A presentation on TerraVest Industries Inc. (TVK), from a talk Guy Gottfried gave on value investing on February 28, to students at the Ivey School of Business at the University of Western Ontario in Canada.

Download the PDF of the presentation here.

What We Look For

“Investment is most intelligent when it is most businesslike.” – Benjamin Graham

- Simple business

- Talented and aligned insiders

- Strong capital allocation

- Sound balance sheet

- Attractive price

Q4 hedge fund letters, conference, scoops etc

Investments exhibiting the aforementioned criteria are rare; therefore, we are:

- Concentrated

- Currently hold seven positions in our portfolio

- Long-term oriented

- For example, we’ve been involved in today’s investment case study since 2009

- Research intensive and focused on investments in which we can develop a significant informational edge

Investment Case Study: TerraVest Industries

Snapshot

*All financial figures pertaining to TerraVest are in Canadian dollars unless otherwise noted.

Background

- Canadian consolidator of manufacturing businesses in Canada and the US

- Current industry focus:

- Home heating oil products (primarily storage tanks): #1 in North America

- Propane, anhydrous ammonia and NGL transport vehicles and storage vessels: #1 in Canada and top three in the US

- Oil and gas wellhead processing equipment: #1 in Canada

- Targets small, fragmented industries with little competition for deals, and which are complementary to TerraVest’s existing operations

- Typically buys from retiring or distressed owners

Why is TerraVest Worth Your Attention?

- Trades at 7.5x free cash flow (FCF) despite material growth prospects

- Consistent record of acquiring businesses at low-single-digit FCF multiples and a long runway for additional acquisitions in the future

- Exceptional management with substantial skin in the game

- Even at a conservative multiple, the stock is worth ~60% more today and will continue to compound at high rates for many years to come

Why is It So Cheap?

- Underfollowed: no analyst coverage and no quarterly conference calls

- Management is focused squarely on creating shareholder value; spends virtually no time on investor relations

- Underappreciated growth potential; management is still in the early innings of building this company

- Energy-related portion of the business is in a cyclical downturn and is therefore under-earning

Past Recommendations

- Previously presented TerraVest at:

- Sohn Canada/Capitalize for Kids Conference (Oct. 2014): stock at $6.20

- Value Investing Seminar, Italy (July 2017): stock at $9.35

- Sohn Tel Aviv (Oct. 2017): stock at $9.25

- In the ensuing years, TerraVest has created tremendous shareholder value through incremental acquisitions, organic investments and share buybacks

- Consequently, despite the stock having risen to $12+, TerraVest is just as cheap now as it was during those prior presentations

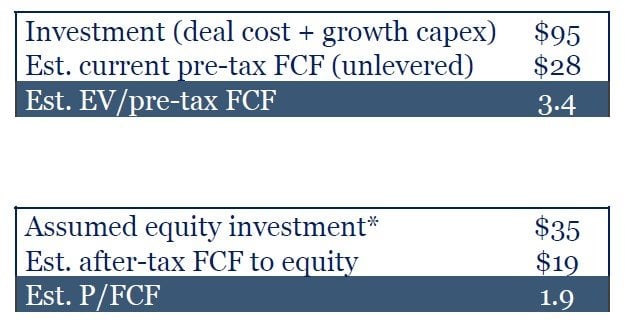

Acquisition Record

- A critical component of our thesis rests on TerraVest’s ability to make attractive acquisitions over time

- Actions speak louder than words

- We need concrete evidence that this strategy is actually working

- With that in mind, let’s examine every deal done by present management in recent years*

"No matter how beautiful the strategy, you should occasionally look at the results." -Winston Churchill

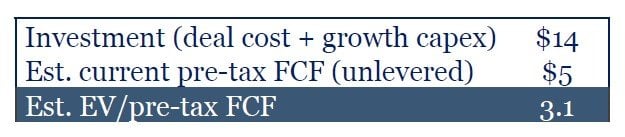

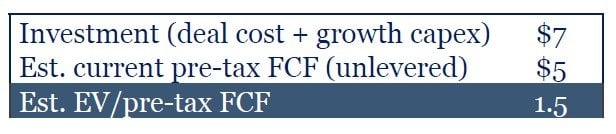

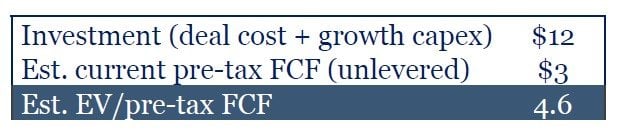

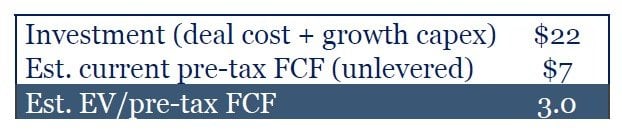

Pro-Par Group (Aug. 2013)

NWP Industries (Aug. 2014)

Signature Truck Systems (Apr. 2015)

Vilco Group (Jan. 2017)

Fischer Tanks (Sep. 2017)

MaXfield Group (Jan. 2018)

Acquisitions: Putting It All Together

Bottom line: TerraVest has repeatedly proven its ability to execute extraordinary deals for shareholders; just as importantly, there is a long runway for additional acquisitions over time

Buyback Record

- In 2012, TerraVest conducted a tender offer for its shares at $2.75 per share

- Bought back 36% of the company at a nearly 80% discount to the current stock price and an even greater discount to intrinsic value

- Last year, launched two tender offers within six months of each other for its shares and in-the-money convertible debentures

- Repurchased 10% of its diluted shares outstanding at $10.41; just 6.5x estimated fiscal 2019 FCF

Insider Alignment

- Clarke Inc. (Canadian holding company with strong record of value creation) owns 30% of TerraVest’s fully diluted shares

- TerraVest is Clarke’s largest position, accounting for over 40% of its EV

- Executive Chairman Charles Pellerin owns 17% of FD shares

- CEO Dustin Haw: TerraVest shares and options account for the bulk of his net worth

Importantly, Haw and Pellerin are only 35 and 43 years old, respectively; shareholders can benefit from their intelligent capital allocation for decades to come (provided they don’t sell the company first)

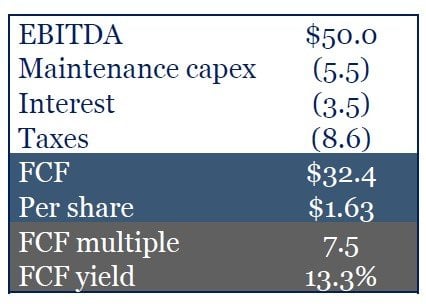

Fiscal 2019 FCF and Valuation

Investors pay just 7.5x for a business that will grow FCF by an estimated 20% this year and continue compounding at a high rate for the foreseeable future

Fair Value Today

TerraVest is worth ~60% more today even at a modest multiple of 12 –“compounder”-type companies routinely trade at 20x or more – and its value will likely grow significantly in the years to come

Catalysts

- Additional deals: their timing may be unknown, but they are virtually certain to happen

- As demonstrated earlier, TerraVest’s acquisition record has been extraordinary

- Additional buybacks: TerraVest has a record of aggressively repurchasing its shares at bargain prices

A profitable “double-dip” for investors: the above factors are likely both to cause FCF per share to soar and to establish a long-term growth trend that will lead to a higher multiple for the stock

Conclusion

A company that can deploy substantial amounts of capital at outstanding returns long into the future, yet trades at a bargain price.

Management is heavily incentivized, has proven itself repeatedly, and is young, with years (if not decades) still ahead of it.

Stock will likely experience both material FCF growth and multiple expansion as investors begin to recognize TerraVest as a long-term compounder.

Rational’s Edge with TerraVest

- TerraVest is an unusual business whose historical financials don’t tell the full story, and whose management makes little effort to promote it

- Rational’s long-term, research intensive approach has enabled us to build deep relationships within the company and conduct extensive due diligence

- We have thereby developed an intimate understanding of TerraVest’s history, strategy and prospects while it is relatively unknown by the market, allowing us to invest years ago at a compelling valuation

This article was first posted on ValueWalkPremium