New Alignable March State Of Small Business Report Released: Shows Increased Levels Of Strife With One Silver Lining. Small businesses are still experiencing negative financial effects.

Q4 2020 hedge fund letters, conferences and more

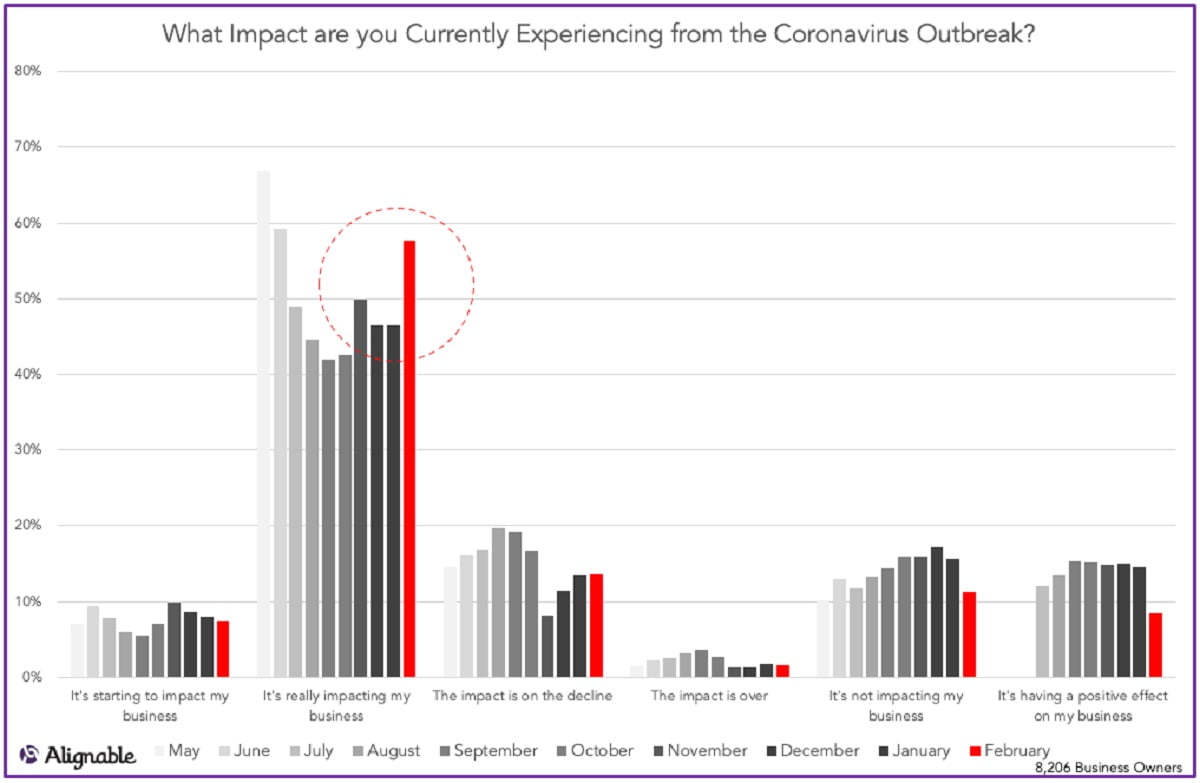

From Alignable’s March State of Small Business Report.

SMBs Are Still Experiencing Negative Financial Effects

First, The Good News: Small business optimism has emerged around several of President Biden’s PPP changes, and the new May timeline for widespread vaccine distribution. In fact, this shift in vaccine availability should help 28% more small businesses to recover in 2021 according to an Alignable poll taken last week among 8,026 SMBs.

Now, The Rest: Several questions remain about the new PPP process and whether solos and others will get the cash they need before the looming March 31st deadline. Alignable and other concerned organizations are pushing to extend the deadline and clarify the process that’s left many banks wondering if they can implement it in time.

And, unfortunately, the level of economic misery among SMBs is on the rise again. In fact, it’s as if we've returned to the early months of the pandemic.

Alignable’s March report shows that 78% of all SMBs are still experiencing negative financial effects (up 10% from last month). And 58% report feeling significant impact (up 12% from Feb.).

A Rocky Road To Recovery

Here’s additional evidence illustrating where SMBs are right now on their rocky road to recovery:

- Revenue Hits A New COVID-Era Low: 58% are collecting less than half of their pre-COVID sales.

- Cash Flow Is Worse Than Ever: 41% say they have one month or less of cash on hand (up 9% from Feb.).

- Statistics are even worse for 56% of minorities and 51% of women business owners, who have only four weeks until they deplete their reserves.

- Rent Woes Hit A New 2020-2021 High: 49% of small business owners say they can’t pay their March rent, up 11% from Feb. and 16% from Jan. And 67% of minority-owned and 53% of women-owned businesses couldn’t afford this month’s rent.

Find the full report here, complete with 16 charts showcasing the issues.