Stanphyl Capital commentary for the month ended February 2021, disucssing that myriad exogenous events can pop this market.

Friends and Fellow Investors:

Stanphyl Capital Performance

For February 2021 the fund was up 12.8% net of all fees and expenses. By way of comparison, the S&P 500 was up 2.8% while the Russell 2000 was up 6.2%. Year-to-date 2021 the fund is up 13.7% net while the S&P 500 is up 1.7% and the Russell 2000 is up 11.6%. Since inception on June 1, 2011 the fund is up 54.6% net while the S&P 500 is up 246.2% and the Russell 2000 is up 196.8%. Since inception the fund has compounded at 4.6% net annually vs 13.6% for the S&P 500 and 11.8% for the Russell 2000. (The S&P and Russell performances are based on their “Total Returns” indices which include reinvested dividends. The fund’s performance results are approximate; investors will receive exact figures from the outside administrator within a week or two. Please note that individual partners’ returns will vary in accordance with their high-water marks.)

This month (except for our gold & silver positions) the longs went up (at least long enough for us to book some gains in them) and the shorts went down. (Every once in a while, that happens!) More specifically…

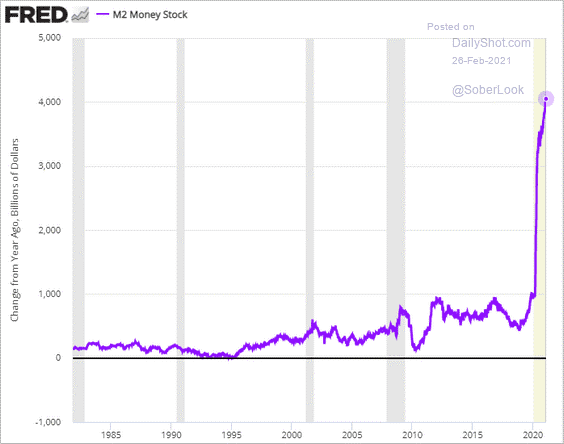

We remain long value stocks & precious metals and short bubble stocks, positioned for the PE multiple-crushing inflation that I (and perhaps now the bond market) believe we’ll soon see (and in fact may already be seeing) as over 200 million Americans get vaccinated while Congress jams through trillions more in “stimulus,” thereby accelerating the velocity of all this newly printed M2:

Myriad Exogenous Events Could Pop This Market

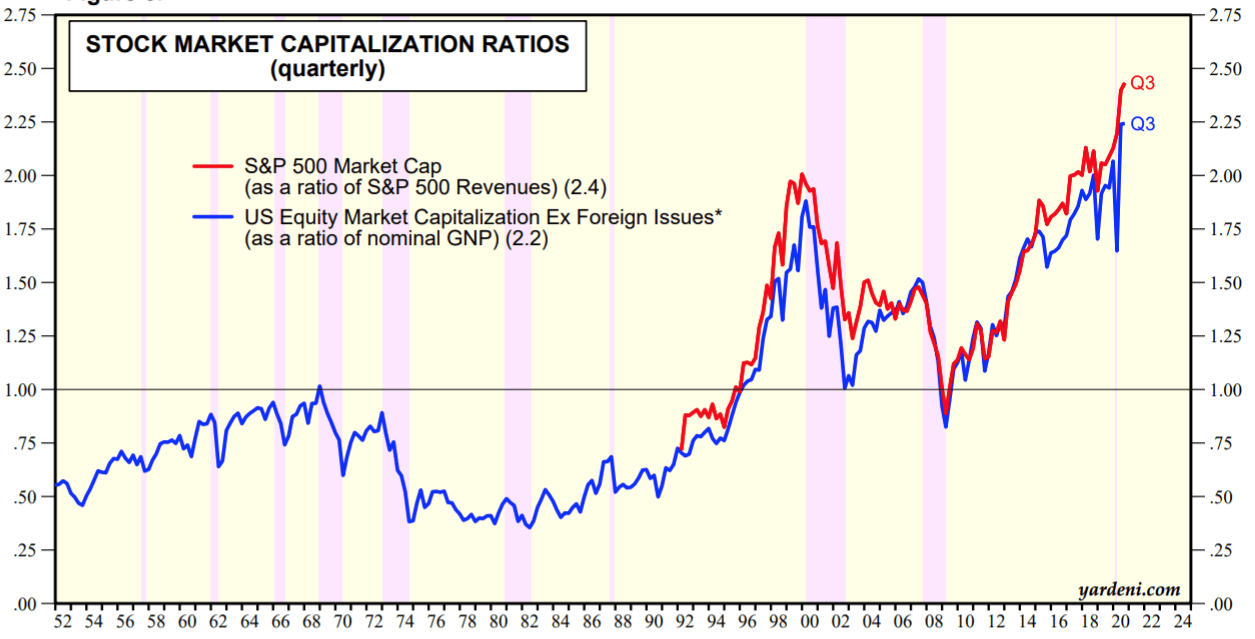

In fact, equity indexes are so stretched that myriad exogenous events (both “known unknowns” and “unknown unknowns”) could pop this market regardless of near-term inflation fears or the Fed’s actions. Courtesy of Yardeni Research we can see that the S&P 500’s ratio of price-to-sales and the overall stock market’s ratio of price-to-GNP are the highest they’ve been in modern history…

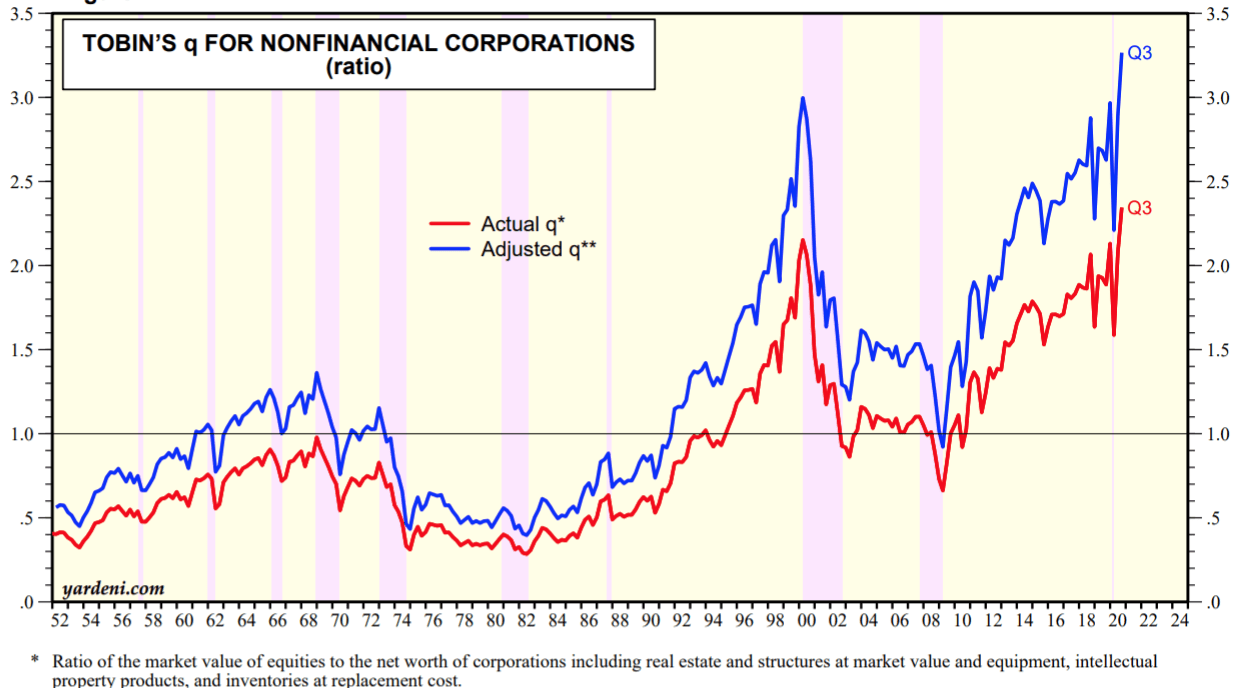

…while Tobin’s Q ratio of stock prices relative to the replacement cost of their underlying assets shows the same thing:

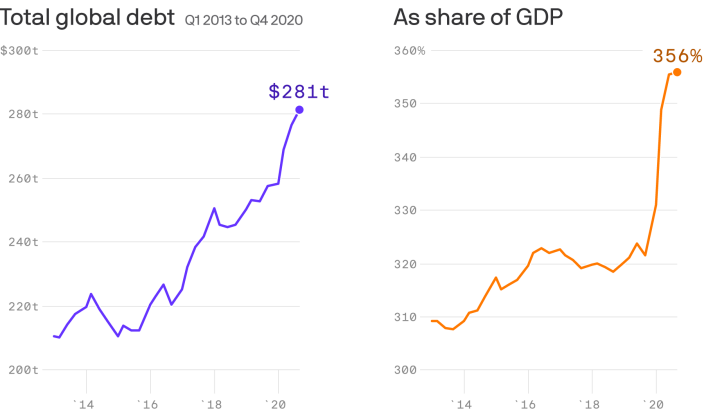

And when the economy does recover, here’s the insane amount of debt it faces; the only “solution” for this is the aforementioned PE multiple-crushing inflation:

We thus continue to be short shares of ARKK, an ETF consisting of the most execrable story-stocks on Nasdaq—a collection of companies with a blended PE of “infinity—run by perhaps the wackiest portfolio manager on Earth. ARKK is today’s equivalent of the Internet bubble funds of 1999-2000, and we know what happened to those. We also continue to be short Tesla, the biggest stock bubble of this (or any) bubble market (more on that in the back half of this letter).

Portfolio Review

Here then are the fund’s current long positions, followed by our regular update on Tesla; please note that we may add to or reduce position sizes as stocks approach or recede from our target prices…

Following a blowout Q4 2020 earnings report, I added this month to our long-held position in Aviat Networks, Inc. (ticker: AVNW), a position I’d lightened when it soared in 2020 and was a big winner for us. Aviat is a designer and manufacturer of point-to-point microwave systems for telecom companies, and in February it reported a fantastic Q2 for FY 2021, with revenue up 26% vs. the year-ago quarter and both GAAP earnings and adjusted EBITDA up hugely, at $1.16/share and $10.1 million respectively. The balance sheet is beautiful too, with $43 million in cash, no debt, and hundreds of millions of dollars in NOL carryforwards. A valuation of 20x run-rate earnings plus the net cash would make this roughly a $100 stock.

We continue to own Data I/O Corporation (DAIO), a manufacturer of semiconductor programming devices, which in February reported a mediocre Q4 2020, with revenue of $4.9 million, down 17% from both the year-ago quarter and sequentially, a 53% gross margin (excluding some non-cash write-downs), and a net loss of a bit over $600,000 (excluding the non-cash write-downs). However, backlog is strong and the company guided to a 10-15% revenue increase over 2020’s $20.3 million, and DAIO has $14.2 million in cash ($1.69/share) and no debt. This company is a great play on the increasing electronic content in cars—particularly hybrids and EVs—and a great buy-out target. An EV of 2x 2021’s revenue guidance of $23 million would put the stock at around $7.15/share.

We continue to own Spok Holdings, Inc. (SPOK), which combines a slowly fading (by around 5% a year) high-margin medical paging division with a high-margin medical software business that management is trying to grow. In February Spok reported a mediocre Q4 2020, with the all-important software revenue up slightly sequentially but down slightly year-over-year due to a combination of COVID-restricted sales calls, intensive hospital focus on COVID (rather than on buying new software), and a gradual change to a SAAS model that books revenue over an extended period of time, rather than “up-front.” Although GAAP earnings were hugely negative, that was due to a couple of non-cash write-downs, and free cash flow was positive by around $1.5 million. Most disappointing was the 2021 revenue guidance, the midpoint of which was just $140 million (vs. $148 million in 2020), as the company expects software sales for the first half of the year to be “COVID-handicapped” with the back half much improved. Overall, Spok is an 80% gross margin company with a great balance sheet (over $4/share of net cash) and November 2020 and February 2021 insider buying, and assuming 19.4 million shares and $79 million in cash, it currently sells for only around 0.9x the midpoint of 2021 revenue guidance. A valuation of 5x revenue for the software business (if management gets the growth it seeks) plus 1x revenue for the paging business would value the stock at over $25/share. While we wait, SPOK pays roughly a 4.7% dividend yield.

We continue to own a reduced position (as the stock shot up in February) in Evolving Systems, Inc. (EVOL) a small telecom services marketing company that in November reported an excellent Q3, with revenue up 8% sequentially and almost 11% year-over-year. This is a 68% gross margin software company that at an EV of 2x $27 million in run-rate revenue would sell for over $4.50/share. Alternatively, EVOL now generates around $2 million/year in free cash flow and would make a great buy for a strategic acquirer, as $1 million/year in savings from eliminating the cost of being a standalone public company would raise FCF to around $3 million/year. Thus, at an acquisition price of 15x post-merger FCF, a buyer would be paying around $4/share on an EV basis.

Finally on the long side, as central banks increase their money-printing to ever higher levels in order to fund multi-trillion-dollar annual deficits, we continue to hold long positions in the silver and gold ETFs (SLV and GLD); the likelihood of the Fed maintaining negative real interest rates for years to come adds a substantial tailwind to these positions, while silver is also a major component in the solar cells the Biden administration is expected to heavily subsidize.

Thanks and stay healthy,

Mark Spiegel