Rowan Street Capital commentary for the second quarter ended June 30, 2021, discussing their investments in Spotify Technology SA (NYSE:SPOT) and Facebook, Inc. (NASDAQ:FB).

Q2 2021 hedge fund letters, conferences and more

Dear Partners and Friends,

Rowan Street Capital celebrated its 6 year anniversary in March. It’s been an amazing and truly rewarding journey full of lessons, ups and downs, successes and challenges. In our very first letter to partners back in 2015 we wrote:

“Our vision is to build something special at Rowan Street Capital where our partners can visualize themselves as part owners of a business they expect to stay with for a long time, just like they would if they owned a rental property or a farm in partnership with members of their family. The goal is to build a portfolio of great companies that will compound our partners’ family wealth at double-digit rates of return over a long-term holding period.“

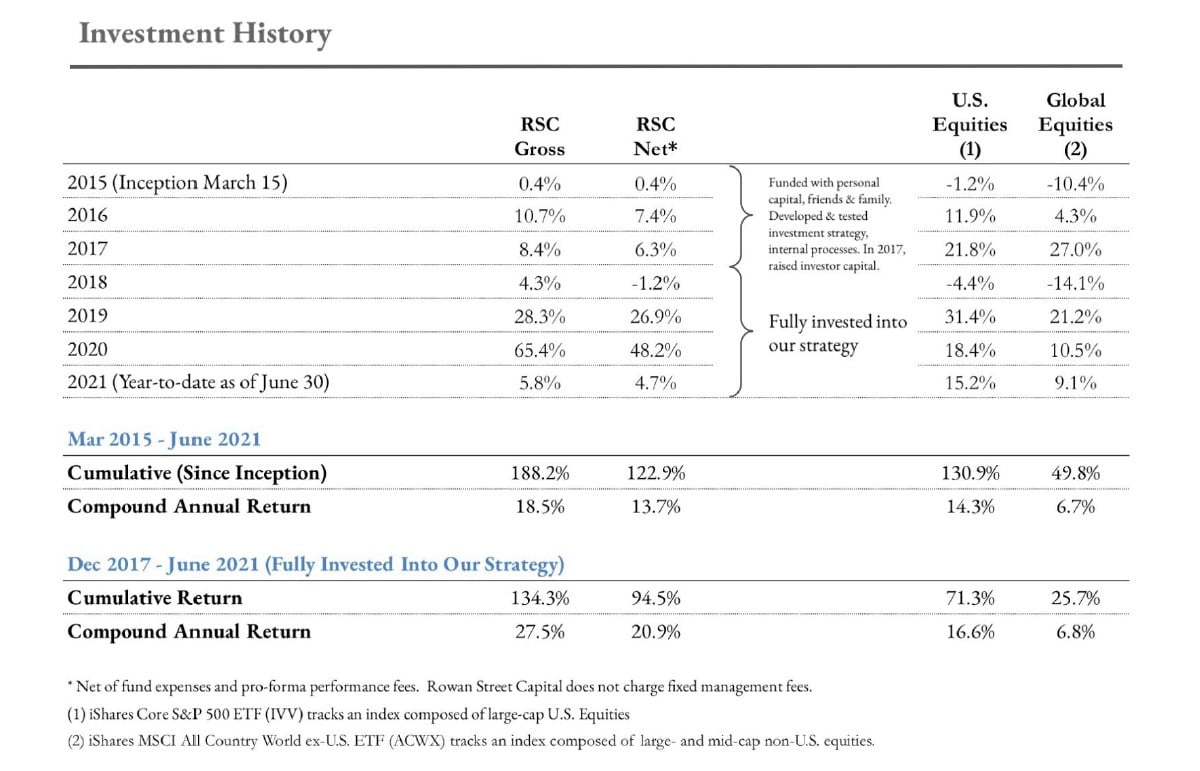

We are very grateful and proud that we have been able to execute on our original vision thus far and deliver double-digit returns to our partners. Since 2017 (our fully invested period), our fund has returned +94.5% (net of fees) vs. +71.3% for the S&P 500. On an annualized basis, this equates to +20.9% per year vs. 16.6% for the S&P 500.

In the first half of 2021, Rowan Street was up +4.7% (net of fees) as compared to +15.2% for the S&P 500. 2021 has so far been a complete reverse of 2020. Our biggest contributors to outperformance in 2020, Spotify Technology SA (NYSE:SPOT) and Trade Desk Inc (NASDAQ:TTD), have been the biggest detractors from performance. As a reminder, their stocks were up +110% and +355%, respectively in 2020, so it takes a bit of time for the business fundamentals to backfill their huge advances in stock prices. Both Spotify and Trade Desk remain our high conviction ideas and we are happy to be long-term business owners (as opposed to “renters” of stock) in both companies.

The biggest contributors to our performance in the first half of 2021, have been Facebook, Inc. (NASDAQ:FB) +32% (see a discussion below) and LYFT Inc (NASDAQ:LYFT)+31%.

Spotify (SPOT)

How many stocks have you owned in the past, where you liked the underlying company and its management even more after 3 years of holding the stock? My guess is not very many. We want to be clear here that we are talking about Spotify the company, not SPOT the stock. It’s a very important distinction that most “investors” forget, especially those that fall in love with the stock that has momentum and is rapidly going up, a lot of times not necessarily for fundamental reasons. Spotify is one of those rare businesses that, after owning it for 3 years, we actually like it more and like the CEO Daniel Ek more now than when we originally purchased the stock. Our conviction has also grown stronger over the past year since we outlined our investment thesis in the Q2 2020 Letter. For those who are new to the fund, we encourage you to take a look at our write-up.

I have recently read a great book that was recommended by a friend of mine: UNSCALED (How AI and the New Generation of Upstarts are Creating the Economy of the Future). For those that are interested, we will briefly tell you what this book is about and why it’s so important to understand the new dynamics that it describes. Then we will tie it back to our Spotify investment. We have included a discussion in the Appendix at the end of this letter. We encourage you to take a closer look…

Facebook (FB)

“Extreme patience combined with extreme decisiveness. You may call that our investment process. Yes, it’s that simple.” – Charlie Munger

Facebook recently hit a trillion dollar valuation on some very strong earnings and legal news. We encourage you to review our brief investment rationale on Facebook that we included in our 2019 Year-End letter.

The company recently crushed analyst estimates when it reported its first-quarter results. Revenue surged 48% year over year to $26.2 billion, leading to a 94% increase in net income. Analysts were expecting revenue of about $23.7 billion. Growth, said Facebook CFO Dave Wehner on the first-quarter earnings call, was fueled by “sustained growth in the digital economy and our continued success in helping businesses engage with consumers across our services.” More specifically, Facebook’s advertising business was helped by a 30% year-over-year increase in price per ad and 12% more ad impressions across all of the company’s services.

In addition, Facebook shares were lifted further on some very good legal news for the social media giant. The FTC, which was spearheading the suit, requested that Facebook be forced to divest two major company acquisitions — photo sharing site Instagram and messaging service WhatsApp. Judge Boasberg ruled that the FTC failed to demonstrate that Facebook’s power and reach were sufficient for such a legal remedy. As for the states’ lawsuit, the judge said that they waited too long to file complaints against the two offending acquisitions (the Instagram deal closed in 2012, and WhatsApp was absorbed by Facebook in 2014).

We started buying Facebook shares back in 2018 when the stock was very depressed as Facebook was dealing with a long ‘dirty-laundry’ list of challenges. What started as criticism regarding the privacy issues that came to light after the 2016 U.S. presidential election had turned into a general lashing of the platform from just about everyone. They responded by spending gobs of cash and hiring thousands of employees to update its platform and make it safer for users. Additionally, it recorded the $5 billion FTC fine in the second quarter of 2019 and a $550 million settlement related to the collection of users’ facial recognition data from 2011 to 2015 (in violation of the Illinois Biometric Information Privacy Act) in Q4.

In spite of these huge expense increases, we estimated that their revenue would still grow at least 20% and their future expense increases would be closer to revenue growth. We were convinced that FB remains an extraordinary business with incredible moat (2.9B users), and they still have tons of opportunities to profitably reinvest their capital. We have been very impressed with how Zuck & Co. handled a long list of challenges over the past few years and managed to keep growing and innovating! We have doubled our money thus far on our Facebook investment over the past 3 years, and are happy to remain shareholders as future prospects remain bright for the company.

Our Facebook investment record begs to ask the following question. If the markets are efficient, how come we have been able to double our money in only 3 years (26% annualized return) on the company that is well-known to everyone in the world and is widely covered by the analyst community?

__________

As a reminder, the fund is open at the end of each month for new investments. If you would like to increase your investment in the fund, please reach out to Joe or myself. As always, we encourage you to refer new investors to join our expanding band of like-minded partners in our quest to compound capital at double-digit internal rates of return over a long-term investment horizon.

We want to thank you for your partnership. Joe and I have our entire net worths invested alongside you — we strongly believe in eating our own cooking.

Best regards,

Alex and Joe

Appendix: Spotify Discussion

From the Uscaled book:

“Through the 20th century, technology and economics drove a dominant logic: bigger was almost always better. Around the world the goal was to build bigger corporations, bigger hospitals, bigger governments, bigger schools and banks and farms and electric grids and media conglomerates. It was smart to scale up — to take advantage of classic economies of scale.

In the 21st century, technology and economics are driving the opposite — an unscaling of business and society. The dynamic is in the process of unraveling all the previous century’s scale into hyper focused markets. Artificial intelligence (AI) and a wave of AI-propelled technologies are allowing innovators to effectively compete against economies of scale with what I call the economies of unscale. This huge shift is remaking massive, deeply rooted industries such as energy, transportation, and healthcare, opening up fantastic possibilities for entrepreneurs, imaginative companies and resourceful individuals.

In an economy driven by AI and digital technology, small, focused, and nimble companies can leverage technology platforms to effectively compete against big, mass-market entities. The small can do this because they can rent scale that companies used to need to build. The small can rent computing in the cloud, rent access to consumers on social media, rent production from contract manufacturers all over the world — and they can use artificial intelligence to automate many tasks that used to require expensive investments in equipment and people… This is the essence of unscaling: technology is devaluing mass production and mass marketing and empowering customized miscroproduction and finely targeted marketing.”

I encourage those of you that are curious to read this book — it’s very thought provoking. But how does all of this relate to our Spotify investment? Well, we believe that Spotify is Unscaling a couple of industries in addition to creating new demand that didn’t even exist before.

Record Labels

The role of record labels has not changed much over the many years that record labels have controlled the music industry. Ownership of the intellectual property has always been controlled by the industries that exploit it rather than the individuals that create it. Record labels are able to exploit artists’ talents and keep a majority of the money for themselves.

Traditionally a record label has 3 major functions. The first major function of a record label is to sign a recording contract with an artist. Record labels need to find new artists and sign them to a contract to produce a new album. The record label will agree to provide many resources for the artist to assist in the creative process. The second role of a record label is to advance money to an artist and arrange for the recording of an album to take place. The record labels provide what is essentially a loan to the artist to cover the upfront costs of producing an album. Record labels withhold the first royalty payment in order to recover this loan that they gave out to the artist. The third and final role of a record label is to handle the entire distribution, sales, marketing, and promotion of the album. Essentially a record label has become a one-stop shop for the entire recording process from beginning to end. An artist contributes the creative talent while the record label handles the financing, arrangements, marketing, production and distribution.

In its traditional form, a record label contributes a very large amount of capital and resources to produce an album with an artist. It is because of this role that the record label can demand to keep such a large percentage of the revenues from album sales. Record labels were the link between an artist and his fans that buy the music. An artist signs a contract with a record label in order to leverage the core competencies of the record label such as marketing and distribution.

The 1960s were a decade of consolidation in the recorded music industry. Due to economies of scale and the large-scale distribution needed to truly commercialize the music industry many of the smaller players from the 1950s joined together to create some of the media moguls that we still see today. The 1960s witnessed the emergence of companies like RCA, CBS, Warner Communications (soon to be Warner Brothers), and Polygram. In order to unite the distribution methods and create the most cost efficient method to mass produce music, these labels bought out and merged with many of the smaller record labels that specialized in one area of the distribution process for music. By becoming giant recording corporations, these few labels were able to vertically integrate the entire recording and distribution process in order to take advantage of the economies of scale (Source: The Rise and Fall of Record Labels).

The real question to answer here is: do we really need intermediaries between the supply and demand in the economy driven by AI and the world oftechnology platforms like Spotify that enable artists and creators to chart their own destiny?

We believe Spotify has revolutionized the music industry and created a technology platform where Record Labels will eventually be Unscaled. The true value creators in this industry are the artists, and Spotify is finally providing technology that enables artists to create, distribute, and optimize their art — essentially rent scale in the recording and distribution process that was historically controlled by the mega record labels.

An artist could use Spotify’s studios to record and mix songs and then distribute on its platform. The artist could then study the data provided by ‘Spotify for Artists’ to learn more about their listeners and shape a strategy to acquire even more fans. By having a better understanding of their fan base, the artist could offer adjacent content relevant to their fans (podcasts, Clubhouse). The artist could consistently interact with their current fans and gain new ones without saturating the market simply to stay relevant.

As Spotify changes the business model, it is our view that most middle men (aka Record Labels) will eventually be cut out of the value chain as Technology can enable the promotion of the artists and allow them to keep more of their earnings, while traditional mega-record labels value-add will be less and less important as time goes on.

Having said that, we still believe that there is room for record labels to exist in the world of AI and audio technology platforms like Spotify. However, the role that record labels play will probably change significantly. Future record labels are likely to be much smaller companies with specialties geared toward unique talent. Economies of scale that were built by major record labels today (Universal Music Group, Sony Music Entertainment and Warner Music Group) will likely no longer be needed as Spotify’s technology and data will offer artists a much more efficient way to create, distribute and optimize their art. Future record labels will probably morph into data analysts and artists’ career coaches rather than gatekeepers. All of this fits very well into Spotify’s mission to unlock the potential of human creativity — by giving a million creative artists the opportunity to live off their art and billions of fans the opportunity to enjoy and be inspired by it.

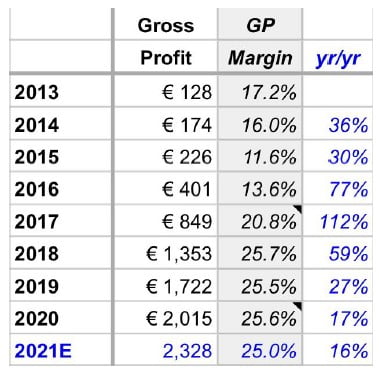

So far, both negotiations with mega record labels and the dynamics of the music industry value chain have been very slow to change. It is evident by looking at the Gross Profit margins of Spotify over time as they have been stuck around the 25% range (see below) with the majority of value still flowing into record labels’ pockets.

Spotify is currently building and testing new business models in talk audio (e.g. podcasts) because it’s a lot easier to do than in the music business with the slow-changing royalty business models. There is a ton for Spotify to learn from this space as they offer audio creators an opportunity to take more control over their fate. We believe these valuable learnings will eventually be carried over to the music business to enable more and more creative artists to chart their own destiny. The odds are very good that we will see Spotify’s gross margins trend significantly higher over time, and that possibility is not currently priced into the SPOT stock.

We wanted to finish up our discussion with the twitter thread (please see below) from March of this year that Spotify’s CEO Daniel Ek posted. It highlights the revolution happening in the music industry powered by the ecosystem that Spotify has built over the past 15 years. Over time, we expect Spotify to capture the economics of the music industry value chain commensurate with the value they are creating.

“Since its 2014 low, the music industry has grown by 44%, driven primarily by streaming revenues which increased 500% over this same period. In 2020 alone, Spotify paid $5B+ and makes up about 20% of global recorded industry revenue, more than any other streaming service.

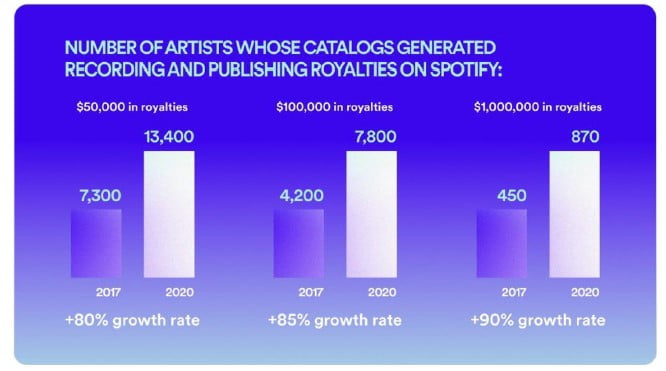

That number is massive on its own, and it doesn’t include other music streaming services, or other sources of music revenue… Streaming is thriving and has been key to helping more artists find global audiences. There are more artists than ever before. That’s awesome. It means new genres, more music crossing borders, and more artists finding new fans. It also means new artists joining Spotify every day, along with the entire history of music that came before them. More artists want to share their art, reach fans and earn a living from music. And it’s happening. From streaming on Spotify alone, we’re seeing growth from artists at all stages of their career: since 2017, the number of artists generating more than $50K/yr is up 8%; more than $100K/yr is up 85%; and more than $1M/year is up 90%.

Today, 57K artists now represent 90% of monthly streams on Spotify — a number that has quadrupled in just six years. This means that the number of the most listened to artists in the world is growing and more diverse.

Fans will ultimately decide who thrives but our focus remains clear: Continue to create more opportunities for more artists to reach more fans. We know we have more work to do, but we’re confident in what we’ve built and the innovations we continue to deliver in what we’ve built and the innovations we continue to deliver for artists and fans. We’ll continue to empower the most talented artists in the world to turn their passion into a profession, grow the money paid to right holders, diversify and expand the number of professional artists succeeding and propel the music industry forward.”