Heading into the third quarter of the year, you’ve probably come across NFTs, the Non-fungible Tokens. The NFT space has taken the world by storm as it emerges as a new digital asset class after receiving paramount support from various industries, especially the digital art industry.

Q1 2021 hedge fund letters, conferences and more

A few months ago, Beeple sold a digital collage out of his collection, “Everdays: The First 5000 days,” for $69.3 million in collaboration with Christie’s, a popular art house. NFT represents a new era of digital ownership, mainly in areas like digital art, fashion, and gaming, where virtual ownership is common as a status symbol.

The Beepl’s Collage | Source: Beeple/Christie's

The nature of NFTs being unique, irreplaceable, immutable, and non-fungible makes them an attractive asset for investors and creators alike. NFTs have empowered creators to monetize and value their digital content, be it music, videos, memes, or art on decentralized marketplaces, without having to go through the hassles that a modern-day creator typically goes through.

Consequently, investors can invest in NFTs knowing full-heartedly the token is unique and they’re the sole owner of that piece. NFTs could revolutionize the gaming, fashion, and digital industry. They offer new ways to buy and sell digital artwork, game collectibles, and fashion items.

After reporting over $57 million in sales just this month, the NFT craze continues to stay strong for half a year. In this article, we’ll be talking about how we evolved from cryptocurrencies to NFTs over the years and how the NFT ecosystem is becoming more mature.

From P2P Currency To Tokenizing Art

A decade ago, Bitcoin took the mantle as the ledger of the world as it reigned over the cryptocurrency market as digital gold. Followed by Ethereum’s inception, we got to see new applications apart from P2P transactions, as it introduced the first smart contract platform in the crypto ecosystem.

Soon after, amid the booming cryptocurrency sector, we got to see the rise of Decentralized Finance. Defi removed centralized institutions from the equation, emphasizing peer-to-peer architecture over traditional finance. At its core, Defi empowered us with complete control over our funds, and gave us access to many financial instruments such as lending, borrowing, derivatives, etc.

The emergence of Defi in 2020 has a lot to do with the decentralized nature of cryptocurrencies. Since coins are decentralized, and blockchains enable peer-to-peer transactions without centralized parities, Defi was able to lay its foundation in the real world to disrupt traditional finance. Moreover, by working hand in hand, both Defi and cryptocurrencies catalyzed the growth and success of finance.

Heading into 2021, the emergence of the NFT industry proved that cryptocurrencies and blockchain technology aren’t limited to the financial market. NFTs became a driving force for expanding the Defi sector, especially after its rise into the mainstream market.

While Defi has, so far, emphasized on decentralized financial products, NFTs offer a new perspective and an array of diverse use cases for the ecosystem. NFTs are a product of Defi’s success, and their popularity has emerged beyond proportion this year. Soon, we could see NFTs appear everywhere in our digital lives and transactions.

The NFT Ecosystem

The growth in the NFT ecosystem was made possible by smart contract platforms like Ethereum, where users could tokenize nearly anything they could imagine, including pictures, music, virtual gaming land, collectibles, and more!

NFTs, at their core, are digital assets representing real-world objects. NFTs solve the age-old problems that creators like you and I have always faced when protecting our intellectual property from being reproduced or distributed across the internet.

The most popular standard for NFTs today are ERC-721 and ERC-1155. ERC-721 has been used in a majority of early NFTs until ERC-1155 was introduced. With that said, these token standards have laid the foundation for assets that are programmable and modifiable; therefore, setting the cornerstone for digital ownership leading to all sorts of revolutionary possibilities.

The NFT ecosystem has found its way into various industries as more people join hands and dive deeper into its novel possibilities. The potential and promise of the technology have led to consistent growth for the NFT sectors. The NFT arena has now accommodated over $57 million in total sales in this month alone.

Here are some of the most dominant sectors that contribute to NFT’s success:

Art

Crypto art is undoubtedly one of the fastest-growing NFT sectors. The Art sector has collected over $13 million this month alone, proving how NFTs empower artists to create more inclusively, and benefit from the NFT ecosystem.

Top platforms in this sector include Super Rare, which is home to over $10 million in volume to date; SuperRare is the pioneer in crypto art DApps for exclusive NFT releases. Other great platforms include Async art, an Ethereum-based art platform that curates programmable art.

Defi and NFT

Defi set the foundation for the future of the digital economy because it reinvents traditional finance. Over the years, Defi emerged amid the booming cryptocurrency sector as it empowered users with decentralized and trust-less financial products. Over the years, Ethereum has catalyzed a lot of success for the Defi sector.

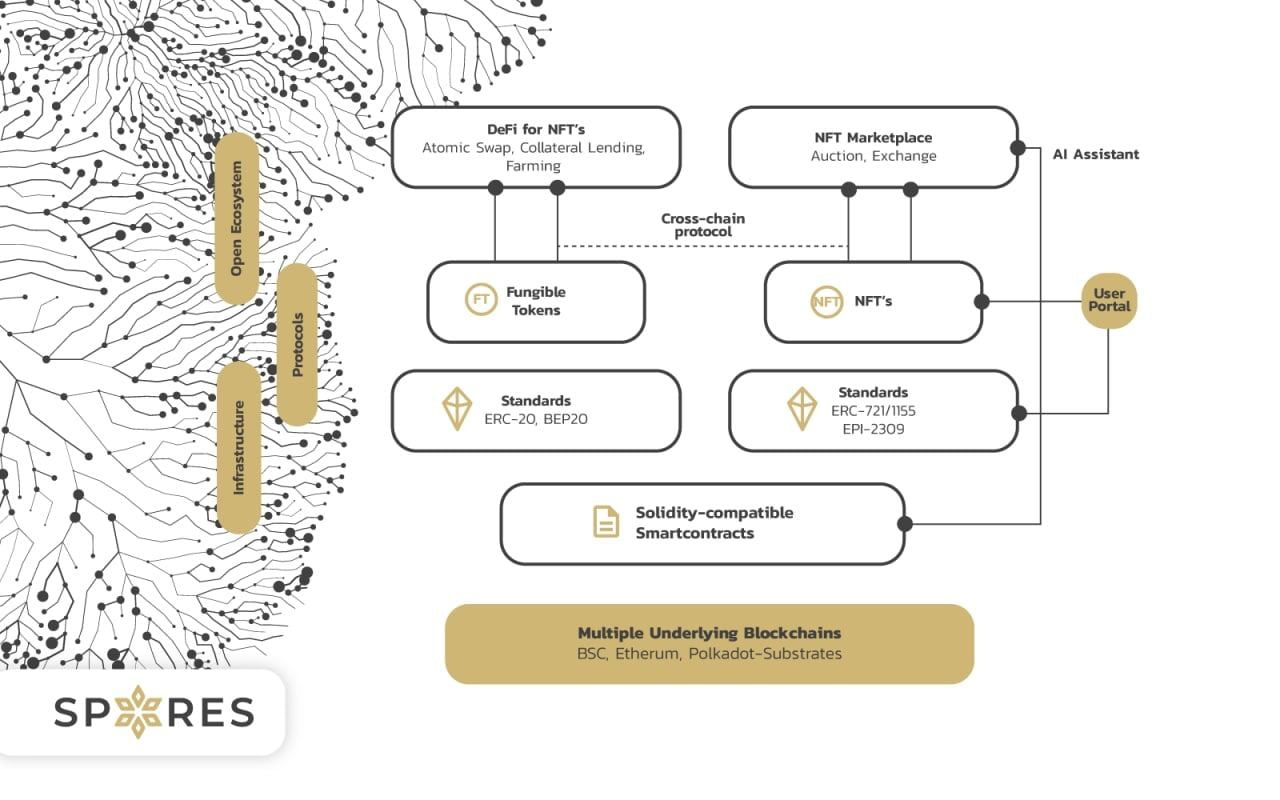

Talking about the bridge between Defi and NFT, Spores Network is a leading NFT marketplace with a full-stack interoperable Defi platform. With the rising influx of users amid the NFT hype, Spores Network aims to empower world's creators by providing a solid platform.

With the increasing number of users that came during the NFT boom, Ethereum as a platform sees a lot of issues such as network congestion that leads to high network fees, which is why a lot of the Defi community is eager for the launch of Cardano’s ADA mainnet. Consequently, Spores Network is ahead of the competition, waiting to debut as the premier Cardano-based NFT platform.

Spores Network aims to establish the first NFT marketplace on the Cardano Blockchain, which is much greener, cheaper, and better than Ethereum and Bitcoin. Moreover, the Cardano blockchain technology will be able to elevate both the NFT and Defi sectors for years to come. So it’s only a matter of time.

NFTX

Another project combining Defi and NFT is NFTX, an NFT index fund protocol that serves to bring liquidity to illiquid NFTs such as Crypto Kitties by generating tokenized index funds like $PUNK.

Collectibles

The NFT rage was catalyzed first by CryptoPunks in 2017. CryptoPunks laid the foundation for the ERC-721 token standard that went on to drive the NFT ecosystem. Ever since, Ethereum has experienced numerous high-quality collectibles, including digital assets that are pegged to real-world collectibles. This month alone, the Collectibles sector brought in over $31 million in sales, which is more than 50% of the total NFT sales this month.

Other drivers in this sector include Crypto Kitties, a project that gained so much popularity that it caused Ethereum’s first major congestion. Crypto Kitties is home to collectible and breedable NFTs that reemerged as the NFT ecosystem picked up its pace again in 2021.

Games

Blockchain-based games are emerging toward a more rewarding “play-to-earn” future. Normally, players often move from game to game as it loses its fire; however, introducing a rewarding model where players can play, earn assets, and trade them along the way allows gamers to stick to the game, all thanks to NFTs.

Axie Infinity, a pokemon-esque game based on Ethereum, allows players to immerse themselves in a world where they can collect, breed, and battle their monsters for glory and profit via NFT gaming assets that can be traded and sold. Other drivers include Gods Unchained, a blockchain implementation of the popular trading card game Magic: The Gathering, where players can face each other and win tokenized prizes.

Metaverse

The metaverse refers to an immersive virtual space that unlocks numerous opportunities and capabilities for users. With virtual reality being a reality for years now, Etheruem and other blockchain platforms are some of the first platforms that will allow virtual reality projects to transcend into the metaverse by making underlying digital real estate scarce and tradable around the globe via NFTs.

Decentraland is a leading and one of the oldest VR projects that allow investors to buy virtual land. Today, with large institutions joining in on the NFT hype, Decentraland has become a popular destination for events, promotions, and games.

Utility

NFTs are often associated with empowering creators with digital ownership and the protection of their intellectual property such as art, music, gaming assets, and more. However, NFTs could be used to represent almost anything, including things like domain names.

One leading platform is the Ethereum Name Service, a service that allows Ethereum users to create and manage decentralized domain names on top of the Ethereum network.

Conclusion

The power that NFTs bestowed on users, creators, investors, inventors, entertainers, artists, and more is impeccable. NFTs have an insurmountable number of use cases, and they are shaping up as the forerunner of mainstream adoption.

While most of the 2021 NFT hype has been mainly surrounding the digital art and collectible sector, NFTs open up an infinite number of opportunities, and it’s more than likely to continue emerging as an exciting asset class for years to come.

Wrapping Up

Cross-chain interoperability is the next big thing in the current fragmented decentralized ecosystem we see today, as it will reduce the monopoly effect and allow innovators to leverage the strengths of the existing platforms to create applications for financial inclusion.