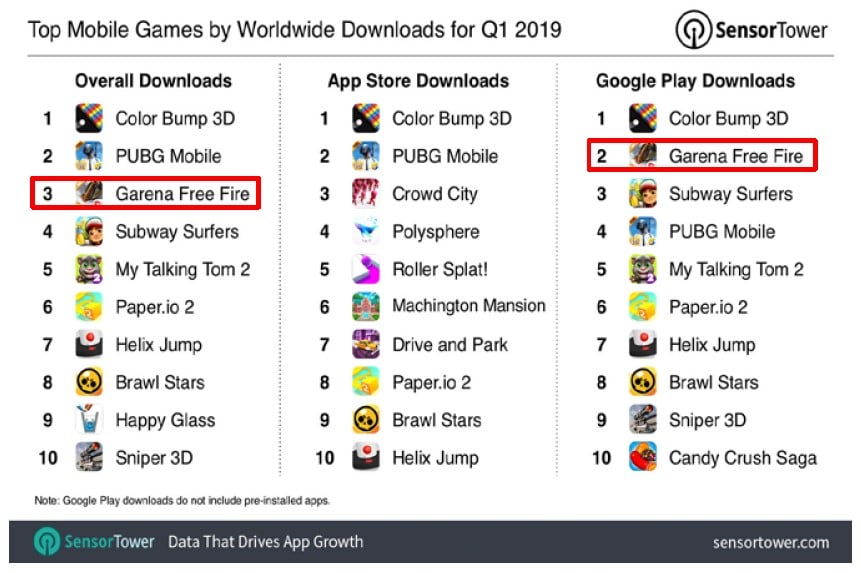

Garena is the original business, founded in 2009, and is the #1 distributor of mobile & PC games in the region. More recently, it self-developed the mobile game Free Fire (a Battle Royal style game, similar to Fortnite or PUBG), released in March 2017. Due to the game’s optimization geared towards lower-end smartphones, which are ubiquitous in developing countries, it’s been a smash hit. Free Fire has proven to be extremely popular in South America, India, and Southeast Asia, and consistently ranks as the #1 game (or at least top 3) across countries in these regions. More impressively, downloads have actually been accelerating in recent months (LINK).

Free Fire Among Top Games Worldwide in Q1 2019

Note that Free Fire is geared towards lower-end phones (non-iPhones), so it ranks poorly on the App Store

While Free Fire has been an outright success, I must caution underwriting any similar hits coming from the self-developed gaming unit going forward. Game developers traditionally have had characteristics similar to movie studios, where a large upfront fixed investment is required, with no guarantee of success and fuzzy sell- through visibility at best. The gaming industry is littered with titles which large studios poured hundreds of millions of dollars into, only to be flops in the market8.

Multi-player games (and especially Battle Royal style games) are a bit stickier than movies, as they exhibit some forms of network effects. There are typically 50 – 100 players required for each round, and matching players with similar skill levels, within an acceptable time frame (for example, players don’t have the patience to wait 10 minutes to join a game), requires a large pool of diverse players. The more players on the game, the better the experience for all participants. However, like with most network effect moats, it’s extremely hard to predict these ex-ante, before the game is actually launched and we can see how players receive it.

As evidence of this, it’s notable that even Sea’s management team didn’t know how popular Free Fire would be. For instance, management has stated earlier that they predominately focused on Southeast Asia, and spent almost no marketing dollars in countries like Brazil, India, Russia, etc. It took them by surprise how popular the game would be outside of Southeast Asia, and the rate of that organic growth. Going forward, the company hopes to have 50% the Garena business come from self-developed games, and 50% from publishing games from external studios.

Meanwhile, I view the publishing / gaming distribution business model very favorably. Just six months ago (in November), Sea Ltd signed a five year right of first refusal (ROFR) with Tencent (LINK). Garena was already distributing Tencent titles such as League of Legends and Arena of Valor, however this contract formalized the relationship. Tencent has had widely reported issues with monetizing / getting approval from regulators for their games in Mainland China, over the last year (LINK)9. Due to this they’ve been forced to look outside the country to monetize their games.

The beneficiary of Tencent’s troubles, is Garena, who is the top distributor in the Southeast Asia region. The terms of the ROFR give Garena an exclusive “first-look” at all Tencent tiles that it hopes to distribute in South East Asia or Taiwan10. The first game under this ROFR is Garena Speed Drifters, and was launched in late December (LINK).

Essentially, gaming publishers / distributors are middlemen, who take a “toll fee” in exchange for localizing the game, marketing it, and putting it in front of players. There’s relatively little capital required for the business, and is essentially a two-sided marketplace model. It’s in our view, one of the best segments of the gaming industry. For this reason, game publishers / distributors tend to consistently generate +30% ROE’s (especially for 3rd party titles).

The gaming division generated $661M of total adjusted revenue in 2018, and the company is guiding for ~$1.25BN of revenue in 2019. On this, Sea earned $263M in 2018 and I estimate will do north of $450M in 2019.

But while these are strong results, all of these profits (and more) are being reinvested into Sea’s other business line, Shopee. In our view, Garena is simply a cash flow stream that gets injected into Shopee, so that it doesn’t need to raise outside capital at inopportune times. Think of Garena’s profits as gasoline, that propels Shopee’s flywheel to spin faster than its organic momentum (and thus getting it to self-sustainability that much quicker). It’s Shopee, that’s really the crux of our thesis, and what you need to underwrite as an investor.

Shopee

Shopee is the leading e-commerce platform in Southeast Asia + Taiwan. The company sold $10.3 Billion of GMV in 2018, and is projected to do over $16 Billion this year (for reference, this is over 2x larger than India’s Flipkart, which was bought by Wal-mart for $20.8BN last year, LINK)11. This is an early stage business, founded only in 2015. However, in just the last 4 years, the company has risen rapidly and even surpassed Alibaba’s Lazada (and their seemingly unlimited access to capital) to capture ~27-28% of the total e-commerce market share in both Southeast Asia and Taiwan.12

Besides management (who we think very highly of), much of Shopee’s success and rapid adoption can be attributed to:

- A Mobile-First Strategy: This is crucial for a region that spends more time on mobile internet than any other region. The average daily mobile internet usage is ~3.6hrs per day in Southeast Asia vs. just ~2hrs per day in the US (LINK).

- Localized Platforms: Shopee operates in seven countries, each with its own distinct shopping habits and top categories.

For example, popular categories in Malaysia tend to be diapers, infant formula, toiletries, etc., while in Indonesia it might be Islamic clothing, cosmetics, etc. These differences necessitate localized apps, since product promotions, the way you advertise to customers, “offline events” to build the brand, and even the celebrity brand ambassadors you recruit are going to be different. - An Asset-light C2C Model: The quickest way to scale in the early days of an e-commerce market, is with a consumer-to-consumer model (C2C). For example, the US had Ebay and China had Taobao (Alibaba). Marketplaces are built upon network effects, which require hitting that “tipping point” of having ample buyers & sellers to make it a usable platform.

By going the C2C model first, it’s the quickest way rapidly build both sides of the platform and provide a wide selection of goods, without tying up the majority of capital in inventory. The primary “costs” are no commissions & free shipping, to encourage sellers to try out the platform. And vouchers, discounts, and marketing to get buyers to make their first purchase13.

I first came across Shopee, when I was in Singapore and Jakarta last summer. In Singapore, I spent a good amount of time asking fellow investors what are the local firms I should be paying attention to. Although Sea popped up several times in meetings, it was mostly in the context of “here’s a local Singaporean gaming company, that’s burning all this cash on a nascent e-commerce arm, but no one really uses it. It’s probably too expensive of a stock.”

Immediately afterwards, I flew to Jakarta where on our first day, I was immediately presented with Shopee billboard advertisements. Jakarta is sometimes called the “Mall Capital of The World”, with over 170 malls within city limits (LINK). Combined with the notorious traffic, where it can take several hours just to get across the city, it was my first indication that the use-case for a platform like Shopee’s is much different than that of a first-world, developed nation like Singapore’s14.

This disconnect, seemed to stem from:

- Singapore is the financial capital of the region, but despite being headquartered in the city, Shopee doesn’t really focus or appeal to users there. As such, the firm had far lower visibility and understanding among the “sophisticated” investors in the region.

- The shares are listed in New York, not in Singapore, and so even if investors are familiar with the opportunity, there is a degree of “friction” to investing in shares listed on the other side of the world (need to open an international brokerage account, for example). Meanwhile, many investors sitting in New York or the US, weren’t (and still aren’t) paying attention to what’s happening in Southeast Asia.

- Shopee, which I consider to have the biggest potential upside, was “hidden” within this holding company of Sea Ltd, along with a gaming business and mobile payments line. From the outside, it looked as if all these gaming profits were being wasted inside this completely outside of their core competency “Shopee” unit. Optically, the business didn’t screen well.

Upon returning to NYC, I spent several months doing more work, and we established our first “toe-hold” position at ~$13 per share, or a ~$4.5BN valuation. In October 2018, I gave a presentation at the ValueAsia conference in Shenzhen, discussing the company and soliciting feedback from other investors in the region.

The presentation (which I’ve never posted publicly until now), is now on our website. I encourage partners interested in the high-level thesis and the opportunity I see with Shopee, to review the deck. As such, I won’t re-hash the details here15.

Link to Hayden Capital’s ValueAsia “Marketplace Businesses + Shopee” Presentation (October, 2018)

Instead, I’d rather use this space to talk about the new developments over the last few months. First off, I was wrong about how quickly the platform would grow (in a very good way). I had originally anticipated the company would sell $9.1BN worth of goods in 2018, above the company’s own guidance of $8.2BN – $8.7BN. Well, it turns out both us and the company were too pessimistic, as they ended 2018 at $10.2BN GMV. As mentioned previously, this equated to ~28% of total e-commerce transactions across Southeast Asia.

Additionally, part of our thesis was that Shopee’s female-dominant customer base, focus on categories that facilitate high order frequency (fashion, health & beauty), larger number of reviews, and higher platform engagement (~19% higher time spent) would give it a leg up vs. its largest competitor of Alibaba-owned Lazada.

This thesis point is starting to play out as well, with Alibaba having indicated recently that Lazada GMV was essentially flat, compared to the regions’ +30% growth rate and Shopee’s +150% GMV growth16.

As evidence of this trouble, Alibaba actually swapped Lazada’s CEO three times last year. Lucy Peng, one of the original 18 Alibaba co-founders, replaced Max Bittner (from Rocket Internet) in May. We’ve heard she brought a very “Chinese” top-down style to Lazada, which doesn’t mesh well with Southeast Asian work culture. In fact, I heard several instances of decisions that were made in Hangzhou, and then emails would arrive to employees in Mandarin to the individual business lines, after which the employees would be struggling to translate the directives. Not surprisingly, she was replaced within just 7 months, by Pierre Poignant (a Rocket Internet and Lazada veteran).

It remains to be seen whether Pierre can fix Lazada’s culture, but so far based on conversations with current employees, internally it still seems a mess. The integration with Alibaba also hasn’t been going smoothly, with some customers complaining that the platform is “too Chinese” (Chinese-style products, engagement methods, etc). In a sign of poor execution, the firm also recently tried to integrate RedMart (an acquired online grocery business serving Singapore), which was met with strong backlash from users (LINK).

Another issue is that Lazada seems to be torn between following a first-party direct seller model (1P), or a third-party marketplace model (3P). Lazada’s roots started as an electronics retailer, which given the low margins, standardized SKU’s, and high value, lends itself to a 1P model17. However, seeing the rising threat of Shopee, they have attempted to pivot to a 3P model in recent years. Interestingly, it’s the 3P model that historically made Alibaba so successful in China, but they chose to purchase a 1P business. I suspect it’s because when Alibaba first invested in Lazada in early 2016, Shopee had just launched 9 months prior, and was miniscule at less than ~$200M GMV to that point. In addition, it was indirectly owned by its arch-rival Tencent.

In recent months, I’ve heard that Lazada is starting to pull back it’s efforts in Indonesia. Pierre Beckers, Lazada’s Chief Business Officer in Indonesia, even stated in a Taiwanese article that Indonesia’s C2C space was already dominated by local players and Shopee within the $2 - 5 product range. Since Lazada is primarily Business-to-Consumer (B2C), they can’t compete, and would instead pivot the focus to cross-border transactions, logistics, and e-wallets instead (LINK). It’s an interesting case-study, of how even access to virtually unlimited capital, doesn’t guarantee success. Execution and tailoring the platform to local users (listen to users’ needs, instead assuming what they want) are far better determinants of success.

Given Lazada signaling it’s pulling back, I believe Shopee is about to undergo an inflection in monetization. Remember, Shopee gained market share so rapidly, because at launch it came out with a 0% commission + free shipping model, which competitors had to quickly match. They were effective losing money on each item they sold.

But digging deeper, this is actually a very smart strategy. Subsidies are a great way to “jump start” your ecosystem, which is crucial when the key business moat is based upon a “network effect” of a diverse base of buyers & sellers. If you’re a smaller competitor that has volume of say 1,000 items / year, forcing a larger competitor who sells 1 million items / year to match your offer, is much more painful for the competitor (if shipping costs $2/item, you’re only losing $2,000 while the competitor is bleeding $2 million). Now that the competitor is forced to play by your terms, you can focus on growing using other methods.

What gave us conviction to build a stake so early, is that last fall, I heard signs that they were going to start monetizing shortly, and reverse that offering. It was a strong signal of their confidence in the strength of its ecosystem / network effect.

Similar to new cities (think Singapore or Abu Dhabi), at first you need to give tax breaks, build infrastructure, and create jobs, before you can get people to move there. Only once that city’s ecosystem is vibrant enough, and people derive value from being located there, can the city now start taxing its ecosystem. Reiterating the previous example, it’s why so many businesses locate in New York City, despite Alaska having much lower taxes. They get more value from being in NYC and are willing to pay for it.

I realized they were going to start monetizing in Indonesia and other countries shortly via primary checks with sales reps, which the market hadn’t quite realized yet18. In fact, in the last few months, management has since confirmed this publicly and that their largest markets of Taiwan and Indonesia will be profitable very shortly. As these profits flow through the financials within the next year, it should alleviate the market’s concerns around cash burn and whether they are embarking on a never-ending subsidy war with Lazada. In early March, Shopee just raised another $1.5BN at $22.50 per share, or a ~$10BN post-money valuation.

Combined with the $1BN cash already on the balance sheet + Garena’s cash flow generation, this should be plenty of cushion to get the company to overall profitability in the next two years. Putting these soft-data points together with Alibaba’s publicly signaled heavier focus on profitably at the parent level, it seems the aggressive “land grab” phase is coming to an end.

Valuation-wise, shares are definitely more expensive today than when we first started buying it last fall. The company is now 140% more expensive, compared to the initial $4.5BN valuation we invested at19. However even at a $11BN valuation, if we are correct in our thesis, it’s going to look very cheap in hindsight. Sea has $1.5BN of net cash on its books, resulting in an Enterprise Value of $9.5BN. Of this, I conservatively value Garena at ~10x EBITDA (compared to gaming peers at ~12 – 17x), for ~$4.5BN today20. The result, is the market implying a ~$5BN valuation for Shopee.

This is still attractive, for a business that is #1 in the region at 28% market share and will do ~$16BN in GMV this year or a 0.3x GMV multiple (albeit a very crude / simplistic valuation measure). Especially when compared to peers such as Flipkart (>2.5x GMV), Tokopedia (~1x GMV), and the latest private rounds of others such as Tiki.vn, Bukalapak, etc at between 1.5x – 2x GMVs, this looks like a relative bargain.

However, I think Shopee’s platform is of much higher quality than many of these comps. Shopee is focused on the most attractive categories of fashion and cosmetics, which are 1) consumable, 2) impulsive purchases, and 3) have among the highest industry profit margins vs. other categories. Shopee consumers purchase ~4x a month on average, and have extremely consistent basket sizes of ~$1721. These characteristics make the platform extremely sticky.

Shopee recognized fashion & cosmetics are largely impulse purchase goods, where the longer a customer spends on the platform and more items they browse, the more likely it is they will purchase. Shopee is leveraging this, by offering gamification features such as Shopee Quiz (mentioned in our Q4 2018 letter), live- streaming sessions with representatives who demonstrate the product (think millennial-style QVC), and Q&A sessions with celebrities on their shopping habits. All of this is geared towards getting customers in the habit of logging into the app, and hopefully making a purchase while they’re there.

With fashion & cosmetic commissions at ~5% in Asia (vs. 1-2% for electronics, which carry smaller seller margins), and also a higher propensity for sellers to pay for seller services such advertising and promotions, due to the competitive nature of the category, this all means the “tax” Shopee is collecting will be structurally higher than other platforms.

Marketplaces consistently have a 30-40% margin profiles globally. Assuming Shopee follows this “base rate”, we’re looking at ~$200M in normalized earnings power this year22. At the market implied $5BN, this may optically seem fairly valued at ~25x normalized earnings. However, I expect Shopee to grow at a ~40% y/y CAGR over the next five years, ahead of Southeast Asia’s projected e-commerce growth rate of 32% y/y (Google-Temasek’s 2018 report projects e-commerce to grow 34% y/y between 2015 – 2025; LINK).

Given Southeast Asia’s accelerating e-commerce adoption (e-commerce penetration is only ~3% in Southeast Asia), the soft-datapoints indicating an inflection in profitability, “downside” protection due to the strength of Garena, and our “edge” of looking in areas of the world few US-based investors are paying attention to, we’re very comfortable making a bet on Sea Ltd. Forrest Li, the CEO, has stated he thinks Sea Ltd can become a $100BN business – we sure hope he’s right, and will be following closely along that journey.

Zooplus (ZO1): In March, I attended Zooplus’ Capital Markets Day in London. The major focus of the event, was the slower sales growth the company expects in 2019 (14 – 18% y/y growth vs. 21% y/y growth in 2018), due to a transition in the way the company aims to attract new customers, and how the company plans to address this.

As discussed in our Q4 2018 letter (LINK), most consumer internet companies are finding that it’s getting more expensive to acquire new customers via traditional online methods. Google’s AdWords auctions are competitive, with more venture capital being directed towards it. As such, prices are rising, while at the same time companies like Amazon are taking the place of Google as the “gateway” / “first stop” to the internet.

Zooplus is equally vulnerable to these trends, especially with 80% of their marketing budget historically directed at Google’s properties. Customer acquisition costs for the company have doubled in the last few years, and the LTV / CAC ratio is starting to feel the pressure. As such, a portion of the ad budget is going to be allocated towards social media & offline marketing, initiatives the company has barely had a presence on in the past.

While I think the company should have taken these initiatives far sooner (it was fairly obvious to us that the rising CAC trend is real industry-wide, and it’s inevitable that if you spend almost all your money on Google, you’ll eventually hit the “Google Wall”)23. The CAC curve in these channels tend to follow an exponential curve, rather than a linear one – something that often catches companies off-guard, who weren’t prepared for it.

This curve is even steeper for companies that have slow-growing addressable markets but extremely high retention rates, such as Zooplus (~70% initial customer retention & 95% sales retention)24. This is because the “best” / most fitting customers for the service have already been acquired and very little “leak” back into the potential customer pool. So, each year the company is fighting a tougher battle in an “already picked over” customer pool.

To illustrate, lets imagine there are 1,000 initial pet owners in the world (to keep the math simple). Of these, 10% would like to buy their pet supplies online (online market share, of the total industry), and are actively searching on Google for pet products. That means the pool of customers you’re targeting by advertising on Google is 100 households. Of these, perhaps 50% of see the appeal of Zooplus’ offering, and become customers. In year 1, Zooplus captures 50 total households as its initial customer base, with relatively little effort (and thus low CAC).

However, by year 2, the initial Google customer pool has shrunk to 50 remaining households, who didn’t want to become customers in year 1. So, convincing them to become customers in year 2 will be equally as tough. You’ll need to give them larger discounts, they’ll need to hear about the virtues of Zooplus from their friends (i.e. trusted referrals) before they become convinced, etc. The hurdle to onboard this pool is high, and thus the CAC required is higher as well.

At the same time, assuming a 70% initial customer retention, 15 households (30% x 50 initial customers) will leave Zooplus and “leak” back into the Google pool. These customers weren’t a good fit for the service, for whatever reason, and thus something needs to change to get them back (need higher discounts, better service, availability of the products they’re looking for, etc).

The good news is, that every year, there are ~3% more households owning pets, who naturally tend to skew young and thus are more internet savvy. Of these 30 new households (1,000 pet households x 3% new pet households), let’s say 50% of the new pet owners (15 households) will search for supplies online and thus enter the Google pool. In addition, a few of the 90% of existing “offline” households will decide to give this whole “ordering off the internet” thing a try (let’s assume 5% of the pool, or 45 households).

Therefore, in year 2, the Google pool is comprised of 50 “non-customers” + 15 churned customers + 15 brand new households + 45 “offline-to-online” households.

If Zooplus is able to maintain their 50% capture rate of first-time prospects (15 brand new pet owners + 45 offline-to-online owners), that’s an incremental 30 customers for Zooplus, resulting in 60% y/y growth. This is how investors can roughly think of the early years of Zooplus or similar e-commerce companies (for example, Zooplus grew 54% in 2008 in the first year after its IPO; LINK)25.

As you can see, the issue is that over time, the [non-customer + churned customer] portion of the pool will grow faster than the [new pet households + offline-to-online households]. Because of this, every year it becomes harder to grow at the same rates, with out increasing the Customer Acquisition Cost.

What some companies have started to realize, is that in order to keep their CAC’s in-line, they need to go “above the funnel”, to where the 90% of offline customers are. If you expect customers take the first step of showing intent by searching for products on Google, and only then trying to capture these customers, you’re fighting with Amazon, Fressnapf, Pets At Home, and a plethora of other pet start-ups for the same keywords. The primary of way to win is by outbidding your competitors.

However, if you can reach the 90% of customers who had never started the online search, you’re in a far less competitive pool. Yes, you’ll need to educate the customers about why they should shop online in the first place, but selling them on the benefits of 20% cheaper prices + not having to carry 15kg bags home should be far easier. If the marketing message is communicated well, the cost of acquiring them will be lower26. In fact, other e-commerce companies who have made a similar transition successfully, have told us that offline methods such as direct mail, are among their highest ROI methods.

The other benefit of “pulling” them onto Zooplus’ platform (especially given the high retention ratio – i.e. once they’re a customer, they don’t leave), is that it also shrinks the potential customer pool for competitors.

Investors can think of this as “front-running” your competitors, by getting first pick of customers (those who are open to shopping online, but simply needed to be educated on the benefits and given the extra “push”) before competitors even have a chance to appeal to them. It’s also for this reason, the internet space often exhibits “land-grab” dynamics, where all profits are plowed into getting new customers27.

At the same time, Zooplus is finally putting more effort into building a social media presence. This gives the company a parallel, but alternative customer acquisition channel. Social Media marketing, such as on Instagram and Facebook, requires the customer to be internet-savvy as well. However, just because a potential customer uses Instagram or Facebook, doesn’t necessarily mean they’re in the habit of shopping for pet supplies online also.

Instagram is the #3 most popular App in Europe (LINK), and according to the Pew Center, 60% of users log in at least once a day (LINK)28. With social media taking daily internet time away from Google, this provides a potentially less competitive market to acquire new customers.

Social media, especially Instagram, requires a different marketing skillset and is largely about brand building and developing emotional ties with customers, versus the more “rational” Google channels which are about engineering the optimal pricing, backlinks, bounce rates, etc. While social media channels can be tough in their own way, the benefit is that once you acquire a “follower” the company can push marketing (i.e. posts) to the customer’s news feed on a daily basis. Assuming users keep logging into Instagram and Zooplus keeps its followers engaged with relevant content, Zooplus can show its followers and potential customers a new ad every day, for free.

The goal is that over time, as both current and potential customers see the Zooplus posts every day (especially if the message is conveyed in a customer-centric, emotional way), the company will remain “top of mind” for pet parents. And by capturing this mind-share and building loyalty, it gives them a strong advantage versus competitors. Considering that the first post ever on Instagram was a dog photo (LINK), I wish the team at Zooplus would have made this a priority earlier – but it’s always better late than never29.

**

Zooplus is currently in this transitional phase. Management has told us that the first direct mail campaign (the flyers you get in your mailbox, sent to targeted customers) went out last month. In addition, external ad agencies have been hired to launch a new marketing campaign (offline + social media) around Zooplus’ 20th year anniversary in late May / early June.

Both of these initiatives are new for the company, where marketing was mostly via Google and largely done in-house previously (something that’s arguably is not Zooplus’ historical cultural strength)30. The company seems to recognize this, with the Sales & Marketing division completely being restructured in the last few months.

I’m told Florian Welz, who joined in November and is the Chief Commercial Officer, is focused almost entirely on marketing at the moment (his other responsibility is supplier relationships). Reporting to Florian, a new Head of Sales and Marketing Analytics was hired recently, and will be joining the company soon.

Lastly, the Head of Online Marketing, Philipp Mainka, was also hired in November and was previously the Head of Search Engine Advertising at Sixt, the €4 Billion car rental & leasing company in Germany (LINK). As you can see, there’s an influx of fresh talent in just the last six months, and should strengthen this new “marketing muscle” for the company over time.

In my opinion this represents very low-hanging fruit, for someone who has experience in these forms of marketing. Hiring external firms to fill in Zooplus’ knowledge gap in the meantime is smart in my opinion, and based on case studies of other e-commerce firms, should have a high chance of success.

Given that shares are trading at 0.4x 2019 sales, the market is largely writing off these initiatives, and pricing in (in our opinion) irrationally low terminal EBIT margins of ~2%.

Consider, for example, that returning customers are ~82% of the total annual revenue (I estimate ~€1.25BN of revenue attributable to returning customers in 2019, with €300M to new customers), with a very high sales retention of ~94%. On the repeat base, the company made 3.6% EBT margins in second half of 2018.

Assuming similar margins in 2019, that would equate to ~€45M on repeat revenues, or a 7.5% yield on the current Enterprise Value of ~€600M, in addition to growing ~16% y/y.

Obviously, the big concern is around new customers, where the company is losing -8% in the first year of acquisition, and have been rising due to the previously mentioned higher CACs. This year, the loss margin may continue to march higher, as there’s typically a “transition period” when a company embarks on new marketing channels, and the new marketing strategy takes time to optimize31. On ~€300M of new customer revenue, the loss will likely offset this year’s profits from repeat customers.

Because of this dynamic, the market is hesitant to give credit to Zooplus’ underlying earnings power (and hence the debate around terminal margins). But we think the social media and offline marketing strategies are relatively easy to execute (given that many other e-commerce companies have successfully made the same transition), and at the very least are a net positive to CACs given that Zooplus has barely focused on these channels previously.

If the company can curtail the rising costs of acquiring new customers, the market will have an easier time underwriting the terminal earnings power of the company. In addition to higher overall margins, I’d expect the market would value the company closer to peers at >1x sales and 20 - 30x EBIT. Given this, if Zooplus is able to reverse the new customer acquisition cost trends, I wouldn’t be surprised if the shares traded at €1.8 Billion (~€275/share), or 200% above today’s prices in the near future.

Note: I haven’t even touched upon the market’s concerns with Amazon competition, which our recent research has indicated is way over-blown. That will be saved for a future letter.

Chewy.com also filed an S-1 recently (April 29, 2019), reportedly seeking a +$4 Billion IPO valuation. There’s a lot of good information in the prospectus, and I’m going to wait for the IPO and additional data before commenting publicly. However, at first look, it has very similar business characteristics as Zooplus (indicating consumer behavior is similar between US & Europe), and makes our Zooplus investment look very attractive (on a simplistic metric for example, Chewy is selling for ~1.2x sales vs. Zooplus at ~0.4x sales). If you haven’t read it yet, I’d encourage our partners to browse the Chewy filing (LINK), and compare it to Zooplus (LINK) to see the similarities.

If partners would like to discuss our findings privately before then, please shoot me an email or give me a call.

Conclusion

Last week, I was in Omaha for the annual Berkshire Hathaway meeting. As with previous years, the best reason to go is for the “tailgating” events surrounding the meeting, rather than the main event itself (the Berkshire Hathaway Q&A session is available on replay anyways, which means more time for other events).

What many don’t realize (and I certainly didn’t the first few years), is that the investment industry is as much a relationship-based industry, as it is an analytical one. Sharing investment frameworks and soliciting feedback from a high-caliber peer group of investors, can add real alpha – by spotting your mistakes earlier, or perhaps sparking a new angle to think about a particular issue. There’s no better place to sharpen your mental acuity, than against the wheting stone of some of the best investors in the world.

Berkshire’s annual meeting is worth going to for this reason alone – there’s no other occasion where you can share investment ideas and research processes, debate analytical frameworks, and understand how your peers are thinking about similar issues (and better yet, over a couple free drinks). In the investment “game” we’re in, it’s just as important to know who the “players” are and how they’re thinking, as it to crack open a 10K.

**

I’ll likely be in NYC for the remainder of the quarter. The last few months have been filled with trips to Los Angeles, London, Phoenix, and Omaha – so I’m glad to have some time to enjoy the NYC spring weather.

On these trips I usually ask fellow investors, entrepreneurs, interested potential partners, or anyone else who’s interested in sharing ideas to reach out and grab coffee. However, very often the schedule for these trips fill up so quickly, I want to apologize to anyone whom I may have missed. Please reach out if you’re ever in NYC, and I’d love to grab a coffee then.

If any of our partners are also around NYC in the next few months, please stop by. Our partners are all part of the Hayden family, and I’d love to catch up and update you on our portfolio in more depth. Additionally, we’re always open for the right like-minded potential partners. Please feel free to reach out, if you think you’d be a valuable addition to our group.

To our partners, I’d like to say thank you. Even though our returns last year were unsatisfactory, our portfolio has been recovering, and Q2 is shaping up to be even better thus far. We still have a long journey ahead, in our mission to build a multi-decade investment firm that can truly make an impact in our partners’ lives.

I look forward to writing to you this summer. In the meantime, hopefully we’ll have an opportunity to cross- paths in-person soon.

Sincerely,

Fred Liu, CFA Managing Partner