Strategic options, in terms of corporate strategy, are small enough bets that a company can make and still walk away from them even if they don’t work out as planned. Jeff Bezos is probably the best proponent of this strategy. Although his bets are in the billions of dollars, he’s not afraid to experiment and to learn from his failures. He understands that by taking a series of small bets you increase your likelihood of achieving success in the long-term. If you’re not continually experimenting you risk becoming complacent. The biggest mistake most management teams make is believing that their core product/offering will always be in demand. The following quote best explains his reasoning: “What really matters is that companies that don’t continue to experiment – companies that don’t embrace failure – they eventually get into a desperate position, where the only thing they can do is make a ‘Hail Mary’ bet at the very end of their corporate existence. I don’t believe in bet-the-company bets.” Similarly, many individual investors are making the same all-in bet on their retirement portfolios by solely relying on the stock market to continue rising onward and upward. The reality is that the S&P500 is trading at stretched valuations. Even Charlie Munger has warned about the potential for a lost decade ahead. So what is the average investor to do? First, they must start by hedging their bets and focusing on increasing income. The first thing that most investors start with is finding high dividend yielding stocks. That is a great place to start but covered call writing is another conservative and effective strategy to reduce volatility in your portfolio and to generate significant income.

Q1 2021 hedge fund letters, conferences and more

What Are Covered Calls?

Covered call writing is an options strategy with two parts. The first part entails purchasing shares of a company and the second part requires you to sell a call option short on those shares. You can write covered calls on individual stocks or ETFs such as SPY and IWM. A call option is a standardized contract that gives the buyer the right to buy 100 shares of the underlying stock at a specified strike price. The seller of the call option therefore agrees to sell his shares at the specified strike price in the contract. The buyer of a call option will generally only exercise his option to purchase if the shares trade higher than the strike price at the time of expiration, which is referred to as being in-the-money. The holder of the call option can buy shares at the below market strike price and choose to sell their newly acquired shares at current market rates or hold on to the position. If the underlying shares close out-of-the money meaning below the contractual strike price, then the call option will expire worthless. In this scenario, the seller of the call option will pocket the premium paid by the writer. As income oriented investors, we’re not interested in purchasing call options to strike it big and gamble on future price movements. We want to be sellers of call options on shares of stock that we already own. As sellers, we collect our premiums month after month and slowly reduce our cost basis in our long positions.

Why Write Covered Calls?

The purpose of writing covered calls is to generate additional income from the shares that you own. The ideal scenario is that you sell a call option and the shares trade below the strike price upon the expiration date. In this scenario, you get to keep the option premium that you received and the underlying shares. If the shares trade above the strike price of the contract you will be forced to sell your shares at the agreed strike price. However, you will have likely sold a contract at a strike price that was significantly higher than the market price at the time of writing the contract. So you’ll enjoy both capital gains and keep the premium from the initial sale of the option. In a down market, the premium received cushions the blow from a decline in the price of the underlying shares. In a rising market, the premium reduces your cost basis and thus enhances returns. A 2006 study by Callan Associates, an investment advisor to institutional investors, found that a covered call index strategy produced superior risk-adjusted returns. Essentially, you captured the entire upside of the index but with two-thirds the risk.

Many investors assume that you’re unable to hold stock positions for the long-term if you sell covered calls. The reality is that there are a number of strategies that can be utilized to maintain long-term exposure to the underlying shares even if the call option that you sold is trading in-the-money. For example, you can buy back the short call before expiration and write another call at a higher strike price or simply buy back the shares after the option is exercised and write another out-of-the-money call option on your position. I’ll plan to go into more detail about various strategies that you can employ if your short calls are trading in-the-money in a subsequent article. Needless to say, there are a number of methods that allow you to maintain long-term exposure to a stock while simultaneously selling covered calls.

Why Now Is the Right Time to Implement a Covered Call Strategy?

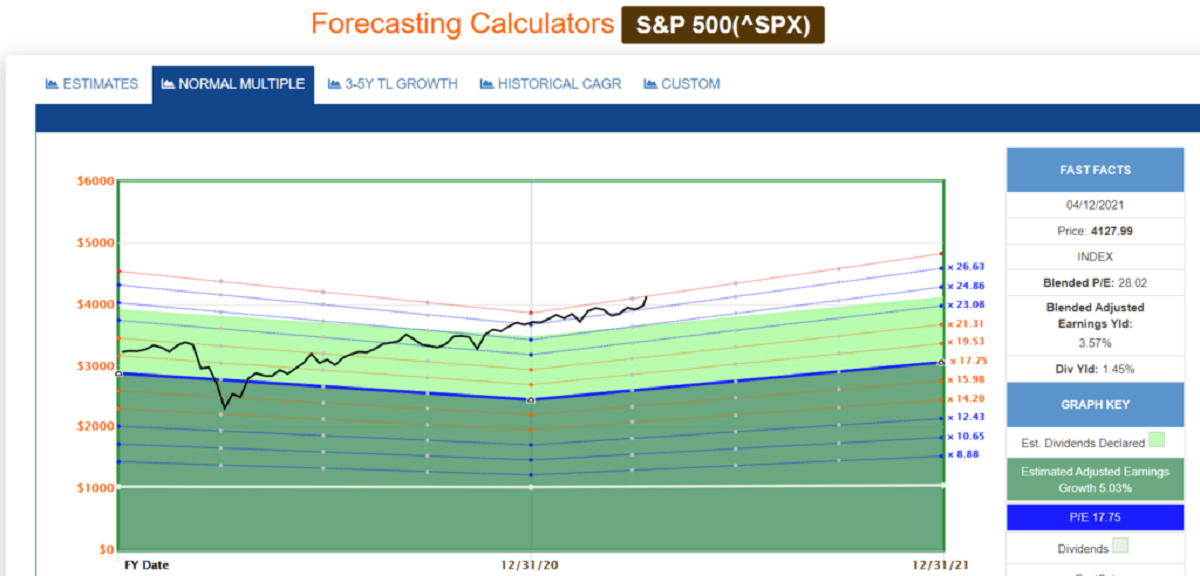

For most investors the 2007-2009 bear market was a long time ago. If you’re part of the Robinhood crowd, you probably can’t believe that the S&P500 actually traded in triple digits. For a brief moment in time the entire edifice of private market capitalism was on the verge of falling over. I vividly remember watching the S&P500 nearly halve itself from October 2007 to March 2009 and watching the market hit the intraday low of 666. Most commentators view the March low as the beginning of the longest bull market in US history that recently ended in early 2020 due to the outbreak of the Covid-19 epidemic. Over that 11 year span the S&P500 produced close to 17% annualized returns. In my view the nascent bull market that has just begun will not be able to repeat the same barnstorming performance. Valuations are significantly stretched, corporate earnings growth appears to be stalling and most importantly the highly accommodative monetary policy put in place by the Fed will most likely be coming to an end as inflation rears its ugly head. We can see from the chart below that the S&P500 is now trading at a blended P/E ratio of 28, surpassing by a wide margin the 18x average multiple the index has traded at over the past 19 years.

The Callan Associates study also found that the covered call strategy on the S&P500 underperformed during the late 90s bull market but just as clearly outperformed during the subsequent down cycle from April 2000 through March 2003. Given the stretched valuations we’re facing, it’s highly likely that the S&P 500 underperforms going forward. Naturally, a covered call strategy would mitigate a portion of the downside risk. As an investor nearing retirement, you want to utilize an investment strategy that protects you on the downside without giving up much upside. Moving to fixed income is another alternative, but the prospect of higher inflation combined with the exceptionally low interest rates on fixed income securities will almost undoubtedly be a losing trade over the years ahead.

Much like Jeff Bezos, we don’t want our portfolios solely reliant on the ‘Hail Mary’ assumption of another record breaking bull market. A covered call strategy has been proven to reduce volatility in portfolios without sacrificing significant upside in bull markets. In bear markets, numerous studies have shown that a covered call strategy will significantly outperform a long only portfolio. While nobody can predict with any accuracy how the equity market will perform over the next decade, a covered call strategy will allow you to participate on the upside with less risk and that’s a bet I’m willing to take in my own portfolio and the Ashva Capital portfolio.

Article by Ankur Shah, Ashva Capital