Markets have turned very volatile this week because of another big jump in inflation. Please see our latest market analysis from EXANTE’s senior analyst, Victor Argonov, looking at the latest surge in price pressures and what this means for stocks and dollar.

Q4 2021 hedge fund letters, conferences and more

Black Friday?

We are potentially set for a Black Friday sale, with US futures declining further following Thursday’s reversal on Wall Street on the back of a rapid increase in rate-hike probabilities amid surging inflationary pressures.

Bears Smelling Blood

It took stock market investors a while to digest those big inflation numbers on Thursday, but by the close of play it was clear which group was on top. The bears pounced after US consumer prices, already at a multi-decade high, came in higher than expected, adding to signs of a tight labour market and rising wages. Although the major indices managed to rebound sharply at one stage, the selling pressure resumed after the Fed's Jim Bullard came out with some very hawkish remarks, causing yields to spike.

Bullard Bullish On Interest Rates

By his own admission, the St. Louis Fed president prefers a 50-basis point rate increase for March, a week after he had said such a move was unnecessary. Bullard said he favours 100 bps interest-rate increases by July and that the Fed should be open to considering inter-meeting interest rate hikes. Traders thought that “if Bullard can change his mind that easily, why can’t the rest of the FOMC?” This theory will be put to the test when more Fed officials speak in the weeks ahead.

50 Basis Point Hike Highly Probable Now

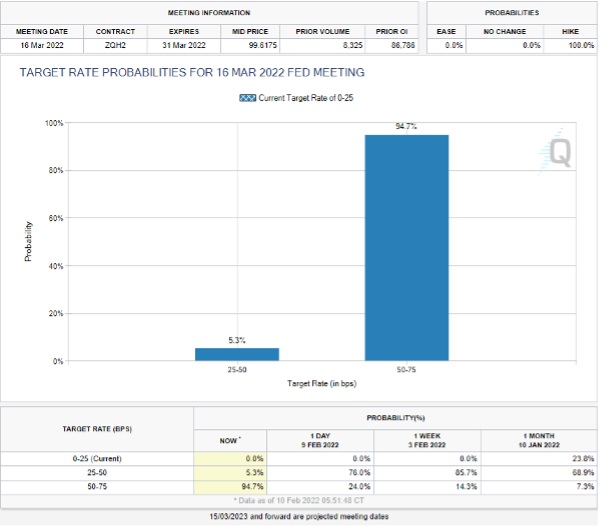

In response to the 7.5% CPI inflation reading, traders had already ramped up their bets that the Fed would hike interest rates more aggressively even before Bullard spoke, judging by the Fed Fund Futures. From around 1/3 before the inflation report, speculators had priced in a 1/2 chance of a 0.5% rate rise for March. But those odds increased to 90% after Bullard spoke.

(Source CME)

This sent bond yields surging higher, with the closely-watched 10-year yields finally breaking the 2.00% barrier for the first time since 2019.

Dollar To Remain Supported On Dips

Ironically, Thursday saw the US dollar fall back to levels it was trading before the CPI data was released, after an initial pop. But that weakness only lasted until Bullard spoke. With yields breaking out and several rate increases inevitable, I don’t think the dollar’s upside potentially is fully priced in yet. I expect to see the greenback do well against currencies where the central bank is still dovish.

What Does It All Mean For The Stock Markets?

The long and short of it is that investors have woken up to the possibility that we are headed for a period of sharp interest rate rises and withdrawal of monetary support from the Fed, and potentially several other major central banks around the world. Against this backdrop, it is difficult to maintain a bullish view on expensive technology stocks and other sectors of the stock market that have low dividend yield profiles. The counter argument for this is that there are lots of people who want to bet on peak US inflation. They argue that if the Fed is very aggressive now it can afford to be less so later. This will result in a lower terminal rate. But I don’t buy this argument. Meanwhile, banks, which tend to perform well when yields rise, could help to provide some balance to the wider market.