What’s New In Activism – Twitter Poison Pill

Twitter Inc (NYSE:TWTR) has employed a poison pill in its defense against Elon Musk’s $43 billion hostile takeover bid.

The company’s board unanimously approved a one-year shareholder rights plan with a 15% threshold, according to a Friday press release. The move came a day after Musk’s offer and amid rumors private equity firm Thoma Bravo was also interested in a buyout.

Q1 2022 hedge fund letters, conferences and more

Musk, who holds a 9.1% stake, said on Thursday that he was seeking to take Twitter private at $54.20 so that he could unlock the platform's "extraordinary potential."

But the Tesla Inc (NASDAQ:TSLA) CEO may struggle to win over other investors. "I don't believe that the proposed offer by Elon Musk ($54.20) comes close to the intrinsic value of Twitter given its growth prospects," tweeted Saudi Arabian investor Prince Alwaleed bin Talal, one of Twitter's biggest shareholders.

To arrange an online demo of Insightia's Activism module, send us an email.

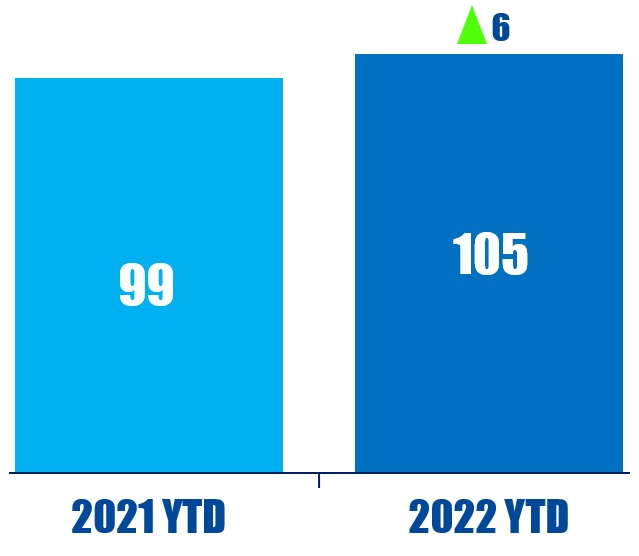

Activism chart of the week

So far this year (as of April 13, 2022), globally, 105 companies have been publicly subjected to activist demands by investors that disclose activism as part of their investment strategy. That is compared to 99 in the same period last year.

Source: Insightia | Activism

What’s New In Proxy Voting - Net-Zero-Aligned Accounting

A coalition of 34 investors, representing $7.1 trillion in assets, sent letters to leading European companies warning of increased opposition towards auditor appointments where companies fail to disclose net-zero-aligned accounting.

Members of the Institutional Investors Group on Climate Change (IIGCC) wrote letters to major European companies in November 2020, outlining their expectations governing corporate climate-related accounting.

On April 5, IIGCC members, including BMO Global Asset Management, Rathbones, and Sarasin & Partners, wrote to 17 European companies, asking why their boards were "unable to make the requested disclosures and what steps will be take[n] to address this omission in forthcoming audited accounts."

To arrange an online demo of Insightia's Voting module, send us an email.

Voting chart of the week

In 2021, environmental and social shareholder proposals at U.S. energy companies achieved an average 51.1% support. That compares to just 37.3% for all U.S. companies.

Source: Insightia | Voting

What’s New In Activist Shorts - Reliq Health Fights Back At White Diamond

Reliq Health Technologies Inc (CVE:RHT) rejected fraud allegations by White Diamond Research, saying the short seller resorted to "demonstrably false statements and conspiracy theories."

Reliq Health said on April 11 that the short report contained "defamatory, misleading, and demonstrably false statements" designed to cause a share price drop. The company called the report "spurious" and suggested this was part of a "short and distort" campaign.

"Reliq is one of countless public companies who have been targeted by short selling firms employing deceptive practices to generate profits for short sellers at the expense of shareholders and to the detriment of the integrity of the public markets," said CEO Lisa Crossley.

The comments seem to point to a recent Department of Justice probe into potentially illegal short selling tactics allegedly employed by multiple outfits, with firms such as Carson Block's Muddy Waters and Andrew Left's Citron Research facing questions.

However, White Diamond does not believe the investigation, though wide-ranging, will have a big impact on the industry. "I think it's more of a warning to keep short sellers on their toes and make sure they do the right thing," Adam Gefvert, head analyst at White Diamond, recently told Insightia's Shorts module.

To arrange an online demo of Insightia's Shorts module, send us an email.

Shorts chart of the week

So far this year (as of April 14, 2022), 17.2% of public activist short campaigns have been at European companies. That is up from 2.5% in the same period last year.

Source: Insightia | Shorts

Quote Of The Week

“Peloton will continue to be poorly valued for as long as close-knit group of insiders, who have proven themselves incapable of creating value, continue to wield voting power far in excess of their economic interest.” - Jason Aintabi