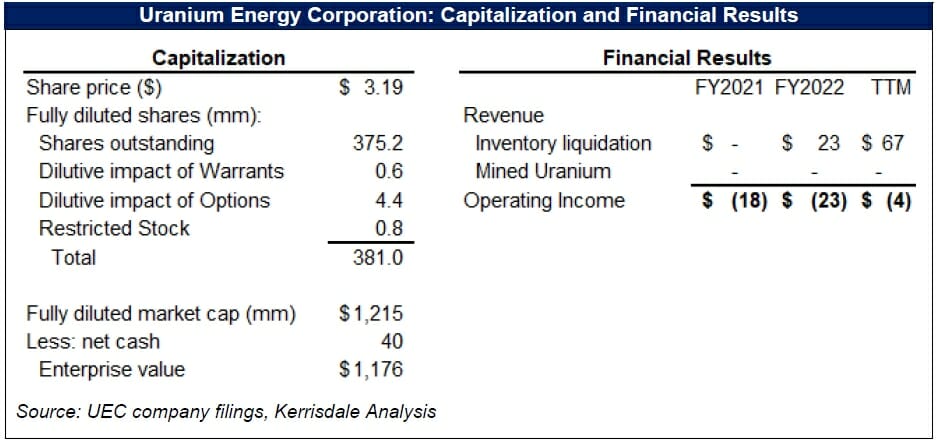

Kerrisdale Capital is short shares of Uranium Energy Corp. (NYSEAMERICAN:UEC), a “fast growing” $1.2 billion uranium miner that has indeed exhibited a blistering growth rate since its entry into the uranium business in 2005.

But on the wrong metric – shares outstanding, the company’s best-selling product, which have grown by an astounding 10x over that time. Revenue from selling mined uranium has been much less consistent, first making an appearance in Fiscal 2012 and last seen in Fiscal 2013.

Q4 2022 hedge fund letters, conferences and more

Over the course of the last two uranium bull markets – in 2006-7 and 2010-11 (the latter abruptly cut short by the Fukushima accident) – UEC completely failed to exploit the run-up in prices, only belatedly mustering a meager half million pounds of mined uranium – unprofitably and inconsistently – between 2012-2013.

While we’re presently optimistic on uranium prices and believe that they need to rise to meet continued demand growth, we don’t expect UEC – or its shareholders – to be any more successful this time around.

UEC has spent the last few years acquiring uranium deposits with both its expensive stock as well as cash raised by issuing its expensive stock. As we dug into UEC’s deposits, we discovered that the resource edifice is just a façade.

Of the company’s stated 140Mlb of estimated resources in the US, none can be mined profitably at current uranium prices. A quarter requires conventional mining in Arizona, which is unlikely to pass profitability or environmental hurdles this century, while the rest can only be mined in-situ where low recoveries mean that less than two thirds are retrievable.

Finally, only about a quarter of the resources will be economically viable even at the much higher uranium prices optimists assume will be needed to balance the market in coming years.

Meanwhile, UEC’s Canadian resource portfolio – acquired last year in two transactions worth a combined $350 million – is comprised of 5 significant assets. Like its US-based projects, none can be mined profitably at current uranium prices.

Additionally, in two of them, UEC’s resource estimate is overstated by 50-100%; one is too small to mine conventionally unless uranium prices triple; one was acquired for $150 million after the informed seller marked it down to zero; and the final one is operated by Cameco, which has suggested that production will probably not get going for another 12-15 years (though it could take longer depending on the trajectory of the uranium price).

We estimate that UEC’s underlying assets are worth just over $350 million at best, which is about 30% of its current market capitalization.

UEC’s market capitalization, and its success in selling almost half a billion dollars’ worth of stock over the last 20 years (excluding its initial public offering), are a testament to the triumph of the company’s prolific use of paid stock promotion.

Outlets shilling for UEC have spanned a wide range – from media companies founded by UEC’s CEO Amir Adnani and owned by his family members to much less savory conspiracy-theory purveyors that urge their “clients” to beware of the Deep State Globalists and listen – simultaneously – to both Adnani and…Steve Bannon.

Neither is UEC’s involvement with these disreputable hawkers some sort of youthful indiscretion of its microcap past – UEC was last disclosed as paying hundreds of thousands of dollars for this kind of publicity just last month.

These shenanigans make a lot of sense if UEC’s management team believes – as do we – that the fundamentals just don’t exist for real investors to be interested in the company: when you look beneath the surface of this uranium miner, there’s not much there.

I. Investment Highlights

UEC is managed more like a penny-stock pump-and-dump than a legitimate mining company. Since it entered the uranium business in 2005, UEC has mined and sold a grand total of about half a million pounds of uranium, all from the small Palangana project it still owns in Texas, and all between 2012-2013.

Instead of mining, a lot of effort at UEC has been expended on selling stock – $465 million of it since, but not including, its IPO – which has been the only way to generate cash in the absence of any functional operating business.

Before its recent rise to the billion dollar club, UEC languished in microcap territory for almost the entirety of its existence, during which it spent large sums – millions of dollars and hundreds of thousands of issued shares – to promote its stock to retail investors through questionable paid stock promoters.

Some of these – like Blender Media and Brazil Resources – were “media service companies” actually founded by UEC’s CEO Amir Adnani. The style of promotion was laid out in a 2015 lawsuit, the facts of which UEC did not even bother denying:

Uranium Energy paid, "directly or indirectly, approximately 30 different entities to publicize its stock" with a "massive promotional campaign" involving at least 40 online advertisements. The third-party promoters released these advertisements in "waves" in four different months: June 2013, May 2014, November 2014, and April 2015.

Each advertisement was styled using the "guise of widely circulated 'newsletters' and 'alerts' authored by seemingly objective analysts and observers" when, in fact, "the information came, directly or indirectly, from Uranium Energy."

Each advertisement relayed positive information about Uranium Energy's stock, encouraging readers to invest. In short, the amended complaint alleged a scheme to "pump" the stock price…

Some of these promotions worked, others didn’t. What should concern shareholders is that UEC still does it. In June of last year, and with a market capitalization of about $1.2 billion, UEC entered into a wide-ranging agreement with Gold Standard Media (GSM) – an extremely questionable network of conspiracy-theory promoting media affiliates – that would cost over half a million dollars in cash and shares and would have GSM promote stories encouraging investors to bet on uranium through UEC stock.

More recently, UEC paid CarbonCredits.com $200,000 to promote UEC stock to CarbonCredits’ readers from October 2022 through February 2023. For context, UEC spent $620,000 in capital expenditures in all of fiscal 2022, even as it told investors that the Burke Hollow project was being ramped up for production (which would require a lot more capex). If UEC fancies itself a legitimate miner, why does it continue to operate as if it's a dubious microcap?

The projects in UEC’s two “Hub & Spoke platforms” are comprised of low-quality overstated uranium deposits that are unlikely to be mined profitably any time soon. The most noticeable promotional trick UEC plays – on both retail and institutional investors – is in its resource claims.

The idea is to show a huge number of “pounds in the ground” across its project portfolio, a quantity that’s often compared by sell-side analysts to a miner’s market value as a heuristic to assess valuation. UEC discloses total estimated resources of 266Mlb of uranium (excluding its recent acquisition of the Canadian Roughrider project from Rio Tinto, which would add 58Mlb to that number).

In the US, it boasts of 134Mlb across a variety of projects in Texas, Wyoming, and Arizona. But even a cursory look at the composition of resources shows that the number is a joke. 37 million of those pounds are conventional deposits in Arizona which are unlikely to be mined in the next century given their extremely small size (for a conventional project) and the environmental issues involved (especially in a region where conventional mining hasn’t been attempted in 75 years, during which time the population of nearby Phoenix has grown by almost 20x).

Read the full report here by Kerrisdale Capital