A presentation on TVA Group Inc (TSE:TVA.B) (OTCMKTS:TVAGF) and TerraVest Industries Inc (TSE:TVK) (OTCMKTS:TRRVF), that Guy Gottfried gave at the Ben Graham Centre’s 2021 Virtual Value Investing Conference.

Download the PDF of the presentation here.

Q1 2021 hedge fund letters, conferences and more

Many Happy Returns: A Value Perspective on Return on Investment

To Which Rate of Return Are You Referring?

- The rate of return (RoR) of the underlying business (or asset)?

- E.g. the incremental ROE or ROIC of the business

- The RoR on the purchase price of the business?

- E.g. the forward free cash flow (FCF) yield on a stock, the cap rate on a property

- This is one way of expressing valuation; we will also call it the “initial return”

- The RoR on your investment in the business?

- E.g. the annualized total return during your holding period

Determinants of Investment RoR

- The RoR of the business and the amount of capital that can be invested at that return

- Together, these form the growth rate of the business

- The RoR on your purchase price (i.e. the initial return)

- Changes in the FCF yield between the time you buy and the time you sell

- Since the inverse of the yield is the multiple, we’ll refer to this last factor by the familiar terms, multiple expansion and contraction

Necessary, but Far From Sufficient

- Investors usually have ROE or ROIC in mind when thinking about RoR, yet in isolation, these metrics are not very informative about the business

- What about how much equity/total capital can be reinvested into the business at the incremental ROE/ROIC?

- What about other avenues besides the business into which management could deploy capital and the returns on these?

- Debt repayment, dividends, share buybacks, diversification into new businesses, etc.

- E.g. if a business with a 50% ROIC has to use all of its FCF toward the repayment of debt carrying a 5% interest rate, its actual incremental return is nowhere near 50%

- Business RoR is also uninformative about investment returns without considering the initial return based on the purchase price (i.e. valuation)

- The initial return is the base off of which future growth compounds for the investor

- It also determines the odds of multiple expansion or contraction over your holding period, one of the dominant drivers of investment returns

In a market obsessed with growth, investors often forget that for the RoR that matters most – the RoR on your investment – the initial return (valuation) is every bit as integral as the returns of the business, if not more so

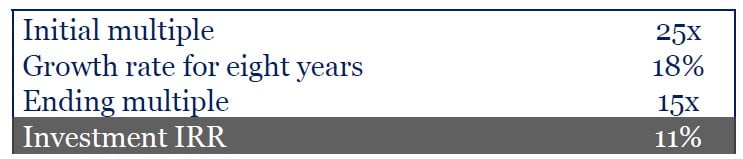

A Common IRR Fallacy

- Inattention to the initial return and changes therein as drivers of investment RoR can lead to flawed thinking

- For example, you may have seen a statement along the lines of:

- We expect ABC to compound FCF per share at 18% per annum over the next eight years. Shares of ABC trade at 25x FCF, a reasonable multiple for a company that can grow at these rates. Therefore, assuming no change in multiple, investors in ABC can achieve a compelling 18% IRR over eight years on their investment.

In reality, stocks discount the future and ABC’s multiple will drop as its growth rate slows, significantly reducing the investor’s IRR

In this example, the return of the business is almost halved by multiple contraction (and when you overpay, it can be a lot worse)

All this confirms what value investors intuitively know: price matters!

Case Study: The Complete Package High Initial Return on a High-Return Business

TerraVest Industries (TSX: TVK)

- Price: $17.00, market cap (diluted): $318 million*

- Canadian consolidator of niche manufacturing businesses

- Dominant producer of propane/ammonia/NGL transport vehicles and storage vessels, heating oil tanks, wellhead processing equipment

- Numerous additional markets targeted for growth (more on this shortly)

- Focuses on small industries with little competition for deals, which are in or adjacent to TerraVest Industries Inc (TSE:TVK) (OTCMKTS:TRRVF)’s existing operations

- Typically buys from retiring or distressed owners

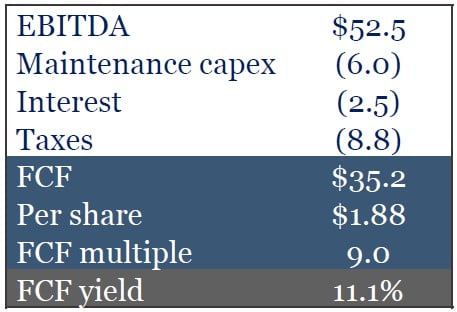

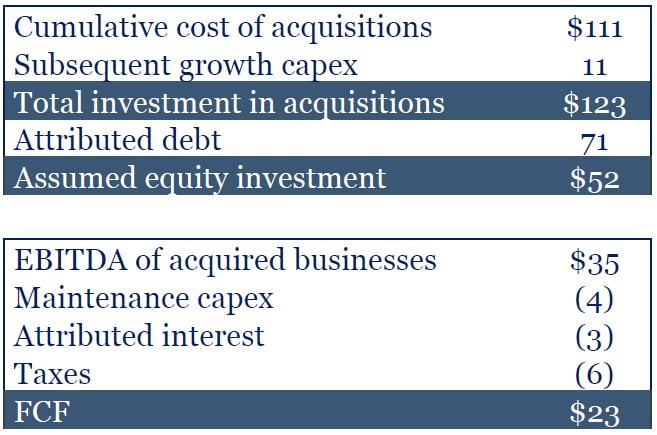

The Initial Return: Estimated Forward FCF Yield

Investors receive an 11% FCF yield upfront for a business that will likely compound capital at a significant rate for the foreseeable future

Getting Confidence in TerraVest’s FCF Yield

- Forward EBITDA will include some COVID-related subsidies (e.g. CEWS)

- Some of these are subsidizing labor costs that would otherwise have been rationalized, but some represent non-recurring income

- Offsetting the above: divisions serving Western Canada will be significantly under-earning as conditions there are at historic lows

- Additionally, forward FCF assumes no additional acquisitions or buybacks

- By contrast, TerraVest has averaged a deal a year for many years and been a consistent buyer of its stock when valuations have been favorable

Netting out these factors, we feel comfortable that our estimate is reasonable

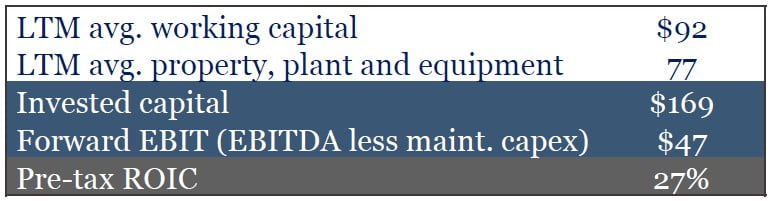

Pre-Tax Return on Invested Capital

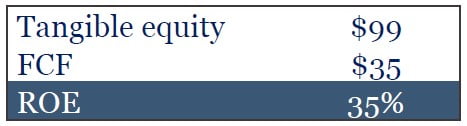

Return on Tangible Equity

Estimated Returns on Acquisitions

Management has a record of excellent returns on acquisitions

Getting Confidence in TerraVest’s Growth: Avenues for Future Investment

- Propane/ammonia tanks and trailers: continued consolidation

- Furnaces and boilers

- LNG and CNG tanks and trailers

- Green energy: hydrogen, renewable natural gas

- Others: chemical tanks, septic tanks, air filtration and purification, etc.

- As more markets are entered, more new markets open up

- Opportunistic repurchases

Large markets being targeted, coupled with management’s excellent record and relative youth (executive chairman is 46 and CEO is 37), indicate that TerraVest’s strong business RoR is sustainable for years to come

Buyback Record

- In 2012, TerraVest bought back 36% of the company through a tender offer at $2.75 per share

- Since then, the stock has risen 6x (intrinsic value by even more) and has paid nearly $4/share in dividends

- In 2018, reduced diluted share count by 10% through two tender offers for its shares and in-the-money convertible debentures

- Avg. cost of $10.41/share or just 5.5x current forward FCF

- Continuing to repurchase when sizeable blocks become available

- Bought back 3% of shares outstanding in block transactions in the past six months

Repurchase of shares at bargain valuations adds another avenue for capital deployment at high returns

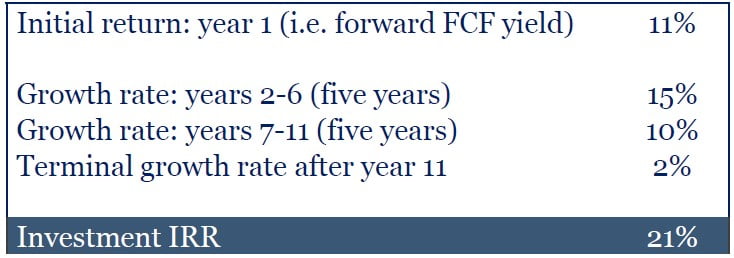

Illustrative IRR Over the Life of the Business (Investment Held in Perpetuity)

Given its record and the size of the opportunity ahead of it, TerraVest should sustain faster growth for a longer period than assumed above; further, actual returns should be enhanced by multiple expansion

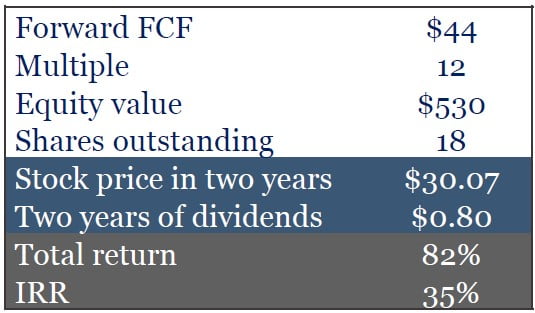

Estimated Return in Two Years

As TerraVest demonstrates the attractiveness of its capital allocation model over the long term, it is likely to benefit from continued multiple expansion

Case Study: Pure Value The Initial Return Dominates

TVA Group Inc. (TSX: TVA.B)

- Price: $2.25, market cap (diluted): $99 million*

- Quebec-based broadcaster (network TV and cable/satellite channels)

- 40% share of French-language audience in the province

- Reinvesting cash flow into content production and distribution businesses

- Also has a small and profitable, but fast-declining magazine business

The Initial Return: Using Actual 2020 Results

Getting Confidence in TVA’s FCF Yield

- Material accounting item – amortization of broadcast rights and NHL delay

- TVA Group Inc (TSE:TVA.B) (OTCMKTS:TVAGF)’s TVA Sports channel makes sizeable payments for NHL broadcast rights

- These payments are capitalized and amortized to operating expenses as games are aired

- Due to COVID, the start of the 2020/21 NHL season was postponed from Q4 2020 to Q1 2021; therefore, TVA did not begin amortizing broadcast rights in 2020

- This significantly reduced opex and increased EBITDA in 2020*

- Non-recurring COVID-related items

- Subsidies

- Other one-time items, e.g. TVA’s movie studios were shut down due to social distancing

Let’s adjust for the above by using 2019 EBITDA instead of 2020; in fact, let’s be conservative and apply a discount to 2019 EBITDA as well

The Initial Return: Estimated Forward FCF Yield (Using 2019 EBITDA With an Extra Discount on Top)

Any way you slice it, TVA’s FCF yield is astronomical for a company not in financial distress (on the contrary, debt/EBITDA is just 0.5x and 0.3x adjusted for IFRS 16). TVA also trades at just 35% of tangible equity.

Getting Confidence in TVA’s Growth (or Lack Thereof)

- TVA has actually grown EBITDA and FCF in recent years by using its abundant cash flows and strong balance sheet for acquisitions

- If it can just keep FCF stable, investors will have an outstanding outcome

- In fact, FCF in the next few years will be so large relative to the market cap that investors would be handsomely rewarded even if the business were to go into decline

- Viewed from the perspective of risk, with such a large FCF yield and almost no debt, there is very little that can hurt us

- Biggest risk is a colossally large and colossally bad acquisition; no historical evidence of management “betting the farm” on a deal

TVA does not need to grow for investors to earn a wonderful investment RoR

Low-Hanging Fruit: Losses at TVA Sports

- TVA’s consolidated profitability masks an estimated $15-20 million in annual losses at its TVA Sports specialty channel

- TVA Sports makes substantial annual payments to Rogers Communications for French language NHL broadcast rights

- The growth in subscribers and rates that TVA anticipated when it committed to these payments never materialized

- If losses at TVA Sports persist, TVA will ultimately:

- Restructure its agreement with Rogers to reduce annual payments

- Not renew the agreement when it expires

- Shut down TVA Sports

- Any of these actions would significantly increase TVA’s profitability

Cutting losses at TVA Sports is a low-risk way to grow consolidated FCF/offset the risk of declines elsewhere in the business over the next few years

Illustrative IRR Over the Life of the Business (Investment Held in Perpetuity)

Given its enormous FCF yield, TVA will generate an impressive IRR even assuming permanent declines in FCF

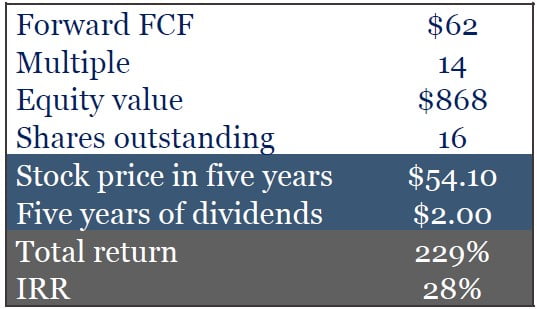

Fair Value Today

With both a conservative assumption for FCF and a conservative multiple, TVA shares are still worth double their current price