According to a new analysis of fintech funding by S&P Global Market Intelligence, venture capital investors remained bullish on the U.S. financial technology sector in the first quarter of 2021.

Q1 2021 hedge fund letters, conferences and more

Highlights

Key highlights from S&P Global Market Intelligence's latest fintech analysis include:

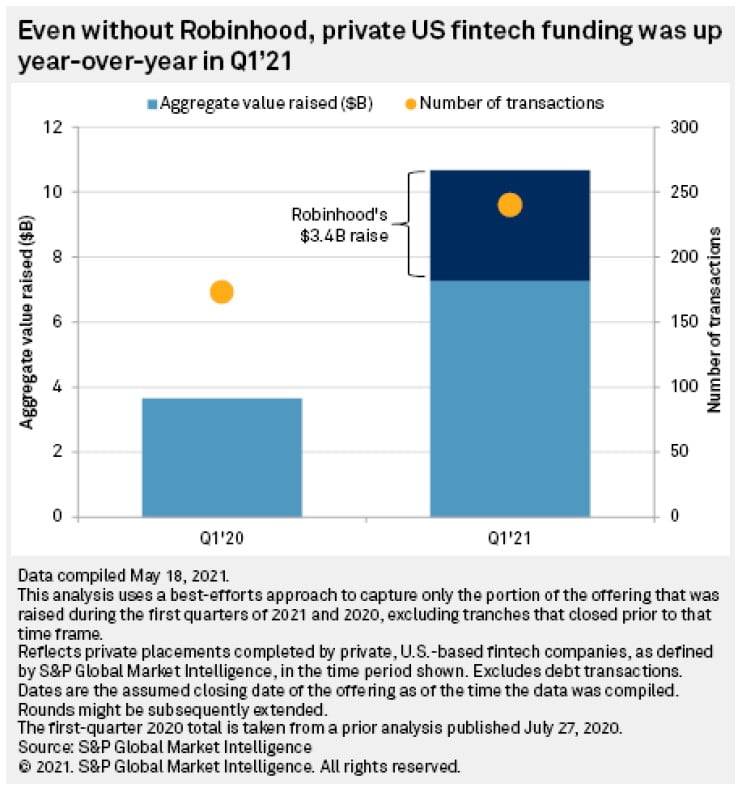

- Venture capital funding to privately held US fintechs is easily on pace to end 2021 higher than 2020’s total. Companies raised $10.67 billion in the first quarter of 2021 alone, which is only $7 billion shy of the $17.79 billion raised for all of 2020.

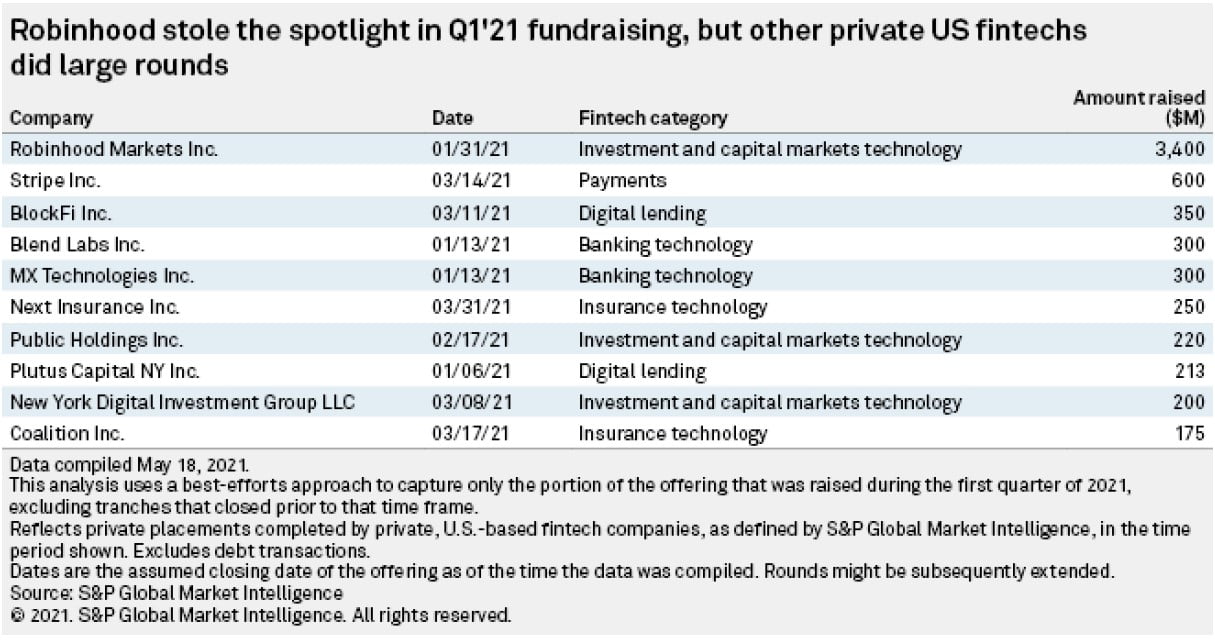

- Nearly a third of the Q1’21 total was from trading app provider Robinhood Markets Inc., which in late January secured $3.4 billion in funding to meet clearinghouse requirements amid a sudden wave of buying in GameStop Corp. and other "meme stocks." But even without Robinhood, U.S. fintech funding nearly doubled year over year in the first quarter of 2021, and volume was approximately 39% higher. The growth suggests increased VC investor confidence in the sector, in our view.

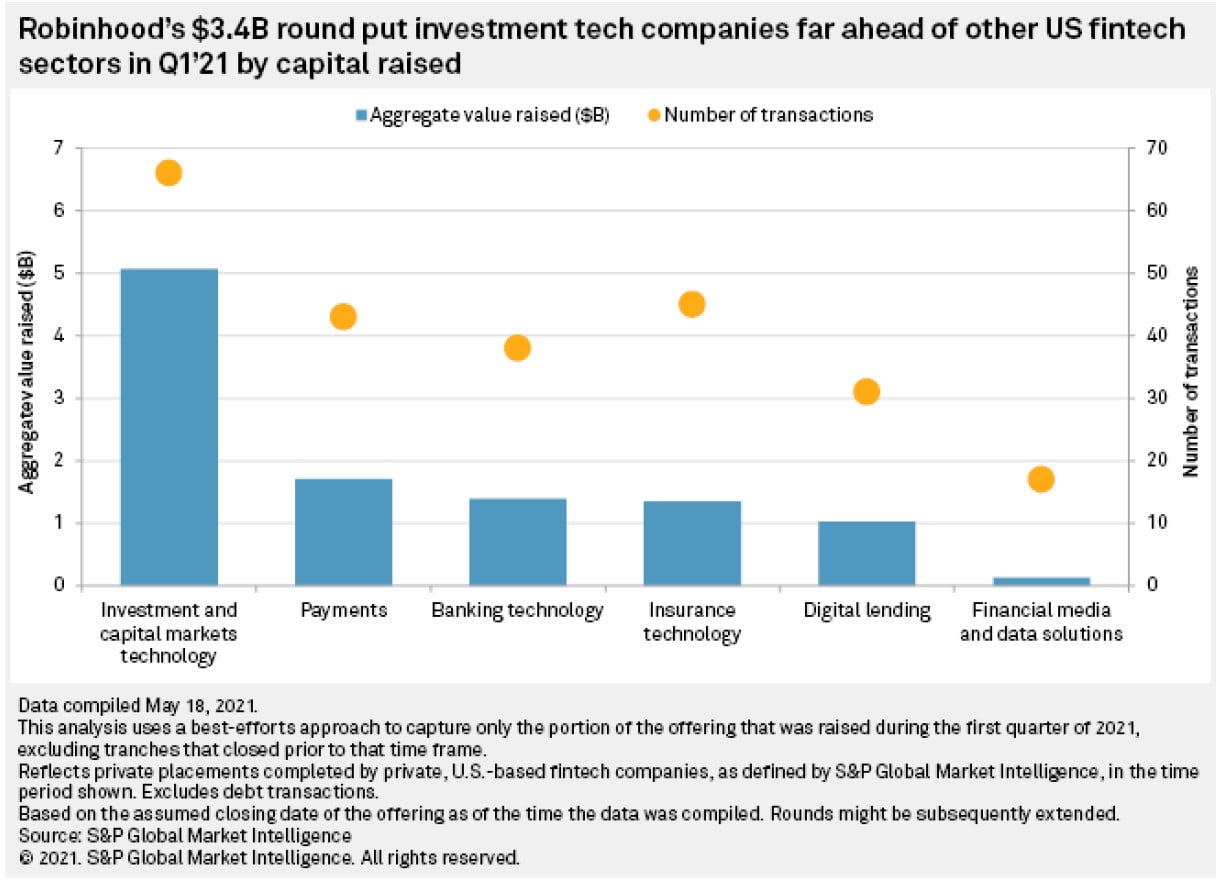

- Of the different types of fintech companies, investment and capital markets technology attracted the most VC dollars in Q1’21, which makes sense given that Robinhood falls into that category. But it was also the most popular when measured by the volume of funding rounds. Fervent retail trading activity and the need for architecture to support it likely enticed VC investors to the space.

VC funding spigot still wide open for US fintechs

Venture capital investors remained bullish on the U.S. financial technology sector in the first quarter of 2021.

Privately held US fintechs raised $10.67 billion in the first quarter. Nearly a third of that was from trading app provider Robinhood Markets Inc., which in late January secured $3.4 billion in funding to meet clearinghouse requirements amid a sudden wave of buying in GameStop Corp. and other "meme stocks."

But even without Robinhood, US fintech funding nearly doubled year over year in the first quarter of 2021, and volume was approximately 39% higher. The growth suggests increased VC investor confidence in the sector, in our view.

While uncertainty over the impact of the COVID-19 pandemic gave some VC investors pause in the latter half of March 2020, most of the first quarter of 2020 was representative of normal activity and therefore still seems useful for a yearover- year comparison. The pandemic's impact could be seen more clearly in April 2020, when the volume of U.S. fintech funding transactions fell roughly 38% versus the prior month.

Of the various types of fintech companies, Robinhood falls into S&P Global Market Intelligence's "investment and capital markets technology" category. As one would expect, that category attracted the most funding, by amount raised, in the first quarter of 2021. It was also, by far, the most popular in terms of the volume of funding rounds.

While Robinhood was a clear outlier, it was not the only company in the investment and capital markets technology category that completed a large raise in the first quarter. Public Holdings Inc., which provides a commission-free trading app similar to Robinhood's, closed a $220 million round, and New York Digital Investment Group LLC was not far behind with a $200 million raise. The latter, more commonly known as NYDIG, provides custody, settlement and other services for cryptocurrencies.

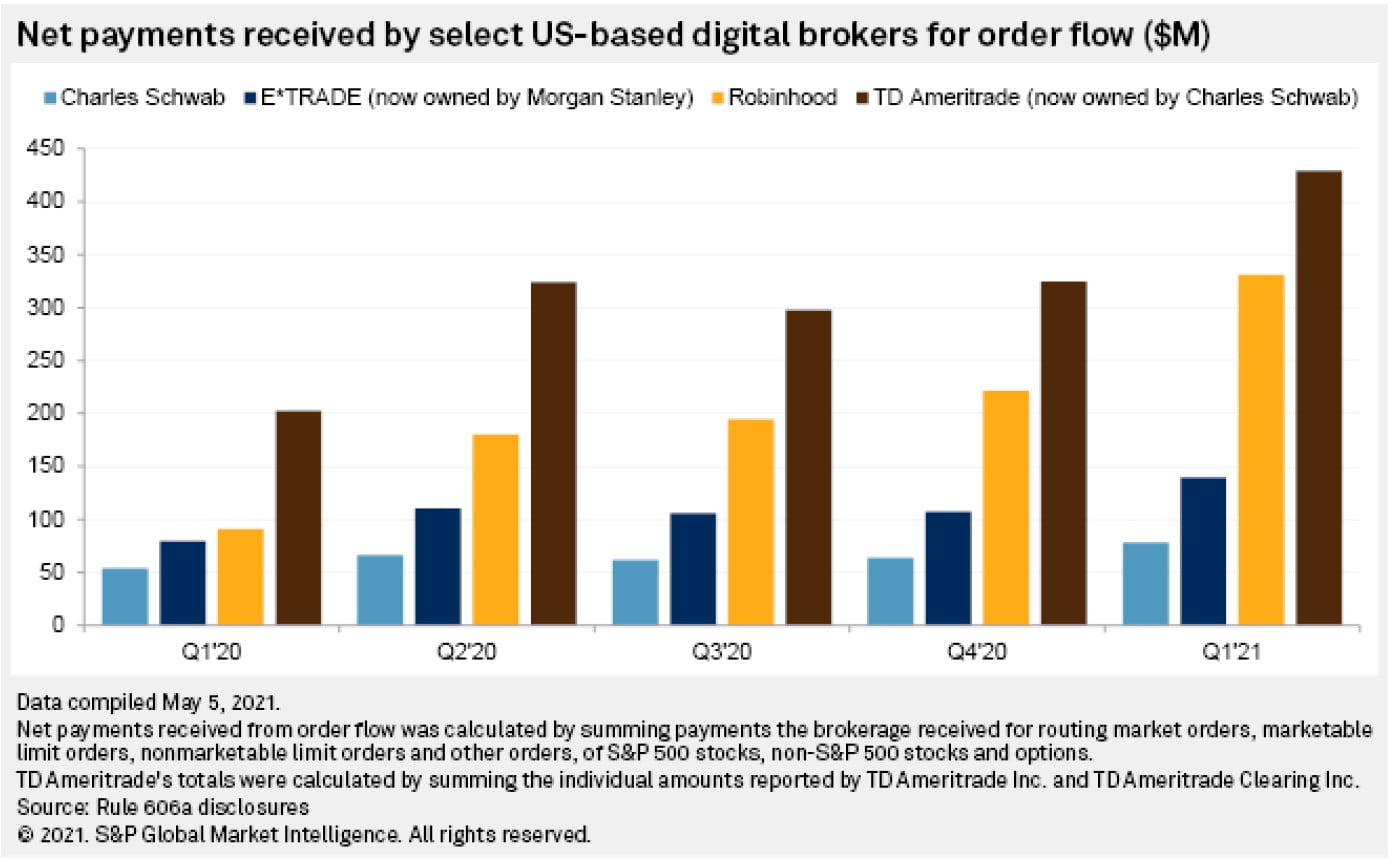

One of the recent dividing lines between Robinhood and Public Holdings is payment for order flow. Following the onset of the meme stock frenzy, Public announced Feb. 1 that it would stop receiving payments for routing trades to market intermediaries and instead route orders directly to exchanges. At the same time, Public introduced a feature giving users the option to add a tip on top of their trade, like one would at a restaurant.

Like other retail trading apps, Public has other sources of revenue, including securities lending and earning interest on the un-invested cash in customer accounts. Robinhood generates revenues in these ways as well, but it is probably far more loath to give up the practice of selling order flow, seeing as how it received $687.1 million from such payments in 2020, followed by $330.9 million in the first quarter of 2021.

Robinhood is reportedly planning to complete an IPO in June, according to a Bloomberg article published May 18. Once it does, its capital raises will no longer be included in our quarterly VC funding tallies (which are limited to private company raises). Several other fintech companies, across all categories, have either completed an IPO or are planning one. Payment processor Marqeta Inc. filed for an IPO May 14 and tech-focused health insurer Bright Health Inc. filed for one May 19.

There are other routes to the public market, including a direct listing or a reverse merger with a special purpose acquisition company. SPACs, also known as blank-check companies, hit a speed bump in April when the U.S. Securities and Exchange Commission took issue with how companies were accounting for warrants. But there are plenty of existing blank-check companies and they continue to strike deals. Singapore-based Grab Holdings Inc. made headlines in April, agreeing to a reverse merger that values the company — which began as a ride-hailing app but now offers a variety of services, including fintech ones — at roughly $40 billion. In the insurtech realm, homeowners-focused Kin Insurance Inc. is considering a SPAC deal, according to a May 19 Bloomberg report.

It seems a pretty safe bet to say that full-year 2021 funding will top the prior year in amount raised, as the 2020 total was $17.79 billion. That means companies would have to raise only about $7 billion more in 2021 to match the level recorded in 2020. Given that the normalized first-quarter 2021 total was $7.27 billion (excluding Robinhood), it seems likely that the 2021 total will eclipse 2020 and could even do so in the second quarter.

While companies like Robinhood going public will leave large voids in future VC funding totals, we think the trend should, at the same time, be an encouraging sign to early-stage investors that there is an eventual pathway to a lucrative exit.

Article by Thomas Mason, S&P Global Market Intelligence