Spruce Point Capital Management is pleased to announce it has released the contents of a unique research report on Realty Income Corp. (NYSE: O, “O Realty” or “the Company”). Spruce Point has conducted a critical business and financial review and believe Realty Income is overstating its same store rent metrics to portray itself as a healthy, growing enterprise. Based on our industry normalized approach, which includes vacancies, we believe that Realty Income is in fact declining organically. We believe the overstatement of approximately 2%, makes the difference between the cosmetic appearance of a growing enterprise vs. a declining one.

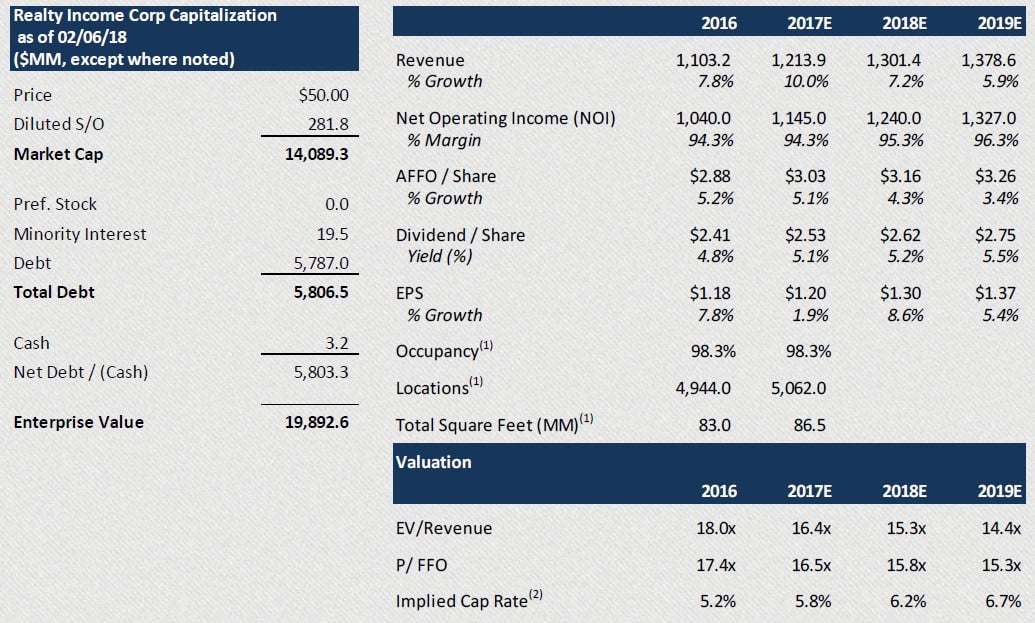

As a result, based on our case study analysis of similar REITs that have swung to declining growth, and a detailed valuation analysis, we have issued a “Strong Sell” opinion and a long-term price target of approximately $28 – $35 per share, or approximately 30% to 45% downside risk.

Executive Summary

Spruce Point Has Established A Short Position In Realty Income (NYSE: O), Sees 30% to 45% Downside For The Following Reasons

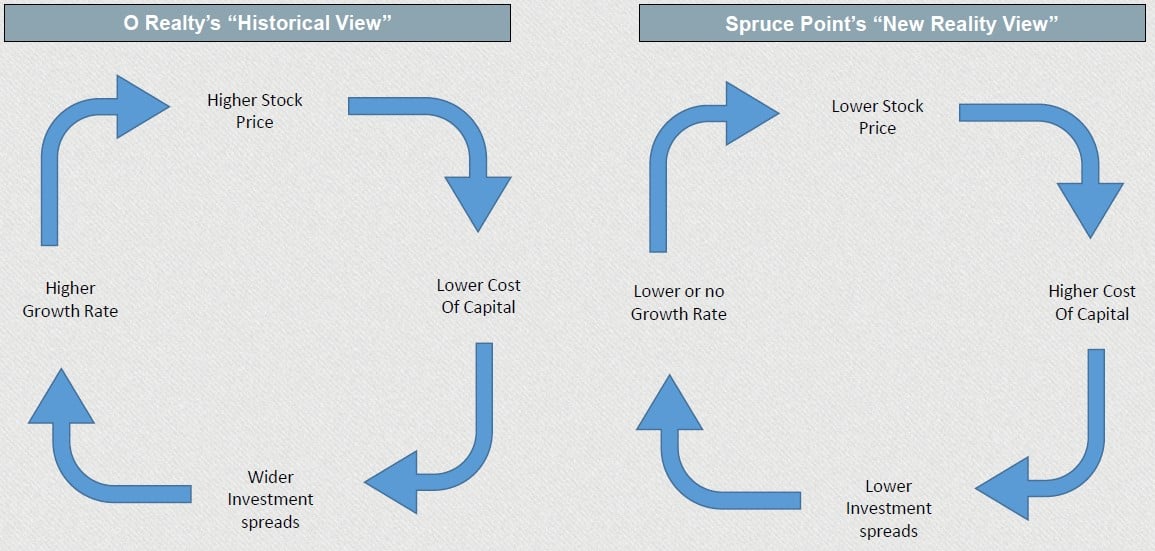

The Allure of Rising Magic Dividends: Realty Income (“O Realty” or “the Company”) promotes itself as “The Monthly Dividend Company®” and preaches “The Magic of Rising Dividends” – it even goes so far as to market itself differently to retail investors vs. sophisticated institutional investors. The Company is very dependent on issuing stock at inflated prices to fund its acquisitive growth strategy, keep its cost of capital low, and consistently raise its dividend. The model has worked well for years when times were good, but we believe this magic cycle is about to break down as investors reassess O Realty’s growth profile amidst deteriorating tenant quality, rising interest rates, and a more volatile and discerning capital market backdrop.

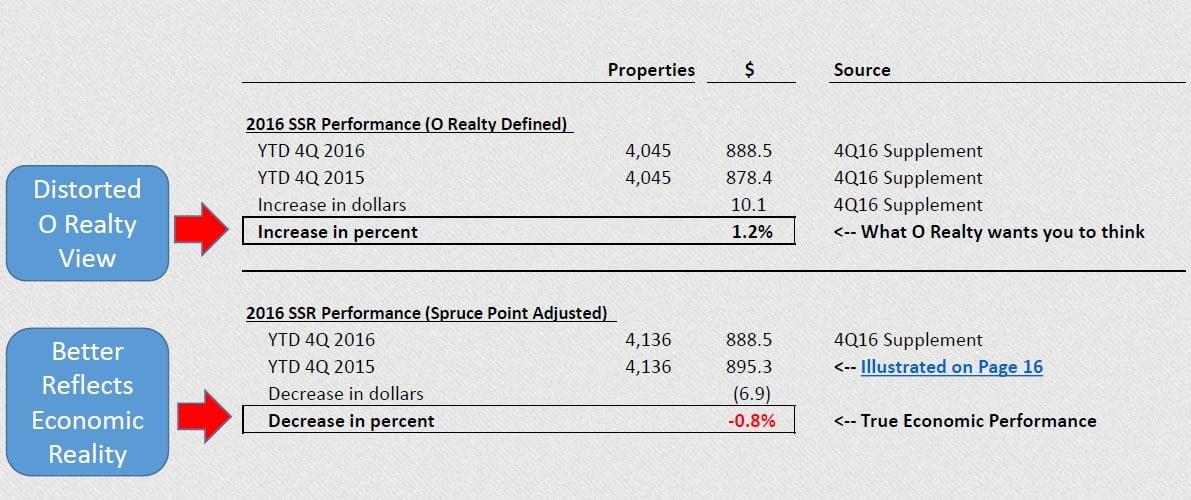

Deceptive Same Store Property Reporting: Our forensic accounting work indicates that the true underlying economic performance of O Realty’s properties, as measured by Same Store Rents (SSR) are declining vs. the company’s promotion that it is growing. The Company disclosed its SSR growth rate of 1.2% in 2016. Our industry normalized definition of same store property performance suggests that that SSR declined by 0.8% in that period – an astounding 2.0% overstatement. Once investors come to grips with our irrefutable conclusion, we expect a major revaluation in O Realty’s share price. There are ample case studies to show 40%-50% share price declines when investors revalue a REIT’s declining performance. For example, Wall Street has penalized a few REITs (DDR, BRX, KIM) that own retail properties where the same store growth profile has swung from positive to negative growth. We believe that O Realty is the next REIT that is going to be penalized for a deteriorating growth profile by investors.

Dispositions And Vacancies Are Rising And Likely Aiding Occupancy And SSR Metric Inflation: We believe that dispositions and vacancies are likely managed to cosmetically inflate occupancy and aid O Realty’s SSR metric. We show dispositions on the rise as well as a larger percentage of property sales coming from vacancies. These trends may indicate more competition from malls as well as the limited alternative use for many of O’s real estate properties.

Investors Should Be Concerned By Background of Management and Audit Committee Oversight By Board: We find that O Realty’s executive management team is comprised almost entirely of ex-investment bankers, trained in the art of financial engineering. It should, therefore, come as no surprise that O Realty could use financial magic to embellish its performance. We have little faith in the Company’s audit committee raising any objections or concerns about management’s practices. We find that the audit committee is comprised of a PGA golf professional, and former executives from Wells Fargo and KPMG, two of the most scandal- ridden financial and accounting organizations in recent history. Given all the factors we have noted, it makes sense that insider ownership trends are at all-time lows, and lowest amongst its REIT peers.

Tenant Quality Deteriorating As Retail Landscape Changes: We conducted a deep dive into the tenant quality and find that O Realty has outsized risk exposure to drug stores, grocery stores and movie theaters -- three retail subsectors facing disintermediation. Drug stores (O’s largest sector exposure) are consolidating their retail footprint (i.e. Walgreens purchase of +2,000 Rite Aid stores), while SSS performance at the store front is down. Even worse, headlines such as Amazon teaming up with Berkshire Hathaway and JPMorgan to disrupt the healthcare business present a now tangible long-term risk that the traditional drug delivery value chain through a retail footprint could move increasing online. The Amazon risk extends also to the grocery store vertical given its recent acquisition of Whole Foods. We believe that any retail transaction that is done repetitively and frequently (i.e. grocery and drug store) is ripe for online disruption, and therefore poses significant risk to the traditional brick and mortar chains and their related real estate profiles. Lastly, movie theater trends (both box office sales and attendance) likely peaked in 2015, and theater chains are not expanding screens. Physical movie theater locations are at increasing risk of disruption as Hollywood and media companies (e.g. Netflix, Amazon, Hulu) are spending money to produce original content for their own “at home” media streaming offerings, and new releases that skip the movie theater completely.

Interest Rate Tightening Cycle Another Major Negative Backdrop For O Realty: We expect REITs such as O Realty to remain under pressure. Consensus expectations is that the 10 year treasury will surpass 3.0% by 1Q’19 and O Realty’s historical stock performance exhibits negative correlation with increases in interest rates. We expect O Realty to underperform the REIT sector given our newly documented growth concerns and premium valuation enumerated below.

Operating Metrics Have Deteriorated While O Realty’s Valuation Remains Sky High: O Realty has lured a dizzying array of analysts to relentlessly promote its story, and make it the most expensive triple net lease retail REIT by a wide margin. Analysts see an average of 18% upside to $59/share, yet seem to ignore glaring signs of weakness. Even Janet Yellen warned that commercial real estate prices are “quite high relative to rents.” O Realty has the lowest occupancy rate of 98.3%. If it had not sold 91 vacant properties since the beginning of 2016, the occupancy metric might be as low as 96.6%. Furthermore, O Realty essentially has the lowest remaining lease term of 9.6 years amongst its peers and the highest amount of leases expirations (7.8%) versus its peers over the next two years. In that context, we created a dividend sustainability index where we incorporate average remaining lease duration in order to assess O Realty’s sustainable dividend paying ability vs. prior year periods. This index now stands at its lowest level since the beginning of our data set in 2005.

Metrics like this can be an early warning sign that the underlying fundamentals are not as safe as they had been historically. We expect that once investors come to grips with the fact that O Realty’s true growth rate is negative, its multiple will re-rate in line with historical precedents, and its share price will decline by approximately 30% - 45% or $28 - $35 per share.

Evidence of A Deteriorating Business Model

Capital Structure And Valuation

The Virtuous Circle Gone Bad

Entering a negative feedback loop: We believe that O Realty is highly dependent on keeping its stock premium inflated to lower its cost of capital to pursue growth. However, we will illustrate that its growth is declining, which will leads to a lower stock price, higher cost of capital and lower investment spreads.

Same Property Revenues Are Declining, Not Growing As O Realty Portrays

Our definition represents the true economic performance of the property base and therefore does not ignore vacancies. The magnitude of the overstatement is 2% which is the difference between growth vs. decline

Article by Spruce Point Capital Management

See the full PDF below.