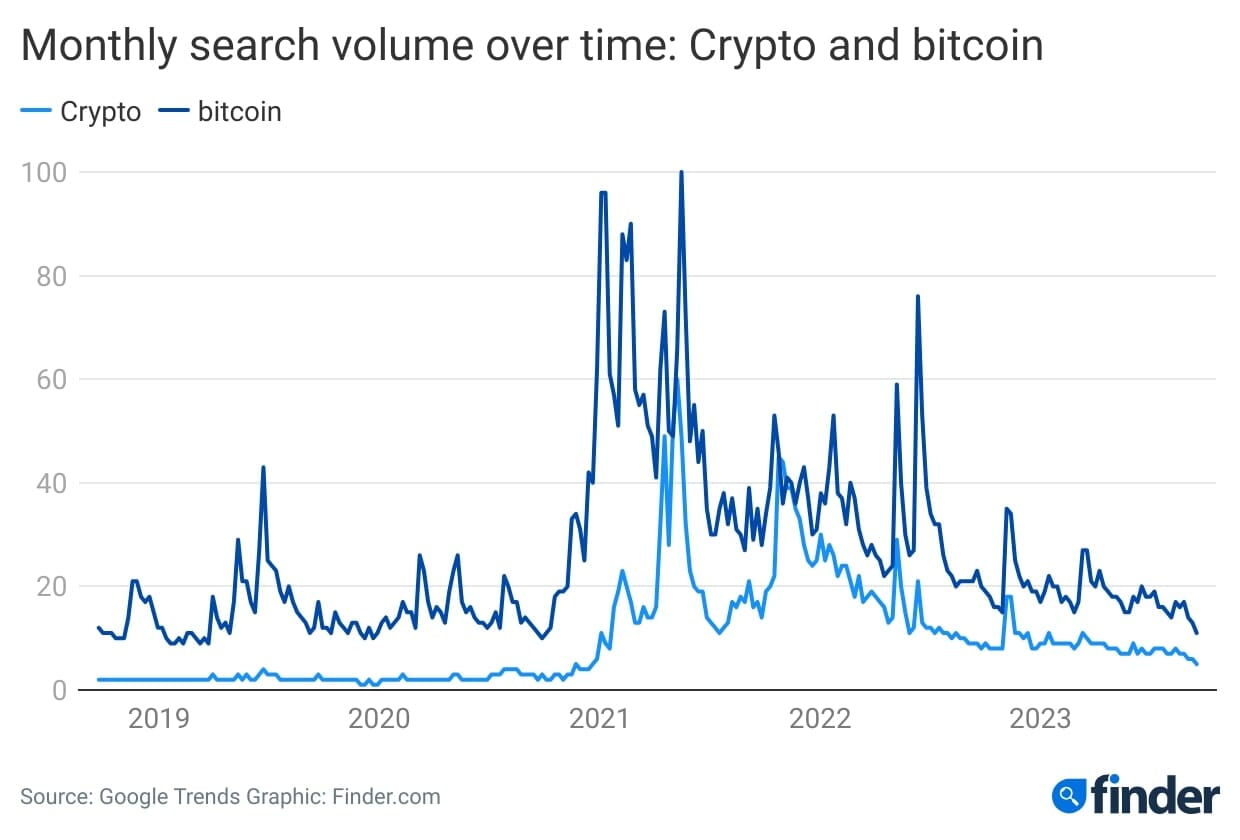

A quick Google Trends search for terms like “bitcoin” or “crypto” quickly shows you how people have lost interest in the asset class.

The stagnant price action for major crypto assets like bitcoin (BTC), ether (ETH) and solana (SOL) has lulled many into a state of boredom-induced capitulation.

However, certain recent events in crypto — especially those regarding crypto’s integration into traditional finance systems — are reason to believe that the table is being set for the next crypto bull run.

From crypto ETFs (exchange-traded funds) that may be on the horizon to new use cases for stablecoins on various blockchains, broader crypto adoption seems right around the corner.

And the ones who will likely benefit most from this broader adoption are those who will put the work in and invest while things are boring, as opposed to those who only become interested again once a new bull market is in full swing.

So, snap yourself out of that apathetic state and take heed of the following happenings in crypto while everyone else is nodding off.

The Spot Bitcoin ETF

It’s been over 10 years since the Winklevoss twins — co-originators of Facebook and owners of the Gemini crypto exchange — first filed an application for a spot bitcoin ETF. And, finally, it seems we’re on the verge of getting one.

Last week at a small event at Pub Key, a bitcoin-themed bar in New York City, James Seyffart, an ETF analyst at Bloomberg, shared that he believes there’s a 75% chance that the US Security and Exchange Commission (SEC) will approve a spot bitcoin ETF before the year is out.

If Seyffart is right, then chances are you have less than four months to buy some bitcoin before the likes of a major financial institution like BlackRock or Fidelity offers a securitized version of the asset to everyone in America who has a 401(k), an IRA or any sort of traditional brokerage account.

Seyffart believes that billions of dollars will likely flow into bitcoin upon the issuance of the spot ETF, which means we could see a rise in BTC’s price in the not-too-distant future.

An Ether (Ethereum) Futures ETF

Some have speculated that an ether futures ETF could come to market even before the spot bitcoin ETF does.

Asset management firms Ark Invest and 21 Shares have both filed with the SEC to bring such an ETF to market, the news of which caused ETH’s price to spike by over 10%.

While this type of ETF wouldn’t require the settlement of funds in ether, it would further legitimize the asset’s status in the eyes of institutional investors, which could be a boon for the price of ETH in the long run.

PayPal Issues A Stablecoin On Ethereum

In August, PayPal announced that it would issue a US dollar-pegged stablecoin — PayPal USD (PYUSD) — on ethereum.

Since PayPal has over 400 million users, this stablecoin could quickly gain traction.

The more people who use this stablecoin, the more ETH has to be used to fuel these transactions.

And the more ETH is used to pay for transactions, the more valuable the asset tends to become, as ETH is predominantly valued based on its network effects — or the number of people using the asset.

Visa Will Use The Solana Blockchain To Settle Stablecoin Transactions

In early September, Visa announced it would settle transactions using USD Coin (USDC) on the solana blockchain. The credit card company plans to employ the combination of USDC and solana to “modernize cross-border money movement,” according to a press release from Visa

If even a fraction of the over 250 billion transactions settled on Visa per year is settled on solana, we should see an increase in the value of SOL, the native currency of solana, which fuels transactions on the network.

While some crypto exchanges have delisted SOL this year due to regulatory uncertainty, others haven’t. See which of the top crypto exchanges still support SOL if you’re looking to get your hands on some in the wake of this Visa news.

Dare To Be Different

While the happenings listed in this piece shouldn’t necessarily be an indication to start purchasing crypto assets en masse, they should remind you that while crypto markets have been sleepy, the traditional world of finance is beginning to embrace crypto, which will likely be good for the asset class in the long run.

If you want to capitalize on this trend of crypto being more broadly adopted, you may want to take action now while the market is quiet. Most will do the opposite, which is why most crypto investors lose money, especially when new to the space.

The goal here is to not be like most. It’s to pay attention while most are looking away, so you have the chance to ride the entirety of the next bull run wave as opposed to just jumping on it as it’s starting to crest.

About Frank Corva

Frank Corva is a cryptocurrency writer and analyst for digital assets at Finder. Frank has turned his hobby of studying and writing about crypto into a career, with a mission of educating the world about bitcoin and other digital assets. As someone who’s lived and traveled all over the globe, he loves the idea of the world being connected by a neutral, apolitical and borderless network and digital currency like bitcoin (BTC).