Spruce Point Capital Management, LLC (“Spruce Point” or “we” or “us”), a New York-based investment management firm that focuses on forensic research and short-selling, today issued a detailed report entitled “A Porch On A Flimsy Foundation” that outlines why shares of Porch Group, Inc. (NASDAQ:PRCH) (“Porch” or the “Company”), face up to 70% downside risk.

Q1 2021 hedge fund letters, conferences and more

Porch Is The “Everything” Spaghetti Business Model In Search of Satisfying A Consumer Need That Doesn’t Exist: 50% - 70% Downside Risk

Spruce Point believes that Porch Group (NASDAQ:PRCH), a recently closed SPAC deal, is a classic example of a Company that has never found a business model that makes sense and was in technical default with a going concern warning before using the frothy SPAC market as an opportunity to allow insiders to dump shares. After having been conceived nearly 10 years ago, Porch has pivoted its business model multiple times, and we believe has never generated a single dollar of operating cash flow. It claims to be many things, but at its core, the Company essentially wants to be the “everything” solution for home services. Spruce Point believes that such a wide-ranging business that fails to solve any real consumer problem, or satisfy an unmet consumer need, will continue to fail. New investors injecting capital into the latest iteration of Porch’s business would be wise to carefully study The Active Network (formerly NYSE: ACTV) where Porch’s CEO Matt Ehrlichman previously served as Chief Strategy Officer. ACTV pursued a similar business and financial strategy in its hopes of becoming the “everything” software portal with expanding vertical solutions to group based activities. Spruce Point’s co-founder helped to expose ACTV’s flawed business strategy and accounting shenanigans in a report in 2012, which led to management quickly resetting expectations lower, and its Chairman and CEO to abruptly depart.

We believe at best Porch’s CEO has unethically portrayed his biography to investors when at The Active Network by concealing his involvement in HelpScore, the predecessor to Porch.com, and at worse committed securities misrepresentation. In fact, there was never a public filing made that he relinquished his executive position at ACTV. In addition, we believe Ehrlichman exaggerates his contributions to ACTV during his tenure.

We believe Porch has concealed or obscured numerous business activities from 2017 – 2021. As a result, investors’ can’t see how miserably Porch failed in its corporate partnerships and through its acquisition strategy. For example, Porch is currently being sued for fraud by Kandela for selling “Vaporwear” or services that don’t exist. We find additional evidence of an obscured recent partnership service that doesn’t exist

We believe Porch has recorded a $33m transaction on its book that had absolutely nothing to do with the Company, and made conflicting statements about it to the SEC. We believe this transaction allowed Porch to avoid taking a staggering goodwill impairment

Porch Doesn’t Include Leases On Its Balance Sheet

We estimate $1.1 billion of maximum potential exposure to financial guarantees are being kept off Porch’s balance sheet, thus understating the Company’s true leverage. Unlike other public peers, Porch also doesn’t include leases on its balance sheet and its $40m of claimed debt is closer to $51m

Experts familiar with Porch disagree with its home inspection economic assumptions, a major pillar of its growth strategy. Porch claims each lead is worth $25 but experts indicate the real value is $14 – $15, or 40% lower. Porch assumes it receives $4 per inspection, but in practice offers discounts

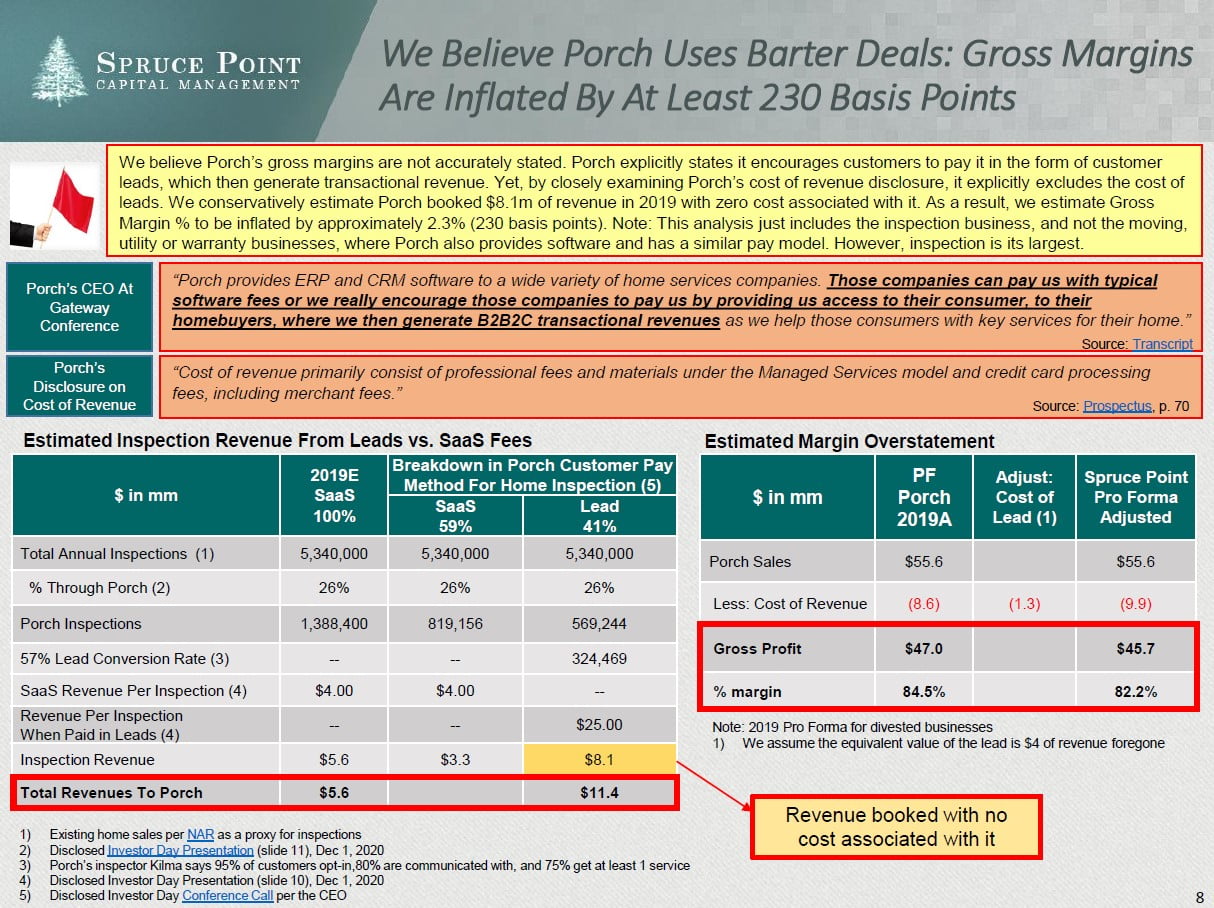

Given negative EBITDA, EPS and OCF, we believe Porch has artificially inflated its gross margin, and positioned this metric to investors as an appropriate valuation metric. Porch books revenues for selling leads to home service companies, but doesn’t account for the cost of these leads which are effectively barter transactions. Barter transactions have historically come under immense scrutiny by the SEC, resulting in many accounting fraud cases. We estimate gross margins are overstated by at least 230 basis points

Buyer Beware

Porch has never made money, and its recent uptick in share price is likely correlated to new home sales and home remodeling, tailwinds during COVID-19 that look to become headwinds as the economy opens and mortgage rates rise. We find tremendous problems with its recent spree of low quality acquisitions made for 2x sales and believe new competition is coming. Porch wants investors to believe it’s a high growth, high margin SaaS company deserving a 9x sales multiple. However, we see Porch for what it is: a low quality lead generation business, and another attempt by Ehrlichman to recreate The Active Network vertical software story, which ultimately failed and was taken private at 2x sales. Applying a generous 2x – 4x multiple range on Porch’s 2021E sales puts its stock value at $5.06 – $8.56 per share (50% – 70% downside).

Read the full report here by Spruce Point Capital Management.