Crude oil inventories turned positive for the second week in a row. Was that the only reason for the recent plunge of black gold?

Q2 2021 hedge fund letters, conferences and more

Fundamental Analysis

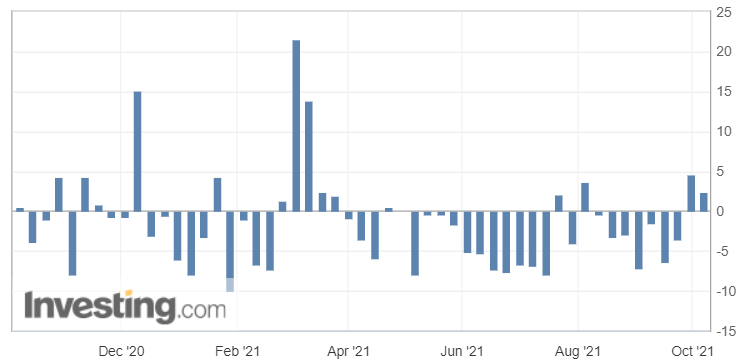

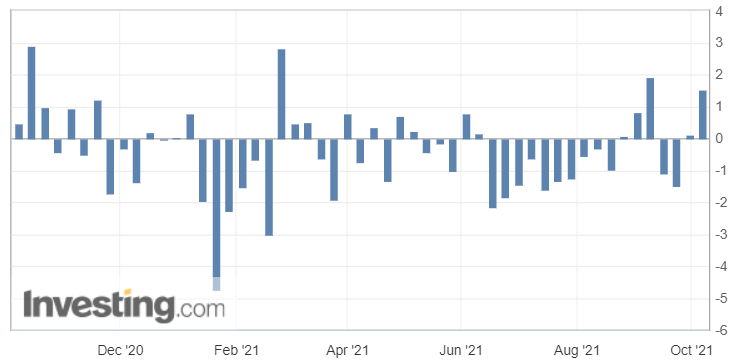

The larger-than-expected rise in crude reserves in the US weighed down oil prices on Wednesday. During the week ending on Oct. 1, crude inventories totalled about 2.35 million barrels according to the Energy Information Administration (EIA), while a number of analysts polled by Bloomberg expected no more than one million barrels. The additional increase signals that the production capacities which were impacted by Hurricane Ida in the Gulf of Mexico are gradually getting back to normal on an operational level.

Consequently, WTI crude oil futures tumbled more than 2% at the end, even though they are still sustained by the maintenance of the OPEC+ gradual production increase of 400k barrels a day in November!

In the meantime, Vladimir Putin's accommodating remarks on Russian gas production pushed natural gas prices down after an initial surge at the start of the market session, making for another choppy day in the market.

Like what you’ve read? Subscribe for our daily newsletter today, and you'll get 7 days of FREE access to our premium daily Oil Trading Alerts as well as our other Alerts. Sign up for the free newsletter today!

Thank you.

Sebastien Bischeri

Oil & Gas Trading Strategist

The information above represents analyses and opinions of Sebastien Bischeri, & Sunshine Profits' associates only. As such, it may prove wrong and be subject to change without notice. At the time of writing, we base our opinions and analyses on facts and data sourced from respective essays and their authors. Although formed on top of careful research and reputably accurate sources, Sebastien Bischeri and his associates cannot guarantee the reported data's accuracy and thoroughness. The opinions published above neither recommend nor offer any securities transaction. Mr. Bischeri is not a Registered Securities Advisor. By reading Sebastien Bischeri’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Sebastien Bischeri, Sunshine Profits' employees, affiliates as well as their family members may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.