Discusses the trial results, analyst commentary and Fintel platform analysis

On Monday, biopharmaceutical firm Vaxcyte Inc (NASDAQ:PCVX) led the market higher as it rose 60.4% higher closing at $33 after reaching as high as $36.10 intra-day after releasing topline data from a proof-of-concept study of VAX-24. Shares continued their gains on Tuesday, rising a further 5.6% and bringing the total two day gain to 69.4%.

Q3 2022 hedge fund letters, conferences and more

Find A Qualified Financial Advisor

Finding a qualified financial advisor doesn't have to be hard. SmartAsset's free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

If you're ready to be matched with local advisors that can help you achieve your financial goals, get started now.

Vaxcyte's Stock Rallies

The stock is currently trading at 52-week highs and has a 2022 gain of 32.5% against a market that is majorly in the red.

The study of VAX-24 was used to evaluate the safety, tolerability and immunogenicity of the VAX-24 candidate in healthy adults that were aged between 18 to 64.

VAX-24 is Vaxcyte’s 24-valent pneumococcal conjugate vaccine (PCV) which is being designed for a target addressable market worth about $7 billion each year.

The study found that VAX-24 met or exceeded the primary safety and regulatory immunogenicity standards that were required in the study and reportedly demonstrated a similar safety profile to Pfizer's (NYSE:PFE) Prevnar 20TM (PCV20) vaccine for all doses studied in the trial.

Patients that reported local and systemic reactions from the vaccine noted that it moderated within several days with no serious adverse effects or chronic illnesses happening as a result.

Vaxcyte’s CEO and Co-Founder Grant Pickering commented in the press release stating, “The findings indicate a potential best-in-class profile for VAX-24 and validate our carrier-sparing approach to enable the development of broader-spectrum PCVs”

Pickering also highlighted “We believe this presents an opportunity to set a new bar for immunogenicity standards for pneumococcal vaccines”

PCVX expects that the full six-month safety data from the Phase 2 trial will be ready during the first half of 2023 and intends to move forward into a Phase 3 program with the vaccine in the second half of 2023.

Analyst Joseph Stringer from Needham called the result a “home-run” best-case scenario that significantly de-risked and validated both the platform and the company.

Stringer highlighted that VAX-24 has the potential to be a major disruptor of the $7 billion and growing size of the Pneumococcal vaccine market. Needham remains ‘buy’ rated on the stock with a $52 price target.

Roger Song from Jefferies Research is also extremely bullish on the stock as he expects to see Vaxcytes vaccine to play a major role in the future $8 to $10 billion dollar PCV market. Jefferies remain buyers of the stock with a $50 price target.

Across the street, all institutions remain upbeat on the outlook of PCVX with a consensus ‘buy’ recommendation and a $52 average price target.

Fintel’s platform analysis of PCVX highlighted a large number of net insiders that have sold stock in the last 90 days. The quant platform has given PCVX a low insider accumulation score of 16.63 when ranking the company against 14,609 other constituents.

Vaxcyte has experienced 5 net insiders that have sold stock in the last 3 months.

These have included:

- CEO and Chairman Grant Pickering

- President and CFO Andrew Guggenheim

- COO and EVP Jim Wassil

- SVP of Process Development & Manufacturing Paul Sauer

- VP of Research Jeff Fairman

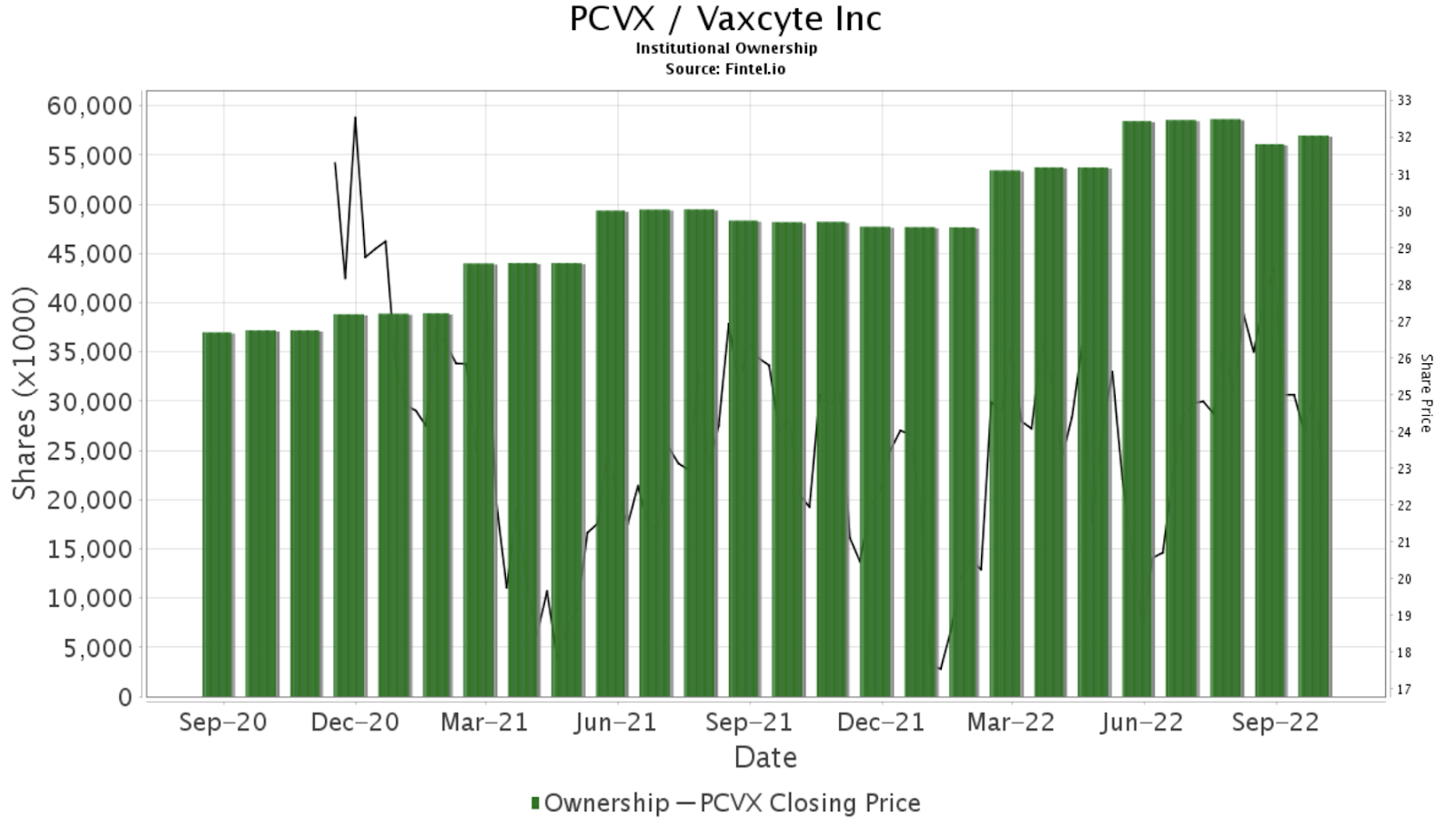

Despite these insider sales, PCVX is supported by 292 institutional investors that are on the register and own about 60 million shares.

The chart provided below shows the slow but gradual increase of institutional interest and ownership since the stock listed.

Article by Ben Ward, Fintel