Many Americans tell money and financial related lies in this day in age. Money and finances are a touchy subject that often leads to added stress and emotion for many relationships. The subject of how much we earn, how much money we spend, how much money we save and how much debt we owe can lead to deception and fractured relationships.

Q4 2020 hedge fund letters, conferences and more

Self Financial recently surveyed 2,600 U.S. residents from across the country to try and learn more about how Americans feel about their finances in 2020 and also how honest they are with friends and family when it comes to the subject of money.

The Top 10 Money Lies Told By Americans

Self Financial found that 75.3% of Americans reported that they lie about money at least some of the time. Listed below are the top 10 money lies told by Americans in 2020:

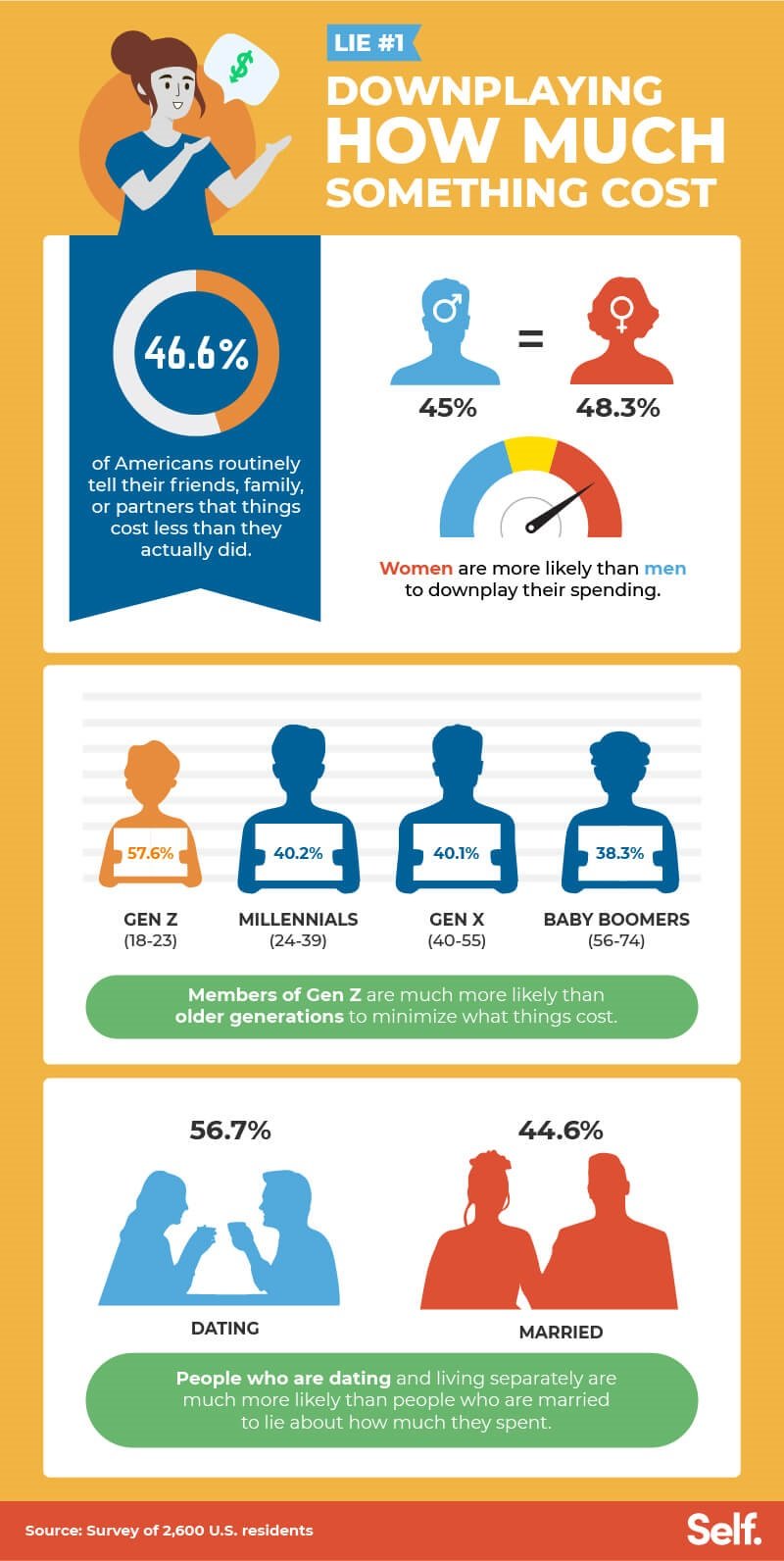

- Downplaying how much something costs to friends, family, or a partner (46.6%).

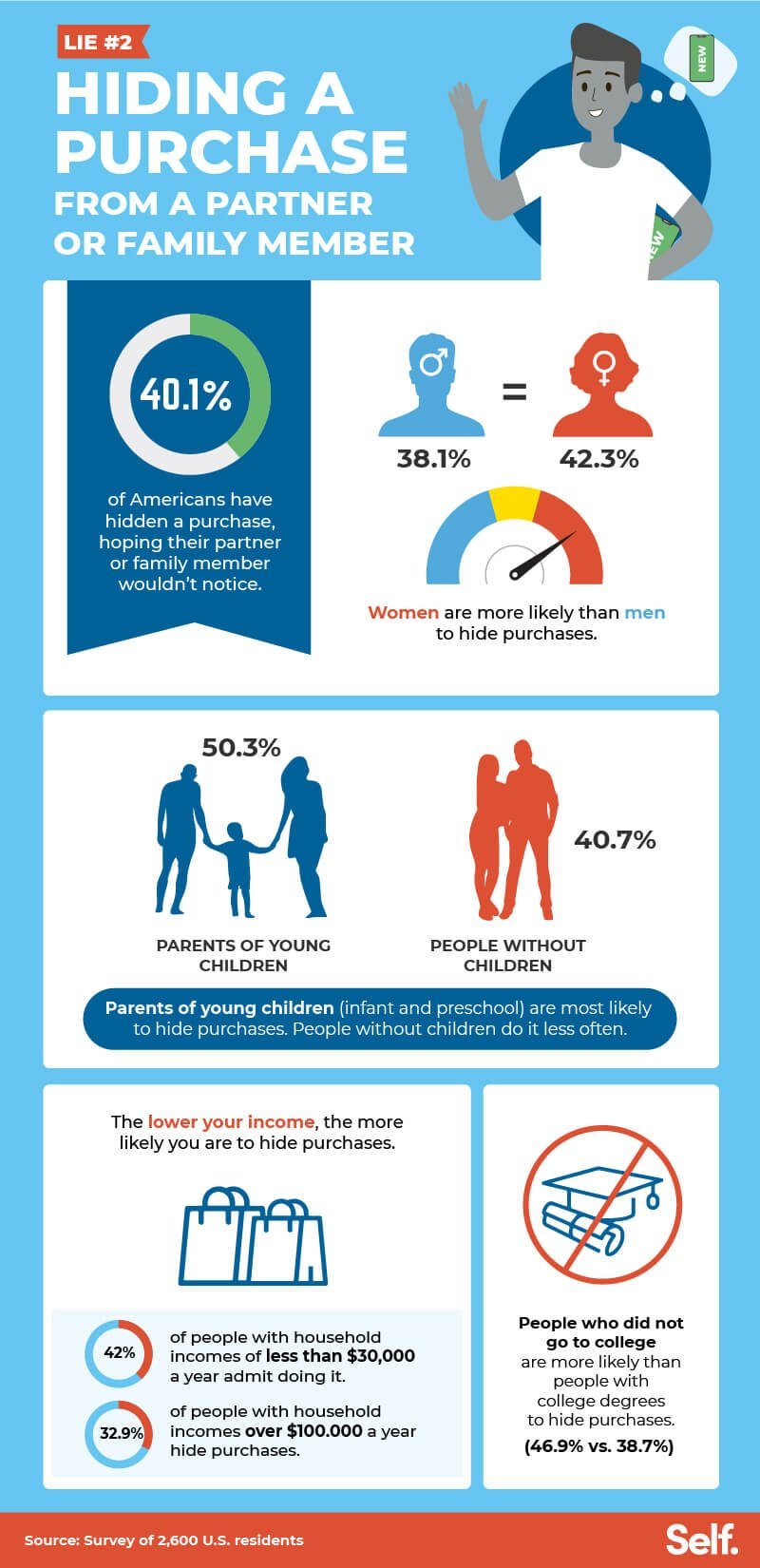

- Hiding a purchase from a partner or family member (40.1%).

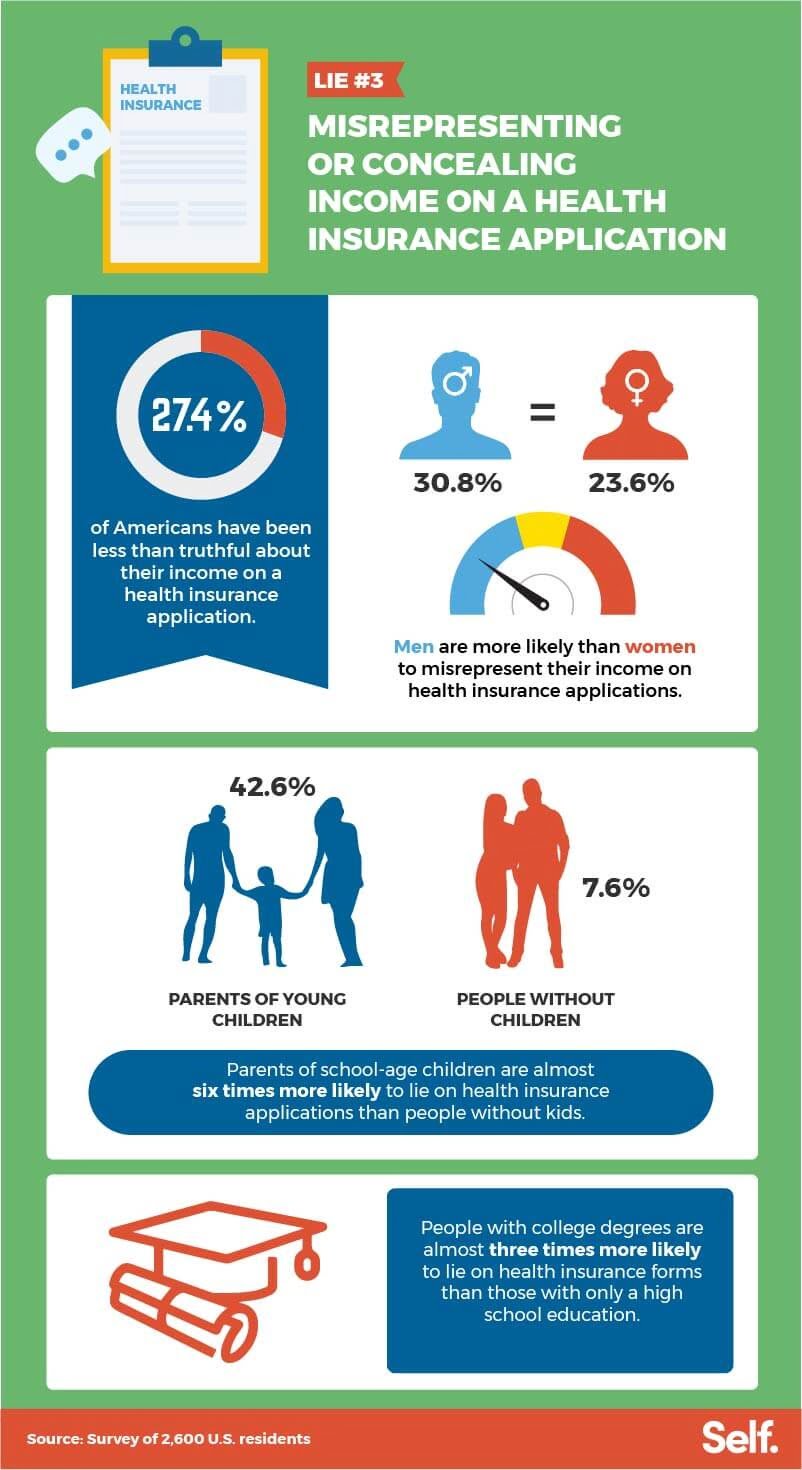

- Mispresenting or concealing income on a health insurance application (27.4%).

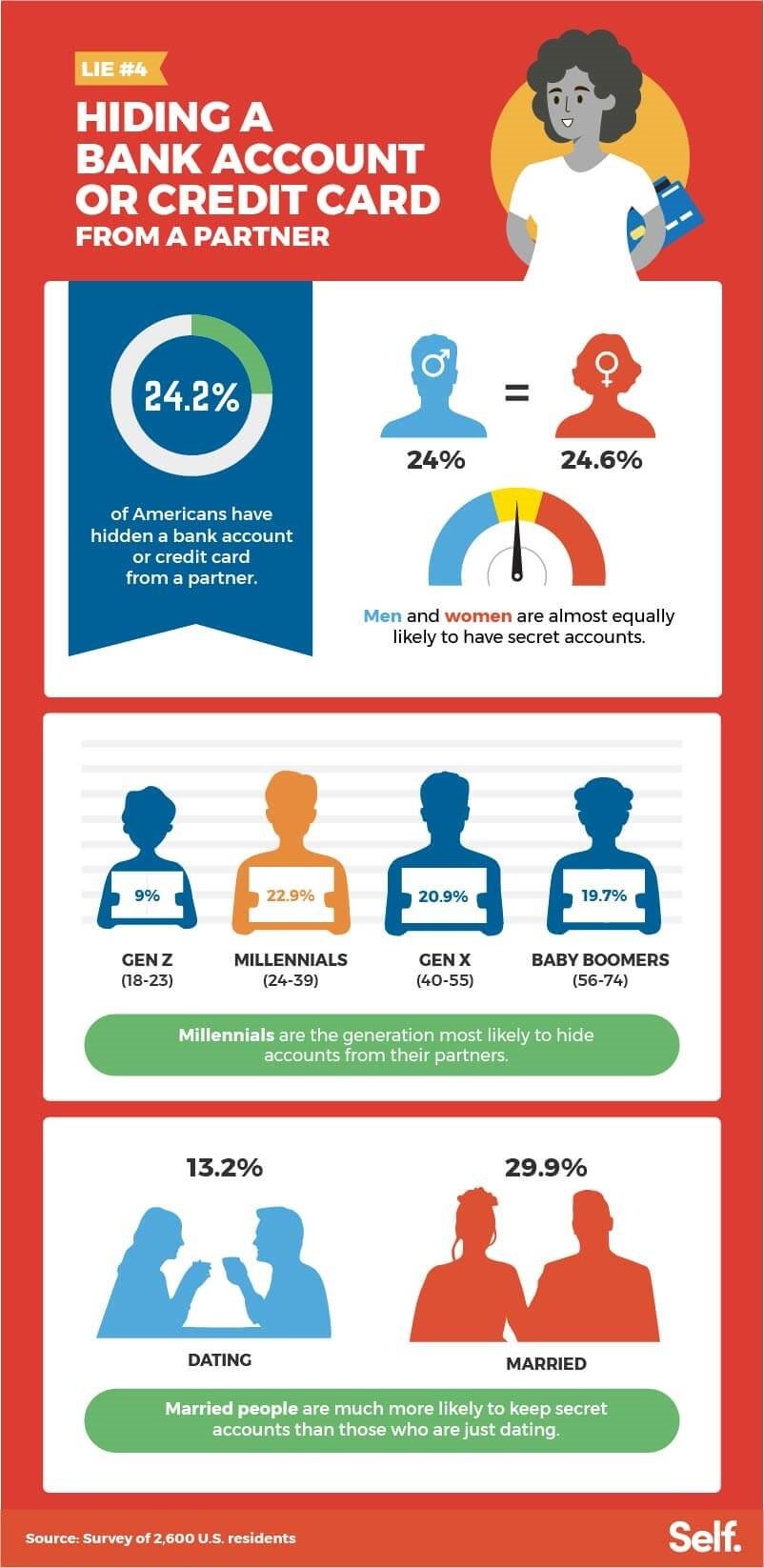

- Hiding a bank account or credit card from a partner (24.2%).

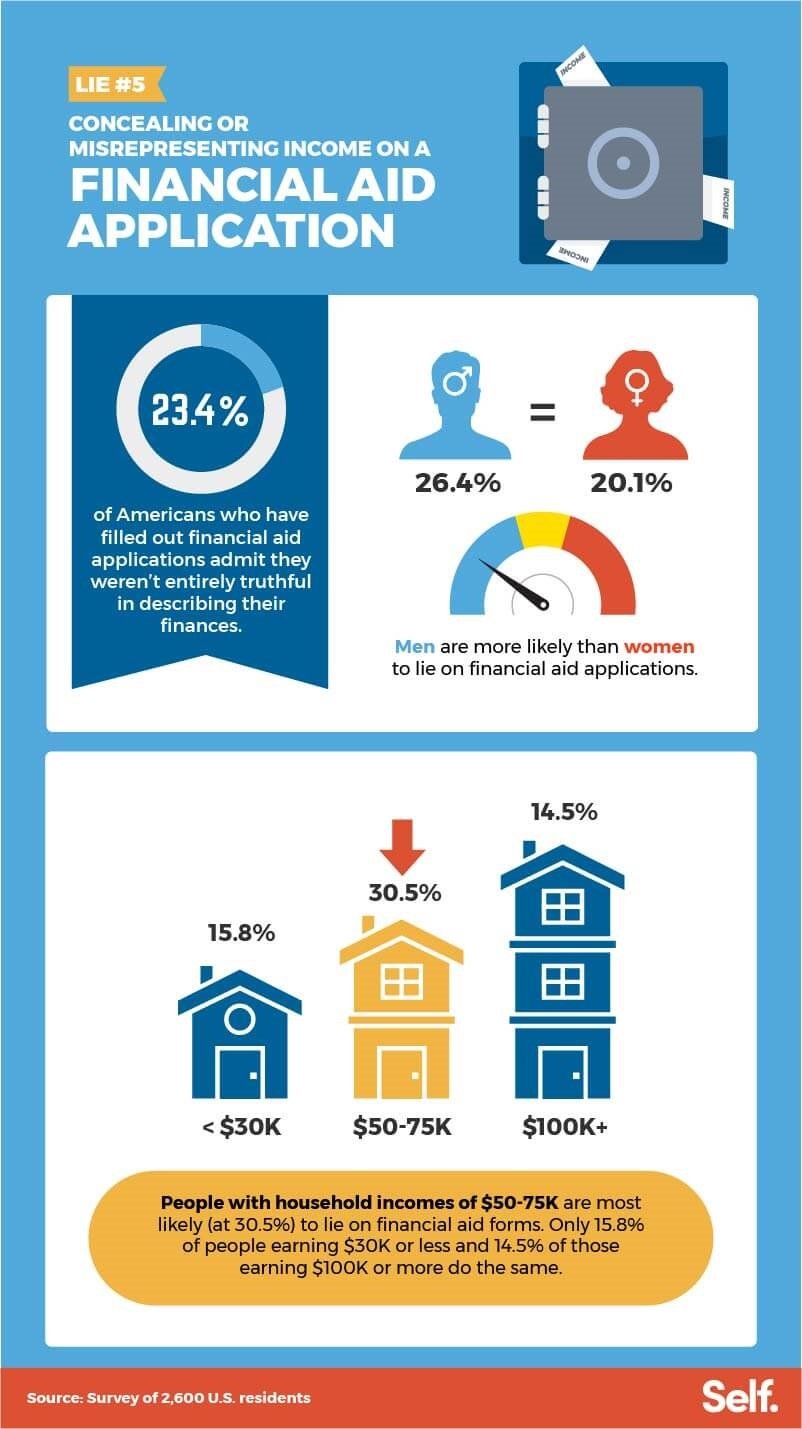

- Misrepresenting or concealing income on a financial aid application (23.4%),

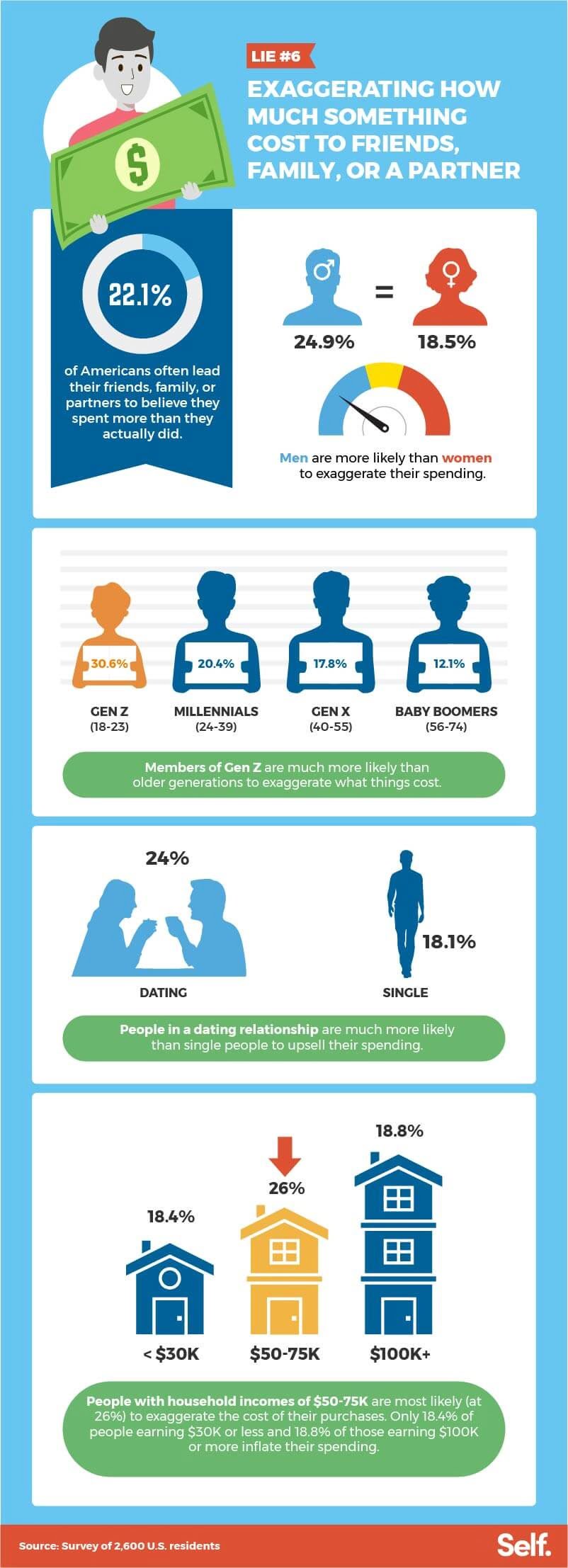

- Exaggerating how much something costs to friends, family, or a partner (22.1%).

- Lying in a job interview when asked about a previous salary (21.5%).

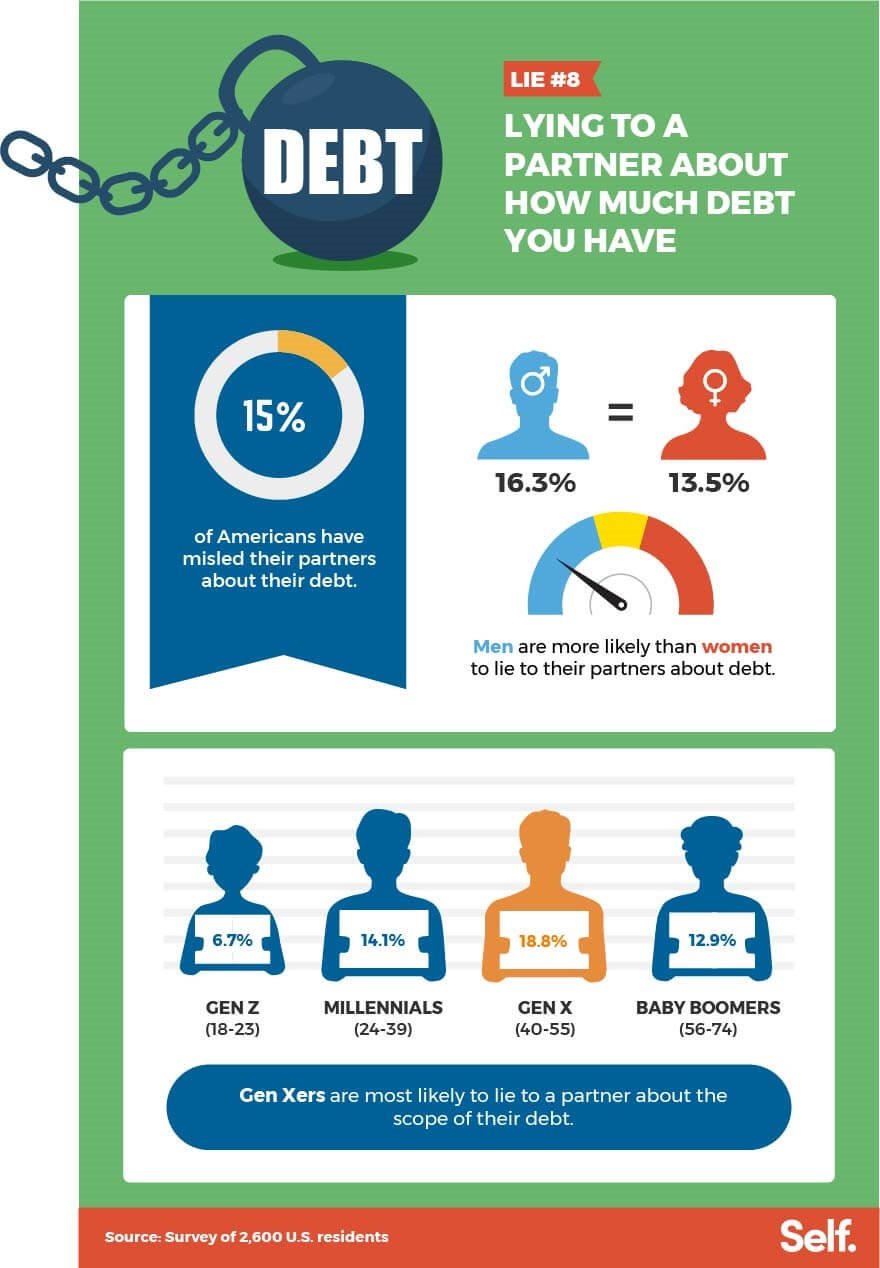

- Lying to a partner about how much debt you have (15.0%).

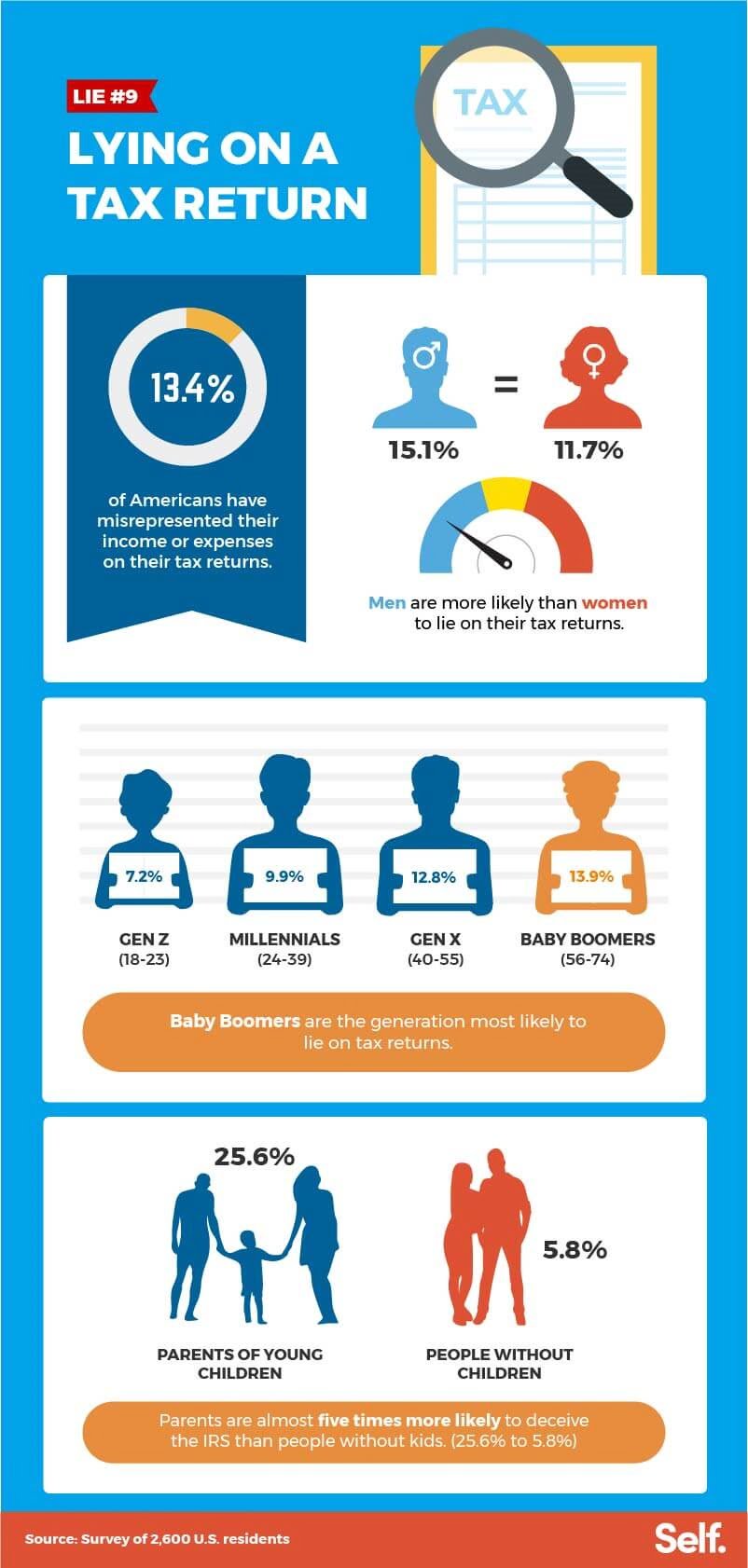

- Lying on a tax return (13.4%).

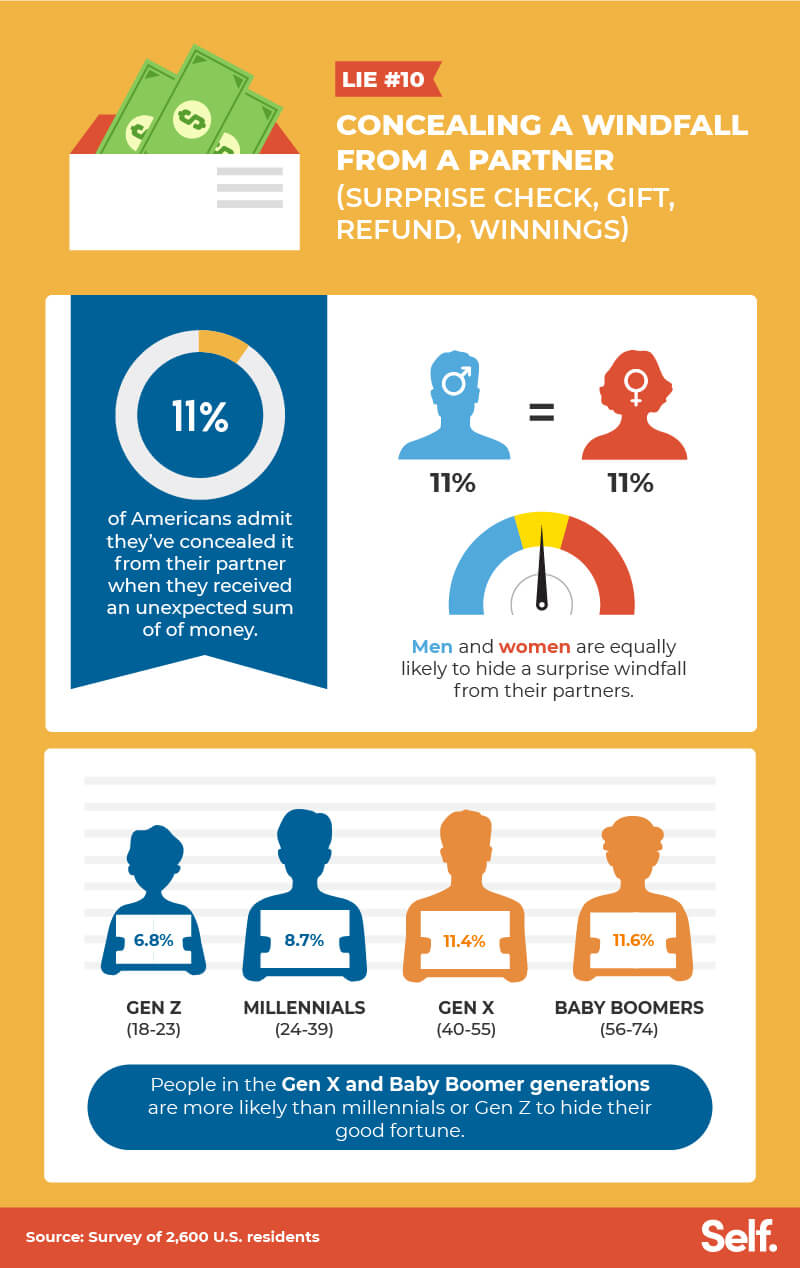

- Concealing a windfall from a partner (11.0%)

As you can see, there are many different money related lies that are told by Americans. The good news? When it comes to being honest about our finances, American are most likely to be honest with their partner or significant other, with over 45% reporting that they share everything financially with their partner. The bad news? Many Americans are much more reserved about sharing honest details of their personal finances with friends, family, and colleagues.

Lies About The Cost Of New Purchases

Let us focus a bit more on the top lie that Americans told about their finances. Over 46% of Americans surveyed said that they routinely tell their family, partners, or friends that something they bought cost less than it actually did. It is very easy for people to tell someone that something that they bought did not cost that much, when in reality it cost quite a bit more. The survey found that women and members of younger generations like Gen Z were more likely to minimize the cost of an item to others.

Another big lie that Americans tell regarding their finances is that they frequently hide a purchase from a family member or a partner. The thinking here is that they cannot be criticized for the purchased item if the other person does not notice the purchase itself. One interesting takeaway from this particular lie, is that the less money that you earn, the more likely you are to hide purchases from your partner or your family.

The full report from Self Financial on the top money related lies that Americans tell can be seen in the graphic below.